NOTICE: This post references card features that have changed, expired, or are not currently available

Marriott recently made the announcement that they will ditch award charts in 2022 and that starting in 2023, award rates will more closely reflect cash prices. Some members immediately swore off the program and declared that now is the time to abandon ship on Marriott Bonvoy. We even talked about saying Bon Voyage to Marriott Bonvoy on the podcast. I am as unhappy as anyone to hear that award charts are going away, but is it time to abandon ship — or just change up strategy?

Marriott free night certificates will become more valuable for most people

By most accounts, the most exciting thing to come out of Marriott’s announcement was the fact that starting in early 2022 members will be able to add up to 15,000 points to a free night certificate to stay at a property costing more points than the certificate covers. There is no doubt that I think this will be extremely valuable for a short window and a big convenience long-term, but I think this major improvement to the program is likely to be a second-best piece of the announcement by some measure. I think free night certificates are likely to become more valuable even before considering this newfound flexibility.

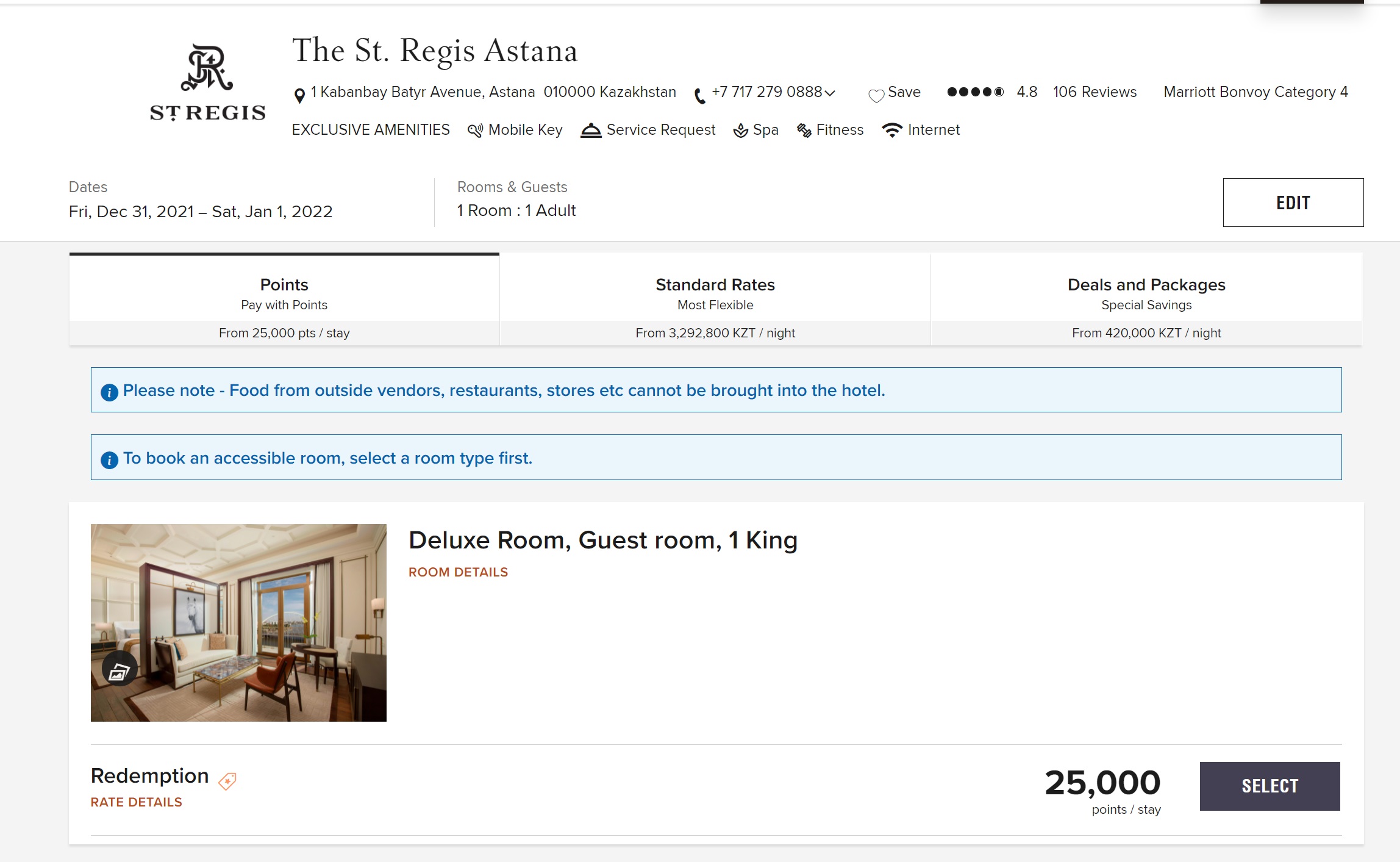

Personally, I am a maximizer. I always prefer to get as much value as possible. I want to use free night certificates to stay at the swankiest place possible. I want to use 35K Marriott free night certificates to stay at a St. Regis when rates are $979.75 per night. However, those instances are very rare. Sure, I have a ton of flexibility and I happen to be the kind of dude who will plan a trip to Astana, Kazakhstan in order to get that kind of value in a more normal world.

