If you obtained your Chase Sapphire Reserve Card® before June 23, 2025, then your new coupons and benefits are finally live. As of today (October 26, 2025), your Sapphire Reserve card no longer offers 3x for all travel, but it now earns 4x for hotels and airfare and 8x for all travel booked through Chase Travel℠. Additionally, you can now activate your free Apple TV+ & Apple Music, and take advantage of a slew of new rebates. With calendar year and July through December credits, you have through the end of December to earn those credits in 2025.

The post that follows was previously published for new cardholders and has now been updated to include those who obtained their cards before June 23rd…

The Chase Sapphire Reserve Card is packed with a complex array of benefits, discounts, and rebates. This post serves as a primer on maximizing the features of the consumer Sapphire Reserve Card.

Activate your benefits!

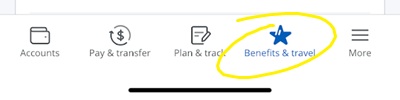

Chase app

Some Sapphire Reserve benefits require activation. I recommend doing this right away so that you don’t forget! Most benefits can be activated easily through the Chase App:

After logging into the Chase App, find and click the button for “Benefits & travel” (on the iPhone, this should be near the bottom-right of your screen:

You will then see benefit boxes that state “Activation required.” Click those boxes to activate those benefits:

Chase website

You can also activate benefits through Chase’s website. After logging in, click on your Sapphire Reserve card, then look for the link to “Card benefits” under the “More” box:

After clicking on Card benefits, you’ll see your benefits listed in various ways as you scroll down the page. There are sections to “maximize your credits,” “Enjoy membership perks,” “Get more with your card,” etc. In each section, look for the words “activation required” then click to activate that benefit.

Benefits that need activation

- Apple TV+ and Apple Music: Activate as shown above.

- StubHub & viagogo credits: Activate as shown above.

- IHG Platinum status: Activate as shown above.

- Peloton credits: Activate as shown above.

- DoorDash DashPass: Add your Sapphire Reserve card as your default payment method within your DoorDash account, then follow prompts to activate your membership.

- Lyft benefits: Activate by adding your Sapphire Reserve card to your Lyft wallet

Earn more points

Use your card to pay for flights and hotels

The Sapphire Reserve card offers 4 points per dollar for flights and hotels, or 8 points per dollar for any travel booked through Chase Travel℠. Be cautious when booking through Chase Travel, as prices may be higher than those found elsewhere.

The card also offers excellent travel protections when you use it to pay for your trip:

- Primary car rental coverage (Note that this coverage is secondary on domestic rentals for New York residents with a primary insurance policy).

- Roadside Assistance: Cardholders are covered up to $50 per incident, 4 times a year.

- Trip Cancellation / Interruption Insurance

- 6 Hour Trip Delay Reimbursement

- Lost Luggage Reimbursement

- 6 Hour Baggage Delay Insurance

- Travel Accident Insurance

- Emergency Evacuation & Transportation: Up to $100,000

- Emergency Medical and Dental Benefit: You can be reimbursed up to $2,500 for medical expenses if you or your immediate family member becomes sick or injured while traveling.

Use your card to pay for dining & food delivery

The Sapphire Reserve card offers 3 points per dollar at restaurants, coffee shops, and food delivery services. Since it has no foreign transaction fees, the card is an excellent choice for dining worldwide.

Refer family & friends

If you have family members or friends interested in applying for the Sapphire Reserve card or the Sapphire Preferred card, you can refer them from your Sapphire Reserve account. If they’re approved, you’ll earn 15,000 points (max 100,000 per year), and they’ll earn whatever welcome bonus is available at the time that they apply.

Apply for no-annual-fee Ultimate Rewards cards

Several Chase no-annual-fee cards earn Ultimate Rewards points, even though they’re advertised as cash-back cards. The trick is to earn “cash back” points with these cards and then move them to your Sapphire Reserve card to make them more valuable. Once moved to your Sapphire Reserve card, you can redeem points through Chase Travel at enhanced value when a Points Boost is available, or you can transfer to select airline and hotel programs for even better value.

Here are some no-annual-fee “cash back” cards to consider:

- Freedom Unlimited: Earn 3 points per dollar for dining and at drugstores, and 1.5 points per dollar everywhere else. Since the Sapphire Reserve card earns only 1 point per dollar outside its bonus categories, the Freedom Unlimited is a great companion card. Use it wherever the Sapphire Reserve doesn’t offer a bonus.

- Freedom Flex: This card earns 5 points per dollar (up to $1,500 per quarter) in rotating categories that change quarterly.

