| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

Note that the offers mentioned in this post have since expired. See our Best Offers page for current offer information.

To borrow a popular phrase, Stop the madness! If you told me at the beginning of the week that we’d see an offer for any credit card as good as the Resy offer for the Platinum card that we reported the other day, I wouldn’t have believed you. If you’d have followed that by telling me that some would instead see a targeted offer for 100K plus 10x back on $15K at US Gas Stations and US Supermarkets, I’d have laughed you out of the room. And so when someone told me yesterday that they say an offer on the Amex Platinum card for 125K points after $5K spend in the first six months that also includes 10x at US Gas Stations & Supermarkets on up to $15K in purchases in the first 6 months (since expired), I facetiously responded with the line, “Screen shots or it didn’t happen lol.” Sure enough, it did. Some people are targeted with this 125K offer — and I can’t imagine seeing this and not applying for it.

Holy guacamole. Mama mia, that’s a spicy meatball. Hat tip to reader Erik L for the screen shot. This offer was found via the Amex prequalification tool.

The following is a summary of all four current (these bonuses were current at the time of writing but have since expired) welcome bonuses being reported on the Amex Platinum card. The next few sections summarize the points portion of the offer. For more details on the awesome perks of the Platinum card, which can include more than $1100 in statement credits in the first 12 months, jump down to “Sweet Amex Platinum statement credit and perks no matter which offer you use” or keep reading below the offer summaries.

The “only 75K” + 10x offer (offer expired)

Many other blogs are reporting what I’ll call the “only” 75K offer, which only includes 75K points after $5K in purchases plus 10x at US gas stations and US Supermarkets . It’s actually not that this offer is bad – indeed, in a normal week, this offer would be a big deal. It’s just that there is a better public offer, which is why we never reported or listed this deal.

The “only 75K” offer made better by referral (offer expired)

If you can’t get the 100K or 125K offers listed below and you would rather have points than the restaurant credits of the Resy deal, you could help a friend pick up a nice bonus. This works particularly well if you’re playing with a spouse/significant other. Since Amex lets you generate a referral across cards these days, Player 1 can find his/her best referral link (some cards offer a bonus of 25,000 Membership Rewards points when you refer others) and refer Player 2. In some cases you may see the “only 75K” offer through a referral. If your other household player is picking up 25K points for referring you, that becomes much less crummy indeed.

Note that you may only see the 60K offer when clicking through a referral link, but it’s probably worth trying each browser on your computer.

The public 75K + $300 in restaurant credits offer (offer expired)

This is the offer we had listed on our Best Offers page until the 100K offer (below) became available to everyone. We always make an effort to list the best publicly-available offer (that is to say an offer that everyone will see when clicking through) on our best offers page / individual card pages.

In this case, our link goes to restaurant reservation website Resy, which has what appeared to be a phenomenal offer for the Platinum card (I use the past tense here only because of the even better targeted offers below):

- Get 75K points after making $5K in purchases in the first 6 months

- Get 10x at US gas stations and US restaurants on up to $15K in purchases in the first 6 months

- Get 20% back on restaurant purchases worldwide for the first 12 months up to $300 back

We wrote more about that offer here. The nice thing about this offer through Resy is that it is easily available to anyone by applying via the link to Resy that you find on our Platinum Card page.

The amazing 100K + 10x offer (offer expired)

As if the above wasn’t good enough, people began reporting an even better targeted 100K deal yesterday (update: this is now available to everyone!). Both Greg and I took a swing at it and successfully snagged the following offer:

- Get 100K points after making $5K in purchases in the first 6 months

- Get 10x at US gas stations and US restaurants on up to $15K in purchases in the first 6 months

This version of the offer does not have the restaurant statement credits of the Resy deal about but instead replaces that with the additional 25K points added to the welcome bonus.

When this post was first written, the 100K offer was targeted, but now it is available to everyone. Click here to find an up-to-date link to the 100K offer.