That is to say that I was disappointed to hear that Marriott is going to more dynamic pricing that will more closely track room rates starting in 2023. I fully expect the St. Regis Astana will be far out of my price range both in terms of cash rates and points in 2023.

But for most people, that example has zero relevancy. I’m going guess that there aren’t many Marriott members joining me on that journey.

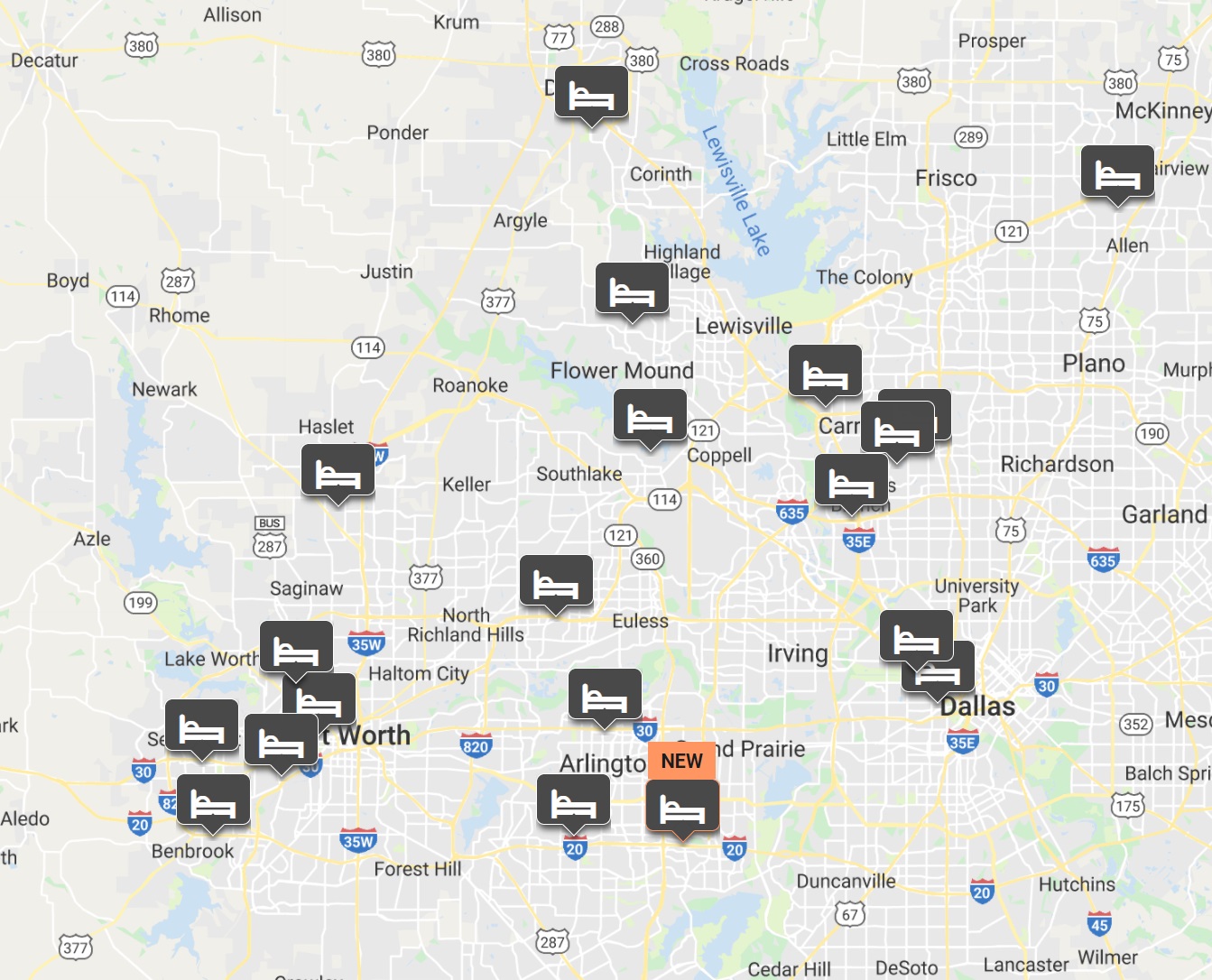

The average Marriott member is infinitely more likely to want to book a Courtyard in the Dallas-Fort Worth area (there are 20 of them!) than the St. Regis Astana.

I didn’t do an extensive search, but I am willing to bet that today you will get poor value more often than not when redeeming for a Courtyard in the Dallas-Fort Worth area whether using a free night certificate or points.

However, when points become more closely associated with cash rates, it should be easier to get consistently solid value out of free night certificates.

