For many, the Amex Gold Card is a great option to have and to hold. In exchange for the card’s $250 annual fee, the Gold Card offers 4x points at US Supermarkets (up to $25K in purchases, then 1x) and 4x at restaurants worldwide. Additionally, cardholders get up to $10 in statement credits monthly with participating dining partners (Boxed.com, Shake Shack, Seamless/Grubhub, Cheesecake Factory and Ruth’s Chris Steakhouse); $10 per month in Uber or Uber Eats credit (use it or lose it each month); and a complimentary Uber Eats Pass Membership for up to 12 months (must enroll by 12/31/21). If you spend a lot at grocery stores and/or restaurants, the card’s 4X categories alone can make the card worth the annual fee. The monthly dining and Uber credits are icing on the Gold Card cake. But I digress… this post isn’t about the value of keeping the card, but rather how to get the best deal when acquiring the card regardless of whether you plan to keep it long term.

Currently, there are multiple different welcome offers available for the Amex Gold Card, and I’ll cover most of them below. The one offer I won’t cover is the one found on most other websites: 60K points after $4K spend. That offer (which other websites get paid to display) is not as good as any of the options shown below. As always, at Frequent Miler, we only show the best public offers even if it means that we lose out on revenue.

The following offers are listed from best to worst (in my opinion). Readers may be surprised to learn that I think that the targeted 75K offer is the worst of the options (but still very good!):

#1) Two Player 30K + 60K Points

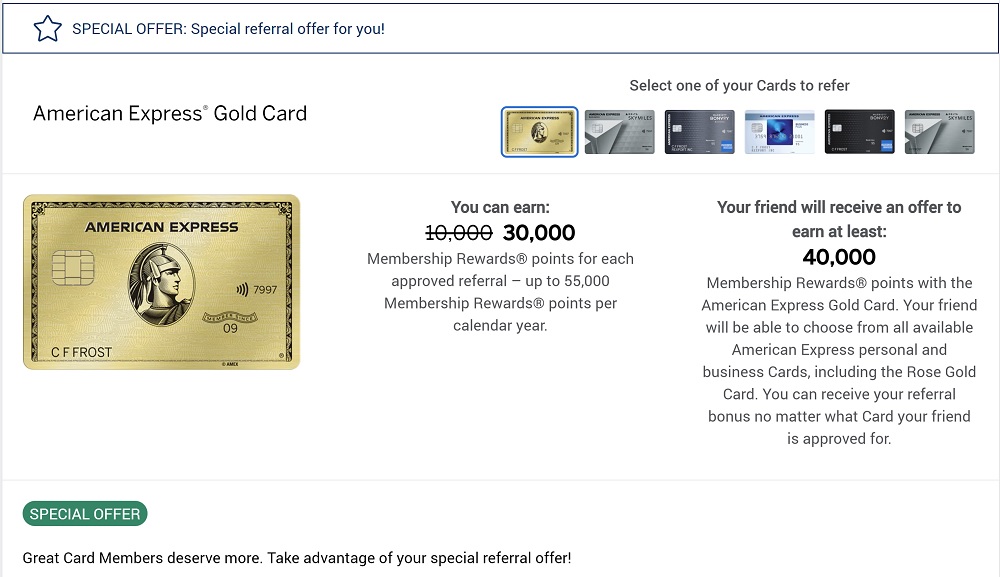

If you are in two-player mode (i.e. you collect points with another adult partner or family member), then check both of your Amex accounts to see if either of you has the ability to earn 30,000 Membership Rewards points (or more) for referring a friend. The idea is that one of you will earn 30K for the referral and the other will earn 60K for signing up with that referral link.

Even though the image above shows a 30K referral offer on the Gold card, this approach will work regardless of which of your Amex cards has a 30K (or more) refer-a-friend offer. Amex lets the recipient of the referral pick a different card to sign up for and you’ll still get the 30K points as long as they are approved!

Note too that the image above shows that the recipient with receive an offer to earn “at least 40,000” points. In practice, recipients usually see the 40K crossed out and 60K in its place (try different browsers if you don’t see the 60K offer):

