NOTICE: This post references card features that have changed, expired, or are not currently available

Most airlines offer extra benefits to their most valuable customers. This is usually handled through elite status. If you fly enough with an airline, you can become “elite”. Of course, not all elites are equal. Most airlines have multiple elite tiers to differentiate their valuable customers from their really valuable customers. And, of course, airlines offer the best perks to their highest tier elites.

Delta does the same. They offer elite tiers ranging from Silver status to Diamond status. Silver status perks are only slightly better than those you get from holding a Delta branded credit card. Diamond perks, though, are very nice.

Where Delta differs from all other airlines is that they offer a path to high tier elite status that does not require flying. Via certain Delta branded American Express credit cards, it’s possible to spend your way to high level elite status.

You might wonder why bother earning elite status without flying? After all, the only way to enjoy those benefits is to fly, right? True, but there’s a difference between earning elite status through flying and enjoying elite status while flying. Most who earn elite status through flying, hate to book award flights for themselves because it means flying without earning more elite qualifying miles. Those who earn elite status through credit card spend don’t mind using miles to fly. You still get elite perks and you don’t have to worry about losing out on status earning.

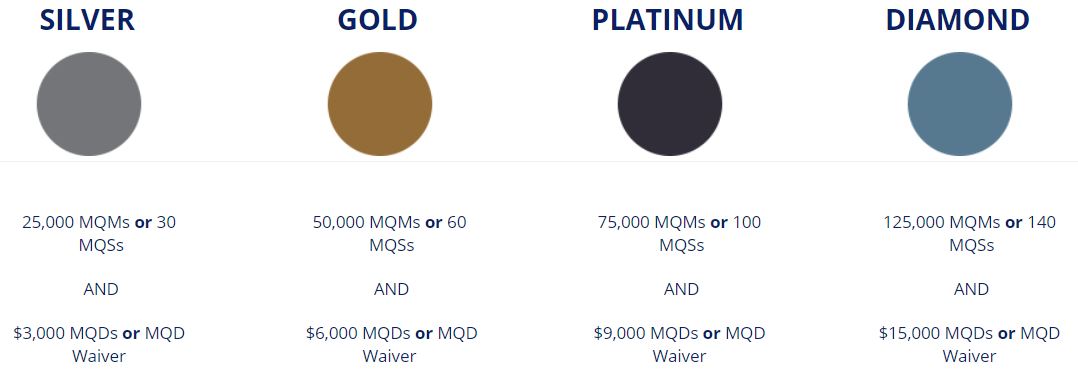

Now lets take a look at Delta’s requirements for each elite tier…

Delta Elite Status Requirements

Definitions:

- MQMs: Medallion Qualifying Miles can be roughly thought of as the actual miles flown. It’s important to understand that these are different from redeemable miles which can be used to book award flights. MQMs are only used for earning elite status.

- MQSs: Medallion Qualifying Segments are the number of segments flown. Unless you fly a very large number of short flights, you are unlikely to earn elite status through MQSs.

- MQDs: Medallion Qualifying Dollars are the sum total of your spend on Delta-marketed flights.

Explanation:

In general, to reach each elite tier, Delta SkyMiles members must earn the stated number of MQMs or MQSs and spend the targeted amount of MQDs. In other words, its not enough to just fly far or often, you also need to spend a lot of money with Delta.

Fortunately, there’s an easy exception to the MQD requirement for Platinum status and below: Simply spend $25,000 or more with Delta branded credit cards and the MQD requirement goes away. Even better, several Delta branded credit cards offer bonus MQMs for high spend, so it is possible to tackle both requirements (MQMs and MQDs) through spend without setting foot on a plane. Unfortunately, Delta requires $250,000 in credit card spend (across all Delta cards you have) to get a MQD waiver for top tier Diamond status.

Rollovers

Most airlines require that you fully re-earn status every calendar year. Delta is mostly that way too, but with one exception: if you earn more than 25,000 MQMs in a calendar year, any MQMs not used to reach status are rolled over to the next year. For example, if you earn 70,000 MQMs and meet Gold MQD requirements, you’ll earn Gold status (at 50,000 MQMs), and 20,000 MQMs will be rolled over to the next year to give you a jump start towards re-qualifying.

