A few years ago, American Airlines changed its elite year timing. Instead of counting activity from January to December, American Airlines AAdvantage now counts activity from March 1st to February 28th to measure elite status for the following year. That makes this month the last month to earn toward American Airlines elite status for the coming elite year.

Back in the day, the end of an elite year signaled that it was time for those on the cusp of an elite status threshold to consider a mileage run (taking an unnecessary trip in order to earn the remaining miles needed for elite status).

I find myself in that type of situation, stuck firmly between American Airlines Gold and American Airlines Platinum (oneworld Sapphire) status. Since I’m close enough, I’m going to “mileage run” the difference. However, I’m not getting on an airplane for my mileage running. American Airlines has made things simple by awarding 1 Loyalty Point per dollar spent on their credit cards or 1 Loyalty Point per mile earned through their shopping portal (and AA hotels, as well as through other partnerships). My 2026 mileage running looks like clicking through from AAdvantage shopping to place an order at Dell this week (to use credits from Business Platinum cards) and a tax payment I’ll make soon. I love the ability to mileage run from my couch.

I did briefly question whether I needed to complete spending on my card before my February statement cuts next week for it to count toward the current membership year. However, American Airlines sent a handy email to cardholders this week reminding us that transactions made through February 28th will count toward the current status year, even if your next statement cuts in March. Since I know that all of my February transactions will count toward this elite year, I’ll probably wait until after my February statement cuts to make that tax payment. That way, it will hit my March statement and be due in April, leaving plenty of time in between for me to file my taxes, and if I’m due a refund, I’ll more likely get it before that bill becomes due (and if not, I’ll obviously still be prepared to pay it off).

Waiting until after my February statement closes to spend toward status will likely mean some delay in my American Airlines status posting for the new membership year, but I’ll gladly take a little delay there in exchange for being able to mileage run in my pajamas.

