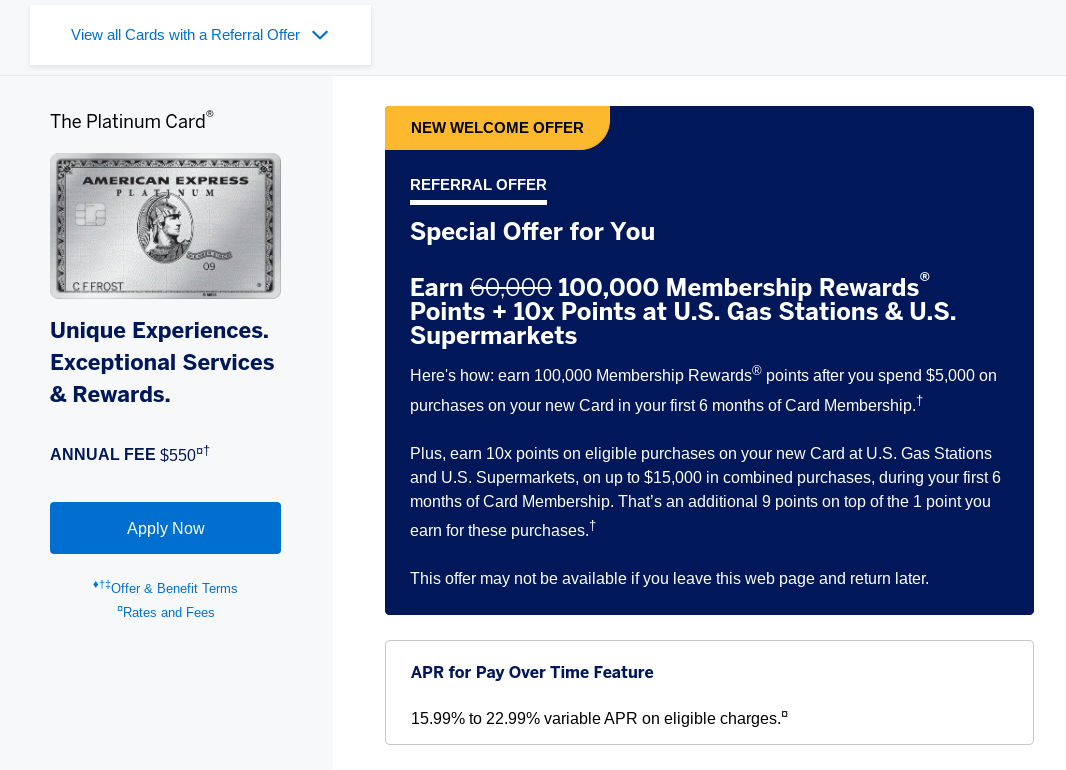

Last month, we wrote about the incredible offers available on the Amex Platinum card. While many readers were eventually able to get the offer for 100,000 Membership Rewards points after $5K in purchases in the first 6 months plus 10x at US Supermarkets and US Gas stations for the first 6 months, it was a disappointment for many that at the time the same offer was not available via referral link (and some struggled to find the 100K offer). Some people now have the ability to refer others to the 100K offer. Better yet, the person making the referral can earn 30K points for referring a new customer (up to a cap of 55K per calendar year).

The Offer & Key Card Details

| Card Offer and Details |

|---|

100K Points + 10x Dining ⓘ Non-Affiliate 100K points after $8K spend in 6 months + 10x on up to $25K in dining spend within first 6 months. Terms apply.$695 Annual Fee Alternate Offer: 100K points after $8K spend in 6 months + 10x on dining for 6 months (on up to $25K in purchases) via Resy. Link here. Terms apply. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This card is absolutely loaded with high end perks. Depending upon your situation, those perks may be worth the annual fee or much more. Earning rate: 5X points for flights booked directly with airlines or with American Express Travel ✦ 5X points for prepaid hotels booked through American Express Travel Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Up to $200 a year in statement credits for incidental fees at one qualifying airline per calendar year ✦ $200 prepaid hotel credit per calendar year valid on Fine Hotels & Resorts and The Hotel Collection bookings ✦ Up to $20 per month rebate for Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, SiriusXM, and/or The Wall Street Journal ✦ $15 monthly Uber or Uber Eats credit ($20 in December, use it or lose it each month) ✦ $189 CLEAR (R) Plus fee credit per calendar year ✦ $12.95 (+tax) monthly credit for Walmart+ monthly membership subscription credit when you pay with Platinum card ✦ Up to $100 in credits annually for purchases at Saks Fifth Avenue (up to $50 in credits semi-annually) ✦ Priority Pass membership (Lounges only) with 2 guests and other airport lounge benefits (Centurion and Delta) ✦ Rental car elite status ✦ Marriott Gold status ✦ Hilton Honors Gold status Enrollement required for some benefits. Terms Apply. (Rates & Fees) See also: Amex Platinum Guide |

Quick Thoughts

Doctor of Credit reported weeks ago that the 100K offer was available via referral in some instances, but I had missed the details and assumed it was similar to how the offer would work in only some browsers previously. However, this is significantly different than the previous 100K + 10x offer. Essentially, some customers have the ability to generate a 100K + 10x referral link and that link will populate the 100K offer for everyone who uses it.

In this case, Greg has the ability to generate the 100K referral from his new Platinum card, so we have updated the link on our Platinum Card page accordingly since anyone can get the 100K + 10x offer by clicking through our link now. [UPDATE: Greg has maxed out his referrals and so we are swapping in other referrals]

By contrast, my Platinum referral link only generates the standard 60K offer.

Interestingly, those who are able to generate the 100K offer have a sweet deal for themselves, also. That’s because those who can generate the 100K offer are showing a 30K points bonus per referral for the referrer (up to the cap of 55K points earned per year for that card — essentially two referrals will cap out referral capacity for the referrer, but the link will continue to work for 100K + 10x after that capacity is met). Those of us whose referral link only earns 15K per new customer have a link to an inferior offer.

This is great news as it means that anyone can get the 100K + 10x offer — and hopefully some who have opened the card recently and have a link to the 100K offer can refer a friend or two before the end of the year and juice their bonus a bit more.

My referral offer has been at 15k since I signed up for the platinum in December. I figured I’d wait a little since Greg mentioned that he originally had the 15k offer too, but it increased to 30k after having the card for a number of weeks. Well, it just changed for me too……down to 5k. Doh!

Mine has been at 5K since the 1st of the year if it makes you feel any better.

Dumb question: does getting an invite from Amex (“pre-screened” offer with RSVP code) improve the chance of being approved compared to using a referral link?

I don’t think it helps, but I’m not sure.

[…] you are looking to take advantage of that situation, the current 100K + 10x offer on the Amex Platinum card would pair nicely with this strategy considering all of the various statement credits that you […]

Who would I use as a referral name?

does it ask on application somewhere for it?

don’t think so; just click on the referral link indicated in the above write up by Nick

Nick / Greg, the referral link named Timothy?

I maxed out my referrals yesterday and so we are swapping in other 100K + 10X referrals.

thx Greg; a fam is still thinking. will use it once deciding to pull the trigger

I can’t get out of popup jail.

Any way around this? It’s burning me up

Is there a issue if you previously had the card? Had the business platinum.

The business card and personal card are different products, so you should be okay applying for the personal card if you already had the business card.

As Dee says, the Business Platinum is an entirely different card. If that’s what you’ve had, you haven’t had this card before.