We don’t yet know exactly how much Marriott points will be worth in the long term, but we expect that points will have a more fixed value against cash rates. Our educated guess is that points probably won’t be worth more than the rate at which Marriott sells points. While the ordinary price for Marriott points is 1.25c per point, they go on sale periodically for less than 0.9c per point. Greg’s most recent analysis found Marriott points to be worth about 0.63c per point. After award charts are eliminated, I expect that we’ll see a consistent Marriott point value somewhere between 0.63 and 0.9c per point.

If we split the difference and assume that Marriott points will be worth about 0.77c per point in cash value, the value of free night certificates will increase. Greg’s most recent analysis of Marriott free night certificates found 35K certificates to be worth about $225. However, if Marriott prices hotel awards based on points being worth about 0.77c per point, we can expect that a hotel costing 35K points would alternatively cost around $269.50 in cash. That makes certificates a better deal than today. More importantly, it will likely be a more consistent deal. Suddenly, rather than redeeming your 35K free night certificate for a less-than-ideal Courtyard in Fort Worth, you’ll likely be able to use it for a night at an Autograph Collection property there or alternatively in even the most expensive cities in the US (where 35K free night certificates can be tough to use currently when most properties are peak-priced at 40K).

I feel particularly bullish about free night certificates for use in cities like New York where I expect that I’ll usually be able to find a Marriott property in the $270-per-night-or-less range but where I have sometimes struggled to find properties bookable with 35K free night certificates.

The same is true with 50K free night certificates which would be worth about $385 if points were worth 0.77c each.

Granted, I’m just making a wild guess about the value of points. They certainly may be worth less than that. They could end up being closer to Greg’s most recent observed value of 0.63c or could even be less. However, even if points were only worth 0.63c per point when award rates become dynamic, free night certificates would only be worth marginally less than Greg’s recent estimates and that value would be more consistent. That only gets bolstered by the ability to add points on top to get precisely the property you want.

That is to say that you would be able to count on that ~$220 value whether you’re staying in New York or Dallas or Astana or Argentina if you’re using it for a property that otherwise costs 35K points per night. Given that the 35K certificates come on cards that cost $95-$125 per year, that seems like a fantastic trade.

In fact, I think that trade will make Marriott credit cards one of the best value plays in terms of credit cards to have and hold long term. Many of us with the old $49 IHG Rewards Club card (which hasn’t been available for new applicants for years) find that card to be one to have and hold because it is very easy to use the card’s annual free night certificate for value beyond $49. I think the same will likely be true for Marriott credit cards if I am right that point value will be somewhere between 0.63c and 0.77c per point and that the move to dynamic pricing makes value more consistent. That sentence is not without conditions, so be aware that this post may not age well. But at the moment, I am holding more firmly to Marriott credit cards than ever before, which is a remarkable change from the time not that long ago when I planned to say goodbye to all of my Marriott cards (thank goodness for procrastination).

Spending on Marriott cards will be a bad deal (but it already is)

When point value becomes more closely associated with cash rates, the opportunities for outsized value will likely dry up if not disappear. That makes the value of collecting Marriott points an easily calculable proposition. Even if points are worth 0.9c after dynamic pricing (which is probably foolishly optimistic), the 2 points per dollar spent that you earn on most purchases with most of the Marriott credit cards would be worth 1.8c per point. You would be better off using a 2% cash back credit card and then paying for your Marriott stays.

But that’s not a change from today. When Marriott points are on sale, you can typically buy them for less than 0.9c per point. A 2% cash back credit card therefore earns about 2.22 Marriott points per dollar spent. If you use the Alliant Cashback Visa (2.5% back on the first $10K in purchases per billing cycle for Tier One Rewards members), you’re looking at an effective 2.78 Marriott points per dollar spent. You are already better off using a cash back credit card and using your cash to buy Marriott points if you want Marriott points.

New credit card welcome bonuses will continue to be valuable. Even at 0.63c per point, a bonus of 75,000 or 100,000 or 125,000 points will continue to be solid return on required spend.

But in the new Marriott world, I expect that there will be little reason to buy Marriott points since I expect the value of them to be less than the purchase price. That doesn’t mean that I’ll eschew Marriott, it just means that I’ll use cash back earned from my cash back credit cards to pay the cash rate rather than using points most of the time.

That’s not a bad strategy. Assuming points are tied to cash rates, I’ll get value on par with an award stay anyway and I’ll earn Marriott points while I’m at it. With Marriott Platinum status, I’ll earn 15 points per dollar spent. Even at our 0.63c valuation, that’s worth about 9.5% back toward future Marriott stays — and when the value of points are more consistent, I’ll know that I can count on that actually being worth about 9.5% even when I’m staying at one of the 20 Courtyards in the Dallas Fort Worth area.

