If you suddenly had to spend a million dollars, what would be your rewards earning strategy to get the most bang for your big bucks? We get this type of question from time to time, whether from small business owners or those with a sudden tax bill from an inheritance or sale of a home and this week we discuss ways to tackle huge amounts of spend.

If you suddenly had to spend a million dollars, what would be your rewards earning strategy to get the most bang for your big bucks? We get this type of question from time to time, whether from small business owners or those with a sudden tax bill from an inheritance or sale of a home and this week we discuss ways to tackle huge amounts of spend.

Elsewhere on the blog this week, Team Tokyo and Team San Francisco print their predictions for the upcoming Frequent Miler challenge, we show how to get great value out of the Amex cross-brand referral program, Greg highlights a high point in the Wyndham/Vacasa partnership, and a lot more. Watch, listen, or read on for more from this week at Frequent Miler.

00:29 Giant Mailbag

01:56 Giant Mailbag #2

04:25 Card Talk: Bank of America Premium Rewards card

19:00 What crazy thing . . . did Choice Privileges do this week?

22:25 Mattress running the numbers: Wyndham summer promo

27:32 Award Talk

27:50 Nordic Choice rebrands as . . . Strawberry?

29:51 Using Wyndham points to book Vacasa

35:39 Avianca customer service success

39:38 Frequent Miler Challenge Update

43:30 Main Event: How would we spend $1 million?

44:29 Bank of America Premium Rewards card with Platinum Honors

46:14 Citi Double Cash or Capital One Venture / Venture X / Spark Miles

48:34 Multiple welcome bonuses

49:03 Business Platinums

51:36 Venture X for Business

54:32 Aeroplan Visa

57:16 Delta Diamond for life

59:41 Get elite statuses

59:42 American Airlines elite status

1:01:45 Air Canada Aeroplan elite status

1:02:45 Hyatt elite status

1:04:51 Marriott elite status

1:06:09 IHG elite status

1:07:20 What would Greg do?

1:09:12 What would Nick do?

1:17:30 Question of the Week: Is it possible to get an Amex Business card with a low percentage of business owned?

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week on the Frequent Miler blog…

Bargain luxury in Hawaii: Greg’s Wyndham Vacasa experience

Greg recently kicked back and relaxed in the lap of luxury, finding a slice of paradise both in terms of being in Hawaii and certainly also in terms of his Big Island Vacasa experience. While properties will always vary from one to the next, Greg’s Kona rental really spotlights why this partnership can be so awesome. Hopefully the rumors of Choice buying Wyndham don’t become reality, because I would hate to see this partnership fade away.

Which award search tool is best?

These popular award search tools just keep getting better and better. In this latest update, Roame.Travel has added functionality for Alaska Mileage Plan, continuing to increase the value of that free tool. Whether you are new to award searching or you just like saving time, these tools can be really handy.

Party of 5 Predictions – What do we think Team SFO has planned?

With the 2023 Frequent Miler challenge set to take flight in just a few days, anticipation is building among the Frequent Miler team. Carrie and Stephen have planned the first week of the challenge, which kicks off in the coming week. As we get closer to the starting line, it feels increasingly strange to know that I’m traveling abroad in a few days….and I have no idea where I’m going. In this post, Carrie and Stephen try to predict what we’ll do in week two, when Tim and I take the baton. This post was full of excellent guesses, but the only tidbit that I’ll confirm or deny is that when Drew said it’s going to be “epic”, he wasn’t lying.

Tim & Nick predict: What we think Stephen and Carrie will do

When I say that Carrie has exuded confidence about the challenge for the past month or so during team meetings, you probably still don’t quite imagine how pleased Team Asia appears to be with itself…..so while I have no idea where we’re going and what we’re doing, I can’t help but think it’s going to be an amazing week. But where will they actually take us and what will we do? In this post, Tim and I try to predict what Carrie and Stephen have in store. You will want to follow @Frequent_Miler on Instagram to keep up with updates in real time when we take off later this week.

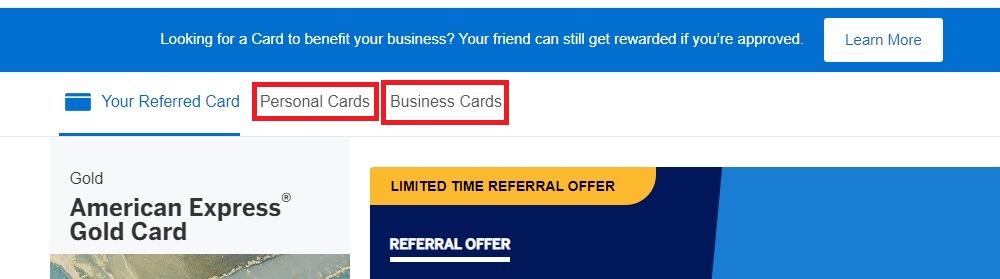

How to create cross-brand Amex referrals

If you have an Amex card that earns Membership Rewards points or cash back, Amex makes it easy to earn points referring others to new cards no matter which card they want. I have extensively updated this post to show you how to create your own cross-brand referral links or refer someone who wants a business card from one of your consumer cards, etc. Referring your household “Player 2” can be another great way to build up points and trigger bonuses, so you’ll want to familiarize yourself with the mechanics.

Alaska Air Mileage Plan Complete Guide

Everything you ever wanted to know about Alaska Airlines Mileage Plan under a single roof. While Alaska has certainly made some negative headlines over the past year, mostly getting rid of an award chart and slashing mileage earnings in some instances, there are also quite a few reasons why you might want to make this your oneworld program of choice. If you’ve decided that Alaska has the program for you, you’ll want to bookmark this guide for easy reference.