- Ink Business Cash: This card always has a great welcome bonus. Additionally, it earns 5 points per dollar at office supply stores and cellular/landline/cable (on up to $25,000 in total purchases in 5x categories annually). If your internet, TV, and cell service providers accept credit cards, this is an awesome way to automatically earn 5 points per dollar on all that spend! If you’re not sure that you have a business or would like more information about applying for this card, see: How to apply for Chase Ink cards.

Earn more with Bilt

Bilt is a free-to-join rewards program. Bilt points are similar to Chase points in that they share many of the same transfer partners. With either Chase points or Bilt points, you can transfer points 1 to 1 to Hyatt, United, British Airways, Air France / KLM, Air Canada, and more.

Bilt makes it easy to earn rewards for a wide range of purchases automatically. Simply add your Chase cards (or other credit cards) to your Bilt Wallet, and you can earn Bilt points in addition to your usual credit card rewards at the following merchants:

- Participating restaurants

- Participating fitness clubs

- GoPuff

- Lyft

- Walgreens

- More coming soon…

You can also pay your rent through Bilt using your Chase card. Bilt will charge you a 3% fee to do so, but you’ll earn 1 Bilt point for every $2. With the Sapphire Reserve card, you would earn 1.5 transferrable points per dollar (1 Chase point + 0.5 Bilt points) for that 3% fee. While I wouldn’t recommend that for ongoing rent payments, it could be an excellent option for quickly meeting the Sapphire Reserve card’s minimum spend requirement for its welcome bonus.

Travel better

The Sapphire Reserve card offers a number of perks that can improve your travel experience:

- Priority Pass Select Lounge Membership: This membership provides complimentary access to lounges for you and up to 2 guests.

- Sapphire Lounge: Use your Sapphire Reserve Priority Pass card to access Sapphire Lounges for free. You may bring up to 2 guests per visit at no additional charge; additional guests are $27 each. There’s no extra charge for children under two.

- Air Canada Maple Leaf Lounge: Use your Sapphire Reserve card to access select Air Canada Maple Leaf lounges for free. You must have a same-day boarding pass or ticket for a Star Alliance carrier. Access is available only to cardholders and authorized users.

- Global Entry, NEXUS or TSA Pre

® Fee Credit: Receive a statement credit of up to $120 every 4 years as reimbursement for the Global Entry, NEXUS, or TSA Pre Check application fee charged to your card.

- IHG Platinum status through 12/31/27 (starting 10/26/25 for cardholders who applied or otherwise obtained their card before June 23, 2025). IHG Platinum status isn’t particularly valuable, but it’s certainly better than having no status.

- Car Rental Benefits:

- National Car Rental Executive status: Reserve a standard car and select any car in the Executive Aisle. Enroll here.

- Avis Preferred Plus Status & discounts: Details here.

- Hertz discounts & 2-hour grace period: Details here.

Save money

Get up to $300 each year for any travel purchases

When you use your card to pay for travel, you’ll automatically earn up to $300 in statement credits each membership year. Note that you will not earn rewards on the $300 in spend that is reimbursed.

Get up to $500 back each year for The Edit hotel bookings

The Edit by Chase Travel℠ is Chase’s answer to Amex’s Fine Hotels + Resorts® (FHR). Like FHR, The Edit offers elite-like hotel perks for a curated selection of hotels and resorts when you book through this program. With the Sapphire Reserve card, you can earn two $250 statement credits per calendar year for prepaid bookings made with The Edit. Two-night minimum. Note that you will not earn rewards on the $250 in spend that is reimbursed.

Note: Only one $250 statement credit is available in 2025 for bookings between July 2025 and December 2025.

Get $250 back for select Chase Travel℠ hotel bookings.

Beginning Jan. 1, 2026, Sapphire Reserve and the Sapphire Reserve for Business cardmembers will receive a $250 credit for select Chase Travel℠ hotels. The credit is valid on prepaid hotel bookings (for stays lasting at least two nights) with the following brands:

- IHG Hotels & Resorts

- Minor Hotels

- Montage Hotels & Resorts

- Omni Hotels & Resorts

- Pan Pacific Hotels and Resorts

- Pendry Hotels & Resorts

- Virgin Hotels

There is no word yet on whether this benefit will extend beyond 2026.

Get up to $300 back each year at select restaurants

Earn up to $150 back every six months at Sapphire Reserve Exclusive Tables. Sapphire Reserve Exclusive Tables is a curated selection of high-end restaurants available through a special version of OpenTable. You do not need to make a reservation or pay through Chase or OpenTable to earn the $150 rebate every 6 months (from January through June and again from July through December). Simply use your card at one of the restaurants listed on this platform.