Unfortunately, that means that I probably won’t ever book the St. Regis Astana for New Year’s Eve. And on some level, I find that disappointing because chasing wacky sweet spot redemptions like that has led me to interesting places that were never on my radar like the JW Marriott Phu Quoc or the Hyatt Regency Saipan (a non-Marriott example).

That part makes me a little sad. However, the truth is that Marriott has such a convenient footprint that while my knee-jerk reaction was the same as everyone else’s — I even said just last week on the podcast “here’s to one more year with Marriott” as though I was joining the chorus in swearing them off — I know that in the end I’ll likely end up staying at a lot of Marriotts. I may go for one last hurrah at the St. Regis Bora Bora while the opportunity knocks, but then I’ll probably look to Hyatt for luxury stays with transferred Ultimate Rewards points and Marriott for most other stuff. I’d love for Hyatt to gain the footprint where that wouldn’t be the truth, but I recognize that isn’t likely to happen soon.

Cash back continues to become a better strategy

The real takeaway for me is that I will likely be using more cash at Marriott properties. Cash back cards with great everywhere rates like the Alliant Cashback Visa or the Bank of America Unlimited Cash Rewards or Premium Rewards (when paired with Platinum Honors) will likely play a more pivotal role in my hotel strategy.

I already currently use my Capital One Venture card with the primary goal of generating Marriott gift cards, but the advantageous redemption option I utilize isn’t available for most people. I’ll also keep my eye open for opportunities to buy Marriott gift cards at a discount.

Beyond my niche Capital One play, I think the upcoming changes mean that the Alliant and Bank of America cards will become my default “hotel points” cards. With Hilton and IHG also being dynamically priced, I think it just makes sense to collect cash back for hotel stays (apart from obviously continuing to collect Ultimate Rewards points for Hyatt).

With the Alliant card specifically, every dollar spent is like 5 IHG or Hilton points (since those programs frequently sell points at half a cent each) and will likely be worth somewhere around 3 Marriott points per dollar spent with the added flexibility of paying for a stay and earning points when that is more beneficial. I could even use the Marriott cards (that I intend to keep) to earn 6 points per dollar on the amount spent on-property at Marriott properties and then cash out cash back earned on my Alliant card (from other day-to-day purchases) to pay myself back. The flexibility to use cash back to either buy points in any of the major programs or get good value when cash rates are cheap (or buy Marriott gift cards when available at a discount) will only make more sense when Marriott becomes more fully dynamic.

Again, that is somewhat disappointing, but not really a change from today. I do sometimes use my Marriott cards on ordinary purchases (I don’t always worry about which card to use for very small purchases that won’t earn a significant number of points anyway), but I recognize that it makes more sense to use other cards in most situations and I don’t use them for any significant amount of spend.

Bottom line

Many of us are disappointed to hear that Marriott will eliminate award charts in 2022. I am as disappointed as anyone about that. However, I am optimistic that free night certificates will be easier to use since I’ll worry less about using them for outsized sweet spot redemptions and use them instead for consistent value even at a property that isn’t a destination in itself. I’ll probably get more consistently-reliable value out of those free night certificates than ever before. And if I’m being truthful, I’ll probably still spend money at Marriott hotels — perhaps I’ll spend more cash at Marriott properties than ever before since it will make more sense to collect cash back than Marriott points. I guess that’s what Marriott wants and while part of me doesn’t love giving in to that, the maximizer in me knows that it will probably be the best way to get good value moving forward.

I think if you are looking to value for money, customer service must also be considered. Marriott consistently has subpar staffing and a management model, which will crumble under itself long before any rewards program they offer. Ultimately people have to feel like they are stay at a clean, capable establishment which can take care of post COVID consumers as we being to work /play again. After attempting to stay there last week, my feeling is , an overhaul in management must be addressed before they even consider what kind of travel points they’re giving out. I for one, will never darken any Marriott doorway again.

Suzanne, you are right. But, the failure is at two different levels. The first level is at Marriott corporate in the gutting of the loyalty program. The second level is at the property owner level in 1) the failure to provide an acceptable hotel environment and 2) the denying of tier status benefits at the point of delivery.

I have been at various Marriott properties in which 1) upon checking into my room, the toilet had a sizable present left for me (how did housekeeping miss it?), 2) upon checking into my room, the shower stall had hair and reeked of urine (housekeeping?), 3) an entire floor continually reeked of weed, . . . I could go on.

To be fare, the other chains experience these problems as well.

I was most disappointed when they removed the breakfast from Gold Elite and moved it to the next level.

The didn’t move it to the next level, they just re-named the levels. Gold status (“free breakfast status”) used to required 50 nights. “Free breakfast status” still requires the same 50 nights, they just changed the name of 50-night status to Platinum. They didn’t change the requirements. That did devalue the free status that comes with the Amex Platinum though.

