NOTICE: This post references card features that have changed, expired, or are not currently available

This week’s Frequent Miler on the Air Main Event was all about Citibank: does the ability to redeem Shop Your Way points for gift cards Sears-iously make ThankYou points any stronger? Is the Double Cash now the ideal starter rewards card because of this redemption? Greg argues yes, but I temper his enthusiasm with a dose of rationality. Also on this week’s episode: how mattress run-worthy is Marriott’s new targeted promo, which credit cards to use to accelerate retirement savings, and more. Watch, listen, or read on for more from this week at Frequent Miler.

FM on the Air Podcast

For those who would rather listen than watch, the audio of our weekly broadcast is available on all popular podcast platforms, including:

| iTunes | Google Play | Spotify |

You can even listen right here in this browser:

If you can’t find the podcast on your favorite podcast platform, send us a message and let us know what you’d like us to add.

This week at Frequent Miler:

Has Citibank Sears-iously improved?

On my mind: Shop Your Way gift cards are a BIG deal

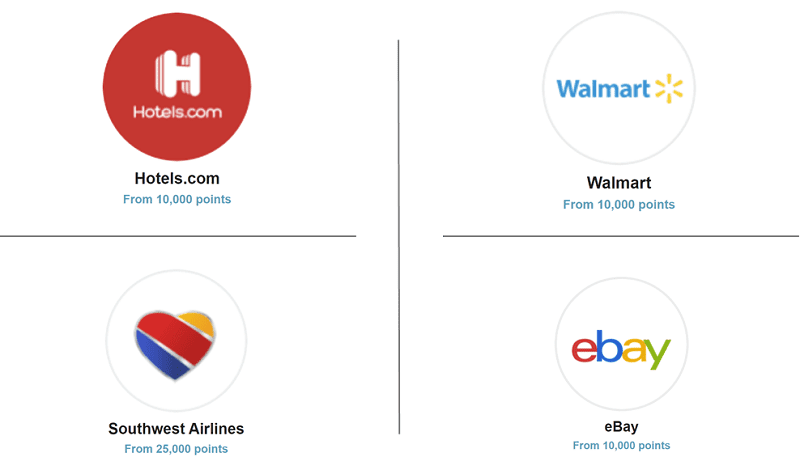

Greg got way more excited about this than I did, and I let him know why I was less enthusiastic on Frequent Miler on the Air. I think that if your cup runneth over with ThankYou points, this is a good way to get acceptable value out of them. But I can’t get very excited about redeeming points at a value of 1.2c each for Hotels.com gift cards when those gift cards can regularly be purchased for 10-20% off of face value. Walmart may be a solid option, but the rest would be a pass from me. On the other hand, in this post, Greg tells you why this option is significant to him.

Citi Double Cash Complete Guide (2.4% back everywhere via gift cards!)

Again, Greg got very excited about the ability to redeem Shop Your Way points for gift cards and re-published our guide to the Double Cash card. On Frequent Miler on the Air, I conceded that the Double Cash and Rewards+ cards make a fantastic no-fee card combination, but I don’t think these gift card redemptions are the key strength that makes it a terrific combo. Don’t get me wrong — I see where the gift card angle makes the Double Cash more valuable in some scenarios, but since you can buy many of the available gift card brands at a discount, I find it a stretch to say that Double Cash rewards are worth quite 2.4%. When you add the complexity necessary to get a bit more than 1c per point in value, I’m less sold on the huge-ness of the new gift card redemption. Is it good? Sure. Just not quite 2.4%.

The case against Citi ThankYou points (On Nick’s mind)

Don’t be thrown by the title: I’m a fan of Citi ThankYou points. However, in considering a question from a reader, I realized that they just don’t offer a compelling reason to branch out if you’re already invested in Amex and Chase. Citi can offer a good chance to pick up a bonus and pad your balances from other currencies, but in a time when your next booking might be a distance in to the future, it seems that now is a time to leave Citi be if you’re not yet in the ThankYou points ecosystem.

In credit card spending:

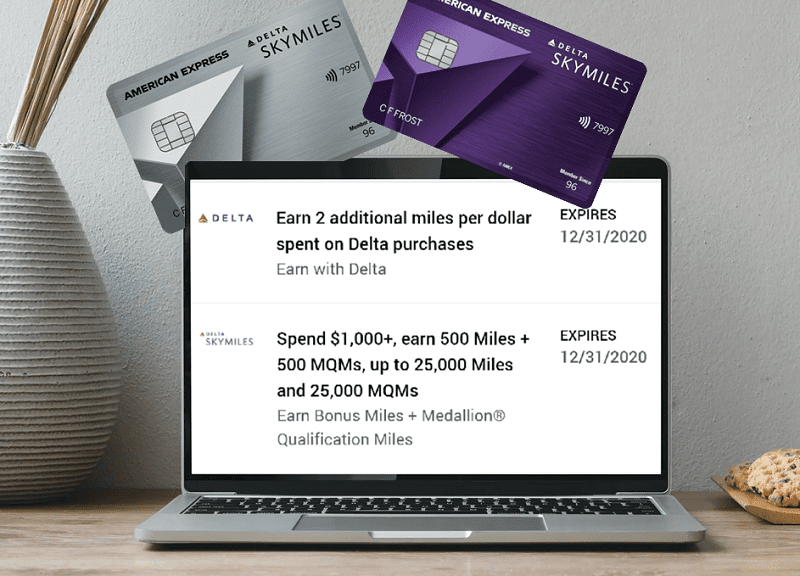

Delta mileage running from home during COVID-19. Should we do it?

