What is the best hotel credit card there has ever been? If you’d say the old SPG card, I’d have been with you until the early hours this morning. If you’d have said the Hilton Aspire to me yesterday, I might not have argued with you much. And if you’re ready to call me a soulless shill for the credit card companies when I tell you that it is neither of those cards, just do us both a favor and read it through — because I wouldn’t have believed it if you’d told me yesterday that Capital One Reward miles make the Venture and Spark Miles cards potentially the best hotel cards that have ever been. It’s OK if you don’t believe me from the get-go. I think you might if you run the numbers.

Stumbling upon something awesome

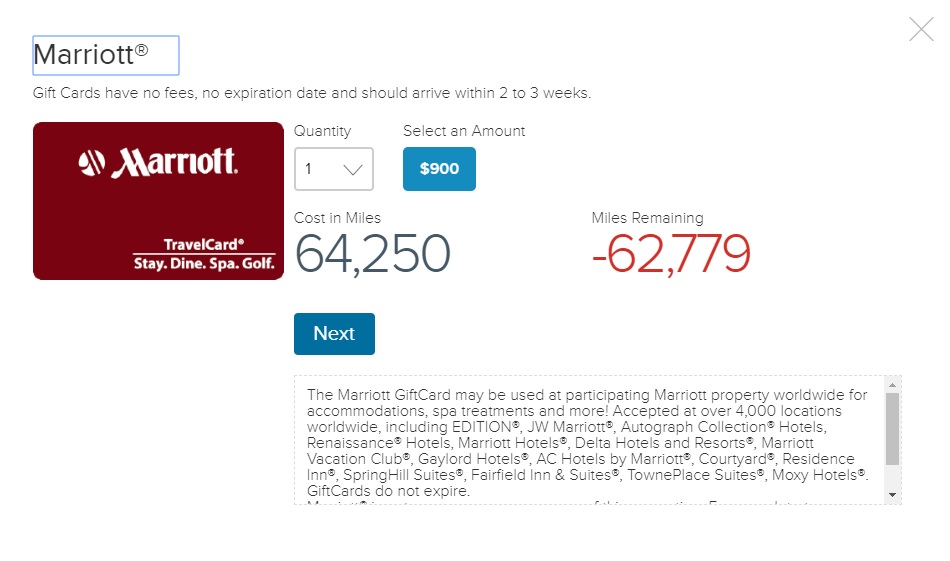

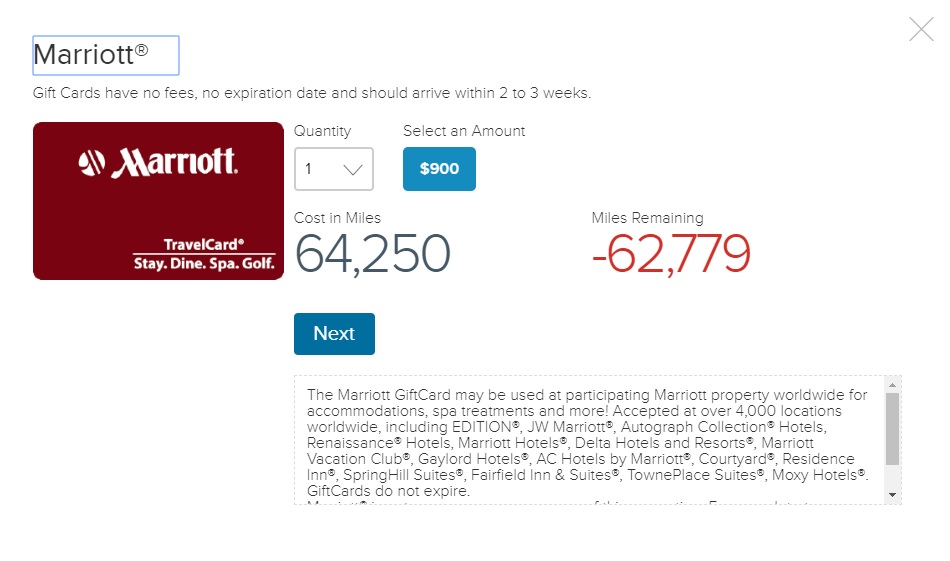

When working on our complete guide to Capital One Rewards miles, I stumbled on something amazing in one of my Capital One accounts that I’ll argue is a total game-changer: some account holders can redeem 64,250 Capital One Rewards miles for a $900 gift card to Marriott, Ritz-Carlton, Fairmont, Raffles, or Four Seasons. If that doesn’t yet sound amazing, I think it will with some analysis.