The incredible 125K + 10x targeted offer (offer expired)

Some people are seeing an absolutely incredible offer via the Amex prequalification tool or the CardMatch Tool. For those who are having trouble reading the fine print in the screen shot at the top of this post, this targeted offer includes:

- 125K Membership Rewards points after you spend $5K on purchases in the first 6 months

- 10x at US Gas Stations and US Supermarkets on up to $15K in purchases for the first 6 months

If you were able to max out the $15K in 10x spend, that would be 275,000 Membership Rewards points. Uh, wow. That more than mitigates the $550 annual fee given that, as Greg pointed out this morning, those points could be cashed out via the Schwab Platinum (maybe you pick that card up next year after you’ve got more points than you know what to do with?) for $3,437.50. For anyone aware of the myriad of Membership Rewards sweet spots, those points could be worth much more with partners whenever travel resumes.

Sweet Amex Platinum statement credit and perks no matter which offer you use

As I’ve written about several times now this week, by applying now for an Amex Platinum card, you can get more than $1100 in credits in the first 12 months on top of the points:

- Up to $400 in airline fee incidental credits ($200 each calendar year; apply now and you can get this $200 before the end of this year plus another $200 in credits next year)

- Up to $200 in Uber credits over the next year ($15/mo and $35 in December)

- Up to $150 in Sak’s 5th Ave credits ($50 between January and June and $50 between July and December; apply now and use the credit once before the end of this year and then twice next year)

- Up to $40 in wireless services credits ($20 in November and $20 in December 2020 due to temporary COVID enhancements)

- Up to $40 in streaming services credits ($20 in November and $20 in December 2020 due to temporary COVID enhancements)

- As Greg pointed out in this morning’s post, you may also be able to get credits for Variis by Equinox (though I didn’t see this offer in the new Platinum account today)

And as I’ve noted several times this week, the Platinum card also comes with other terrific standard benefits like Hilton Gold status, Centurion lounge access, Delta SkyClub access when flying Delta, and more. See our Amex Platinum Complete Guide for more.

Note that if we knew that these amazing offers would be around in December, we probably would have held off on applying as it could potentially be possible to get an extra set of airline fee credits in January 2022, but we just don’t know whether these offers will be around and they were too valuable to ignore. If you’re a gambler, you might wait it out until December.

Bottom line

Some people are finding a prequalified offer for both 125K points after $5K spend in the first 6 months and 10x at US gas stations and US supermarkets on up to $15K in purchases for the first 6 months and that offer is absolute insanity. As I argued in yesterday morning’s post and will talk about on tomorrow’s podcast, I think that some people are making the mistake of looking at the 10x categories as an all-or-nothing proposition. If you can’t spend the full $15K in the temporary bonus categories, who cares? Before this week, the best offer I ever recall seeing on the Amex Platinum card was for just 100K after $5K in purchases with no 10x bonus categories. Given that most purchases on the personal Platinum card only earn 1x, most people would only end up with 105K total points with that 100K targeted offer (which, before this week, was considered to be such a good offer that many of us check for every few months hoping to see). If you are targeted for the 125K offer, I think that’s the best offer we’ve ever seen on the personal Platinum even if you don’t spend a dime at US gas stations or US Supermarkets. On the other hand, if you’re able to spend $5K in those categories (which works out to about $193 per week, which is probably at least close to a realistic grocery and gas figure for a large segment of readers), you would end up with 175,000 points. That is amazing.