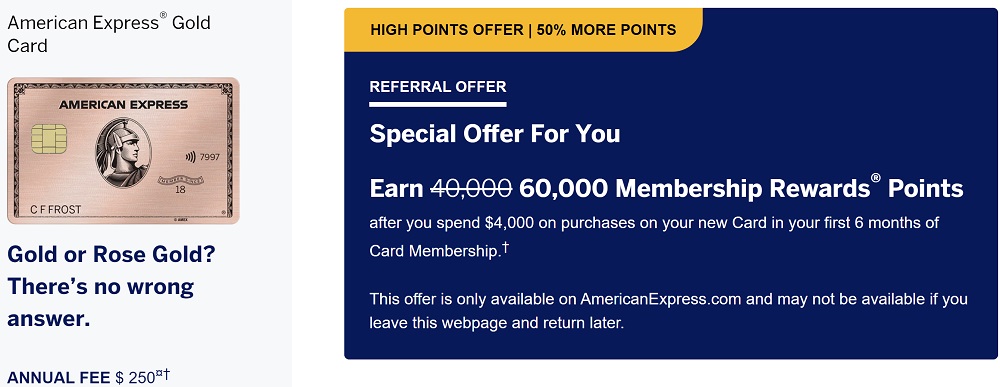

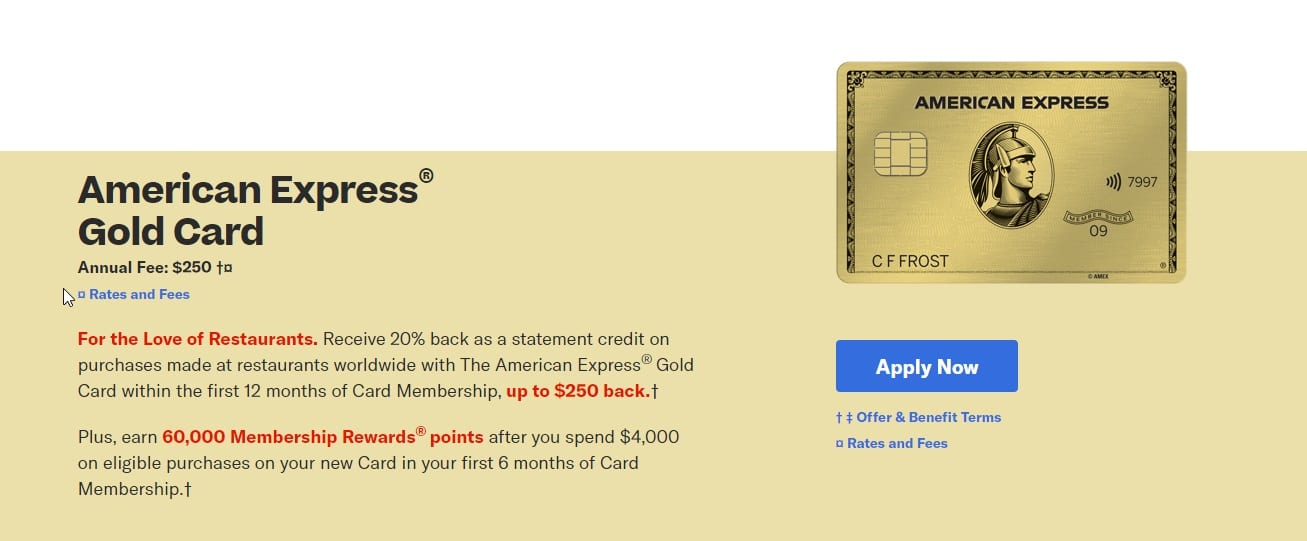

#2) 60K Points + $250 cash back

The second best option (in my opinion) is the publicly available offer through the Resy website: 60K points after $4K spend + $250 back. The $250 back is earned as a rebate on restaurant spend: for the first 12 months, you’ll get 20% back for all restaurant purchases, up to $250 back total. To max out the $250 back, you would have to spend an average of only $25 per week at restaurants. This should be so easy for most to accomplish that I consider it to be almost the same as a straight up $250 cash rebate.

This is the offer that you’ll currently find on the Frequent Miler website when you visit our Amex Gold Card page.

#3) 75K Points

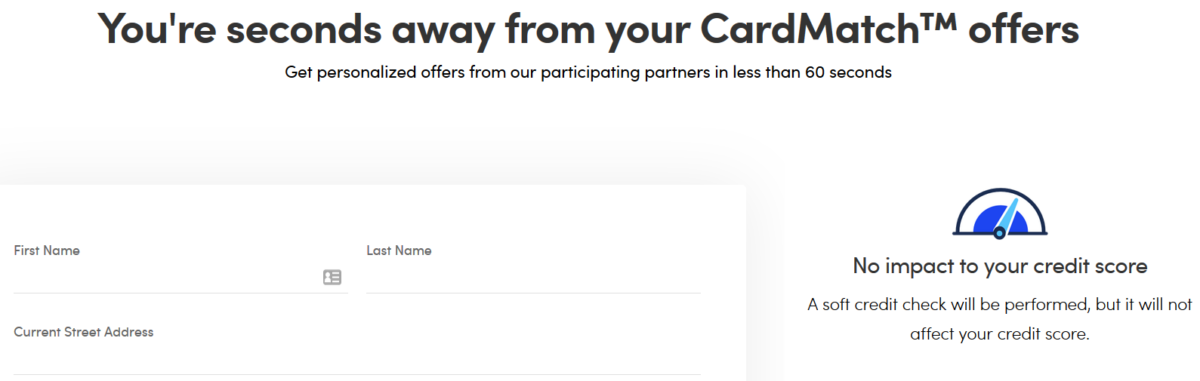

Through the CardMatch Tool, some people have reported receiving an offer for 75K points after $4K spend for the Amex Gold Card. Even better (in my opinion), some have found a 125K offer for the Platinum card.