The mysterious Hotel Special Offers option

The mysterious Hotel Special Offers option

I have a Capital One Venture One account (the card that only earns 1.25 Capital One Rewards miles per dollar) that has been open for years. It has no annual fee, so I’ve kept it despite not using it much. My wife also has a Venture One card and additionally has a Venture Rewards card (what can I say? We were all-in on the Capital One ecosystem before we learned about all of the other valuable options on the market). Capital One has been good about waiving the fee on her Venture card, so we haven’t bothered to close it.

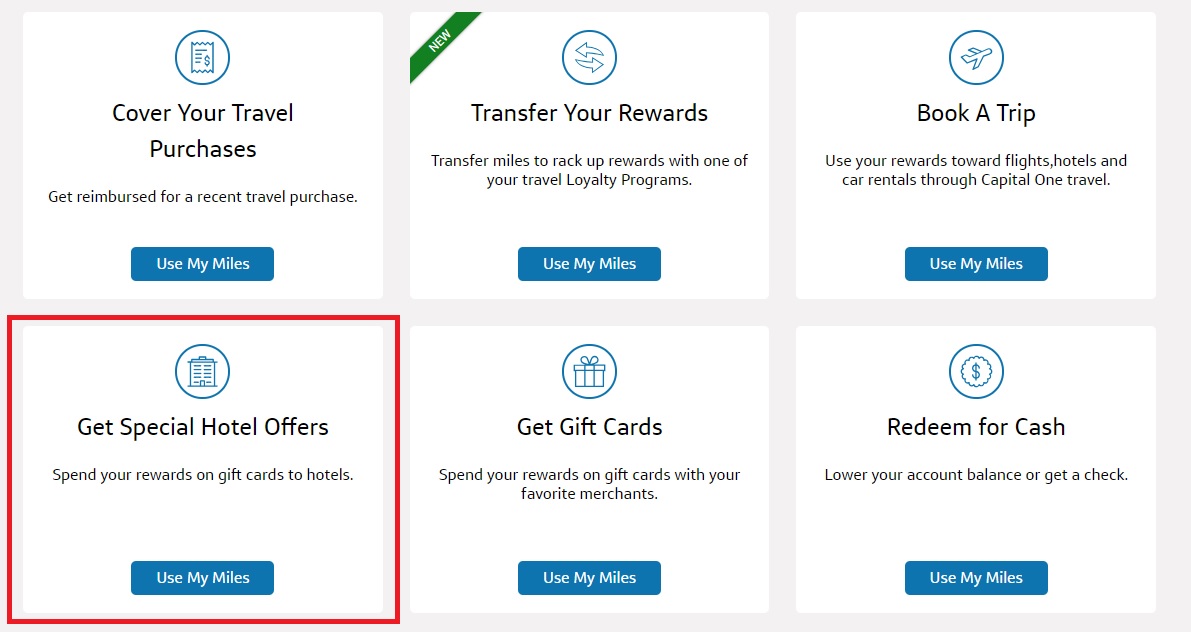

When I was taking screen shots for our posts on how to transfer Capital One Rewards miles to airlines and how to share them with other people, I noticed that my account seemed to have one more option than my wife’s, but I didn’t go back to see what it was until the next day. That’s when I noticed that in addition to “Cover Your Travel Purchases”, “Transfer Your Rewards”, “Book a Trip”, “Get Gift Cards”, etc — I had an additional option, “Get Special Hotel Offers”. My wife’s account doesn’t have this option.