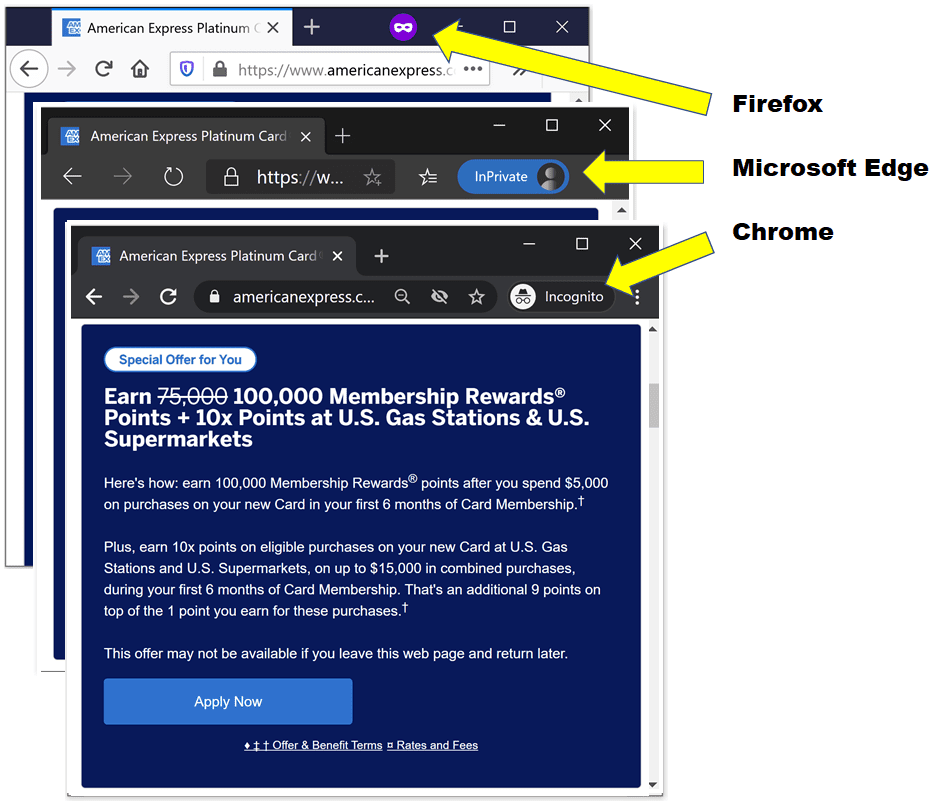

To find the 125K targeted offer, you can go to the American Express prequalification tool. Again, this is a targeted offer, so most people likely won’t see it. However, it’s always worth a shot. The 100K offer that Greg and I found is also an awesome deal, but the 125K offer would obviously take the cake. I tried a few devices in my household before I saw the 100K offer. I knew my wife was wrong when she told me to throw those old laptops away.

Any way you slice it, these offers are the rare type of thing that we just don’t expect to see again and wouldn’t wait on because we don’t know whether they’ll be around for long.

H/T: Readers John and Erik L and Doctor of Credit

What’s the likelihood of the 125K offer? I tried the Card Match and the Pre-Qualification link and got 75K. The main link in an incognito yielded 100K. Should I take that and be done?

Is the 125K a crazy rare thing? And is it essentially a 0% chance once you’ve gotten your answer on the prequalification page? Or is it something that might pop up for me or change?

The 125K offer is rare. Personally I tried once to get it to appear and then gave up and went with the 100K offer. The offer on this page should give you the 100K offer even without incognito mode: https://frequentmiler.com/amxplat/#Goto

Wouldn’t you know it? I applied and got the card a couple weeks ago. In today’s paper mail is the 125K offer. *shakes fist at the sky*

So have you ever heard of anyone getting their offer upped based on an offer they received after applying for the card? And does the 125K not include the $200 home furnishings bump? And what would become of Katherine’s (I think it was) referral bonus that she got when I used your link and I guess it was her turn to be rotated in from the FM Insiders FB group?

1) Unlikely that they’ll match in this situation because the 125K offer does not include the $200 statement credit. Two substantially different offers now. That said, there’s certainly no harm in asking.

2) Referral bonus would be unaffected by anything you do now. You got approved, so that’s been awarded. They aren’t going to claw that back whether or not they match you.

Thanks. I’ll give it a shot and report back only in the event of success.