Get up to $300 back each year with StubHub & viagogo

Earn up to $150 in statement credits every 6 months (January through June and again from July through December) for purchases made on StubHub and viagogo. Activation required.

Get Apple TV+ and Apple Music for free

Sapphire Reserve cardholders get Apple TV+ and Apple Music for free. This is not a rebate. Here’s how Chase says to activate this benefit:

- Open the Chase Mobile® app and go to the Card Benefits section.

- Find the Apple TV+ and Apple Music offers and follow the prompts to link your Apple ID.

- Activate your complimentary subscriptions. If you already have a paid subscription, it will be automatically suspended.

Get $10 back per month with Peloton

Get up to $10 per month back on eligible Peloton All-Access Membership, Rental, App+, Guide, App One, and Strength+ memberships through 12/31/27. Activation required.

Save with DoorDash

Sapphire Reserve cardholders are eligible to get complimentary access to DashPass – a membership for both DoorDash and Caviar. This unlocks $0 delivery fees and lower service fees on eligible orders for a minimum of one year when you activate by Dec 31, 2027

Additionally, DoorDash members receive up to $10 off non-restaurant DoorDash orders twice a month and $5 off a restaurant order once a month.

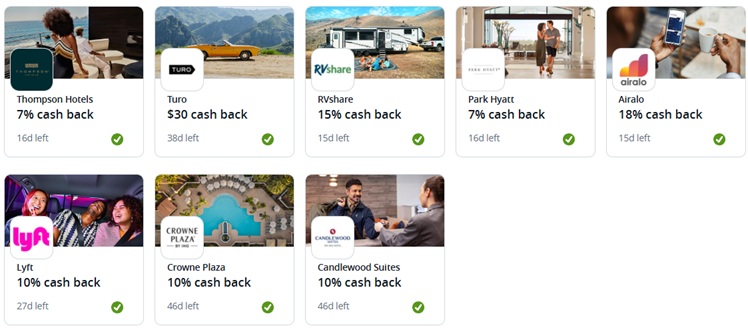

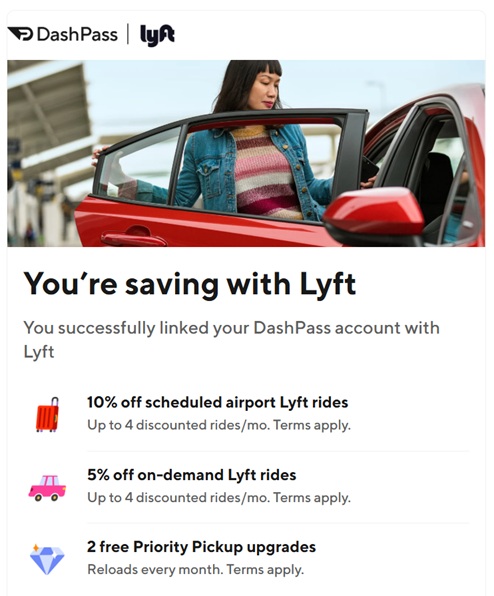

Save with Lyft

Add your Sapphire Reserve card to your Lyft wallet in order to get the following benefits:

- $10 monthly in-app discount

- 5X Rewards: Use your Sapphire Reserve card with Lyft in order to earn 5 points per dollar through September 2027.

- Additional discounts: You can get additional Lyft benefits indirectly thanks to a partnership between Lyft and DoorDash. Link your DoorDash and Lyft accounts here to qualify for Lyft discounts and priority pickup upgrades.

Save with Chase Offers

Chase Offers are rebates for specific merchants. Available rebates change regularly, and you must add the offers to your account before making an eligible purchase to receive the rebate. Use tools like CardPointers or SaveWise to automate adding offers to your card.

Take advantage of big spender perks

The Sapphire Reserve card offers several additional perks once you spend $75,000 within a calendar year. Please note that we are not recommending that you spend $75,000 to obtain these perks, but if you do reach that threshold, you might as well take advantage of them! Make sure to activate and use the benefits that matter to you:

-

- IHG One Rewards Diamond Elite Status

- $500 Southwest Airlines Chase Travel credit (credits automatically applied when booking Southwest flights through Chase Travel)

- Southwest Airlines A-List Status

- $250 Credit for The Shops at Chase

Redeem points for great value

Book Point Boosted flights & hotels through Chase Travel

Via Chase Travel℠, it’s possible to get good value using points to pay for flights and hotels, but only when Points Boosts are available. For all other travel, you’ll only get 1 cent per point value when paying for travel with points, which is not good at all.