After making the discoveries included below, I searched the Internet for more information about why this option was available on my account. There were a couple of datapoints from Reddit in 2017 (one with comments indicating this has existed since perhaps as far back as 2011). See this one and this one. I couldn’t find much beyond those. Interestingly, the only data points I see are from Venture One cardholders. That’s the crummy fee-free version I have. My wife has both that version and the Venture Rewards card that earns 2 Capital One Rewards miles per dollar and she does not see this option on either of her cards. Capital One has since indicated that this redemption option is something that existed during some specific period of time in the past and accounts that are grandfathered in have this redemption and others don’t — we’re not sure when the magic window occurred.

Thanks to the ability to move Capital One Rewards miles to anyone else with an card account that earns Rewards miles, you only need to know one person in your social circle who has this capability as you could easily transfer your Capital One miles to that friend or family member and have them redeem for you.

Update: When I originally wrote this post, I didn’t know whether or not the redemption would remain for multiple redemptions and/or if it was only available for a limited time. A couple of years have since passed and I’ve redeemed for multiple $900 Marriott gift cards without issue. The ability to redeem Capital One miles for gift cards disappeared entirely for a while, but when it came back, my $900 hotel gift cards for 64,250 miles returned as well. It seems that this redemption option is here to stay for those grandfathered.

What are the Hotel Special Offers and why are they awesome?

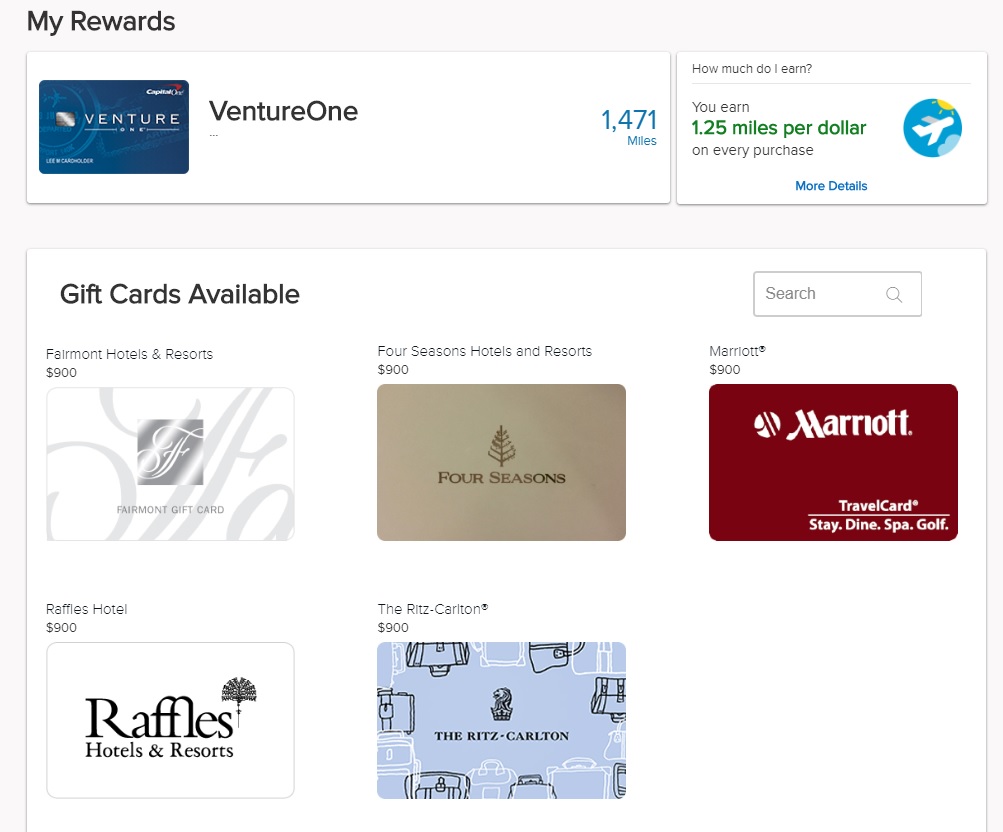

Clicking the above took me to a page that showed five options: a $900 gift card to Fairmont Hotels & Resorts, Four Seasons Hotels and Resorts, Marriott, Raffles hotel, or The Ritz-Carlton.