Nick, I’m curious if you have met you $5k SUB spend yet. I saw a dp on DoC from someone saying that they got the 30k referral bonus offer soon after meeting the SUB spend. It could explain why Greg has the higher referral offer, but you and I don’t. I’d be interested to hear if you’ve met the SUB spend, and if your referral bonus increased soon after. Thanks!

I received the business platinum bonus twice before but just received a targeted offer for 100k. Never had the personal platinum and hence eligible for the current 100k offer. Not seeing the 125k. Should I just take the business offer now and the personal later?

I wouldn’t do it that way. Those 100K Business Platinum offers come around now and then (I’ve seen as high as 150K, though that offer requires $20K spend). We’ve never seen an opportunity to get both 100K plus 10x in two highly useful categories for up to $15K spend as we are seeing on the personal Platinum right now. Even if you only do $5K at 10x over six months, you’ll end up with 150,000 points. That’s phenomenal return on $5K spend that we’ve never seen before and as such I have no idea whether or when we’ll see that again. Add on top of that the $30 monthly PayPal credit through June on the personal card ($150 in credits for you that aren’t normally there) and I can’t see missing the personal offer right now if you’re eligible.

Thanks for the advice, Nick. The only reason I was leaning towards the business platform is that I already had it and may not be eligible again without a similar targeted offer. Never had the personal platinum and should be eligible anytime. I can see the personal offer is more valuable.

[…] month, we wrote about the incredible offers available on the Amex Platinum card. While many readers were eventually able to get the offer for 100,000 Membership Rewards points […]

What kind of spend is safe to hit the minimum spend on AmEx cards these days without having your points clawed back or otherwise experiencing the wrath of AmEx?

(1) Can I pay a contractor who invoices via paypal?

(2) Can I send my landlord a check with plastiq?

(3) Can I pay taxes via Paypal Key (before January 4th)?

My guess is that all of those would be fine with Amex IF you can get those payments to go through paypal and paypal key

Tax payments are dead for PayPal key and all PPK Amex support is ending 1/4/21.

After that will PayPal payments for services (eg. paying invoices where fee is paid by service provider) , Plastiq payments for rent and tax payments count towards Amex minimum spends?

These are all legitimate non-cash equivalent purchases as far as I understand it. Thanks for your original reply and any additional insight you can offer!

[…] working on the spending requirement for the big new cardmember bonus and this would provide a decent chunk of […]

[…] Incredible Amex Plat Offers! 125K + 10x [targeted], 100K + 10x, 75K + 10X + $300 […]

[…] As if on cue after this morning’s post about Extreme stacking for holiday purchases, shopping portal Rakuten is offering 10% back or 10x Membership Rewards points per dollar spent at Saks Fifth Avenue today. This could make for an excellent stack for new Amex Platinum cardholders who have taken advantage of the recent amazing welcome offers. […]

Amex-zing experience!

My wife and I landed our best Black Friday deal for 2020 – our welcome bonus for meeting the minimum spend requirements on the American Express Platinum credit card that we recently applied for got upgraded (finally!) from 75,000 to 100,000 Membership Rewards Points by a kind Amex customer service representative named Catherine!

I’d applied for the card on the 12th of November when Amex had a seemingly awesome welcome bonus offer of 75k points on meeting the minimum spend of $5,000 in 6 months (amongst other juicy benefits). But, within 12 hours, on a Friday the 13th that lived up to its name, after reading a post on the ever-so-dependable Frequent Miler blog, I realized that I was targeted by Amex for a 100k Membership Rewards Points welcome bonus on the same card with the same spend requirements! WTF! Missing out on 25,000 Membership Reward Points (equivalent to $400-500), and that too by a whisker, is a big deal, and more so for us because we extensively (and sometimes solely) use points for travel and other purchases!