Elite Benefits

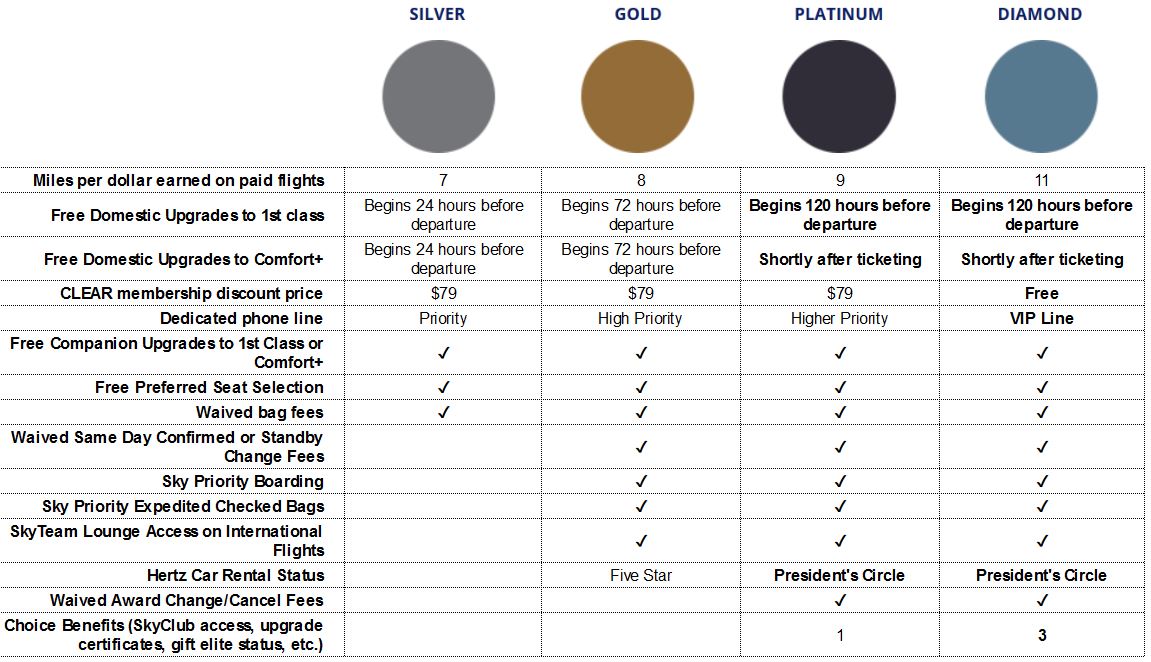

Delta’s chart of elite benefits can be found here. Here’s a summarized chart I created:

The elite benefits I’ve personally found to be most valuable are:

- Unlimited complimentary upgrades (when available, upgrade from coach to first class on domestic flights). Higher status leads to better chance of upgrades.

- Waived same-day confirmed fees and waived same-day standby fees (switch to different flight on same day as ticketed flight). Requires Gold or higher.

- Complementary Comfort+ seats (more leg room, free drinks, better snacks).

- Free award changes and cancellations. This is huge because it lets me book awards when I see availability even if I’m not sure I’ll take that particular flight. Requires Platinum or higher.

- Regional upgrade certificates. Puts you to the front of the line for regional upgrades. This is great to use for flights where upgrades are most important to you. For example, I use these for flights of about 4 hours or longer. This is a choice benefit for Platinum and Diamond status.

- Global upgrade certificates. Use these to upgrade from coach to business class on any international flight when upgrade space is available. In many cases the upgrade space won’t be available at the time of booking, but you can then waitlist for the upgrade. My wife and I have had 100% success in upgrading this way, but we’ve been very lucky: most of our upgraded flights have been between the US and Europe where upgrades are much easier to score than with longer distance flights (such as to Asia, South Africa, or Australia). This is a choice benefit for Diamond status only.

