| Card Details and Application Link |

|---|

Chase Ink Business Premier®  ⓘ $695 1st Yr Value EstimateClick to learn about first year value estimates $1,000 Cash Back ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer $1K after $10K Spend in the first 3 Months$195 Annual Fee Click here to learn how to apply This is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This is an almost 1 to 1 copy of Capital One's Spark Cash Plus card, but the Chase card throws in 2.5% earnings on very large purchases. Unfortunately, the Chase card also has a slightly higher annual fee. The biggest disappointment about this card is that, unlike other Chase Ink cards, the rewards cannot be moved to other Chase cards to improve their value. Even though this card technically earns Ultimate Rewards points, it's best to think of it as a straight up cash back card. Click here for our complete card review Earning rate: 2.5% cash back on purchases of $5,000 or more ✦ 5% back on travel purchased through Chase Travel(SM) ✦ 2% cash back on all other spend ✦ 5x Lyft through September 2027 Base: 2% Portal Flights: 5% Portal Hotels: 5% Card Info: Visa Signature Business Charge Card issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: Purchase protections ✦ Cell phone protection (up to $1K per claim) ✦ Travel protections |

Ink Business Premier Review

The Ink Business Premier is a charge card, not a credit card. That means that there’s no explicit credit limit and that you must pay the bill in full each month. This card is a reasonable choice for those with large business spend who are looking for a single business card with decent cash back rewards for all spend. The card earns 2.5% cash back for purchases of $5K or more, and 2% back everywhere else. Unfortunately, unlike other Chase Ink cards, you can’t move rewards to other cards in order to make them more valuable, nor can you product change it to an Ink credit card (since this is a charge card). Think of this card as being exclusively good for cash back. Whether the card is worth its $195 annual fee depends upon what alternatives you have…

While there are plenty of fee-free 2% cash back consumer cards with no annual fee, the only fee-free 2% cash back business card I can think of is the Evergreen by FNBO Business Edition® Credit Card. Unlike the Chase Ink Business Premier card, the Evergreen card does charge foreign transaction fees (3%), but if most of your spend is within the U.S., the Evergreen card is probably a better bet. If you spend $40K or more on large spend ($5K or more) each year, though, you would do better with the Chase card since the 0.5% cash back earned on those large purchases would more than pay back the card’s annual fee.

Another comparison worth considering is to the $150 per year Capital One Spark Cash Plus card. Both the Chase and Capital One cards are business charge cards that earn 2% cash back for most spend. With the Chase card, for only $45 more per year, you gain the ability to earn 2.5% cash back on purchases of $5K or more. It would only take two $5K purchases (or one $10K purchase) to come out ahead with the Chase card. On the other hand, with the Capital One card, it’s possible to move your cash back to a card that offers transferable “Miles,” like the Venture X, in order to turn the cash back into points transferrable to airline and hotel partners for potentially much better value. Unlike with other Ink cards, Chase has unfortunately made it impossible to do the same with the Ink Business Premier card. There is no way to move the Chase points to other cards and so it’s best to think of this card as a straight up cash back card.

The Bank of America alternative… If you have $100,000 or more in business accounts with Bank of America or Merrill Edge, you can qualify for Platinum Honors status with Bank of America’s Preferred Rewards for Business. Among other perks, you’ll get 75% more rewards from select Bank of America business credit cards. The fee-free Business Advantage Unlimited Cash Rewards credit card, for example, usually earns 1.5% cash back, but with Platinum Honors, you’ll earn 2.62% cash back on all spend! That’s a much better option than the Chase Ink card if you can swing the $100K in business funds requirement. See this post for full details: Bank of America cards — awesome with Platinum Honors Status.

Amex alternatives… Amex offers two fee-free business cards that offer 2x for all eligible spend on up to $50K spend per calendar year (then 1x). The American Express Blue Business Cash™ Card offers cash back rewards whereas the Blue Business Plus offers Membership Rewards points. The first is best for those who prefer cash back whereas the latter is best for those who value the ability to transfer points to airline and hotel partners.

Ink Business Premier Application Tips

Should you apply?

If cash back is your thing and you have lots of big $5K+ purchases (but you don’t qualify for Bank of America Platinum Honors for Business), then this is a good choice..

Are you eligible?

To get this card you must have a business, and you must be under 5/24 (more on 5/24 below).