Update: The Raffles and Four Seasons gift cards are no longer available for this redemption.

I initially laughed to myself thinking that there is already a separate section on Capital One to redeem for gift cards…but then I saw the price on these gift cards. As shown above and below here, it’s 64,250 Capital One Rewards miles for a $900 gift card (all of these “special offer” gift cards cost the same number of Rewards miles).

Normally, 64,250 Capital One Rewards miles would be worth $642.50 when applied towards travel. That is to say that if you booked a Marriott hotel and paid with your Capital One Rewards miles-earning credit card, you could redeem miles at a value of $0.01 each toward the bill and get $642.50 towards your stay.

These $900 gift cards are offering an additional $257.50 in value. That makes your Capital One Rewards miles worth 1.4 cents each towards these $900 gift cards.

That, in turn, is terrific because the Capital One Venture card and Capital One Spark Miles card each earn 2 Rewards miles per dollar spent — an effective return of 2.8% towards stays at your choice of one of those five brands when you redeem in increments of 64,250 points.

Alternatively, you could sell the gift card. Let’s say you redeemed for the $900 Marriott gift card. In the past, public resale rates for Marriott Gift Cards have been around 85% of face value. That makes the $900 gift card theoretically worth about $765. That’s assuming that a resale site would buy such a large gift card, but if they do that means $765 cash in your pocket in exchange for your 64,250 Rewards miles — a value of 1.19 cents per mile. Since the Venture and Spark Miles cards each earn 2 Capital One miles per dollar, your total return is 2.38%.

The “catch” is that earning enough points for this redemption would ordinarily require $32,125 in everyday spend (assuming we’re not including any welcome bonuses), so it’s not nearly as straightforward as a cash back card. That said, I’m sure there are readers who used to spend at least that much annually on an SPG card. And as we work through the math, I think it might be worth making a Capital One miles card the daily-driver-for-unbonused-spend card that SPG once was. On $32,125 spent (in order to earn the 64,250 Rewards miles required for this gift card redemption), your return is 2.38%, and that is cash assuming you sold the gift card. While the gift card redemption-and-resale angle still wouldn’t make it the flat-out most rewarding card for everyday spend on its own, that’s still very competitive.

How does that compare to the “old” SPG card earning rate?

By comparison, the SPG card used to earn the equivalent of 3 Marriott Rewards points per dollar spent. Since our Reasonable Redemption Value for Marriott points is 0.72 cents, our value for Starpoints was 2.16 cents per point before the Marriott merger since each Starpoint could be converted to 3 Marriott Rewards points pre-merger. That is to say that each Starpoint earned before the merger would buy you about 2.16 cents towards a Marriott stay (remember that today, most Marriott credit cards earn 2 Marriott Bonvoy points per dollar — a lesser earn ratio than before).

Capital One is offering significantly more value if you can redeem for those $900 gift cards — a value of 2.8 cents towards Marriott stays is 30% more than the old Starpoint valuation of 2.16 cents.

And it gets better.

A major difference between using Starpoints to book a hotel room versus using a Marriott gift card is that you will earn rewards points when paying with a gift card. A general member with no Marriott status earns 10 points per dollar spent at most brands. At a value of 0.72 cents per Marriott point, that’s worth approximately 7.2% back. The water gets muddy here because you’ll earn those points on room rate and incidentals, but not on tax. How much of the $900 gift card will go towards tax and not earn points? I don’t know. Let’s conservatively say that you pay, on average, 20% in taxes and fees that don’t earn Marriott points. That means you’ll earn 10 points per dollar on $750 in spend from your gift card — 7,500 Marriott points. That’s before any hotel promotions, the 50% bonus for Platinum status members, etc — one might reasonably expect that you could pull together a couple/few thousand more Marriott points by taking advantage of various promotions. Even if we ignore the chance at earning promotional points for that $750 in stays, you’ll have earned about $54 worth of points (7500 * $0.0072 per point). Keep in mind that’s enough points for a free Category 1 Marriott night.

