In the November 4th post “Should I go for Marriott Titanium Elite Status?” I explained that my travel plans meant that I would be 8 nights short of requalifying for Marriott Elite Titanium status this year. I knew that I could select 5 elite nights as my 50 night Choice Benefit, but then I’d still be three nights short. Titanium status doesn’t offer much above Platinum status, but it does offer a better Choice Benefit (a 40K free night) and United Silver status. Was it worth booking a three night stay just for those extra benefits?

After publication, Nick reminded me that the Bonvoy Boundless card offers an elite night with each $5K spend. That had slipped my mind! Was that worth doing?

Elite Benefits

Here’s a high level chart showing benefits of each status tier:

| Elite Status Level | Requirements Per Year | Key Benefits |

|---|---|---|

| Silver Elite | 10 Nights | Late checkout, 10% point bonus |

| Gold Elite | 25 Nights | 2PM late checkout; 25% point bonus; welcome gift (points only); room upgrade; enhanced internet |

| Platinum Elite | 50 Nights | 4PM late checkout; 50% point bonus; welcome gift w/ breakfast option; room upgrade includes suites; lounge access; Choice benefit (such as 5 nightly upgrade awards) when you achieve 50 nights. |

| Titanium Elite | 75 Nights | All of the above, plus: 75% point bonus; United Silver Premier status via RewardsPlus; Ritz-Carlton suite upgrades; Additional Choice Benefit (such as 40K free night certificate) when you achieve 75 nights. |

| Ambassador Elite | 100 Nights + $23K Spend | All of the above, plus: Ambassador Service (dedicated Marriott agent); Your24 (Choose the 24 hours of your stay. For example, choose to check in at 9am after an overnight flight). |

Analysis

Assuming that I could quickly generate $15K of spend for about 2% in fees (pre-paying taxes, for example), I ran the math:

- Cost of spend: $15,000 x 2% = $300 in fees

- Cost of using 5 elite nights from Choice Benefit: Loss of 5 Suite Night Awards

Benefits from spend:

- 30,000 Marriott points (The Bonvoy Boundless card earn 2 points per dollar for all spend)

- Marriott Titanium elite status

- United Premier Silver status

- 75 Night Choice Benefit: 1 40K Free night

When I laid out the costs and benefits as above, the choice to move forward was obvious. Forget about the Choice Benefits. If I really wanted the 5 Suite Night Awards, I could pick them as my 75 Night benefit, so the loss of the 50 night benefit is either a wash or a win. Now consider that for $300 in fees, I’d get 30,000 points, Titanium Elite status, and United Silver status. Let’s look first at the points…

In my latest analysis, I found that Marriott points are worth around 0.8 cents each. More specifically, the median observed value was 0.8 cents per point, but the 80th percentile was 1 cent per point. That means that while you’d be likely to get only 0.8 cents per point value if you just randomly booked nights with points, it shouldn’t be hard to get 1 cent per point value by cherry-picking good value awards. So, in general, I’d be happy to buy Marriott points for 0.8 cents each since I know that I’ll likely use them for 1 cent per point value, or better. Using that 0.8 CPP (cents per point) “purchase point,” the 30,000 points I’d earn from spend are worth 0.8 CPP x 30K = $240. That’s a huge portion of the $300 in fees right there!

Given that the points earned are worth $240 to me, that leaves $60 of the $300 in fees unaccounted for. The next question is whether earning Titanium Elite status and United Silver status is worth the extra $60? Absolutely. Titanium status doesn’t offer much above Platinum status, but there are times where it is valuable. For example, if you stay at the St Pancras hotel in London, you’ll only get access to their amazing Chambers Club if you’re staying in a Chambers Suite or if you have Titanium Elite status or higher. Also, at Ritz-Carlton properties, Titanium Elites and above are eligible for suite upgrades while Platinum elites are not. To be clear, suite upgrades are not guaranteed, but at least they’re possible.

Even without the advantages of Titanium Elite status, I’d pay $60 to keep my United MileagePlus Premier Silver status. I don’t fly United often, but when I do, I appreciate the ability to choose preferred seats for free, and I’ve even been upgrade to domestic First Class a time or two.