I’m not someone who chases airline elite status and I’m even less inclined to go after Delta status given how rarely I ever fly Delta, but every time Greg does a post like this it feels like it makes sense to spend your way to Delta status. If he’s able to convince me that maybe it’s not such a bad idea, then you should definitely read this one if you live near a Delta hub and can handle some heavy spend.

Use Chase Ritz-Carlton travel credits at restaurants & grocery stores through 12/31

I didn’t see this one coming despite several tips from readers: Chase is allowing Ritz cardholders to apply 2020 travel incidental credits to restaurant and grocery purchases from 7/1/20 to 12/31/20 (they’ve just for some reason held off on letting cardmembers know!). Still, this is very good news that will feel overdue for Ritz cardholders.

Did I lose 1x in the Whole Foods double dip? The importance of base vs bonus earn

You might ordinarily think that 5x times two is worth more than 9x, but in this case you wouldn’t be right. Double dipping Whole Foods right now is the play for those who can. See this post for more on how I double dipped the bonus category.

Radisson Rewards Premier Visa Signature Card (now with a dash of aspiration)

How perplexing is it that Radisson decided to open their Maldives property now? Still, that gives Radisson Rewards a crown jewel for which too strive (While Radisson is known to have some pretty nice properties in Europe, they are pretty weak in the United States). Suddenly the credit card might be a bit more interesting if you’re looking to manufacture a bunch of free nights in paradise. Personally, I’d not plan a trip around this place until we see some more reviews — and given the current environment, that might be a while.

Other updated resources:

US Bank Altitude Reserve Guide

The Deal of the Week

The deal of the week was without a doubt the DoorDash deal for $20 off of $20, which was so popular that it got pulled early. This week was otherwise light on great deals, but if you’re looking for an interesting one to consider for the future, check out how you can now Earn status with award tickets & other Virgin Atlantic changes. While that isn’t a right now sort of deal, the ability to mix award flights and credit card spend might make Virgin Atlantic elite status more interesting down the road.

That’s it for this week at Frequent Miler. Check back soon for our week in review around the web and this week’s last chance deals.

![A coupon book with a credit card, a credit card program with an airline, and more [Week in Review] a person reading a magazine on a couch](https://frequentmiler.com/wp-content/uploads/2017/05/kick-back.jpg)

That last little tidbit about the platinum honors business bonus categories actually led me to look into possibly moving a solo 401k to Merrill. Unfortunately, the fees are outrageous.

What fees? I don’t pay any fees.

I tried to search for business investment accounts at Merrill Edge after listening to the episode too. I already have had a personal account with premium honors since 2016. I have a joint taxable brokerage I could shift around back to a Merrill business investment account that would qualify me for business premium honors as well. I could not find on the website a taxable business investment account. They did offer 401k, solo 401k, sep iras, and simple Iras. The fees on the solo 401k did appear to be quite high.

The reason to do a solo 401k instead of a simple or sep irs is to preserve back-door roth ira contributions from experiencing the cost and record keeping problem of the pro-rata rule.

They charge a $100 plan set up fee, $20 or $25 a month for plan record keeping (under $250,000 in assets is $25). Then they charge participants (which you would have to pay as a business owner as well) $3 a month record keeping AND an annual asset fee of 0.52%. Thus on $100,000 it looks like you would pay $100 to set it up, and then $300 a year plan record keeping, $36 a year participant record keeping, and $520 in asset fees. Compared to the $0 Merrill edge charges on a $100,000 personal account this $856 a year is pretty high.

https://www.merrilledge.com/small-business/individual-401k#acctop

That’s actually a little less than what I had seen for a small business 401k as I had originally landed here when trying to find what Larry was talking about:

https://www.merrilledge.com/small-business/401k

However, I think Greg has a “Business Investor Account”. See the full list of account types here:

https://www.merrilledge.com/global-oao?src_cd=allaccounts

And more info about the Business Investor Account, see this PDF (it shows it carries a $125 annual fee for a Merrill Edge Advisory Center account, but $0 for an online account):

https://olui2.fs.ml.com/Publish/Content/application/pdf/GWMOL/BIA_WCMA_FactSheet.pdf

Thanks Nick. The only business account I would be able to do for lots of reasons (including avoiding aggregation rules on the backdoor Roth as another poster notes) is the solo 401k. (Actually, my player 2 is the one who could qualify for the solo 401k to get access to business preferred rewards).

Unfortunately, the Merrill fees for their solo 401k are prohibitive and dramatically over the market for solo 401ks. She has her solo 401k at ETrade and there are zero fees as is the case at fidelity and others. The Merrill fees really are excessive. Also, it is harder to move a solo 401k. It is not just a simple rollover.

But … Even though we couldn’t get to platinum with a taxable business account we might be able to get to gold. And while 5.25 is obviously the gold ring here for the use you guys were mentioning on the podcast, 3.75 percent wouldn’t actually be that bad and possibly worth it.

I wouldn’t be able to open and fund a business account with cash so my only option seems to be moving a solo 401k account there. The fees on the solo 401k look high but maybe I am looking at the wrong thing. What kind of business account at Merrill do you have?

Sorry I didn’t realize that you meant a business account. My business account is a regular taxable investment account. And that has no fees. It’s probably worth calling Merrill and asking them if they have any fee free options that meet your needs.

Napa is Burning save the Vines !!!