Note this exception: For cardmembers who applied or otherwise obtained their card prior to June 23, 2025, all points earned prior to October 26, 2025, are eligible to be redeemed at 1.5x through Chase Travel until October 26, 2027.

Points Boosts are available on all hotels in The Edit collection, and on select other hotels. With flights, Points Boosts are only available on select airlines. Here’s the value you can expect to get when Points Boosts are available:

- Hotel Point Boosts:

- The Edit hotels: 2 cents per point

- Other hotels: 1.75 cents per point

- Airfare Point Boosts:

- Economy: 1.5 cents per point

- Economy Plus & Premium Economy: 1.75 cents per point

- Business & First Class: 2.0 cents per point

Unfortunately, Chase’s hotel prices are often uncompetitive compared to those on competing sites. On the other hand, flight prices are usually the same as you’ll get when booking directly with the carrier.

While Points Boosts can be a good way to redeem points, you can do even better by transferring points to select airline and hotel partners…

Transfer points to Hyatt for hotel stays

When looking to book a hotel or resort, Check Hyatt’s website to see if there’s a Hyatt that fits your needs and is bookable with points. Hyatt points are often worth around 2 cents each, or more, for Hyatt’s own properties (note, however, that Mr. & Mrs. Smith hotels and other partner brands bookable with Hyatt points offer far less value).

Before transferring points to Hyatt, find a comparable hotel (or the same hotel) on Chase Travel to see how many points Chase would charge to book your stay. Compare that to the number of points that Hyatt requires to book their hotel with points. If you find that Hyatt’s point price is much lower than the price found through Chase Travel, then you can transfer the required number of points from Chase to Hyatt to book your stay.

Transfer points to United Airlines for select flights

United Airlines doesn’t have fixed award prices. You can sometimes get great value for your points, and sometimes you’ll get awful value. For this post, I conducted a random search for flights from Detroit to San Francisco and found that United offered either $324 in cash for economy or 15,000 points plus $5.60. Using points in that case would deliver an excellent value of over 2.1 cents per point. Paying with points through Chase Travel would cost more: 21,600 points when a Points Boost is available.

Transfer points to other airline programs

Many airline programs can offer great value for your points under the right circumstances. It’s possible to get great value from Air Canada, Air France/KLM, British Airways, JetBlue, Virgin Atlantic, and others. See this post for a complete list of Chase transfer partners.

I don’t recommend transferring your Chase points to hotel chains other than Hyatt. Marriott and IHG points are usually worth far less than Hyatt points.

For many ideas of how best to use points transferred to partner airlines, see: Best uses of Chase Ultimate Rewards

I get a little banner at login that specifies 1.5 cpp, and the counter in my account shows all of my points are eligible for 1.5x, but when I search for non-Points-Boost hotels, the redemption rate is only 1 cpp. My CSR has been open for years. No idea why it’s not showing me the guaranteed minimum rate. Anyone else experiencing this?

Eventually answered my own question. It appears the better redemption rate only shows up once you add a selected trip to your cart. A needless and annoying change, IMO.

Good stuff as always!

I’m looking to book an Edit hotel now for a trip I’ll be taking next year. By the time the trip rolls around, I will have downgraded my card to a Preferred. Any idea if that will affect my booking?

Thanks

I believe it will be fine but I’m not 100% sure

Thank you for posting these helpful reminders and the overview. It’s a lot at once and quite a learning curve. Activated everything. Used StubHub already. Booked restaurant, though, surprisingly limited for NYC. Gotta map out how to use The Edit still (keep reminding myself, I need to pay, but not necessarily stay, by 12/31/25.) Yeah, let’s be honest, Amex did far better with its recent updates (quarterly Resy, Lulu, and $300 FHR, just 1 night, a lot easier, oh, and that ‘mirror’ card, ooh lala.) Even Citi (for all their mess ups) is doing slightly better with a lower AF on Strata Elite. Sheesh.

After seeing this all again for the first time since the amex plat refresh, I’m really really wondering why o should keep this card. So much work, so many niche benefits that require more work, and shout a break even proposition. Chase really biffed here IMO. I think the best UR card is an Ink Business.

Is it possible to double-dip on the $250 Chase hotel rebate and the Edit rebate? For example, if a I book a 2-night stay at an IHG hotel that is also an Edit hotel, would I get a total of $500 in rebates?

Yes. Remember, that new hotel credit starts in January. And, they can stack with your annual $300 travel credit if available.

I’ve spent more than $75K on the CSR year-to-date. I emailed Chase and no word yet on when or if the $75k spent before Oct 26 will count.