Through the CardMatch Tool, some people have reported receiving an offer for 75K points after $4K spend for the Amex Gold Card. Even better (in my opinion), some have found a 125K offer for the Platinum card.

To check for yourself, click through to the CardMatch Tool and enter your information. There is no hard credit inquiry and so there’s no downside to checking. Full disclosure: I can’t remember ever personally finding any offers through this tool that were better than the ones found on our Best Offers Page. That said, many readers have reported success and so it’s definitely worth a try.

Bottom Line

If you are working in two player mode and have access to a 30K (or better) refer-a-friend offer, then you can snag 90K points by referring player 2 to the 60K Gold Card offer. That’s a great deal. If that’s not an option for you, then I’d recommend going with the Resy 60K + $250 offer. The only reason I can think of to go for the 75K offer is if you don’t think you’ll earn the full $250 with the Resy offer. Personally, I wouldn’t give up $250 for the extra 15K points available through the 75K offer. Doing so is like paying 1.67 cents per point for Membership Rewards. That’s not a bad price if you have an immediate high-value use for those points, but in most cases I don’t recommend it.

Despite my sort-order of the above offers, you can’t go wrong with any of them. They’re all fantastic offers. The only way you can go wrong is by signing up for the standard 60K offer alone. I purposely didn’t link to that offer anywhere on this page because it’s just not as good as the other options.

[…] but, as usual, our friends at https://frequentmiler.com/ do a great job of sorting it out for us https://frequentmiler.com/how-to-find-the-best-amex-gold-bonus/ . Amex Gold is a middle tier card ($250 per year) that gives you the same Membership Rewards […]

I’ve had the PRG but when I check for pre-qualified offers, it gives me the plain 60k offer. Seems like this SUB is therefore available. The question is, are the other offers available if I try them instead of the one they give at sign-in?

Yes, the Resy offer is available to everyone. You can simply sign up with the link in the post.

Don’t have anything to add other than I appreciate you never leading readers astray with lesser offers. It’s been sickening seeing so many other blogs push lesser sign up bonuses these past couple of weeks on this card. And depressing reading comments of folks who have signed up for those same offers…

So to get it clear. Neither me or my wife have the gold card. Can i still refer her even if I don’t have the gold card ?

Yes. You can send her your referral link from any Amex card and she can click your link and then at the top it says “Looking for another card?”. She can hit “All personal cards” and then find the Gold card and apply for that and you still get your bonus.

The exception is if you have a Hilton, Marriott, or Delta card. Those cards can only refer people to the other cards in that family (i.e. if you have the no-fee Hilton card, you can only refer people to that card, the Hilton Surpass, Hilton Aspire, or Hilton business). If you have a Platinum or Everyday or Blue Cash Preferred or any other Amex-branded card, your wife will be able to choose whatever card she wants and you’ll get your referral bonus.

I’d much rather an additional free and clear 15k now than $250 over the next several months if I spend $1250 at restaurants (I assume that’s the spend required if $250 is 20%). That $1250 could be spent going towards another SUB, or towards one of the many other restaurant promos out there. So you have time value of money(or points), restrictive spend requirements (restaurant only) and opportunity cost as why it’s not the same as buying Amex points for 1.67 cpp.

Now if your goal with Amex is cashing out with Schwab, then I could see how you could come to your conclusion.

I think it just depends how much you usually spend on dining. If you spend significantly more than $25 per week then you wouldn’t have to worry about whether you’d earn it all. Since the card offers 4X on dining, it doesn’t seem like you’d be missing out in most cases with using the Gold card vs any other.

That said, I can certainly understand wanting to get the whole bonus in one shot

I once had a gold card but it was called PRG. Does that disqualify me for a bonus on the Gold? What if I have it as a prequalified offer in my account – does that mean I get the bonus?

Technically it probably does disqualify you, but if you try to apply and don’t get a pop-up telling you that you are ineligible, you should get the bonus. See this post: https://frequentmiler.com/bending-amexs-lifetime-rule/

A prequalified offer can help if it doesn’t have offer terms that state that you’re ineligible if you’ve had the card before. Some prequalified offers state that, others do not.

I checked the terms and it has the lifetime language. And in any event, I too would prefer the 75k offer, but no Amex offers come up on the card match.

I have a pre-qualified offer for 75k on the Amex pre-qual tool for Gold card. However, each time I try to apply, it requests that I sign in. I try to sign in and it refreshes the screen and makes me login again. I also tried the “Apply without logging in” button, but the same thing happens–screen refresh and prompts me to sign in.

Anyone else unable to reach the application screen?

I haven’t seen that happen. Just out of curiosity, is there a reason you prefer the 75K bonus to the 60K + $250?

Basically, what WR2 said below. I rarely have restaurant spend (we just don’t eat out much), so the $250 rebate feels like work.

Makes sense.

I’ve had the Gold card before, so am not eligible for these offers. I just checked for pre-qualified offers in my Amex account. I had an offer to upgrade my Green card to Gold for 40,000 MRs after $2000 spend. My Green card’s AF posts next month. I’m happy with this option. Amex even let me choose the Rose Gold card.