Manufacture Delta elite status via credit cards

Thanks to a few Delta branded credit cards, its possible to earn elite status entirely through spend. The following cards make it possible to earn Delta MQMs (and MQD waivers):

Card Name w Details No Review (no offer)

It’s theoretically possible to own all four Delta credit cards, so it’s possible for one person to manufacture up to 100,000 MQMs each calendar year:

- Delta Platinum: Spend $50K, Get 20K MQMs

- Delta Platinum Business: Spend $50K, Get 20K MQMs

- Delta Reserve: Spend $60K, Get 30K MQMs

- Delta Reserve Business: Spend $60K, Get 30K MQMs

Giftable MQMs

When you earn MQMs from the Delta Reserve card (business or consumer), you can keep those MQMs for yourself or gift them to someone else. The ability to gift MQMs makes a number of scenarios possible for achieving elite status…

Scenarios

Here are a number of options for earning status through spend with Delta credit cards:

Silver status (requires 25K MQMs)

This can be accomplished with a single card. Spend $60K per year on the Delta Reserve card and you’ll earn 30K MQMs each year, plus a MQD waiver. Even without flying any paid Delta flights, you’ll roll-over 5K MQMs each year and will eventually earn Gold status!

Another option is to spend $50K on a Delta Platinum card. This will generate 20K MQMs. You’ll still need to earn 5K MQMs through flying (or through roll-over from a previous year).

Gold status (requires 50K MQMs)

This requires two cards. Spend $60K on the Delta Reserve card plus $50K on the Delta Platinum card. Together you’ll earn 50K MQMs.

Gold status (with a little help from a friend)

Another option is for a couple to each get their own Delta Reserve card and to spend $60K on each. 30K MQMs can be gifted from one person to the other so that one person ends up with all 60K MQMs. One advantage of this approach over the one above is that each person will get Delta Reserve perks such as SkyClub access when flying Delta, and an annual first class companion certificate. The obvious downside is that it requires paying the Delta Reserve’s hefty annual fee twice.

Platinum status (requires 75K MQMs)

This requires three cards. Spend $60K on both the Delta Reserve consumer and Delta Reserve business card, plus spend $50K on the Delta Platinum card. altogether you’ll earn 80K MQMs. A big downside to this is paying for a second Delta Reserve card.

Platinum status (with a little help from a friend)

Another option is for a couple to each get their own Delta Reserve card and to spend $60K on each. 30K MQMs can be gifted from one person to the other so that one person ends up with all 60K MQMs. And that personal also has a Platinum card with which they spend $50K and earn 20K MQMs. In total, one person would end up with 80K MQMs.

Platinum status (two player mode: two for the price of one)

This option takes advantage of the fact that once you reach a level of elite status, you keep that status for the rest of that calendar year, all of the next calendar year, and through January of the year after that. If you have the ability to manufacture spend quickly, you can give two people Platinum status by alternating who gets the MQMs. Here’s how:

- Year 1: Person A spends $60K on Delta Reserve & $50K on Delta Platinum. Person B spends $60K on Delta Reserve and gifts 30K MQMs to Person A. Now Person A has 80K MQMs which gives them Platinum status for the rest of year 1, and all of year 2, and through the end of January of year 3.

- Year 2: Person B spends $60K on Delta Reserve & $50K on Delta Platinum. Person A spends $60K on Delta Reserve and gifts 30K MQMs to Person B. Now Person B has 80K MQMs which gives them Platinum status for the rest of year 2, and all of year 3, and through the end of January of year 4.

- Year 3: Person A’s Platinum status runs out Feb 1, so as quickly as possible, Person A spends $60K on Delta Reserve & $50K on Delta Platinum. Person B spends $60K on Delta Reserve and gifts 30K MQMs to Person A. Now Person A has 80K MQMs which gives them Platinum status for the rest of year 3, and all of year 4, and through the end of January of year 5.

- etc.

Diamond Status (125K MQMs + $250K spend for the MQD waiver)

It’s possible to earn Diamond status through spend alone, but it’s pretty difficult. Through spend alone, one person can earn at most 100K MQMs. Options for additional MQMs include: gifted MQMs from another Delta Reserve cardholder; MQMs from flying paid flights; MQMs from previous year rollover; etc.

The Delta MQD requirement is much harder to achieve. To get a Diamond status MQD waiver, you need to complete $250,000 in Delta credit card spend within the calendar year. If you have all four Delta cards that earn bonus MQMs, and you max out their MQM earnings, you’ll have reached $220K of spend. You’ll need $30K more to get your MQD waiver.

