NOTICE: This post references card features that have changed, expired, or are not currently available

For years I’ve been manufacturing top tier Delta Diamond elite status for both me and my wife through credit card spend (see: How to earn Delta elite status through credit card spend). Now, we have until the end of January to choose or lose our 2020 Choice Benefits. Plus, it’s time to decide whether to continue seeking Diamond status year after year.

Which Choice Benefits Should I Take?

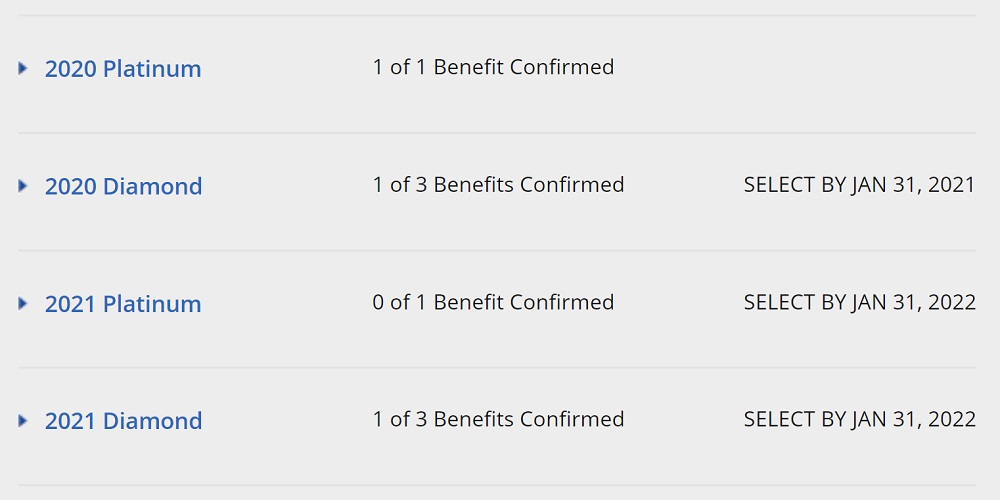

When you earn Delta Platinum elite status, you get to pick 1 Choice Benefit. And when you earn Diamond elite status, you get to pick 3 more. You can wait as late as until your earned status expires before choosing a benefit. For example, elite status earned in 2019 for the 2020 year, lasts until January 31 of 2021. So, as you can see above, I have until the end of this month to pick 2 more Choice Benefits from my 2020 Diamond status (which was earned in 2019).

Some choices, such as gifting elite status, would be crazy picks because they are only valid until January 31 of this year. Some, such as upgrade certificates, are valid for a year from selection. And some never expire (Delta SkyMiles, for example). See this post for details: Delta Diamond Choice Benefits: Which to choose and when.

One of my two remaining Choice Benefit selections is obvious to me: I’ll take the 25,000 SkyMiles. Delta miles never expire and, as long as you have a Delta credit card, you can use them for a value of 1 cent each towards paid flights, or, even without a credit card, for more value (sometimes) towards award flights. So, selecting 25,000 miles is like selecting at least $250 in Delta flight value.

The remaining choice is harder to decide. I’ve been dithering between taking a second 25,000 mile choice, or taking 4 Global Upgrade certificates. If I wait until the end of this month to make that selection then those upgrade certificates will be good until the end of January 2022. Normally this is a no-brainer for me. The global upgrade certificates are worth way more than $250. We can book, for example, a relatively cheap economy flight to Europe and then use the upgrade certificates to fly lie-flat business class. The paid difference between transatlantic economy and business class, especially with Delta, is usually thousands of dollars.

That said, I don’t know that we’ll have the opportunity to use our upgrade certificates over the next 12 months. Even if COVID wasn’t an issue, I have lots of miles in another program that will be expiring this year and so I’ll want to use up those miles before booking paid travel. It’s a tough call to make, but unless something changes between now and the end of this month, I’ll take the miles. If I do end up needing upgrade certificates, I still have my 2021 Choice Benefits to select from.

Should We Spend Our Way to Diamond in 2021?