I saw my prior spend included; there’s a tracker within the Benefits page on desktop.

Thanks for the pointer!

I was one that canceled the CSR card. I had it for a while but it really wasn’t worth it to me for a while but I can be lazy in canceling cards. Unlike the American Express Platinum where I can easily recoup the AF, I can’t do so on the CSR although I realize others can.

I downgraded to the original Freedom card and then, maybe I got lucky, applied for the CSP card which I had for a while but canceled around 2021. I was surprised that I am eligible for the 75,000 pts SUB.

I consider that a win. I just need to start spending my decent size collection of points. For some reason I’ve found using Amex pts via Lifemiles works better for my Europe trips.

Anyone know if the stubhub credit would be triggered with gift card purchases?

Stub Hub GCs are sold on a partner site and a purchase would likely not reflect Stub Hub as the seller. And, this not trigger the credit. This is not uncommon.

So maybe I’m a tech dinosaur, but I don’t like to change (update) my phone frequently. Too much hassle and expense. I have a 2018 Samsung android phone that works fine. I have recently learned that Samsung only updates its phones operating systems for about 4 years. My last OS update was in 2022. As a result, Chase will no longer allow me to update its phone app, so it locks me out.

I’m wondering if it’s possible to do everything you mention here on the Chase website or the Ultimate Rewards website?

Yes, log into Chase.com, select your Sapphire Reserve card, then click More… Card Benefits. You can then activate your benefits there.

Great. We tech dinosaurs thank you.

I’ve updated the post to show that option too.

Good reminder to sign up for Apple TV and watch as much as possible before the increased annual fee hits.

I’m sad that you’re encouraging people to redeem at 2 cents per point. That’s a mediocre redemption. Shouldn’t be recommended

Why do you think 2 cpp is mediocre?

I like using my points for redemptions that I could never afford in cash.

Like a $10,000 first class flight to Asia.

Usually 5-10+ cpp.

Is it really worth the effort to play this game if you’re gonna use the points for a $300 flight?

Not everyone wants what you want.

That’s why everyone can post their opinions on here. I think it’s unhelpful to lead people to poor value for their points. You clearly disagree

But, you can redeem for 2cpp at hotels. Is that not a good value for their points?

I disagree that 2 cpp is poor value. So does FM, given that their reasonable redemption value for Ultimate Rewards is 1.5 cpp.

So go for it. I’m gonna keep enjoying a level of travel that’s totally different. Peace.

Until award availability inventory dries up.

This was useful. Thank you. I’d like to see more articles like this for other cards. I’m a recent Capital One Venture X cardholder, my husband is a recent Chase Reserve Sapphire Business card holder. Articles like this help to make sure we don’t miss anything as it’s easy to get confused between the several cards we hold.

The freedom Flex also gives 3x dining and 3x at drug stores. Worth a mention.

I’m confused you said “hotel prices are often uncompetitive” via Chase but you posted your own analysis in June and the examples you posted showed Chase was within like 3% on average. That’s not uncompetitive to me

I think Greg’s statement was about whether the Chase portal was competitive solely based on price and not other factors (e.g. The Edit credit or points boost).

From my perspective, all else being equal, a portal that costs 3% more is never going to be competitive because I will always choose the cheaper price. In such a scenario going from the Chase portal to a cheaper portal is equivalent to getting an extra 3% back on my purchase, and I will never turn that down.

That’s true! That post looked only at The Edit hotels, and only at a fairly small sample of them. Since then I’ve frequently run into times where the Chase portal is significantly more expensive than other options.

thats fair. i guess in that case you just earn 4x by booking direct with the hotel if its a big price difference. not a bad consolation

Picking up a thread from another post, what is your interpretation of the following language that occurs in the Chase terms and conditions: “We may reverse statement credits if an eligible purchase is returned, canceled, or modified or if you close your account within 90 days of receiving a statement credit.” (This is repeated in the sections for the $300 travel credit, The Edit credit, the restaurant credit, and the StubHub credit.) If I am reading this right it would seem to affect the strategy for some planning to cancel the card when the annual fee posts, and for those looking to hold it for a year and then cancel. Also, would this limitation apply if I use a credit and then product change to something like the Freedom Flex?

I doubt that they really enforce the last part “if you close your account…” My bet is that they have that there so that if they see a pattern of someone gaming their credits, they can do something about it. I doubt it would be a problem if you use the credits as advertised and within 90 days decide that the card isn’t for you and you cancel.

Thanks for the analysis! I doubt I will manage to use The Edit credit but I might use one of the restaurant credits before I have to take my trusty CSR out behind the barn.