[…] Time To Ditch Marriott?: Anytime loyalty programs devalue their points, it stings because prices for awards become more expensive or unpredictable. Marriott has done this by getting rid of their award charts. So is it time to ditch Marriott? […]

I wanted to mention two comments about Marriott. Most people do not give them enough credit and are too quick to ditch them. Consider how easy it is to get to platinum status and the benefits – breakfast and/or lounge access, late check out, room upgrades, etc. Platinum or equivalent status with other hotel chains are like Marriott’s gold. It’s easy depending on your strategy to get platinum, such as status matching, credit cards, etc. Using points is not about the price per dollar you calculate, but it is more about the value of points versus the room. If a $1200 room costs 85,000 per night, that’s a much better deal than a 35,000 point room of $200.

yes but would your really pay 1200 to stay at that room?

the points only have outside value if they replace something you would already be willing to pay for.

This is a major reasoning flaw that this blog has addressed in the past.

My friend you are pursuing status for status sake not for value.

I can’t get them to give me the elite checkout benefits and bft that I am “guaranteed” as a plat member. The hotel owners know that the program will not punish them. Thus more and more do nothing for elite guests.

Perhaps the only money one should invest in Marriott is their stock, so far up 50% for me.

But then again Choice stock has done even better. And they offer their guest even less. It seem that Choice Hotels is Wall Streets view on the path Marriott should take.

These loyalty programs are to be evaluated in the context of investor returns not guest satisfaction, esp if they have reached a certain market penetration

Correct. That’s why it’s easy for them to extend tier status and simply give away tier status to everyone. This way, more people can be denied benefits for longer.

You are correct about redemption value. As for tier status, you’ve bought into the big lie. If you keep your analysis to just points, you’ll be fine. But, understand that with dynamic pricing, you’re not going to get that $1200 room for 85k points or even 100k points any more. Just look to what’s happened at Hilton.

St. Regis Astana’s cash rate looks far more reasonable during the summer time (or when you book far in advance) at around $215 per night. I plan to go there when it’s not freezing cold though.

Curious, has this blog ever recommended closing major brand cards?

The tortured reasoning to keep these cards seems just that – tortured, as do the claims for Amex Plat cards etc.

Even when I traveled extensively, I rarely felt I was getting great value vs the hassle factor – always blackout dates, always program gotchas, always devaluations.

The only reason I bothered was ability to MS in scale.

Just get 2% cards and be done with it. No more expiration dates, no more devaluations, no more dubious annual fees.

You forgot one — no chance to ever get double the value you put in.

So this should benefit points use where it’s a $100 night with 20k points. I’ll pay cash then. I currently use the 0.8c value so $160 / 20k would be. An at market exchange.

“Bank of America Premium Rewards (when paired with Platinum Honors) will likely play a more pivotal role in my hotel strategy.”

This…

3.5% cashback everyday with no limit is unbeatable for the don’t have to think what to swipe.

2.625%, not 3.5%.

Going forward, would certainly make more sense to do hotel bookings through Chase portal for 10x with CSR or booking through Amex travels for 5x instead of booking directly through Marriott imo

That’s a good point. We talked about that on the podcast last weekend and I said that I could potentially see myself doing that since I will likely end up staying at more limited-service Marriotts where breakfast is free for everyone anyway.

It’s sad to see this, maybe Marriott just don’t care about their loyalty anymore, since they got so much coverage around the world. We would end up staying in a Marriott anyway…

What do you mean “maybe?” After all of the articles talking about how hotel loyalty programs are devaluing or denying benefits, how can anyone use the word “maybe?”

Idk. Maybe I’m still keeping my hopes up

I’m a multi-year Ambassador. I spend six figures a year on hotels (and the first digit isn’t a one). One would think that if anyone were going to receive great treatment, it would be a member with this profile. But, that isn’t the case. The individual properties — the point at which benefits are delivered — do not care about one’s loyalty to Marriott. They care solely about one’s loyalty (in the form of paid stays, not award stays) to their properties. Period. On multiple occasions, in spite of room upgrades available at check-in, I been told point blank that I would not be given an upgrade — although, I could pay for it.

I’m just trying to save you the time and energy.

Have you thought about switching to Hyatt? I definitely think you will be treated better if you switch your spend there

I’m also a Globalist. While one person swears by one program and another person swears by another program, fundamentally, they all have the same problems. A unique problem with Hyatt, although it is improving, is its geographic footprint and depth of brands outside the US.

After years of experience, I’ve gone down a different path. Stays at the loyalty program hotels are now redemptions only. That’s it.

Best of luck.

In your experiences, what are the best redemptions you had done?

I will not spill the beans on specific properties or methods because the opportunities will disappear. But, I can garner over 3 cents per point with my redemptions. This is repeatable.

Come on buddy, sharing is caring 🙂

Some blogger (or YouTube “influencer”) posts something about a deserted beach paradise located at X. Say, the Maldives. Next thing one knows, it’s crowded. As baseball great Yogi Bera said, “No one goes there anymore, it’s too crowded.”

In addition to all of the readers who are looking for the secrets, so are all of the loyalty programs (hotel and airline). They have people whose job it is to read these blogs.