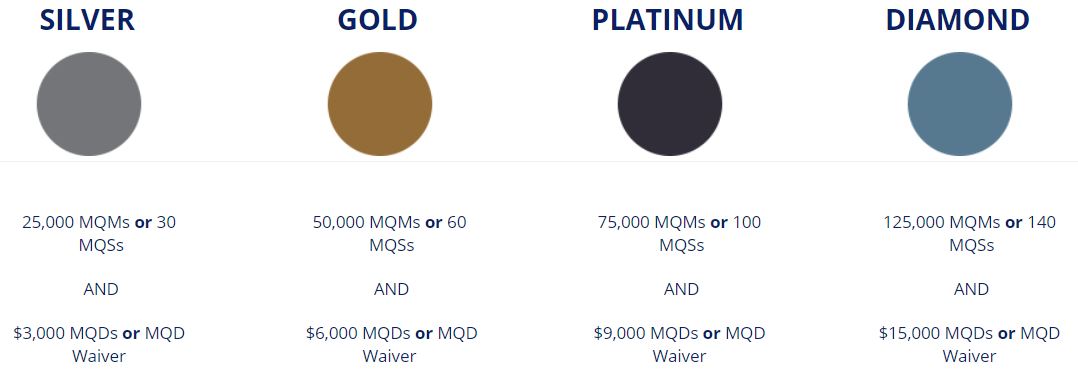

My wife and I each have more than enough MQMs rolling over from 2020 to requalify for Diamond status with no action on our part whatsoever. Unfortunately, MQDs and MQD Waivers did not roll over from 2020. Here are the rules for MQD Waivers:

- Spend $25,000 on Delta Platinum and/or Delta Reserve cards within a calendar year for a waiver good for Silver, Gold, or Platinum elite status.

- Spend $250,000 (yes, a quarter million dollars) on Delta Platinum and/or Delta Reserve cards within a calendar year for a waiver good for Diamond elite status.

Our current Diamond statuses are good until January 31, 2022. Requalifying now for Diamond status won’t help anything until February 1, 2022. Even then, my primary incentive for seeking Diamond status in the past has been to get global upgrade certificates. My wife and I can each pick those from our 2021 Choice Benefits as late as January 31, 2022 (assuming we don’t use them sooner). The answer is simple: No, we won’t spend $250K in 2021 for Diamond MQD waivers.

Should We Spend Our Way to Platinum in 2021?

My wife and I each have over 190,000 MQMs that rolled over from last year. I don’t expect Delta to automatically roll over those MQMs again at the end of this year, so we’re in a “use them or lose them” situation. As long as we each spend $25,000 on Delta credit cards, we’ll earn MQD Waivers good for Platinum elite status. Then, at the end of this year, any MQMs we have above the 75,000 needed for Platinum status will roll over to 2022 (that’s a normal feature of Delta’s program).

The answer here again is simple: Yes, we will spend $25K each on Delta cards. This will mean earning Platinum status for 2022 and keeping most of our MQMs alive for another roll-over towards 2023 status.

Will We Seek Diamond in 2022 and Beyond?

We have plenty of time to decide whether to jump back onto the elite status treadmill in 2022. In the past, the effort to earn Diamond status was worth it to me because my wife frequently travelled overseas for work on paid economy tickets. With Delta Diamond status we were able to use our global upgrade certificates so that she could fly up-front. When economy cash prices were low, I’d also buy a coach ticket and upgrade it. Otherwise, I booked business class award tickets for myself for the same flights.

In 2022, if we find that she is again travelling overseas often for work, we might once again find that it’s worth the considerable cost to manufacture Delta Diamond status for one or both of us. Of course… things change. In 2022, I don’t know if my wife will still be travelling as much for work; I don’t know whether Delta’s elite program will change for the better or worse; I don’t know whether Delta’s elite requirements will get easier or harder. In other words, the answer to this final question is “we’ll see.”.

The calculations for the opportunity cost for spending $250K are way off. If you spend $250K this year you get a minimum if 375,000 SkyMiles: The first thre times you hit $30K in spend you get an additional 18750 bonus skymiles for a total of 75K more miles. Then, after your spend $150K, every dollar earns 1.5 miles, giving you another extra 50K miles. So adding bonuses together you get a total of 125K extra miles.