What ensued was my making multiple calls to the Amex customer service in the last fortnight starting on that fateful Friday the 13th, requesting them to reconsider my case and increase my welcome bonus to match the latest 100k offer that is showing up for me till date (talk about adding salt to injury!). But this didn’t seem to be going anywhere.

Yesterday, on Black Friday, I called Amex again to follow up on my case. After ending a lengthy call with Catherine, who patiently heard me out and promised to reach out to me if there’s any progress on my case, it seemed as if I had hit a dead end. Let’s admit it, I had pushed my luck despite knowing very well that Amex doesn’t usually budge on such matters. I got the feeling that it was time to write off our loss of 25k points and move on to something more iDeal.

Voila! Within a few minutes of ending the call with Catherine, she called me back that she again went through the notes pertaining to my case on file. She acknowledged that I had indeed called them to plead my case that very day (hello again, Friday the 13th!) and multiple times thenceforth. So, she mentioned that, being a customer herself, she understood how terrible it must feel to narrowly miss out on such a great offer, and, therefore, used her authority to kindly increase my welcome bonus to 100,000 Membership Rewards Points with the same spend requirements! GASP!! She even added a reminder on her calender to check in with me in April (by when we hope to meet the minimum spend) to ensure that we have received the entire 100k points!

WOOHOO! Thankful to Catherine at American Express, and to all the fantastic and tireless customer care representatives who reciprocate their customers’ patience, time and effort with their own patience, consideration and kindness! And many thanks to the team at Frequent Miler for these prompt and detailed alerts!

” Amex prequalification tool.” – i do see 100k but is it targeted for intended receipient will it work for others?

[…] the way that Amex is displaying bonus points for those who have opened Platinum cards under the incredible new welcome offer that includes 10x at US Supermarkets and 10x at US gas stations on up t…. It isn’t immediately clear that those purchases are earning bonus points, but fear not: the […]

[…] instead: The Platinum card’s 100K + 10x bonus category if you can swallow the annual fee (the welcome bonus more than mitigates the fee and 10x Membership […]

I was having a hard time finding the 100k offer but had repeated success on 2 different devices with this method (though not every time):

1) Using Microsoft Edge in a regular, NOT InPrivate tab, on a Windows PC, load the Amex Platinum page (at link in this post) – probably will show 75k

2) Leave the page open for 20 minutes, it should expire.

3) After the expiration page shows, refresh, now it may show the 100k offer.

You might try this a few times. Also, side note, I had 3 browsers open with some in incognito/private tabs refreshing them all again and again for about 15 minutes before this worked the first time. I only discovered it because I walked away from the computer and they all expired, then I returned and refreshed them all and Edge regular tab was the only one to show 100k. Subsequently I’ve had it work intermittently without other browsers open or repeatedly refreshing.

Got the 100k. Couldn’t get the 125k offer even after many attempts and browsers.

How do people plan on maximizing the x10 offer by spending 15k at gas/supermarkets?

Doesn’t Amex receive level 3 CC processing data and deny the x10 (or even shut you down) if they see abnormal spending on gift cards? (Amazon, Visa/Mastercard etc.)

I have a large family and still don’t spend anything near 15k in 6 months

In Greg’s case, smallish gift cards ($200-$300) with every grocery purchase and hope. According to his post about maximizing this offer at least. Regarding level 3 data – idk. For awhile it was only MC and Visa and only certain merchants, reportedly.

Thanks for replying. I’ve done some more digging and it appears that though Amex may only be getting level 2 they have something else that effectively makes it like the Visa/MC level 3.

Either way I think you can assume that they CAN see your purchase details if they want to. It may be that it’s not automated to reject it but be carful not spend in a way that draws attn and makes their RAT team take a deeper look since they likely WILL see the GC’s and claw back or worse.

[…] card because of the extraordinary signup bonus (here’s the coverage by Doctor of Credit and Frequent Miler), you might be wondering whether Triple Dipping (TM) the $200 airline credit with one annual fee is […]