If someone spills the beans about a trick to extract value out of something, that is value out of their pockets and they’re going to shut it down.

How many times have we seen article updates labelled as “DEAD”? Consider the PayPal debit card trick — it didn’t last two weeks. Now, the Curve Card is about to debut in the US and it’s already under attack.

I put too much time and effort into this game to do that. I have too much at stake to do that.

My best advice is to have an inquisitive mind and ask “what if I did this or that?” It takes time. But, if you’re persistent and creative, you’ll invent your own tricks . . . and you’ll keep them to yourself. Don’t you dare share them. Good luck.

As Sully said to Mike, “Scaring is caring.”

I disagree, hotels should already have a rough idea of how much they are willing to give up for these rooms at certain properties for a certain point redemption.

I don’t think they need to look for those “secrets” as much as we do as consumers

If you want to know the extent to which these scumbag property owners will go to deny benefits, read this article:

https://viewfromthewing.com/marriott-hotel-sells-its-best-rooms-through-airbnb-not-marriott-com/

This ownership group pulled all of its suite inventory from Marriott — making it unavailable to members. This ownership group markets its suite via AirBNB.

By doing this, it denies members upgrades — paid or award or SNAs.

It is a systematic and institutionalized denial of tier benefits.

And, this is just one story.

And, I’d recommend you see what happened to “No Black-Out Dates.” It has been pulled as a stated benefit. Properties are allowed to limit inventory available for award stays. Conceivably, that could mean 1 entry level room per day. Members have been routinely confronted by an inability to even redeem their points.

Again, if someone still “believes,” the person is not in touch with reality.

Use your points and find a different hotel strategy.

For Chase I think you are right 10UR> 10 Bonvoy+3 UR.

For Amex its more questionable: 5 MR might not beat 12.5 Bonvoy, 1 base 1MR, 1.5 Rakuten MR, and the ability to use the Gold status

It all depends on how valuable Marriott Points are going to be after the changes. I would prefer to have MR over Marriott points though, also if it was a FHR or Hotels Collection property, you will more likely to have those perks over a property to “recognize” your elite status

I think it would be tough to take 2.5 incremental MR over 12.5 Marriott points unless it was FHR. I would definitely take advantage of a hypothetical 5 to 1 transfer bonus from Amex despite really not liking Marriott. If the BBP were in play it could be a 8 to 1 trade

You earn Marriott points, elite credit, and benefits through FHR.

You are right, I totally butchered my phrasing. I meant to say that FHR was an exception to the general rule of not booking through Amex.

I just prefer to earn MR over Marriott points with no award chart even if it’s at lesser value honestly. MR is more flexible, but I guess we will know more in 2022

I don’t think we can say that the certificates will become more valuable for most people, at least not yet. At best we can say they *might* be more valuable. As several people have mentioned, when totally dynamic pricing kicks in, we could easily see hotels price at 51k and 66k points. We also can’t forget that the 15k points that we use to top off the certificate have (some) value. If you are short on points, and need to buy them at 0.9 cents each, adding 15k points to top off a cert costs $135. So suddenly that $95 cert costs $230 (plus parking plus resort fees etc).

The top off option sounds interesting, but at best it is wait and see at this point. Bonvoy has not given me any reason to confidant that anything will improve.

Wow that’s perhaps the most poignant point! How can any blogger with the reader interest at heart not mention the 5/24 restriction.

Except for a few business travels and maybe those in love with a specific property there is seemly no point to giving up a Chase slot to Marriott unless they are giving away 10+ nights.

If you want a deal at a property you stay at often call up the property reservation or general manager. Regardless of the chain they will more likely give benefits to a frequent guest. SPG and Marriott used to fine 45-75$ properties who failed to provide elite benefits now they do nothing.

Status means nothing and points are worthless while cash might be subject to inflation certainly it’s better than points

lol. I think you overvalue Chase 5/24 slots if you would only give one up for 10+ Marriott nights. And the Amex Marriott business card doesn’t add to your 5/24 count.

As someone without any Marriott relationship, I will definitely not bother with them now. Given the new Amex hotel credits and Chase portal earning, I’ll be sticking with Hyatt when available and boutique hotels everywhere else. Is it really worth a 5/24 slot plus the mental gymnastics to get value out of their cards? It’s time to move on Nick, Marriott doesn’t love you like SPG did.

To each his own. I have stayed at a couple of Autograph Collection properties I like, but in general I do not prefer boutique hotels. Greg is right there with you on boutique properties though!

The real question is whether one can obtain greater value from 1) a hotel loyalty program or 2) another booking platform. On a pure dollar-for-dollar basis. I think that’s what Bob is talking about. Never mind tier status benefits because a program like FHR and others will give those to you.

Getting any hotel credit card for any reason other than the sign-up bonus implies one believes the hotel’s loyalty program offers meaningful value. Any regular reader of this or any other travel / points blog knows this belief is wrong. Rely on the experience of others and save yourself the time, energy, and frustration.