I thought the 25% extra bonus for 2021 were MQMs and not SkyMiles? Wouldn’t it therefore make it 300,000 SkyMiles earned and 75,000 MQMs? And, isn’t the 1.5X SkyMiles after $150,000 spent only on the Business Reserve?

Good points, I think you’re right about the 1.5x only being on the business version. I don’t know how Delta will handle the extra threshold bonuses. I assumed they would award both extra skymiles and MQMs but that may not be the case. At worst then we’re only looking at an extra 60K skymiles.

Last year, Delta stopped awarding SkyMiles along with EQMs, so you’ll only earn 1 mile per dollar on the first $150K spend, at least. Then if you are spending on the Delta Reserve Business card, you’ll earn 1.5X on the next $100K spend for a total of 300K miles after $250K spend.

Singapore also expire………just say no to anything other than transferable miles!

But all those expiring miles were transferable points before they were transferred!

LOL…….that’s a great assumption but correct none the less………What has become the new purgatory rub is when those transferrable points have gone to a Singapore or a Virgin and then the trip gets cancelled and suddenly all the doors of the prison slam shut! It’s the new hell for frequent flyers!

Oh and if I wanted to stick with “transferrable points” Citi has gone to the bottom of my list. I had booked a flight in Australia using Citi points to book a revenue Qantas flight that was supposed to occur just as the pandemic was starting……….Qantas wouldn’t let me cancel the ticket online and had a message to go back to the travel company that booked the ticket………Citi would put me on hold when I called for an hour or more at a time and I never got through……finally they stopped the illusion and said they were too busy to take calls on a recorded line…….LOL! Shame shame on me for being such a stupid person to believe in a bank in the first place! 6 months after I cut up my cards and mailed them to their corporate office they finally reimbursed me the miles. I’m transferring all my points out to OMG a French airline and expect never to do business with them again……….there is a certain cathartic freedom that comes with knowing you can use cash to stay WHEREVER you want and decide at the last minute to change or cancel that cash reservation! This freedom is invigorating as I walk away!

Ughhhh…….

I have just over 50k MQM, and don’t want to manufacture on a Delta card…..trying to decide if worth putting 25K on a card and even how I’d do it with some MS options gone…..(not to mention, I’d have to upgrade since I downgraded my reserve when the pandemic hit)

I would like to see an analysis of the opportunity cost of trying to meet the $250k spend. How much is it actually costing one to do so? Just doing a quick “back of the envelope calculation” it seems like the opportunity cost might be $2,500. Assuming a Delta mile is worth 1 cent and that you have a 2% cash back card, putting $250k of non-bonus spend on a Delta amex would yield a net loss of approximately $2,500, right?

Yes, that’s exactly right. In normal times, I wouldn’t be against spending $2500 to get 4 global upgrades plus 2 other diamond choice benefits plus 1 platinum choice benefit. This year, though, I don’t see the value in it.

Yes, and then there are the intangible values of being Diamond. Just a quick story on how our family of four monetized those intangibles. We were traveling to a ski resort on the Friday of a President’s weekend. Our flight was canceled before we went to the airport. After looking online I saw everything was sold out to get to our destination. I called the “Diamond Line” and the agent somehow opened four seats on an oversold flight so we could fly that day. When we got to the gate the they were asking for volunteers. No takers at $300 or $500 and only a couple at $750 because everyone wanted to go skiing. They then announced $1,300 and we jumped, times four, to net $5,200 worth of Visa prepaid cards. We made it to our destination the next morning for our “free” ski weekend. I always think about this story when I am slogging it out to spend $250k.

Score. And another way to look at that. If they had gotten the volunteers at $750 and you wound up flying the day before, you would have gotten $3,000 worth of value (since you decided it wasn’t worth 4 x $750 to delay overnight).

Dude, you can say ANA! You’re not the only one.

LOL

Which program do you have so many points that will expire? Isn’t there a way to keep those points alive?

ANA. No, there’s no practical way to extend the life of the miles.