Furthermore, you should be able to book your Marriott gift card stays through a shopping portal and earn an additional return there. Pre-COVID, we had seen shopping portal payouts as high as 12% for Marriott stays. If you were able to earn 12% back on those $750 in room rates paid, that’s another $90 cash back.

When all is said an done, you’ll have spent $32,125 on a Capital One Venture or Spark Miles card and earned:

- A $900 Marriott gift card

- $90 in cash back from using that GC

- At least 7500 in Marriott points (~$54)

That’s a total value in the ballpark of $1,044 on $32,125 in spend — a total return of around 3.25%. Let’s be clear: I am not saying that the Capital One cards earn the equivalent of 3.25% back. They don’t: first of all, you probably don’t value a Marriott gift card at its full face value. Second, trying to value the return on a card based on stuff like how much portal cash back you can get when redeeming your rewards is like valuing your bank account by an additional 10% because you could spend all of your money at Macy’s today and get 10% cash back through a shopping portal. Let’s not get silly.

However, it’s essential to take the bigger picture into account when comparing the Venture and Spark Miles cards to a traditional hotel credit card that earns hotel points. Redeeming traditional hotel points will not earn an additional return in terms of shopping portal cash back, points earned for stays, etc. In my opinion, the return on these Capital One “miles” cards becomes stronger by an order of magnitude in this regard than the return on hotel-branded credit cards (on unbonused spend) since you do have the ability to grow your savings even further than the 2.8% towards paid Marriott stays that you’ll get when redeeming for a $900 gift card.

Of course, there are opportunities to get far outsized value out of hotel points that you just can’t get with fixed-value points — Reasonable Redemption Values are meant to make it easier to understand when it makes more sense to use cash and when it makes more sense to use points. If you use your points for a hotel in Times Square at New Year’s Eve or for a resort in the Maldives, for example, you could easily get a lot more “value” out of the points in comparison to cash prices. You won’t be booking those off-the-charts redemptions with Capital One Rewards miles. If the majority of your hotel redemptions are for those types of hotel stays where you were getting far beyond 2.8 cents per point in value, I can understand if you hold tight to the SPG card from days of yore.

A key point thus far ignored is bonus categories: if you do a lot of your spending at grocery stores or gas stations or restaurants or actually at the hotels, you can get a better return with some hotel or flexible point credit cards. The Capital One miles cards only come out on top for unbonused spend — and then only if you have this magical fairly limited redemption capability.

Flexibility has intangible value

However, keep in mind that it’s not just Marriott gift cards at this redemption level. Unfortunately Four Seasons is no longer available — but Raffles and Fairmont remain options. You’re not going to find many mid-range hotels options outside of Marriott there, but those who normally pay for stays at Fairmont and Raffles might find the return on the Capital One miles cards to be the best bang for their buck. That was as surprising a sentence to write as it is to read.

And alternatively, selling the gift cards for cash and using that to pay for stays at other chains yields the 2.38% back number thrown out above — which isn’t quite as good as the Bank of America Premium Rewards card with Platinum Honors or the ongoing return on the Alliant Cashback Visa, but it’s pretty good for a long-term earn rate — albeit hinging on the ability to redeem for these $900 gift cards at a preferential rate. Will that option remain in perpetuity? It’s anyone’s guess and there is certainly some gamble in collecting Capital One Rewards miles in the hopes that it does remain. That said, there is some gamble in collecting any rewards currency since devaluations can happen without notice.

No real “premium” benefits

If the Capital One miles cards lose out to the old SPG card in terms of aspirational redemptions, they lag far behind a card like the Hilton Aspire card in terms of ancillary benefits. The Aspire card comes with Hilton Diamond status, an annual $250 airline incidentals credit, an annual $250 Hilton resort credit, and more. The Capital One cards don’t come with any of those sort of benefits. Sure, they added a Global Entry or TSA PreCheck credit to the Venture Rewards card, but that’s about it. No Priority Pass, no elite status…on the other hand, no $450 annual fee, either.

