NOTICE: This post references card features that have changed, expired, or are not currently available

I didn’t travel much in 2021. I mean, aside from that trip to Dubai, Abu Dhabi, and The Maldives. And to the private island in the Caribbean with Greg. Still, not much. And so as the game wound down to the bottom of the 9th, I spent the last couple of days of the year swinging for the fences with my various airline and hotel credits. I did have a couple of nice hits, but a few unforced errors have me watching over my shoulder for the guy in the on-deck circle. Here’s how I spent the last couple of days of 2021 trying to trigger airline fee and hotel credits.

The Hits

Fine Hotels & Resorts credit

Let’s start with an easy win that provides good intel for future reference: The Amex Fine Hotels & Resorts credit that comes with consumer Platinum cards.

As the final days of the year wound down, I found that many people were making the (incorrect) assumption that if they hadn’t made a Fine Hotels & Resorts booking in time for the reimbursement from Amex to show up before December 31st they were out of luck. I think a lot of people assumed that you had to receive the $200 credit from Amex by December 31st.

Thankfully, I knew that wasn’t likely to be the case. In my experience, when it comes to airline fee credits, wireless and dining credits, and Amex Offers, the credit is based on the date of the charge on your statement. As I noted in the final days of the year, the date when the merchant finalizes the transaction is what matters and in my experience non-merchandise purchases often get finalized by the merchant right away. That is to say that a purchase made today for anything that doesn’t physically get shipped to you usually (though not always) codes on your statement with today’s date even though you won’t see the charge move from pending to posted until a few days from now. More thoughts on that concept in this post.

Thus I expected that a Fine Hotels & Resorts booking made even on December 31st, 2021 should receive the 2021 Fine Hotels & Resorts credit even if you didn’t actually see the credit on your statement until January of 2022. I can confirm that my assumption was correct.

As you’ll see in the following screen shot, I made an Amex Fine Hotels & Resorts reservation on 12/31/21. I received the $200 credit for the previous-year reservation on January 1st, 2022. Note that while the $200 credit posted on 1/1/2022, that was actually my 2021 credit for the reservation I made on December 31, 2021.

Then, I made a second reservation on January 1, 2022. On January 2, 2022, I received another credit for $200. That was my 2022 credit for the reservation I made on January 1, 2022.

Note that I wouldn’t recommend waiting until December 31st to make a reservation. There is always the chance, particularly the closer to midnight that you wait, that the charge won’t finalize right away and will post with a January 1st date on your statement. Ask me how I know. If that December 31st charge ended up with a January 1st date, I’d have missed out on $200.

Of course, in any normal year, I would have easily used that credit long before the end of the year. Given that this benefit only debuted in the second half of the year and my family spent a total of three nights in hotels (I think) during the second half of 2021, we just didn’t get the chances we normally would to use it. The good news here is that if you’re a procrastinator, you might be able to wait pretty late in the game and still use that credit.

On another Platinum card, I ran into an oddity that will enable me to test the answer to another key question.

We know from experience that if you book a Fine Hotels and Resorts reservation and receive your $200 credit and you later cancel that reservation, Amex claws back the $200 credit.

Based on that knowledge, we have assumed that if you made a reservation in late 2021 for a stay that is scheduled in 2022 and you received the 2021 Fine Hotels & Resorts $200 credit but plans change and you cancel that reservation in 2022, Amex will claw back its $200 credit. You would then be stuck with no way to go back in time to 2021 to make another booking and use your 2021 credit.

Some people wondered what would happen if you had multiple reservations made in 2021 for stays consumed in 2022. In other words, will Amex automatically recognize that you have still used more than $200 worth of fine hotels & Resorts and let you keep the $200 credit?

I don’t yet know the answer for sure, but it looks like Amex was determined to punish me for my procrastination by giving me an opportunity to test those waters.

On December 31st, I first made a reservation totaling $149.38. Then, later the same day, I made a reservation that totaled $240.94. I intended to cancel the first reservation but forgot to do so — resulting in the credits posting as $149.38 toward the first reservation I booked and $50.62 from the second one. Now what happens when I cancel the $149.38 reservation? Will Amex recognize that my $240.94 booking was enough to still consume the whole credit?

I don’t yet know the answer to this one because I wanted to make another Fine Hotels & Resorts booking to use my 2022 credit before I mess with canceling anything. I made that reservation a couple of days ago and I am just waiting for the credit to arrive. I’ll post a quick quick tip when I do know.