Huh? Plenty of people hold hotel credit cards for the long-term for the annual free night certificates. It isn’t hard to get more value than the cost of the annual fee out of any of the cards that come with an annual free night. But right now, I often run into properties that are 35K but only cost $150 (I imagine they cost 35K because at some time of year rates support that). I am hopeful that with award prices tied to cash prices, we’ll see a property like that cost fewer points when the cash price is $150. Unfortunately, that also means it’ll cost more points when the cash price is higher. That obviously stinks and I am not less upset about that than you or anyone else, I just think it’ll be easier to consistently get $200+ in value out of the free night cert.

Certainly, one can obtain greater value out of a card than the annual fee. Kudos to you if you can get $200 out of the certificates. But, that’s the “small” game.

The “big” game is the hotel loyalty program itself. They are worth less and less — tier status benefits are the big lie. You have written about this. As a concurrent Ambassador / Globalist, I’ve been repeatedly denied upgrades in spite of availability at check-in — literally, I have been told “I’m simply not going to give you an upgrade.” Well (forget) me.

Now, with dynamic pricing, points themselves are under attack. That St. Regis award stay will float up to 500k or 600k points and one’s value will evaporate.

Many criticize Four Seasons, etc. for not having a loyalty program. They actually do. But, it’s not in terms of points — the paradigm in which most minds are enslaved. These non-points programs are well aware of one’s frequency to their brands. As one’s relationship with a brand deepens, various perks open up . . . including substantial room rate discounts (worth as much as or more than points), room upgrades, breakfast, etc. They are gladly given.

People ought to focus on the big game.

I won’t quibble with the point valuations, because frankly who knows what ends up being true, but I do disagree with the idea that most people use the certs for Courtyards near an airport. I would argue at this point, especially amongst people who have acquired Marriott (or Hyatt or Hilton) cards in the past few years (now that the points-and-miles things has become so huge and mainstream) many people look to redeem them for fun and leisure…meaning not a Courtyard at the airport.

In fact, is there data on this? I’d love to know what percentage of points/certs get redeemed at airport hotels.

I been in the miles game for years and I consistently struggle to find a hotel for one night anywhere but an airport location. If fact given the low price and pts valuations of airport hotels right now I am just burning them at 20% or more under value. Plus they are not always the most convenient location. It seems pointless to collect certificates or points when cash is king.

I worry that too many ppl are mesmerized by “A fetish Of status seeking” rather than any logical economic decision making processes and that should be the focus of further discussions about some of these programs should be centered on this approach since the programs have decided justify their existence as economic value based now more than ever.

Perhaps it’s more ethical to “de-program” the members and participants than to continue the charade that only nakedly benefits corporations and marginally some biz travelers who are program prisoners.

I agree with your point on programs in general. In my view, these credit cards are casinos and the house almost always wins.

In terms of what kind of redemptions people make I certainly have used points for airport hotels and will continue to do so, but that is not probably the actual desire of the person applying for the any particular rewards card…I would assume (and I know practically nothing so I’m talking out of my rear almost completely) that most apply with the idea that they are going to use that cert for “that trip they are taking next year”, whether that’s a night in Vegas, NYC, or Paris.

Whether that’s true I don’t know, but Nick made it sound like most dont, and I would say that’s probably not true given the aggressive marketing of dreams these cards are sold with.

I think most people don’t go to the St. Regis Bora Bora or St. Regis Astana. A lot more people stay in non-aspirational hotels — otherwise the majority of hotels would be aspirational. The vast vast vast vast vast vast vast vast majority of hotels in the world are not aspirational at all — they are just places for people to stay away from home, so I think the vast majority of hotels nights overall are spent at those more “normal” hotels (which is what the Courtyards in Dallas represented rather than an “airport hotel”).

My point wasn’t that you should plan to use the cert at an airport Marriott, my point was rather that at a normal hotel in a normal city you will likely be able to expect good value rather than having to plan a trip around the outlier properties like the St. Regis Astana to get solid value.

I totally agree that I’d rather use the cert at a place that’s nicer than a mid-tier Marriott and my point here is actually that when awards are dynamically priced I’d bet that you often will be able to.

In other words, when I decide to go to a pumpkin patch and corn maze for a weekend away near friends I haven’t seen in years (something I really did recently), and there is an Autograph Collection Marriott property nearby that only costs $250 (also true – or maybe it was Tribute Portfolio or something else upscaleish), I’d love to be able to use my 35K certificate to book it (but of course because it is more expensive at another time of year it is in a higher category and I couldn’t use my cert). I think it is more likely that a place like that will be award priced in a range where you could use a certificate since the award price will hopefully be tied to the cash price based on what they’ve said.

Sorry but please use periods, not commas.

Its very odd that your take is that Marriott moved to dynamic award pricing in order to increase the value of their points. So you are saying that the price of hotels in points is going to come down after the change?