An Avianca LifeMiles success story (thanks to screenshots)

Avianca LifeMiles customer service has long had a reputation that preceded it, and not in a good way. That’s why I found it so surprising when I recently had a website error fail to ticket a booking and customer service was able to help me fix it and get ticketed with a call that took less than 20 minutes. More shocking yet is that I’m not alone — see the comments for multiple reader reports of both similar errors — and similar positive experiences getting them resolved.

That’s it for this week at Frequent Miler. Keep a close eye on this week’s month-ending last chance deals to make sure you don’t forget those expiring this month.

![Viral marketing proves infectious for two more airlines, a new card lands with a thud and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/viral-airline-marketing-218x150.jpg)

This podcast was very entertaining. I was hoping that in response to one of Greg’s proposals, Nick would say, “It’s so crazy, it just might work!”

I probably do close to 500k biz spend a year. I keep things under 5/24, but how I do a lot of my un-bonused spend is two BBPs, that I max, Ink Premier at 2.5% cash back. A couple of Hilton Biz, that I do 15k on for FNCs. All while keeping a steady velocity and hitting Inks, and Biz Plats, Staples GCs, etc.

I used to do a lot of Ink Unlimited x CSR 1.5 PYB for 2.25%, but after the nerf, the Ink Premier has taken that spend.

I also did the 3k on 50k spend offer on the Sparks Cash Plus when that was last offered.

BOA Platinum has tempted me, but at the time the bonus was 300, and the Ink Premier was 1000, so the break-even would’ve been 700/.00125 = 560k spend, which isn’t worth it.

It was not discussed if you can time your spend. Airline or Hotel spend can give you 2 years of status if spent at the right moment. AA for example…let say you spend 200k on March…you get Exec Plat status for that year, next year, and then to Feb of the third year. That cut the “cost” of getting status for 1 year in half. Same with Hyatt.

I have a data point somewhat related to question of the week. I have an executive title in a small family business but 0% ownership. I have been approved for both chase and Amex business cards. Both banks do ask additional questions about who has ownership and my title.

I don’t know if other owners could get the same credit cards in our business, but I imagine they can. If I try I’ll let you know.

Why not just use a sole prop “biz”?

@partrick can you explain a little more about what was required for this. I have a similar situation

Amex and Chase asked for the social security numbers of owners with over 20% interest in the business. My family operates a c Corp so it may be different for an llc or s Corp.

Barclays required a form notarized by owners with over 20% to allow me to be the primary on the Wyndham business earner card. That one took a while to get approved.

I have a business that spends a million a year on credit cards. And my answer is… exactly what your final conclusion was. Spark Cash Plus as the primary card due to best earn and flexibility on cashing out. Amex biz gold for 4x shipping and advertising spend. Then churn inks, biz plats/golds/bbp, and whatever else you feel like. Spending for status is not worth the opportunity cost to me right now, but if AA or Delta was my primary airline I would.

There are also some practical considerations for this kind of spend: credit limits, personal credit utilization, accounting complexity, and tax considerations. But those make for a boring podcast. Well done!

A US Altitude Reserve and about …. oh ….. 4000 ……mobile wallet transactions should do the trick.

For the million dollar spend, especially if one were traveling more domestically (what with less acceptance abroad), what about the Discover It Miles? 1.5 “miles” per dollar that’s matched uncapped for the 1st year, effectively making it a 3% cash back card (unless I’m missing something here?). Would 3% move the needle on the team cashback vs. transferable points conversation y’all have been having lately?

Realistically you start hitting CL issues once your spend gets high enough. Eventually the best option ends up being Amex Biz Plat especially if your charges are over 5k.

If P1 and P2 jointly own a business, each can apply for Amex cards for the business. My wife and I have such cards. Not an issue.

Another data point: P1 / P2 are 50/50 with our LLC. Constant referrals back and forth, same cards, different cards, multiple Biz Plats – no issues, plenty of targeted offers still coming, too.

$1 million at Dell when its 15X on Rakuten. Ha.

A discussion of, let’s say, more general applicability than might otherwise be apparent.

The purpose of the post was fun. Forgive them for that.

You aren’t getting my drift.

Over 40 cards between me and my wife, we’ve definitely spent more than 1 million miles. Some of the highlights (you can multiply it by two for player two)…

Roundtrip polaris business class to Peru for 70k United points

Roundtrip to the maldives Qsuites for 140k AA points

Round trip to Naples Italy on Turkish airlines business class 63.5k Turkish miles (when they had their 30% off business class awards promo)

75k AA points to Qsuites South Africa, 88k United points return on Ethiopian/Turkish business class

120k Virgin Atlantic Points to fly round trip ANA F the suites to Tokyo

60k Etihad points to fly round trip on AA business class lie flat to Colombia

75k Etihad points to fly round trip lie flat on AA to Hawaii

145k Aeroplan points to fly first class to Abu Dhabi with a stop over in UAE and then business class to South Korea on Etihad followed by 60k Alaskan points to fly JAL business class from Korea to Tokyo (with a stopover) and then to the USA

112.1k Asia points to fly Qsuites to Doha then Qatar’s first class A380 to Sydney with a return trip of 90k Asia miles of Sydney to Tokyo to the USA on JAL business class

104k ANA miles to fly Turkish roundtrip business class to Egypt.

So that’s 1.2 million points, but with all the transfer bonuses I received it definitely probably came in under 1 million. All of this has been since October 2020, so some great value since Covid and we got to visit some of the spots like Machu Picchu and the pyramids when they were completely empty. Also, I didn’t include hotel points but we spent plenty of Hilton at Conrad Maldives, Marriott at Al Maha in UAE, and Hyatt all over the place (because of just general great value).

The discussion was about how to earn rewards by spending $1 million of cash . . . not about spending 1 million points.

Gets you at least one million points!