What still works still works….for the most part

I had a number of easy wins with airline fee credits used thanks to data points in our Amex airline fee reimbursements: What still works? post. Specifically, all of my Amex cards were set up to use either United or Southwest and I had no difficulty getting easy reimbursements for things seen in that post.

The misses

Unforced error #1: Selecting my airline late in the game

we have a lot of cards in our household with Amex airline fee credits. Again, in a normal year I find ways to use these credits sooner. In 2021, the credits waited until the last minute for a combination of factors. First, I didn’t travel much. Second, United was the airline of choice on a few cards in my household and waiting until the end of a year in which I knew I probably wouldn’t travel (2021) made sense in terms of maximizing how far out I’d be able to use that credit.

Since I had just opened a Platinum card of my own in mid November, I only realized on December 30th that I hadn’t even selected an airline yet for the 2021 credit. That realization led off a comedy of errors. The bottom line is that I made two charges with United that should have triggered my airline fee credit but did not.

Here’s what I think happened. Note that I take screen shots like it is going out of style, so I have screen shots with timestamps to reference for all of this stuff along with the email timestamps.

First, the order of events

- I selected United as my airline at 12:03am Eastern time on 12/31/21. This was just after midnight.

- I made a United charge for $100 at 12:58am Eastern time on 12/31/21 and a second charge for $50 at 12:59am.

- I later made a third charge for economy plus seating later in the day on 12/31 for $55.

- I only received the credit for the $55 economy plus seating (received on 1/2/22 and not counting against my 2022 credit)

What do I think went wrong?

- Amex correctly recognized that I chose my airline on 12/31/21 — just a few minutes after the stroke of midnight in my time zone. Whether they go by user timezone or by Eastern time, they got the date right.

- The United charges for $100 and $50, which I know from screen shot timestamp and email timestamp were 12:58am and 12:59am Eastern time on 12/31/21, the date on my online credit card statement is 12/30/21. How did my purchase get backdated? I’m assuming that I must have been dealing with some sort of United-related thing in processing purchases based on the corporate headquarters timezone.

Either way, I got burned since the charge from United looks like it came the calendar day before I selected my airline even though I made the charge about an hour after selecting my airline.. Regular readers may remember that this is the second time I’ve gotten burned by United as in a previous year I purchased a lounge pass on 12/31 only to have them not finalize the charge until 1/1, losing out on my previous year’s airline fee credit and using some of the new year’s credit on a lounge pass on day 1. Ugh.

Fool me once, United. Well, I mean fool me twice….you can’t fool me again!

Unforced error #2: Procrastinating too long on BOA Premium Rewards

The Bank of America Premium Rewards card’s travel credit is pretty easy to use as these things go. We’ve never maintained a lengthy database since many different airline charges seem to work.

I was therefore pretty surprised when I realized on 12/31 that we hadn’t used our 2021 airline fee reimbursement credit on this card.