Personally, I was actually getting ready to cancel my Boundless card because I’ve been having trouble finding value from the 35k cert since everything I want to book seems to be 40k. Adding the ability to top up the cert will get me to keep the card at least until we see where award prices end up in 2023. But I’m assuming that I will probably be canceling then.

Anecdotally and in the limited times I have looked at potential x-fers to Marriott with MR bonuses post-COVID, when cash prices went down Marriott didn’t go off peak so cpp suffered. I could see valuations ‘re-inflating’ as cash prices rise and partially offsetting the blow of going dynamic. Still a huge negative vs sticking with the chart because that natural upside just got capped.

If their goal is to make award prices more closely reflect cash prices then yes, I do think that cheap hotels will cost fewer points than they do today when they are cheap (and when they are expensive they will cost more points). I think it is very likely that we’ll see award rates more consistently reflect the price as we do with Hilton (until you get to the top end where Hilton does cap things — Marriott explicitly declined to commit to any cap whatsoever in award pricing).

I don’t think they are going to dynamic award pricing to “increase the value of their points” but rather to charge even more points for expensive hotels. See the St. Regis Astana in the post. On New Year’s Eve this year that hotel costs $979.75 (and you can’t even book just the room, you have to go to the “package deals” section as the only rooms under standard rate start at almost 10 times that price). But as an award stay it is only 25K points thanks to an award chart (I’m sure because the place is probably cheap at other times of year). In the future, I think you’ll see that place cost well over a hundred thousand points on New Year’s Eve and probably 25K or less at other times of year.

Greg’s observed value is a middle point — you get more value at some properties and less at others. In the future, I think it will be more consistent — whether that’s 0.5c or 0.6c or 0.7c, I expect it to be a fairly consistent value.

I can’t speak to what Marriott points are “worth” as I don’t make a habit of collecting them and every Marriott point I’ve ever used was transferred out to an airline partner. And I understand the difficulties with assigning a value to points, but if you come into an announcement about ditching award charts by assuming your current RRV is the floor for future value as you did in the post, then either (1) you are wrong, or (2) your current RRV is way too low.

My frustration has been that most hotels I want to use my 35k cert for have been 40k. My guess is that those that were peak Cat 5 will end up being 45k or 50k while those that were offpeak Cat 6 will still not drop below 40k. But I guess we’ll see.

But the nature of the RRV is that points are far more valuable at some hotels and far less at others. The nature of a revenue-based program (take Southwest for example) is that the award price changes every day according to cash prices. \

I think your assumptions about properties ending up being 45K or 50K are too locked in to the idea of an award chart. Based on what they said, I expect the price will be 27K on a day when the cash rate is cheap and 68K on a day when the cash rate is expensive.

Greg actually makes a good case for why the value will be 0.6c on the podcast publishing this weekend — that’s the value they have landed on with Marriott Homes & Villas.

Yeah, had you used 0.6c for your example, I wouldn’t be complaining. 🙂 But then you would have gotten the new value of the 35k cert to be $210 which is less than the $225 you have for it currently.

I guess even if the price does goes down to 27k, then that kinda just makes it a bad redemption for a cert because the cash price would be ~$162 and I would only be getting that “value” from the cert. Whereas using them at anything from 35k-50k assures you the “full” $210 value. Obviously this is all assuming everything goes 100% revenue based, which it likely won’t be (at least at first).

I will still be thrilled if I can count on a 35K cert getting $210 value all the time instead of having to cherry pick it. To be clear, I’ll be disappointed for points being a fixed value, but happy for certs — because even in your theoretical $162 example, that’s still a good trade for a $95 annual fee but realistically I’ll find more opportunities to get closer to full value if and when properties are more consistently award-priced near cash-price (again, this is horrible news for points redemptions but it makes certificates a much more predictably good deal).

As you imply, I don’t expect this to happen in 2022 — but I expect that in 2023 and beyond it will become the norm.

Nick, I think you’re too optimistic about the upcoming “value” of Bonvoy points. I think it will be closer to a half cent per point, which would be a gigantic devaluation of the program. I agree with your other arguments, and I think the three credit cards I hold will still be worth it for the free nights and the 6X at Marriott. But, we’ll see.

One thing is certain: The rules of this game will keep changing, and it’s fun to find good values!

They certainly might — but even still as you say the free night certificates will be worth more than the cost of the annual fee and you’ll get that value more consistently.

Doesn’t Marriott earn revenue when people transfer Amex/Chase points? At 0.5cpp wouldn’t the demand from MR/UR programs dry up?

If Marriott goes to 0.5cpp, they start getting dangerously close to the new version of IHG. I would have to think both the point earning structure of their cards and the transfer ratio’s for Amex and/or Chase would need to change.

The transfer ratios for amex were already nerfed. They used to be by default with no bonuses 1mr=1.5 bonvoy but it was devalued to 1:1