What about the opportunity cost of spend? Since I have Bank of America Platinum Honors, I earn 2.62% back with spend on my Premier Rewards card. If I had spent $15,000 on that card instead of on the Bonvoy card, I would have earned $393 cash back. If I use that number as my cost instead of the $300 number, is it still worth it? If we subtract out the value of the points earned, we get $393 – $240 = $153. I still think that the combined value of Marriott Titanium status plus United Silver status is worth $153. So, yeah.

Going for it

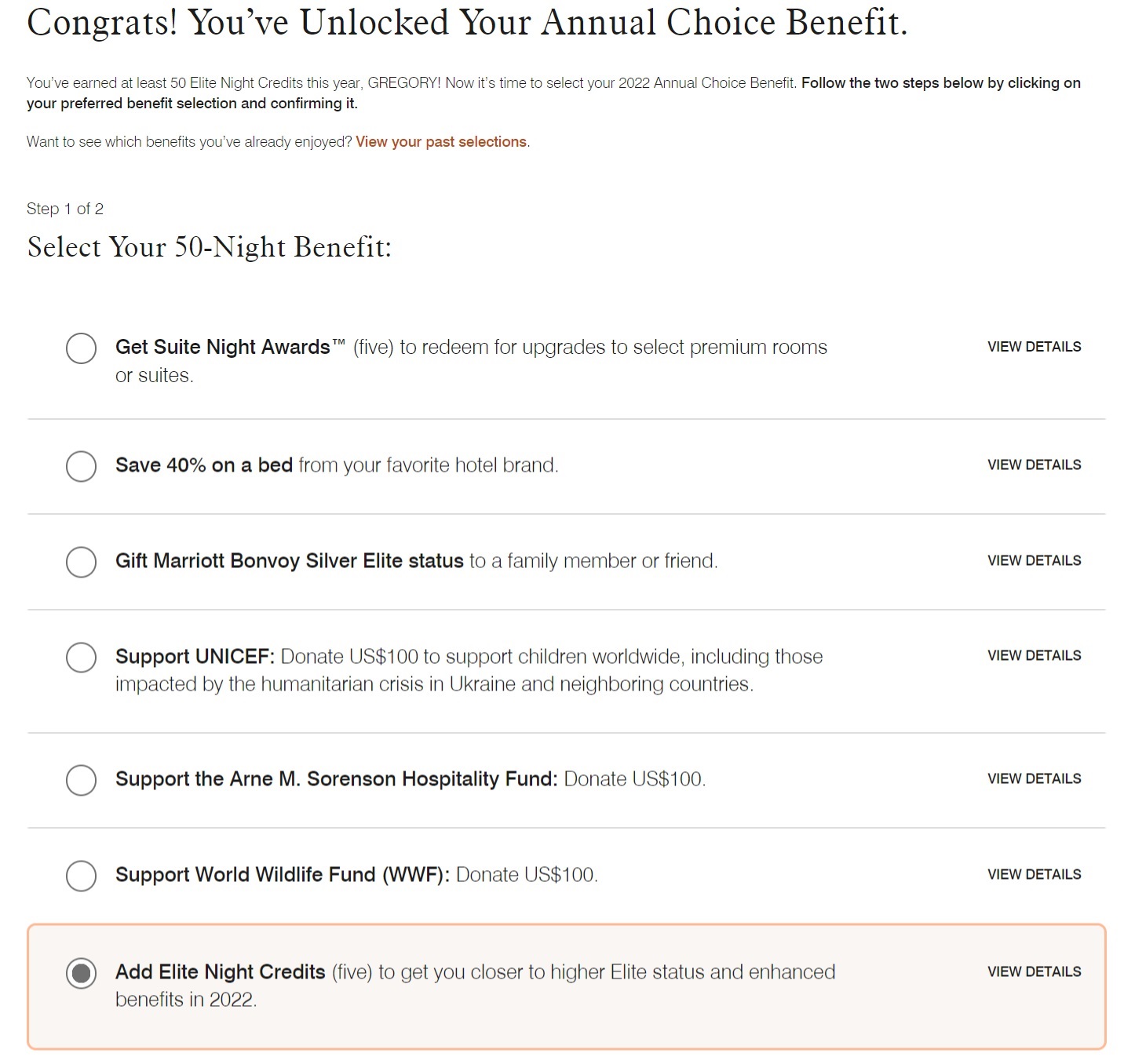

Once I decided to go for it, I quickly spent $15K with my Bonvoy Boundless card. A day or two after my December statement closed, I checked my Marriott account and saw that 30,000 points plus 3 elite nights had been added to my account. At this point, I had 70 elite nights, but still needed 75 for Titanium. So, I picked my 50 Night Choice Benefit:

Results

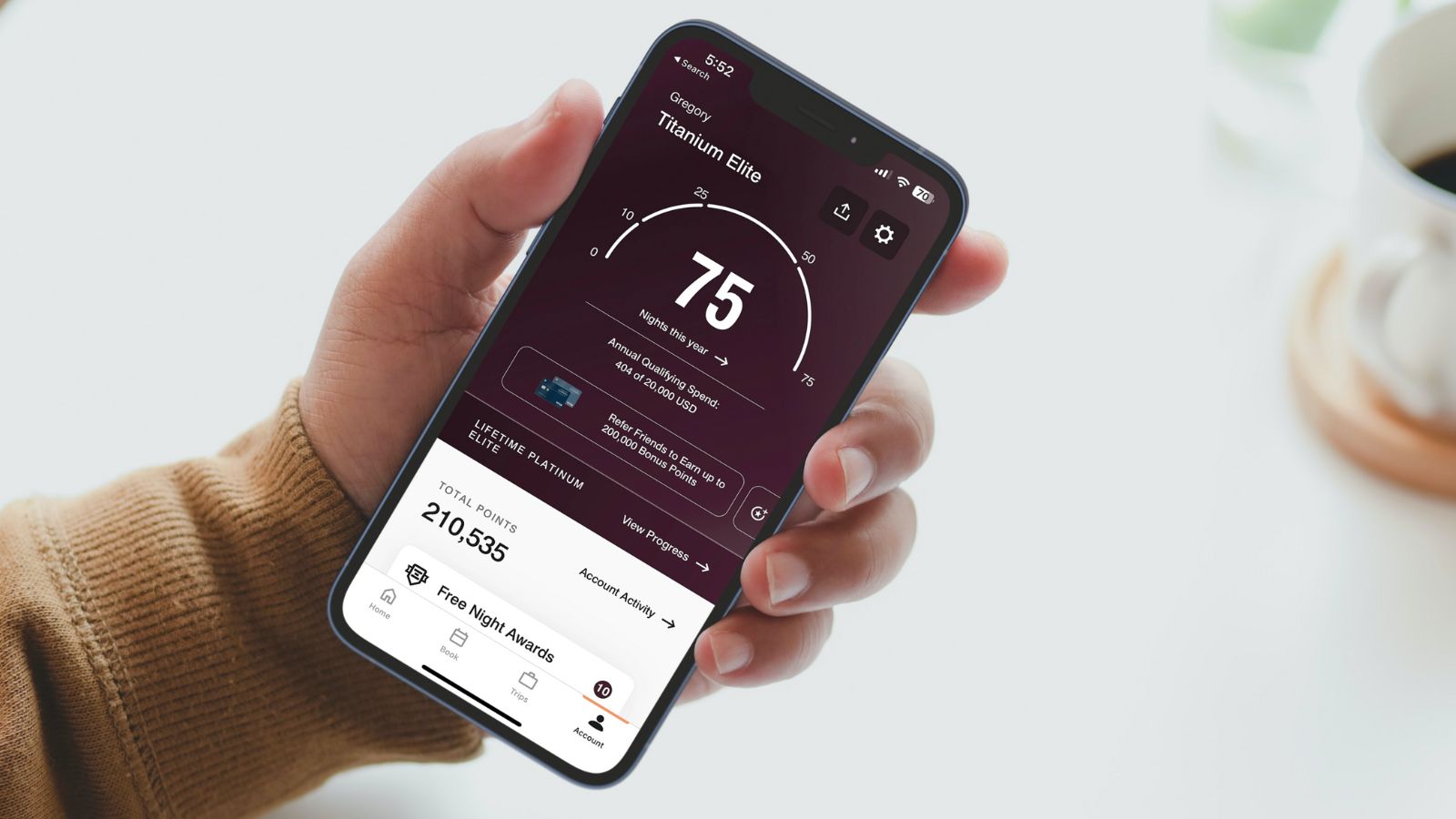

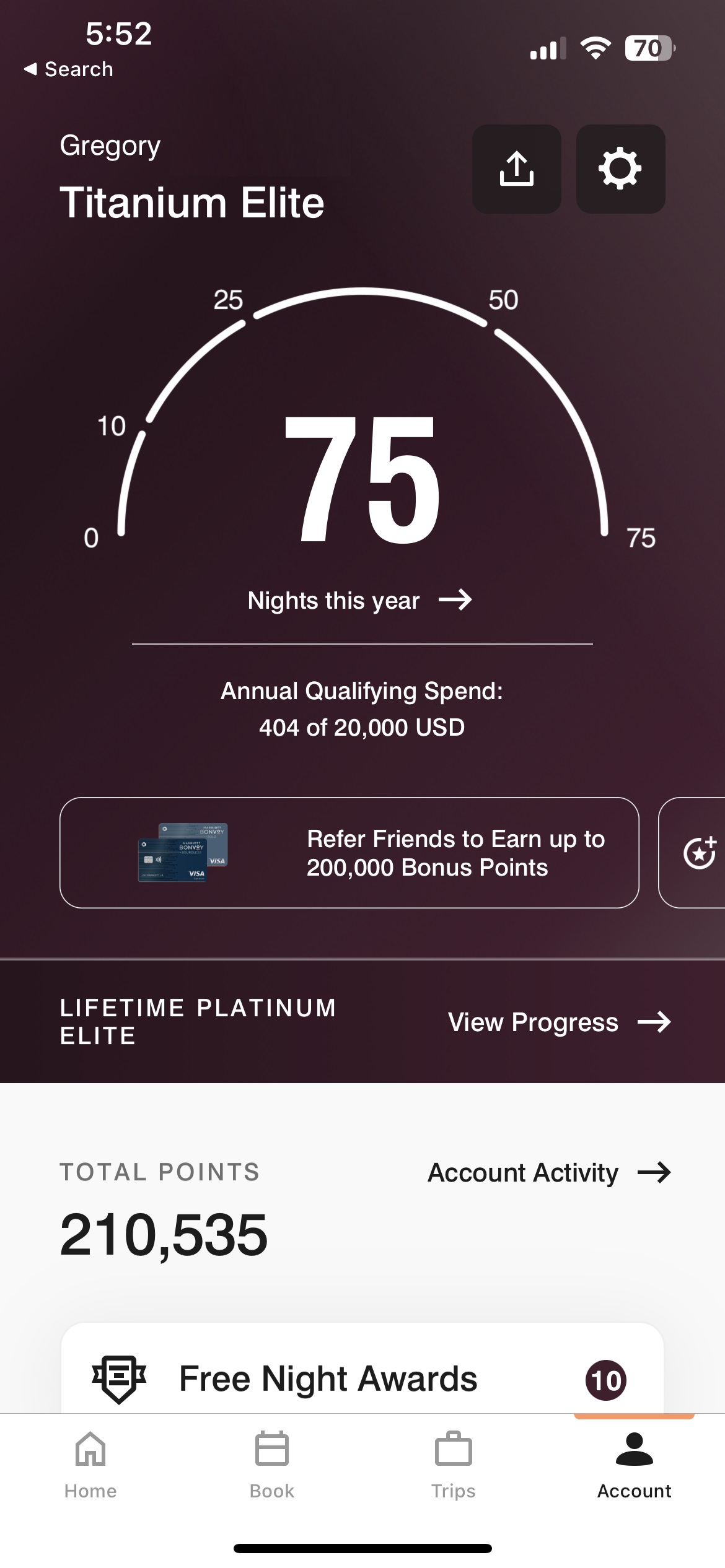

Shortly after picking 5 Elite Nights as my 50 Night Choice Benefit, my Marriott account showed that I had indeed achieved Titanium status once again:

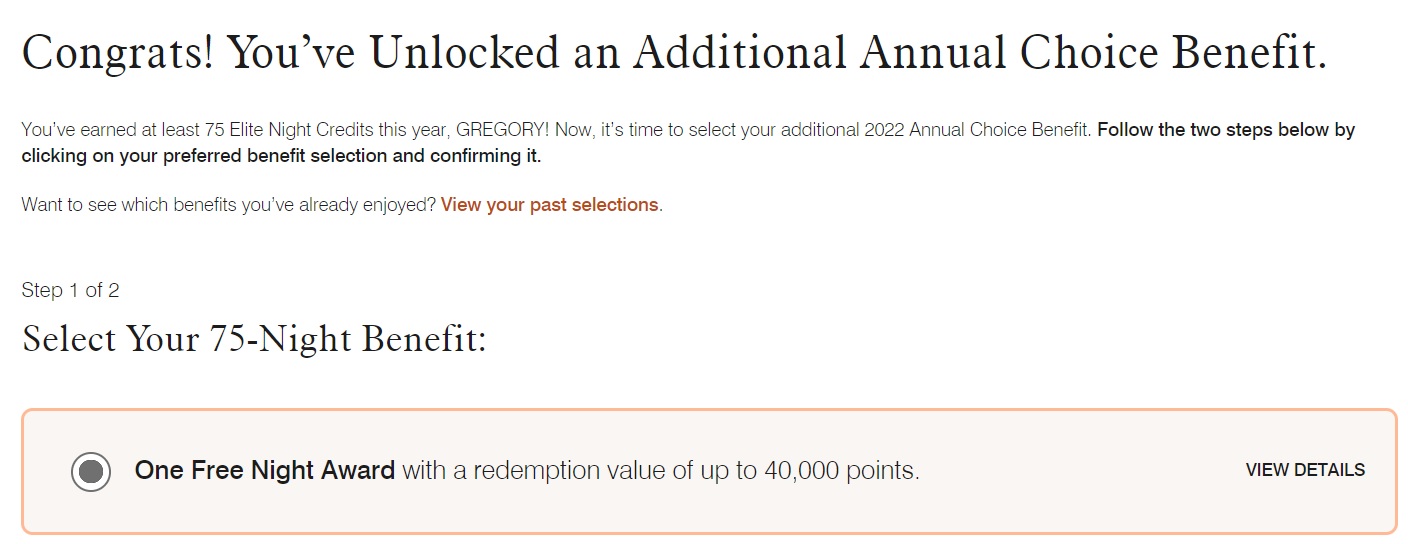

Then, a day or two later, I was able to pick my 75 Night Choice Benefit:

Conclusion

It doesn’t always make sense to spend money to earn elite status. In fact, I’d argue that it’s often a bad financial decision. In this case, though, I’m very happy with the choice, and I’m happy to have Titanium status and United Silver status for another year!

![Register to earn 10K bonus Marriott points after $7K spend [Targeted] a hotel entrance with a street and a building](https://frequentmiler.com/wp-content/uploads/2020/09/Marriott-Featured-Image-218x150.jpg)

I was 8 nights short, even with the +5 choice at 50 nights. I had considered the cc spend route, but 40k didn’t seem to make sense for me 🙂

I’m not sure I’d even want to burn 15k$ to get only 3 EQNs in return. Really not worth it.

I was missing 7 nights to get back to Platinum, so I burned 99k points over 2 mattress runs. Will get those points back really quickly anyway with 50% elite bonus and higher welcome gifts. Also racked up some restaurant bills during the mattress runs, so I’m going to have my account back to 600k points in a month time.

You convinced me to do this myself for 3 nights – until I learned that it’s too late to get 2022 elite nights if you already had a December statement close. 🙁

With Chase Hyatt, it works based on the SPEND DATE even if the statement date is in ’23. Are you sure this is how Marriott works (I’m unsure myself)?

I believe that Marriott titanium status also carries over into the following year. Does United Silver also carry over?

Status earned in 22 lasts until end of Feb ‘24. United is the same (I think — not sure if it goes to end of Jan or Feb)

So when you selected the 5 elite night credit in November that went into your account for 2022, giving you Titanium for 2023. We are at 73nights, so I’m guessing if I select that as my benefit I will be Titanium for 2023. Is that true

If you select in 2022, yes

They cannot be applied to the new year. Even in January, they’ll apply to the previous year.