Don’t get me wrong: I love the Hilton Aspire card; I think its annual benefits far outweigh its annual fee. But it’s not terribly rewarding for ongoing spend, awarding just 3 Hilton points per dollar on everyday purchases. Even its bonus categories don’t come close to matching the Venture card’s return on Hotels.com spend.

But if you’re looking for premium benefits, you wouldn’t get excited about the Venture / Spark Miles cards as your hotel cards of choice. Whether you’re #TeamVentureSpark or #TeamAspire likely comes down to whether you’re more interested in rewards for ongoing spend or perks for being a cardholder.

Earn more miles with Capital One Venture or Spark Miles

One of the things most-loved about the old SPG card was the fact that you could use the SPG card to effectively earn airline miles at a rate of 1.25 airline miles per dollar spent.

Capital One offers a better return — albeit with far far far far far far far far far fewer airline partners. That’s because the Capital One Venture and Spark Miles cards earn 2 Capital One Rewards miles per dollar spent and you can then transfer to most of the airline partners at a rate of 2 Capital One Rewards miles to 1.5 airline miles (the ratio is worse for Emirates and Singapore). That means that for most airline partners, you’re earning the equivalent of 1.5 airline miles per dollar spent on a Capital One Venture or Spark Miles cards — 20% more than the earning ratio on the old SPG card and much better than the earn ratio via the Marriott Bonvoy credit cards. Again, the major difference here is the fact that Capital One only has just over a dozen airline partners and is missing many of Marriott’s most useful partners. Still, Capital One says that they plan to expand on the partnerships and indeed they have added some along the way.

So while it’s true that the Capital One card earns more airline miles per dollar, it has a long way to go to catch up with the transfer partners we all enjoyed with SPG/Marriott over the years. Still, I’ll hold out some hope on that. And the value here is that you can choose between airline miles or gift cards or travel statement credits. Capital One is weak in breadth of transfer partners but strong in flexibility.

Visa is more widely accepted

Speaking of breadth, Visa is obviously more broadly accepted than Amex. These days, I don’t run into many instances in the US where I can’t use my American Express cards, but it does happen now and then. Overseas, Visa is certainly more widely accepted. That adds another small feather to Capital One’s cap over the old SPG and current Aspire cards.

Welcome bonuses are more valuable than they seemed before

Certainly one thing that popped into mind immediately was the fact that the welcome bonuses on the Venture and Spark Miles cards are a lot more exciting to me now than before considering the ability to redeem 64,250 Rewards miles for a $900 hotel gift card. The Venture card has at times had a welcome offer of 75,000 Rewards miles (since expired and replaced with a 50K offer). At 75K, the welcome offer alone could bring in a $900 gift card and leave you with more than $100 worth of Rewards miles left over. That would be a terrific bonus if you would have otherwise used the points for hotel stays.

There have also been big offers on the Spark Miles card. While not currently available, we’ve sometimes seen welcome offers that would yield a total of 300K Capital One miles after $50K spend. If you had the hotel special offers available, you could redeem that for four $900 gift cards — $3600 towards hotels — and still have 43K Rewards miles left (worth at least $430 towards travel). That’s a total return of around $4K on $50K spend. Of course you could do a lot better by splitting that $50K spend over multiple cards to earn multiple welcome bonuses, but if you’re a business owner with high expenses where that $50K in purchases won’t come at the expensive of going after other welcome bonuses, that looks like an awesome return. Of course, that offer hasn’t been around recently. We’ll always have the best currently-available offers on the best offers page.

Bottom line

The moves to add airline transfer partners and to allow people to share miles with others made Capital One much more of a player in the rewards card market than they ever had been before. However, for those with the capability to use your Rewards miles for 1.4 cents each towards certain hotel gift cards, the Venture Rewards card becomes a pretty good option in terms of everyday spend. I’ve kept the Venture card on rotation into our wallets ever since finding this. If you had told me in January 2018 that I would hang up my SPG card and be excitedly using my Venture Rewards card by the end of the year, I never would have believed you. I still can’t really believe it. But between the fact that I know my floor redemption is no worse than a 2% cash back card and I now have the additional options to transfer to partners, move the points between my wife and I, and possibly get really surprising value towards Marriott stays, I’m digging these Rewards miles.