This year, via manufactured spend techniques, Ive already completed the required $250K spend for Diamond status. And, I’ve already applied my 2019 global upgrade certificates for an upcoming round-trip flight to Europe with my wife. Surprisingly, all four upgrades cleared instantly (e.g. I didn’t have to be put on the waitlist for the upgrades).

Is it worth it? For most people, probably not. Platinum status is pretty darn good and far, far easier to achieve. That said, I do enjoy the extra perks for being Diamond!

Conclusion

I’ve presented here the tools needed to obtain Delta elite status through spend. Whether or not you should do so depends heavily upon your situation. Do you fly enough with Delta to make it worth it? If not, don’t do it. In my case I live near a Delta hub, and both my wife and I fly Delta often. As a result, it is worth it to us.

[…] also: How to manufacture Delta elite status (i.e. spend your way to […]

Can you clarify: If I have two Delta Amex Cards (Platinum and Reserve, for example). One card has $20k spend on it and the other $5k spend. Does that mean I meet the $25k spend requirement for MQD waiver? Or do I need to hit the $25k on both cards individually?

As for the MQM boost….Do I need to hit the requirements specific to each card ($25k and $30k, respectively) to get the MQM boost that each card offers? Or does the spend across all cards somehow get added together?

Yes, you would get the MQD waiver with $20K spend on one Delta card and $5K spend on the other.

For the MQM boost you need to hit the requirements with each card. So you have to spend $25K on the Platinum card and $30K on the Reserve card.

[…] manufactures Delta Diamond status every year and loves it. I do like elite status in general — I’ve written quite a bit […]

[…] On the other hand, you might want to consider whether it makes more sense to fly or spend. See: Delta mileage running: flying vs. spending for […]

[…] chasing Delta status, this would be a key tool to have in your wallet. For more on that, see: How to manufacture Delta Elite Status, recently […]

[…] I’ve done some mileage running with same day turns in the past. When doing them with friends, it can be a lot of fun. When doing it alone — not so much. It’s been a couple of years now since I’ve done anything like that. I now earn my status almost entirely through credit card spend. For details about how that works, please see my recent post: How to manufacture Delta elite status. […]

Thanks for the write up. You always have the most roundabout, fascinating analyses.

My gut already knows that this isn’t gonna be worth it for me, but I am still curious how much it’d cost me to do this if I were ever interested. Let’s say we aim to achieve diamond via pure MS:

– $1,640 in credit card annual fees: all four Delta cards plus a Reserve for a friend

– $310,000 in spend on these cards… $250,000 for self and $60,000 for friend

– Assuming we value Delta miles as highly as MR points (a stretch) and have a Blue Business Plus, the opportunity cost is at least 310,000 MR points. It’s possible that the opportunity cost was higher if some of the spend qualify for better bonus. That’s a minimum of $6,200

– Optionally, for those who don’t have gigantic organic spend, let’s assume a 1% cost to MS. That’s $3,100

So, the 1-year Diamond status would come with a minimum cost of $7,840 for those with large organic spend, and $10,940 for MS purists. You will offset a bit with the other perks of the credit cards, but probably not much.

I’m guessing that nobody can possibly get this much value out of the Diamond status by taking only one or two trips. So, in order for this to be worthwhile, one must travel with Delta at a certain frequency, which in turn reduces the MS burden.

Well, at the end of the day, at least those who hold both Diamond status and four Delta Amex cards are for sure at the top of any upgrade list 🙂

You’re absolutely right: if you don’t fly Delta often, it doesn’t make sense.

how do you justify the DTW prices for DL given that DL charges 1.5x – 3x as much for flights as other airlines, and often penalizes DTW flyers through married segment logic, and has tossed the award chart making searching for awards a waste of time except when there’s flash sales?

Do you really think it’s worth manufacturing status just to get an upgrade maybe once in a while?

I highly value nonstop flights and reasonable departure times, so I find that once I filter to those flights, Delta is usually about the same price as the competition (not counting Spirit) and/or the only choice out of DTW.

Married segment logic: sometimes I use it to my benefit with hidden city ticketing or throw-away returns. Sometimes I get around it on awards by booking through Virgin Atlantic.

tossed the award chart: I don’t know why that makes it any less beneficial to search for awards. Sometimes I search and find great awards, sometimes not. I have the exact same experience on that front with United or AA (except with AA I never seem to find good awards)

Is it worth it… I highly value fully refundable tickets and with Platinum or higher, all awards are fully refundable. I also highly value upgrade certificates. Regarding free upgrades: as Diamond I can’t remember when I last failed to get upgraded either in advance or at the gate. So, yes, to me it is absolutely worth it!