I really don’t understand why one should give Marriott the extra nights of business to achieve Titanium. I have Plat, My SO has Titanium. The difference in benefits is negligible and not worth it IMO. I have been using the difference in nights to achieve Hyatt Globalist, which is a much a better program IMO.

In Greg’s case, he’s using award nights and not cash.

The one key benefit that opens up with Titanium is suite upgrades at Ritz Carlton.

Airline elite status can be worth something to certain people. United Silver can easily be converted (challenged) to other FF programs.

As for your math, your analysis is spot on.

As for your choice of Marriott . . . well . . .

Think of it as choosing United silver status then

Absolutely. I get it. Little effort. Smart move.

It’s just my dislike of Marriott talkin’.

Honestly, if I were ever going to stay at Marriott, I would play it exactly as you have. That is, on points. And, status (if it’s worth anything) comes from award stays and not cash stays.

All for nothing. I have 10 Suite night awards. They never clear. And you will get Bonvoyed at most properties.

I had been an Ambassador for multiple years. Given my destinations, I was never able to use SNAs. And, given my destinations, I concluded that I never would. Then, throw in property owners’ unwillingness to grant upgrades even when an upgrade is available for one’s entire stay. Then, throw in property owners playing games with award inventory. Etc., etc. Ultimately, reliable benefits came down to WiFi and late check-out. And, I realized that I was the problem. I was an idiot for going on as long as I did. Mea culpa.

That’s why I didn’t pick SNAs as my Choice Benefits.

What are you choosing for your titanium benefit?

40k night

Some people get lucky. I was able to use 5 SNA to compliment a 5 night award stay at Riviera Marriott Hotel La Porte de Monaco last month. It was my first ever attempt to use SNAs, so I am batting 1000. I won’t need the 5 elite night to get to Ti, so I plan on choosing them again this year.

I feel like having apparently unlimited capacity to spend at 2% makes your reasoning completely different from most people’s?

That’s true and unfortunately it’s something I can’t write about. However, anyone who can float the cash can make a loan to the IRS by overpaying taxes. You’ll pay just under 2% that way.

I’ve heard you talk/write about your ability to generate spend at ~2% before and totally respect your need to keep that close to the vest. But is it something specific to you or could it be replicable for others? I know it’s important to experiment and find your own MS honey hole but just curious with your situation.

As to your post, I think the choice to go for Titanium and United Silver through spend made good sense. Congrats and thanks for sharing your reasoning!

You should visit Flyer Talk and search for MS. Once there, look for the sticky article “Read This First.” That will give you a sense of things.

The specific technique Greg mentioned was prepaying income taxes to the IRS. There are services that charge a convenience fee as low as 1.85% or so. That’s not MS per se. It’s prepaying a bona fide expense. It is a technique any person can use to meet a sign-up bonus. The caveat is: only if you actually have taxes to pay and are not dependent on the timeliness of a refund should one be due back.

Hi Lee,

Thanks for pointing me in the right direction for getting started with MS. I’m pretty familiar with some of the more obivous avenues – VGC to MO, Amex BlueBird, etc. I actually do pay my quarterly taxes with with gift cards (to get a lower processing fee) and will “pre-pay” my annual taxes with CC if trying to meet high spend for a sign up bonus or something else.

My question for Greg was more so related to what he actually did to generate $15,000 in spend so quickly. I believe he wrote about pre-paying taxes as an example but he really used a different (unique) avenue instead. As the original commenter wrote, “having apparently unlimited capacity to spend at 2% makes your reasoning completely different”.

Anyways, I really do appreciate you trying to help as that’s what this whole community is all about! I was just hoping to get a little more info out of Greg without him totally giving away his secret.

Just be aware that some credit card issuers do not like MS and might ban a person from their platform. Also be aware that some MS techniques have been completely shut down. Other MS techniques are hit or miss depending on geographic location or specific store employed. Liquidity is your absolute number one priority. Be cognizant of fees. Start small.

I don’t engage in MS but have read much and tested much (just to know).

Because of the risk that a given MS technique will be shut down, I think you’ll find that those who have successful techniques are unwilling to share.

For example, using your best cash-back technique for Amazon purchases, what percent cash back would you expect? Now, let’s say a person has a way of obtaining (say) 14 or 15 percent cash back, wouldn’t you like to know? But, if the person shares, perhaps the technique is shut down and now no one benefits. That’s the situation. That’s why you might not find much assistance. But, good luck in developing your own methods.

