NOTICE: This post references card features that have changed, expired, or are not currently available

Over the past year, there have been rumblings / rumors / fears that Chase might someday limit the ability to combine Ultimate Rewards from one account with another (see this post at Doctor of Credit from July 2017, where he covers surveys that included a number of options that would limit the ability to transfer between cards or limit the value of transfers between cards). At the moment, it is possible to combine your points between two Ultimate Rewards accounts in your household or combine them with a joint business owner (e.g. from your Freedom to your Sapphire Reserve or from your partner’s Sapphire Preferred to your Ink Business Preferred, etc). We have received a report from a trusted source that Chase is actively looking at eliminating the ability to pool points in a household and the ability to move points to a more valuable card. At the moment, this is still just a rumor, but you may want to preemptively combine your points if you have points sitting in a less valuable account.

Why combine points?

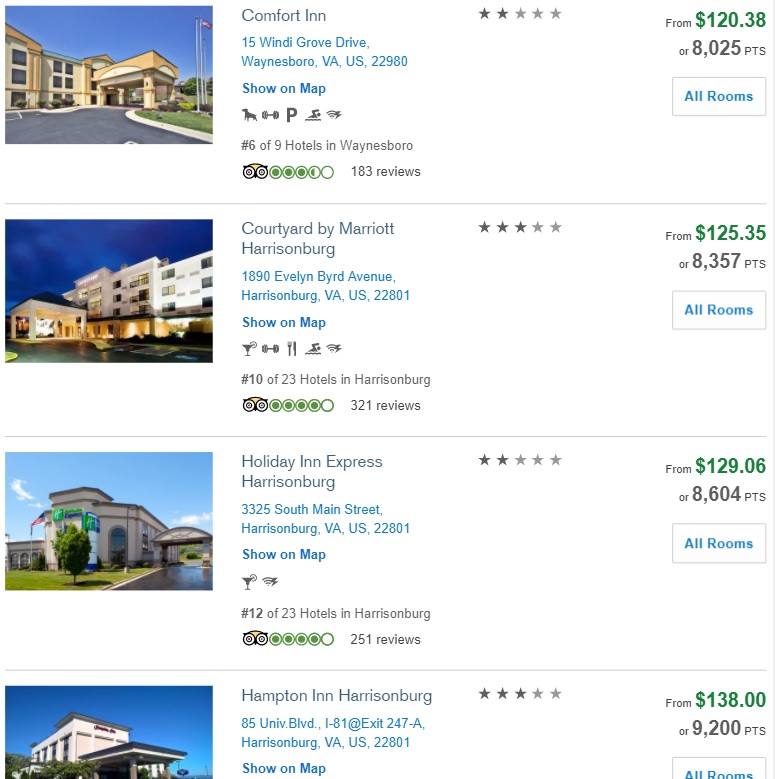

There are many ways to gather a large sum of Ultimate Rewards points (See our resource page: Amassing Ultimate Rewards for some ideas), but all Ultimate Rewards points are not created equal.

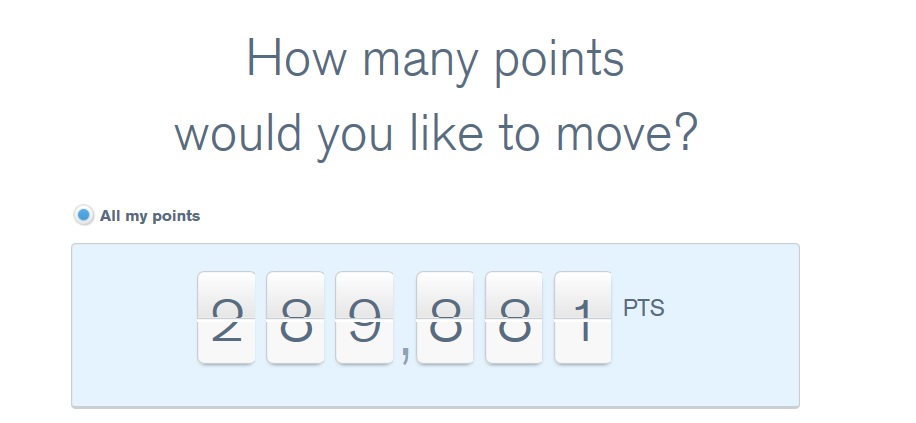

For example, my wife had a balance of several hundred thousand Ultimate Rewards points in her Ink Business Preferred account that she just transferred to her Sapphire Reserve account so as to have the option to use those points for 1.5 cents in value toward travel booked through Chase Travel. While we generally prefer to transfer to airline and hotel partners, it makes sense to have the most valuable backup option possible. You can only book travel at a value of 1.25 cents per point with the Ink Business Preferred, so she’ll take an extra .25 cents per point with the Sapphire Reserve.