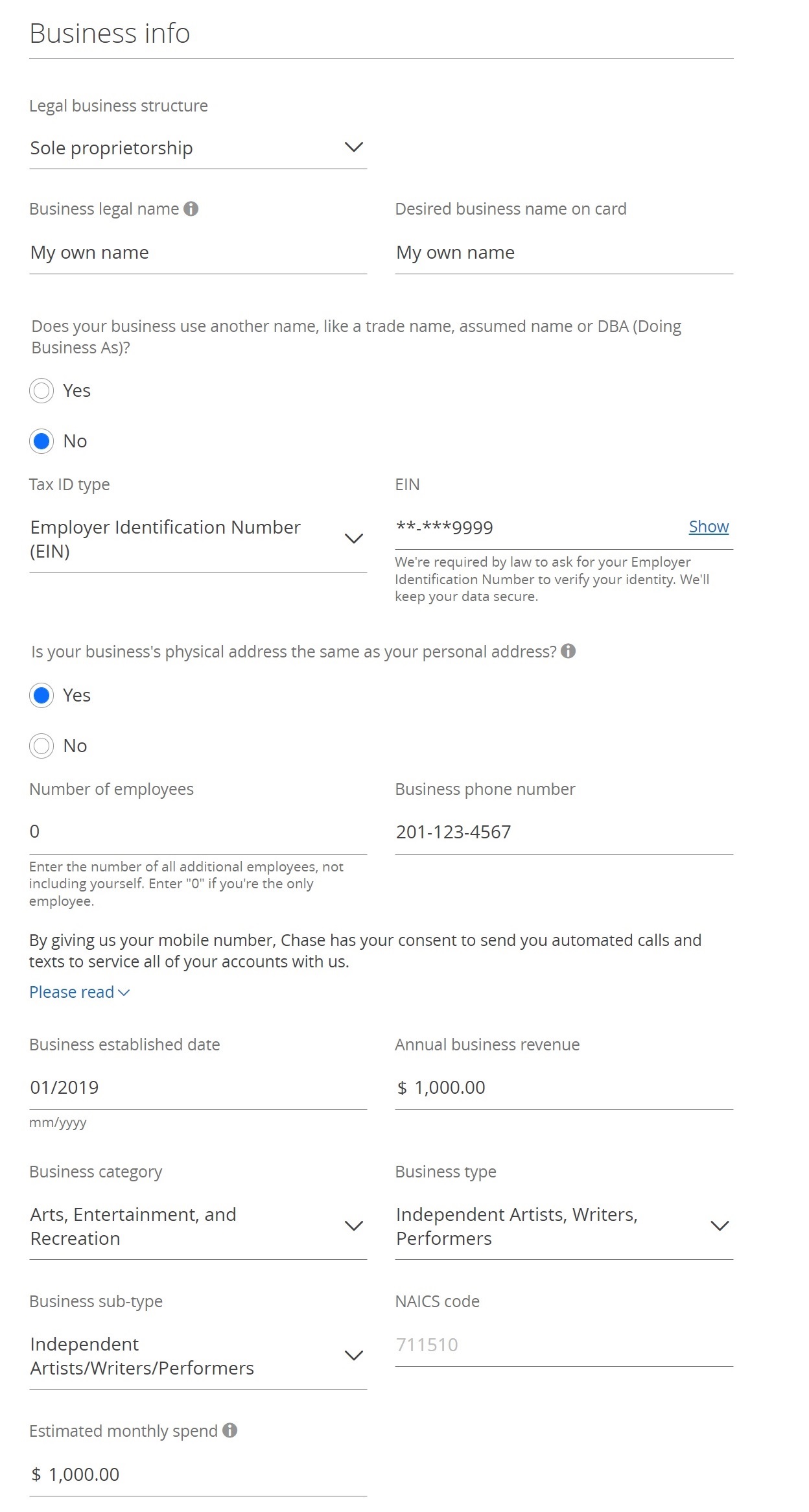

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

How to apply

You can find the current best signup offer and application link here: Chase Ink Business Premier.

- Legal business structure: Sole Proprietor

- Business legal name: If you don’t already have a business name, I recommend using your own name as the business name.

- Desired business name on card: Again, this can be your own name if you don’t have a business name to use.

- Does your business use another name? No

- Tax ID type: EIN (you can get an EIN quickly and for free from the IRS here) If you'd prefer to use your social security number as your tax ID, select SSN rather than EIN.

- Is your business's physical address the same as your personal address? Yes

- Number of employees: 0 (the instructions say to enter the number of employees you have, not including yourself)

- Business phone number: Your phone number

- Business established date: When did your business start? If you've been doing your business for years (selling stuff at yard sales, for example), it's fine to estimate the starting date.