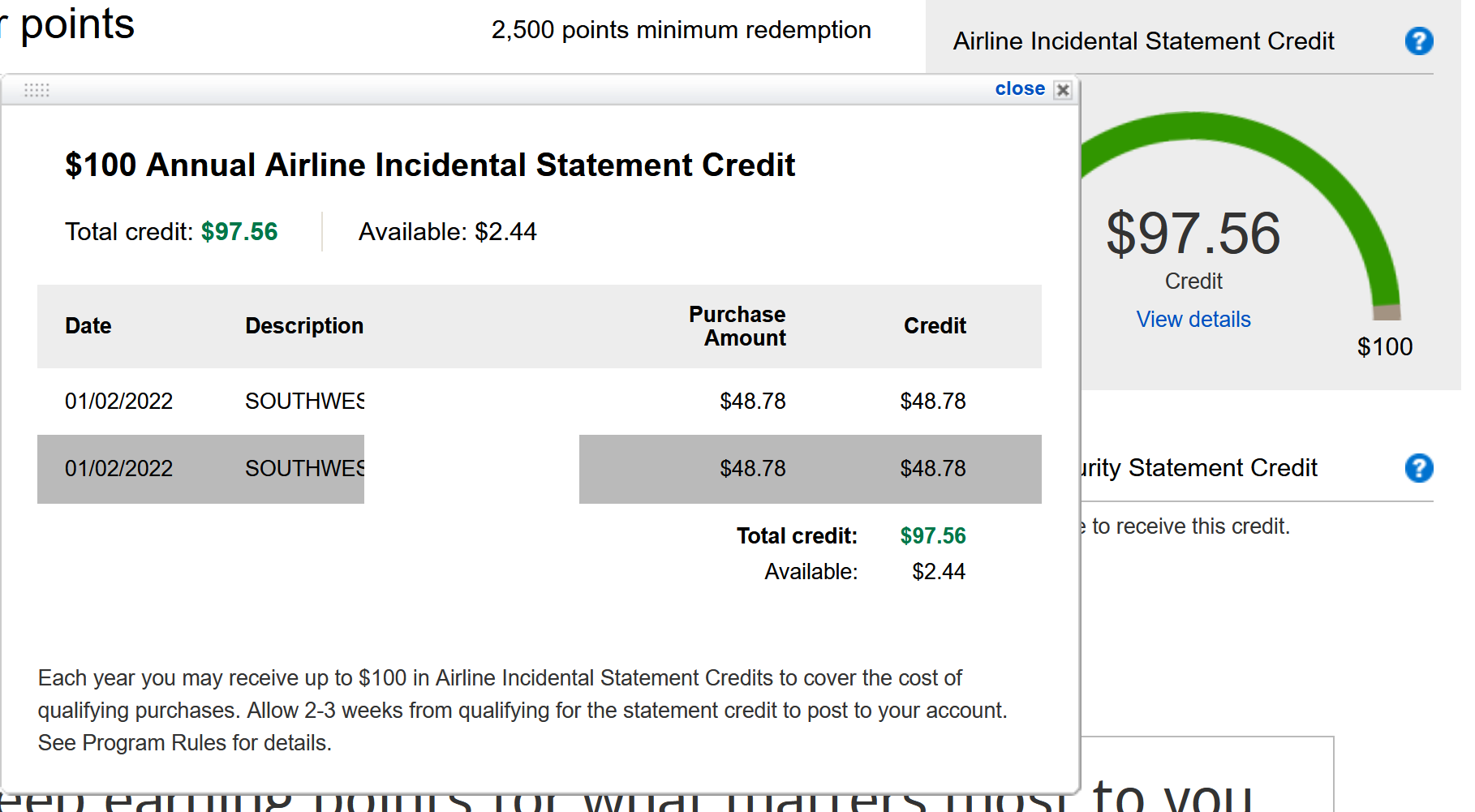

I’d read plenty of data points indicating that cheap Southwest tickets would trigger the reimbursement. I found a $49 city pair and booked it twice. I thought i had this one wrapped up since I knew the tickets should trigger the reimbursement.

Fortunately for me, the tickets did trigger the airline fee credit. Unfortunately for me, not only did they sit in pending transactions for a few days, they posted to Bank of America with a 1/3/22 date. Yes, an airline ticket I bought on 12/31/21 shows up as though I made the purchase on 1/3/22. So it did in fact trigger the credit — it’s just that it triggered the 2022 credit. The 2021 credit is lost in the ether.

Bottom Line

You win some, you lose some. though in this case it was entirely my fault to have lost out on easy airline fee credits thanks to waiting until the last minute to use my credits. Do as I say, not as I do — at the time of writing you’ve got about 359 days to for in 2022. Try not to leave using your airline fee credits until December 31st.

[…] Did you make sure to use your travel credits by the end of the year? I almost forgot last year and had to rush to spend the money at the end of the year. There are risks to waiting until the last minute, as Nick found out when he waited until December 31st to use his credits. […]

Funny, I one time selected The airline after I made the purchase and still got it credited automatically

Ha, I love the Dubya reference! I also procrastinated using the travel credits on my Bus Plat and Ritz cards. I totally spaced and already selected SW on my Bus Plat but luckily was able to switch to United through Amex chat on 12/29. The next morning I made (2) $100 United TravelBank purchases (before the site went down apparently) and luckily they both tracked and were credited on 1/2. Also on 12/30 I bought (4) $75 gift cards on my Ritz card through southwest.com (in desktop mode on my mobile browser). On 1/2 I sent a Chase secure message requesting reimbursement for (4) $75 oversized luggage fees towards my 2021 airline credit and Chase replied the next day that this was approved. I was a little worried that they wouldn’t retroactively apply the credits to 2021 since I made the request in 2022, be apparently it didn’t matter. Cheers!

I did a last minute Hyatt mattress run where I ended up having to cancel last minute due to omicron/restrictions from my work around travelling. I would have popped in/out during the 7 day stay. Checkout was 1/1. Good news was that I did everything online and got credited all the nights without even going there. Bad news was that they credited for 2022. Win/lose

I’ve read in various Facebook groups about people who say they were told by Hyatt Customer Service that stays ending 1/1 that credit to 2022 can be manually changed to credit to 2021. No personal knowledge of whether that’s true or not but you could give it a try. . .