Similarly, I had points earned from a Freedom card that could only be redeemed for 1 cent per point via that card and could not be transferred to Chase transfer partners (as the points need to be in a premium account to transfer to airline and hotel programs). I just moved those points over to my own Ink Plus account as that account carries the ability to transfer to partner loyalty programs. Part of the reason I did this was to have a sizable balance of points in each of our names (mine and my wife’s) in order to transfer to each of our own loyalty accounts. Currently, Chase allows you to transfer points from a premium card (Sapphire Preferred, Sapphire Reserve, Ink Business Preferred or some currently unavailable products like the Ink Plus) to your own loyalty account or the loyalty account of someone who is an authorized user on your account. We have not heard anything to indicate that transfers to travel partners would change. I may reconsider keeping a balance in my own account and transfer all of our points to my wife’s Sapphire Reserve, knowing that she could add me as an authorized user in the future in order to transfer to my loyalty accounts if necessary.

Transfer difficulties? Create a loop

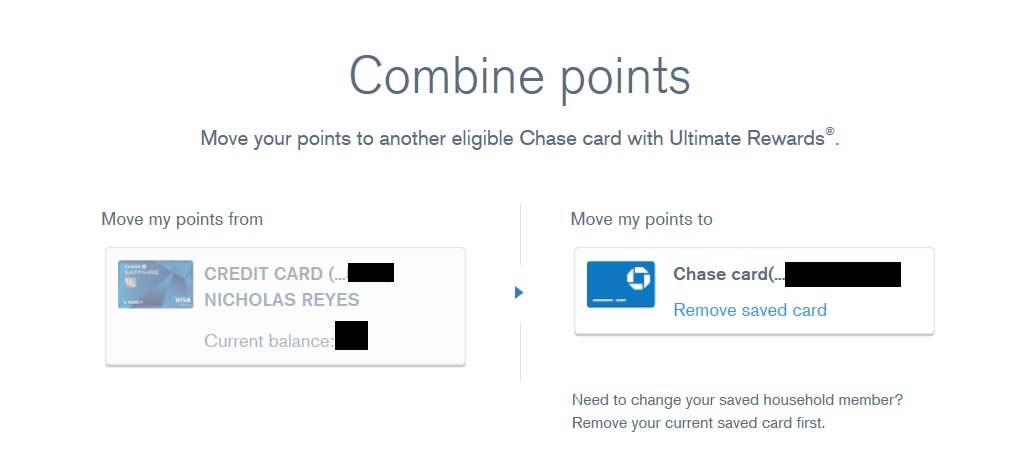

If you have trouble transferring between accounts, some users have been able to combine points between their own accounts — like from Bob’s Freedom to Bob’s Sapphire Reserve — via secure message.

However, you may run into an issue if you try to connect more than one of your cards to a single card that belongs to someone else. Chase allows you to combine/transfer to someone else who lives in your household (or a co-owner of your business for business cards), but I’ve had complications with this from time to time.

For example, let’s say that Joe and Suzy live in the same household and are joint owners of a business and have the following accounts:

- Chase Freedom Unlimited (Joe)

- Chase Ink Business Preferred (Joe)

- Chase Sapphire Reserve (Suzy)

Joe first combines points from his Freedom Unlimited to Suzy’s Sapphire Reserve. Later, he logs into his Ink Business Preferred account and tries to combine points with Suzy’s Sapphire Reserve. Joe may run into an error adding Suzy’s Sapphire Reserve card to combine points. This has happened in our household several times. In that case, Joe should log into his Freedom Unlimited account and remove Suzy as a household member (click “remove saved card). About 24 hours later, he should be able to add Suzy to his Ink Business Preferred in order to combine his points to her account.

The easy solution I’ve found is to create a loop. In the example scenario they should transfer like this:

Joe’s Freedom Unlimited–>Joe’s Ink Business Preferred—>Suzy’s Sapphire Reserve—>Joe’s Freedom Unlimited

Creating a loop chain has solved that problem in my household. As noted, it took 24 hours after removing accounts to re-add them to other cards, so be aware of that limitation.

Bottom line

While there have long been rumors that Chase might limit or end the ability to combine Ultimate Rewards points, the timing on this particular leak does make some sense. We recently reported an offer to earn 3x everywhere for 1 year with the Chase Freedom Unlimited for new cardholders. That offer has sporadically, but not consistently, shown up on the Chase homepage (though it is easily available via the link in our post). Awarding 3x everywhere would presumably get very expensive for Chase if people were to sign up and transfer all of their Freedom Unlimited-earned points to the Sapphire Reserve — effectively earning 4.5% cash back everywhere for a year if the points are used towards travel through Chase Travel. Is it possible that we haven’t seen that offer mass marketed because Chase is working on limiting transfers? Again, we don’t know that they are any closer today than they were last July when Doctor of Credit first posted about the surveys — but I can imagine a world where this makes sense. While the 3x Freedom Unlimited offer is subject to 5/24 and thus excludes many people who frequently open and close accounts, consider a married couple where one person is under 5/24 and the other has a Sapphire Reserve. Chase may be looking to eliminate the expense of allowing people to combine points, especially considering how popular the Sapphire Reserve was (and the high retention rates that have been reported).

Also keep in mind that eliminating the ability to combine points isn’t the only possible negative solution. In the Doctor of Credit piece linked at the top of this post, Chase was exploring options including reducing the value of points earned on no-fee cards (such as transferring those points 3:2 to a more valuable card).