- Annual business revenue: $0 (or project an amount based on expected revenue)

- Business category, Business type, Business sub-type: Pick whichever categories are closest to your business. For example, an aspiring author, artist, or musician might choose: "Arts, Entertainment, and Recreation" and "Independent Artists, Writers, Performers."

- Estimated monthly spend: $3,000 (Use your judgement here. A higher number might lead to a larger credit line, but if it's too high it might negatively affect approval).

Reconsideration

If your application is denied, I recommend calling for reconsideration (1-888-270-2127). It’s surprising how often denials can be changed to approvals just by asking.

Chase Ink Business Premier Perks

Travel Protection

- Trip Cancellation/Interruption Insurance

- Trip Delay Reimbursement

- Baggage Delay Insurance

- Auto Rental Collision Damage Waiver

Purchase Protection

- Cell Phone Protection: Up to $1K per claim

- Fraud Protection

- Zero Liability Protection

- Purchase Protection

- Extended Warranty Protection

Chase Ink Business Premier Earn Cash Back

Welcome Bonus

Here’s the current welcome bonus offer:

| Card Offer |

|---|

ⓘ $695 1st Yr Value EstimateClick to learn about first year value estimates $1,000 Cash Back ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer $1K after $10K Spend in the first 3 Months$195 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This is an almost 1 to 1 copy of Capital One's Spark Cash Plus card, but the Chase card throws in 2.5% earnings on very large purchases. Unfortunately, the Chase card also has a slightly higher annual fee. The biggest disappointment about this card is that, unlike other Chase Ink cards, the rewards cannot be moved to other Chase cards to improve their value. Even though this card technically earns Ultimate Rewards points, it's best to think of it as a straight up cash back card. Click here for our complete card review |

Bonus Spend

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: 2.5% cash back on purchases of $5,000 or more ✦ 5% back on travel purchased through Chase Travel(SM) ✦ 2% cash back on all other spend ✦ 5x Lyft through September 2027 Base: 2% Portal Flights: 5% Portal Hotels: 5% |

This is where the Ink Business Premier card shines. Purchases of $5K or more earn 2.5% cash back. When comparing to a 2% cash back card, this means that you can earn enough extra to cover the card’s annual fee with $40,000 of large purchases each year.

Chase Ink Business Premier Redeem Points

Cardholders can redeem points for 1 cent each either as statement credits or as cash back. Points can also be used to pay for travel or gift cards, but it doesn’t make sense to use your points in that way since you won’t earn rewards on those purchases. It’s better to redeem for cash back and pay with a credit or charge card for these things.

Chase Ink Business Premier Manage Points

Combine Points or Share Points? Nope

Unlike all other cards that earn Ultimate Rewards points, with this one you cannot move points to another card or to another cardholder in the same household or with the same business.

How to Keep Points Alive

As long as your card account is open, your rewards will be preserved. If you want to cancel this card, simply make sure to cash out all of your earned points first.

Greg’s Thoughts

This would have been an exciting product if points could be moved to other cards that earn Ultimate Rewards. Without that ability, it’s impossible to get better than 1 cent per point value from your rewards.

So, then, the question is whether this card is worth its annual fee for those who are happy with cash back. The answer is… maybe. If you spend $40K or more per year on purchases of $5K or greater, then this card has an edge over a fee-free 2% cash back card. On the other hand, with Bank of America, it’s possible to get 2.62% back on all purchases with a fee-free card. If you can qualify then that’s obviously a much better option than paying $195 for this Chase card that earns 2.5% back at most.

Personally, I do qualify for 2.62% back everywhere with Bank of America and so this Chase card is completely uninteresting to me beyond its welcome bonus.

Just curious why is the first year value not $805 ($1000 cash back – $195 AF)? Do you adjust for the alternative of spending on a 2.625% card?

Sort of – it’s based on the opportunity cost versus putting that spend on a 3% card. You can find out more about our First Year Value calculations here https://frequentmiler.com/estimated-first-year-value/

Very *odd*, isn’t it?

If you follow the link that Stephen shared, you’ll find this statement: “We value cash back at full face value.”

Secondly, if you spend exactly $10,000 to meet the minimum spend, you’ll get at least $1,200 in cash back (full face value). Comparing 12% return vs. 3% card is, again, very *odd*.

Are there any data points regarding product change at end of 1st year, when annual fee is charged?

Thanks –