I was considering the same method to get platinum status. How much do you actually spend in order to get the status (ms fees – miles value)?

Look for a post tomorrow on that topic.

This might be a little off topic. I recently (about 1 week ago) closed a Delta Gold Business card to avoid the annual fee. Yesterday, I tried applying for Delta Platinum (tried both personal and business), and the popup showed up indicating I wouldn’t be getting the signup bonus because of account open/close history, etc. I assume this ineligibility is due to the fact that I just closed the Gold account. Looking back, maybe I should have opened the Platinum first. Just thought to share …

Also, any idea how long I will need to wait to become eligible again? Thanks.

That’s sort of surprising except that I think the pop-up is often over zealous with it’s warnings. My guess is that you would get the bonus anyway, but of course there’s a chance you wouldn’t. I don’t know how long you would need to wait, but there’s no harm in trying regularly until the pop-up goes away.

Thanks Greg. One related DP, on my wife’s account, she closed her Delta Gold a couple of months ago, and she was getting the same popup when I tried for Platinum. I think I will keep trying regularly as you suggested.

Also, what do you think if I ask AmEx to reopen the Gold account? I will need to book a Delta flight with cash soon, so might as well get the Gold card back to earn some miles as well as cover the baggage fee. Thanks.

That’s not a bad idea if you need the free checked bag

My wife and I have been flying Delta even when the price is higher. We fly domestically about 3 times a year, always first class. And we fly business class to southeast Asia twice a year.

But thinking about it, First Class and Business class get us most of the benefit of status so if we do occasionally use Delta, it won’t matter much if we lose our status.

So I plan to choose my carrier mostly on cost, reviews, and personal experience.

That makes sense. If you buy your business class tickets for international flights, then I highly recommend that you get an Amex Platinum card (not the Delta Platinum card). Those cards have a benefit called the international airline program in which they can sell you premium cabin international flights at a significant discount. Here’s their website about the program: https://www.americanexpress.com/us/travel/international-airline-program/index.html

I’ve been a Diamond for several years now primarily through this method. However, I recently decided to give it up. Searching for award tickets this year has convinced me that Delta has devalued skymiles to an absurd level. Two quick examples: I was looking for one way ticket PHX-EZE in early Dec. Cheapest First Class w/ DL was 280k miles. AA was 57.5k and UA 60k. Then I searched domestic one way MOT-PHX: DL 52k, UA 12k. There are other searches I’ve performed throughout the past couple of years (PHX-JNB) that confirm these results. How can one of the three major airlines be so much higher than their competition? It breaks my heart to leave (I became a million miler this year) and I love the GU certs, but the opportunity cost of buying 250k skymiles vs UA, AA or any hotel chain is just too much.

In my experience the award costs vary tremendously from time to time and by route. Yes, often Delta is much more expensive than AA and UA, but sometimes I find Delta is cheaper.

[…] Please see an updated version of this post, here: How to manufacture Delta elite status. […]

How do you gift MQMs? Nice article; thanks for writing it.

Thanks. Once the Amex credit card statement closes in the month you finish the spend requirement for the bonus MQMs ($30K and again at $60K), you’ll get a congratulations email saying “15,000 Medallion Qualification Miles are Yours”. In the email it explains that you have 90 days to log in and gift the MQMs to someone else or accept them for yourself (there’s a page on the site somewhere for doing this online). If you don’t gift within 90 days, the MQMs go to your account. Note that if you earn them in 2018, but don’t accept them until 2019, they still count towards your 2018 MQM totals.

@Greg- Kinda of a shame that Delta has been granting waivers to exempt from the $250,000 spend requirement. It was pretty aggressive to start with. Hopefully in the near future they drop the dollar amount to a more reasonable amount.

I hope so too!

Am i reading that correctly…. Delta has granted waivers exempting people from the $250k spend requirement for the MQD waiver?

Some people have reported that, yes. I’ve tried a couple of times with no success.

Thanks for the info! There’s hope for me then :-).