I guess the big question mark that makes all the difference in the world is: who has the ability to redeem for these gift cards and is there any logic to it? If you have an old Capital One account, it’s definitely worth checking.

[…] about using Capital One miles at a value of $0.01 each since I value transfers to partners (and the weird Marriott redemption thing that I’ve been grandfathered into and am crossing my fingers returns when gift card […]

Thank you for putting this all in percentages. The banks win when the numbers are confusing. Hotels like Hilton and Marriott count on that. Technically Marriott could have went from their points towards SPG, but they didn’t. I wonder why… haha

It’s easy to get caught up in the higher Nx but running the real numbers is the way to go.

[…] that says “Get Special Hotel Offers”. We’ve written about this before (See: The best hotel credit card ever) — essentially, some cardholders can redeem 64,250 Capital One “Miles” for a $900 […]

[…] somewhat tempted by this because I have previously redeemed Capital One “miles” for Marriott gift cards, but Marriott is not currently available through Capital One. Since Marriott runs these purchases […]

The gift card is no longer available

[…] bummed about Capital One removing gift card redemptions because I have written before about one of my Capital One accounts being among a group that was grandfathered in to a particularly good … that offered $900 gift cards to a number of hotel brands (including Marriott) for 64,250 points (a […]

[…] my Capital One account still has the ability to convert 64,250 “miles” into a $900 Marriott gift card. I made that redemption today and I’m glad I did because this news doesn’t make me […]

[…] where the card offered a special gift card redemption that I’ve written about before (See: The best hotel credit card ever): while most gift card redemptions through Capital One offer 1c per Capital One “mile” […]

[…] the Venture card that earns 2 miles per dollar spent). I’ve written about this before (See: The best hotel credit card ever). As far as we’ve been told, this was a benefit that was offered for a limited time and those […]

Nick and Greg, I wanted to give you an update on this deal. I did do the $50K spend thang with the Spark. After transfering points to the wife’s Venture Card, I bought a Marriott GC for $900.

Please note: you canNOT “book” rooms with the GC. You can only pay in arrears. I.e. AFTER your stay. IOW, you can’t get a promotional rate if you pay in full today for a future stay with the GC. You have to book a “flex price” room and pay when checking out. That could easily be a $100 difference in price between paying in advance and paying when leaving. You don’t get that saving with the GC. Still not a bad deal, but w/out a doubt, caveat emptor.

All of the above about stacking and what not. I don’t think you can do that with the GC.

If you’d like, I can take a screen shot on back of card that spells out the limitations. I’ll need to know how to send you the pic.

[…] so you’ll want to check the exclusion list before you book. We recently wrote about how some Capital One cardholders can redeem 64,250 points for a $900 Marriott gift card. Stacking that gift card with an offer for 12% cash back would make for a nice way to stretch your […]

I have the Venture One card and the GM card. I’ve had the former for 10+ years. I use it very occasionally (i.e., life-support type of use).

No special offers for me.

reminds me of Julian’s “devils advocate” posts

Old timers (from 2011) remember the short-lived $900 Hyatt check certificate offer for 51,250 “miles” right after a 100k Venture sign-up bonus for those who could stomach the 3-agency pull…and Capital One’s famously bad customer service.

Years ago when the venture card came out they had a similar deal on Hyatt gift cards. I think there was a 100k sign up bonus and you could parlay that into two $900 gift cards after meeting min spend. Later it went up to something like what you are describing now do you had to do a bit of spend to get the 2nd gift card. This was one of those desks that everybody jumped on due to the amazing value of the sign up bonus.

Really nice to see the hotel gift cards are back on n some form.

My really old venture card doesn’t have hotel offers

-David