I’ve heard the same. We have known that stays credit based on check-out date (that’s why many of us checked in during December 2020 for a stay stretching into Jan 2021 to get double elite night credit for all the nights as though they happened in 2021). As Larry notes, I’ve heard from multiple people that Hyatt is able to manually adjust those nights that happened in the previous calendar year to count toward the previous calendar year.

I started a *little* earlier than you, Nick, and discovered a 12-18 United TravelBank charge to one of my Plat’s didn’t get a credit. Found out via 12-30 chat that I had not chosen an airline. They hand-input my selection and guaranteed I would get the 2021 credit if I purchased that day. Received two $100 credits on 12-31 as promised. Also purchased $100 United TravelBank on BOA Premium Rewards on 12-30 and it didn’t post till 12-31 (credit received 1-5). Glad to say I’ve learned my lesson and have already added to United for 2022. Not putting myself through that again!

Nick – on the BofA travel credit – were you going to take those trips on Southwest? Or were you going to cancel those tickets but get Southwest credits? Just wondering your exit. I have the card for two years, with the pandemic I haven’t used the credits once! I am such a sucker. Thanks in advance for any advice.

Nick – To add a data point to your above discussion, I made an FHR booking on 12/30 for stay in 2022 and decided to make another as a backup before the end of the year. By the time I finalized my second reservation it was just minutes after midnight Eastern Time on 1/1. I felt comfort knowing that you could make 2021 bookings until 11:59 pm Central time on 12/31. However, early Jan, I received 2 FHR credits one of which is for 2022 and one for 2021. Not sure why the 11:59 Central time did not work for me but seems like a risky strategy to be that close to the deadline

You might want to update your personal version of the Premium Card Keeper spreadsheet. Not really joking. There is a pretty large diminishing return as you accrue more use-it-or-lose-it credits you that require tracking.

I didn’t miss any in 2021, but I might cut down too. Starting to feel like too much effort.

Nick, every year I wonder why you wait until the absolute last minute to use your travel credits? I get wanting the resulting credits with the airlines to expire as late as possible, but the UA travel bank expiration is 5 years of inactivity. I’d be more worried that UA takes away the travel bank option and forces me to move to my second-best option that only gets me 12 months, instead of worrying whether my travel bank expires at the beginning or end of December in 2026 if I never purchase a ticket on UA before then.

Not having to deal with all this nonsense is why I’m swearing off ultra premium credit cards this year.

As Douglas Adams wrote “Time is an illusion, lunchtime doubly so”.

The issue of time in software that crosses time zones is both philosophically and practically difficult to solve. In this case it’s clear that the transaction originated on a server running under some time zone west of Eastern time where it still was the 30th. It’s possible that the transaction issued by those servers could obtain a local time from the browser and pass that along as the transaction date (that would open up interesting opportunities to choose your own transaction date by messing with the time zone on your computer), but that opens up the philosophical issue — if United charges your credit card, did that transaction take place on the date you believe it to be, the date United believed it to be, or the date that the credit card intermediary believed it to be?

I don’t know, but I’m pretty sure that a tree just fell in the forest somewhere.

Ah, but if a tree falls in the forest, is Nick Reyes out $150?

The issue with forward-booking and not losing FHR credits in the next year is going to stick around — not only because of procrastinators, but also because so many people apply for that card in December in order to triple dip. Looking forward to hearing what happens with your accidental experiment.

Wow, what a bummer. I got almost burned once on the airline fee credit by making a purchase too soon after selecting my airline. Flyertalk wiki recommends waiting a day now, tho I think 4 hours was considered okay if I remember right. I was waiting for the meter to move, and on 12/31 (several years ago) I decided to re-read some DPs. That’s when I realized I likely made the purchase too soon. So I made more on NYE and sure enough they did credit and counted for that year. My guess is this what happened to you, and it didn’t matter the charges showed up as 12/30. You could have done them an hour later and the system still wouldn’t have been up to date for your selected airline.

That said, definitely review your airline fee credits by 12/29 so you can select the airline by then and purchase on 12/30. Last year I pushed myself to think like 12/30 was the last day of the year as I can be a procrastinator too. It was mainly the hotel credits as airline stuff was already done. I hope travel bank codes nicely this year too. Fingers crossed.