We’re thankful to the FM team for what they do share.

What I love about this post is you show hitting this goal with a total annual Marriott spend of just $404. Bravo.

LOL, yeah I find it hilarious how far I am from Ambassador status

All on award stays. Brilliant.

I did very similar to you in very few real nights to titanium elite. I did have some real work nights, which helped. Made lifetime plat in December, which is >600 night. At least a third of that comes from this hobby.

Hey Greg, are you just charging on a POS you own and getting the money right back? Trying to make sense of this 15k spend.

If you are caught running charges through your own POS system, you would likely get a lifetime ban from your credit card issuer. Trust me on this one. And, it will likely recharacterize the charge as a cash advance.

No.

Tax wise this is completely dead end

Congrats, Greg! I finish my own last 2 nights post-Christmas.

I was also thinking how nice it would be also to have had one of those cards that offers incremental nights for spend, but your chart shows a problem getting the Boundless while also having RC, Brilliant, & Biz cards. I know you also have some/all of these cards as well, how were you able to recently qualify for the Boundless (I think you picked it up for your Challenge trip?). Thanks for everything this year & Merry Christmas!

Merry Christmas to you too!

My collection of Marriott cards predates the crazy rules. If I remember correctly, before the merger I had the Ritz, Premier Plus, and Business Marriott cards from Chase; and the SPG and SPG business cards from Amex. If trying now and already have Marriott cards, believe that you can still get the Boundless card, but likely won’t qualify for a welcome bonus.

I guess i need PhD in Marriott School of Management and since i am not clear and thus the ask – I have Amex bonoy personal and Business card that were converted from SPG after merger. Its way more then 24 months. I had never had any Chase Marriott card – so can i apply for Chase Boundless card and get bonus ? Idea is i want this card for 1 year and then PC to Ritz card. Is this possible ?

There’s no problem getting the Boundless while holding the cards you’ve mentioned. The only limitation that you’ll run into is if you’ve received a welcome bonus on any of the AmEx cards in the last 24 months. Even then, you’re only precluded from the Boundless’ welcome bonus, not from opening the card at all.

Thanks for the info!

Thanks for this. I would also suggest that the extra benefit for qualifying for Titanium (which I also just achieved) over Platinum (where I am lifetime) is that you get priority over Platinum for available suites and when you are at a large property, you definitely get the nicer/bigger suites.

In my race to Titanium this time, I took the 5 Elite night stays when I got to 50 nights (after receiving 30 nights from credit cards) and then the 40K certificate at 75 nights.

I’m not at all confident that you get priority for suite upgrades over Platinum elites. It just depends on how each property handles upgrades. Most seem not to differentiate in my experience (but it’s hard to know for sure). If you know of some nice places that are more likely to upgrade Titaniums to suites, I’d like to know about them!

Sure — For example: This place: Overview (marriott.com) and this place: 5 Star Hotel in Vienna | Hotel Imperial Vienna – 5 Star Superior Hotel In Vienna (marriott.com) and this place: Hotel Bristol, a Luxury Collection Hotel, Vienna (marriott.com)

I’m curious if your reasoning and decision changes if you didn’t have the MS avenue and either had to mattress run 3 nights or shift a stay to Marriott. Would you still go for it?

I’d probably still go for it, but the math doesn’t work out as nicely unless you can find a crazy cheap property

I usually find the couple days after CMas are a great time for cheap(er) stays. And a good possibility for suite upgrades since people have checked out of the larger rooms often used for family gatherings.

I use all my SNAs every year, but I also never try for 5 nights at a time. I’ll also always call the property a time or two before our day of arrival to politely request a suite, along with the SNA on file. I do think using them takes a little more effort, but the outcome for me is almost always worth it for a much better stay experience.

Pam, I think that’s a key point that seems to increase the odds of clearing an SNA dramatically.

Make sure the room you’re requesting is available and then ask for it via phone or property DM prior to arrival.

Thanks & Merry Christmas, Tim. I almost always squeeze even more value by following the SNA stay with a regular points night(s) and the hotel allowing us to stay in the suite without changing rooms.