A change this significant no doubt requires considerable planning and IT to execute. We do not have a timeline nor a confirmation that this is a definite eventuality, but our source confirmed that it is a serious point of discussion that is actively being pursued at high levels. As it has been nearly a year since this was first discussed, I would not expect changes to be coming in the immediate future. It would nonetheless be prudent to move your points to your most valuable account and/or an account that allows transfers to partners in order to be prepared if an unannounced change were to spring forth in the future.

[…] nuggets — including the fact that Chase was in fact considering an end to points pooling, a rumor we reported months […]

[…] to move your points from card to card within your portfolio of Ultimate Rewards points. While it had been rumored at one time that Chase might take away this functionality, that hasn’t come to […]

I noticed I can no longer transfer my Ink points to my reserve account, I was able to transfer them to my freedom account than to the reserve account, things are changing it was fun while it lasted time to think of Amex trifecta now.

If you had the CSR also linked with the Freedom, that falls in with my theory above that you need a loop because I am guessing you had the CSR linked with both the Freedom and the Ink. I’ve had problems trying to link one card (like your CSR card) with multiple others (like linking with both your Freedom and your Ink) as well, hence the loop.It’s been that way for me since long before this post.

It’s certainly possible that this stuff could change at any time, but I don’t think it has yet. As noted in my response above, I moved points straight from Ink to CSR without issue.

I’ve been transferring Ink points for over a year and a half now. I logged in today to make a transfer and my reserve account was removed so I tried to add it again and it confirms its a chase account but gives me a message unable to make a transfer. I hope this didn’t end.

I just now moved points from an Ink to a Sapphire Reserve.

Have you linked the CSR with another card (like a Freedom or something?). I believe the system sometimes gets stuck on allowing transfers from multiple cards to a single card. I remember at some point I had to set it up in a loop. Something like my CFU->my Ink+->Wife’s Ink Business Preferred->Wife’s CSR (or something along those lines) to maintain a loop. You might try unlinking the CSR from other cards and then giving it a day (I think it takes about 24 hours to be able to re-link it) and setting up a loop.

I’ve been transferring points since 2017 no problem. I logged in today to transfer the account was there it is only linked to my reserve account. I tried to transfer it said it can’t transfer points the account then disappeared I then tried to add my reserve account again I see the check marks confirming it’s a chase account then when I hit confirm it says error. After several times I added my freedom card and it says confirmed and the transfer went through to my freedom card. I saw on another blog that others are having this problem and they called in and chase doesn’t allow it anymore. I didn’t call in to confirm this but if you want to move points do it now.

[…] Frequent Miler, there’s a RUMOR that Chase is looking to end the ability to combine points and move them […]

[…] Frequent Miler “received a report from a trusted source that Chase is actively looking at eliminating the ability to pool points in a household and the ability to move points to a more valuable card.” […]

I received an error when attempting to combine points from my Chase Ink Business to my CSR account today. Called and was told that can no longer combine points from the business cards to CSR because CSR points are more valuable. They did however move my points to my Freedom and then to my CSR account.

[…] stick around? And, will Chase really revoke the ability to pool points across accounts? (see: Leak: Chase may end Ultimate Rewards pooling). You’ll find my thoughts about each of these questions below. First, though, let’s […]

[…] and thinks the devaluation might have spared us from a potentially worse devaluation. According to rumors, Ultimate Rewards points transferability between different cards will no longer be allowed, […]

Count me as another who would go from Chase to Amex or Citi if this happened. Citi’s DoubleCash card gives 2% across the board. Amex has their MR ecosystem which is pretty similar to Chase’s.

These aren’t just words on a blog comment either — There are still companies I’ve not done business with in 10+ years and plan on keeping it that way for a long time.

[…] days ago, Frequent Miler wrote the following: “We have received a report from a trusted source that Chase is actively […]

[…] Nick over at Frequent Miler posted some interesting information he received from a source over at Chase…that Chase is continuing to pursue limitations on internally transferring Ultimate Rewards between accounts – this was originally a rumor based upon a survey reported by DOC. I’d suggest reading either of their posts as they go into detail, but the long and short is that Chase may prohibit transferring 1:1 between Freedom, Unlimited, Preferred, Cash, Reserve, etc. The replacement program would create proportional transfers equal to the redeemable amount of a point at Chase Travel ( or even worse case just cash back for Freedom, Cash, etc). […]

[…] The End of UR Pooling???: So a “trusted source” to some bloggers has stated that the ability to pool our Ultimate Rewards points in a household, and the ability to move points to a more valuable card may be no more. At this point it’s all speculation, but you may plan accordingly just in case. […]

My experience: have been unable to transfer points to my wife’s Sapph Pref from my Freedom via combine points for a few months, but secure message made it happen. (I figured it was due to the IT problems a while back?) Now I’m just thinking it’s related to the point in this post. BUT, I HAVE been able to transfer to my wife’s regular Sapphire (no Preferred) and then to her Sapph Pref within her account. So loop I shall…

[…] because there are so many out there and would rather not bother and waste your time. But this latest rumor that Chase may stop Ultimate Rewards pooling is important to remind you to move points from one of the “cash back” type cards […]