This week on the Frequent Miler blog…

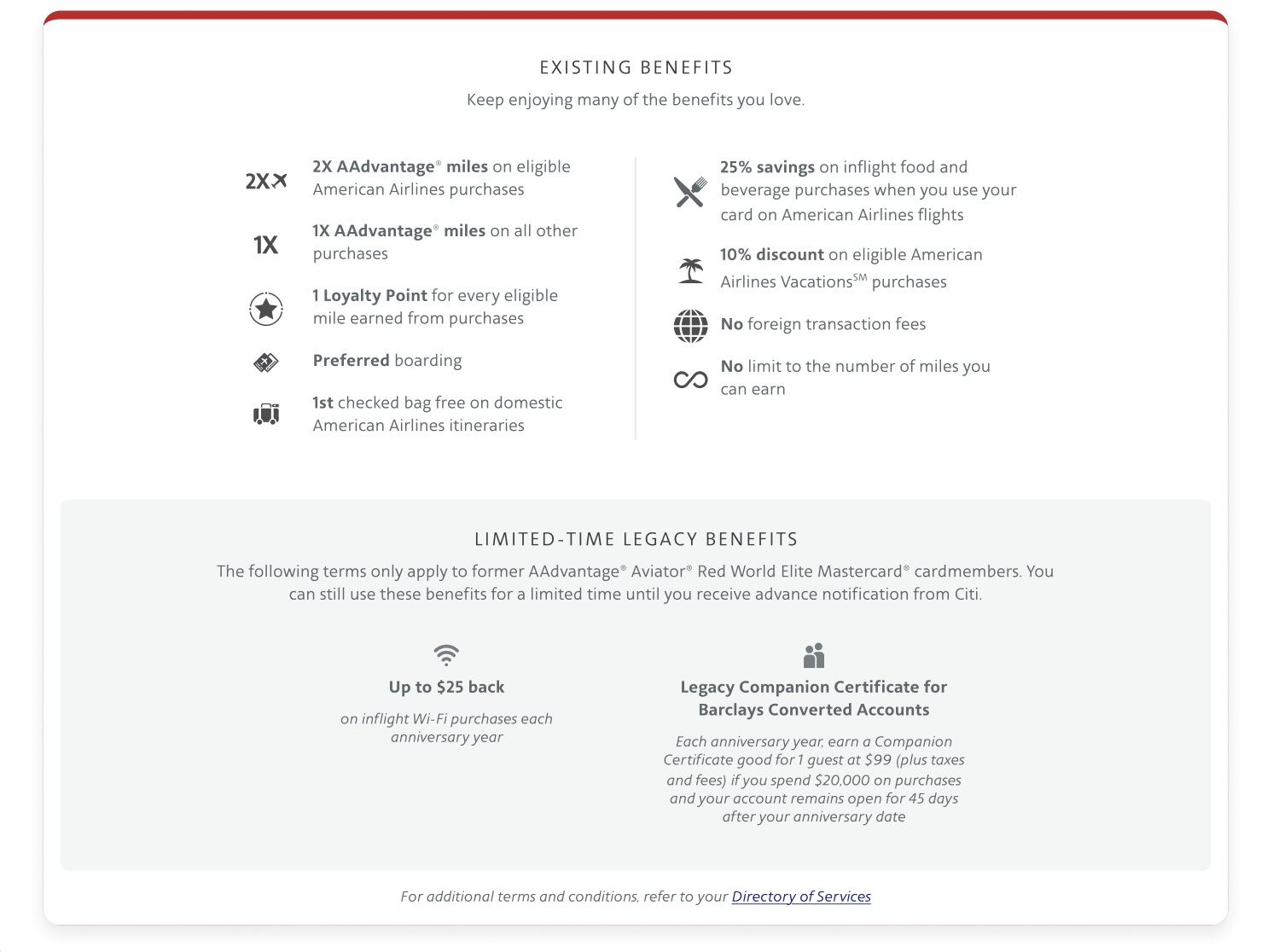

Barclays Aviator to Citi transition April 2026: What we know and what we don’t

Speaking of American Airlines credit card spending, the Barclays Aviator cards will become Citi American Airlines cards in April 2026 (for most cardholders, though not everyone). Interestingly, transitioning customers will both hang on to some legacy benefits while apparently also picking up new benefits. That creates a “best of both worlds” scenario where it sounds like there will be some double-dipping opportunities, particularly for Aviator Silver cardholders. I’m particularly curious to see if converted cardholders are grandfathered into the $199 annual fee for some amount of time. Given the conspicuous absence of annual fee information from the conversion documentation, I think it is likely that renewals will be at the old fee for at least a while.

Barclays AA cards: planning the transition to Citi | Coffee Break Ep91 | 2-3-26

With that clearer view as to the exact transition paths, Greg and I analyzed the key details on this week’s coffee break, including discussing the key advantages and disadvantages of closing your Barclays card before the transition. In short, we’re keeping our cards open, and we discuss why we think that’s the right move for most (though maybe not all) current cardholders.

Battle of the $350 airline cards: AA, Delta, United (and Alaska) | Frequent Miler on the Air Ep344 | 2-6-26

With the transition of Aviator Silver to Citi Advantage Globe, the mid-tier ~$350 airline credit cards have been top of mind as of late. On this week’s Frequent Miler on the Air, Greg and I discuss each of the major airline ~$350 credit cards to decide which is best for various purposes and customers. That said, I disagreed with the entire main event and proposed a different card altogether for those who really appreciate extra legroom seating. Watch or listen for more.

Can we trust Bilt with our points?

Bilt has had a messy few weeks, with what has felt like an underprepared roll-out of its new credit cards and string of over-promises and under-deliveries (my wife chose to transition to the Palladium card on January 26th, well ahead of the deadline for a “smooth transition”, and her card hasn’t even shipped yet. So much for a “seamless transition”). That has shaken faith in Bilt points for some. In this post, Greg shares why it hasn’t shaken his faith in the power of his Bilt points. I generally agree with him that Bilt seems to take particular pride in their points being deemed the most valuable, so I don’t see a devaluation of points on the horizon. I do expect that we will continue to see changes, and those willing to adapt and adjust will probably continue to find value in the ecosystem.

Best US credit cards for expats & international travelers

As anyone who has ever listened to an Ask Us Anything has probably noticed from his accent, Stephen is from the UK. Given that he’s based himself in the UK for a bit now, his credit card strategy has shifted a bit since the days of his 8-year 50-state road trip. That has given him unique insight into the best cards for expats and international travelers since he is now overseas. This post is a handy resource for anyone who spends a fair chunk of time abroad.

Using Buying Groups to Increase Credit Card Spend (2026)

If you want to supercharge your earnings, whether in terms of capacity to meet spend for new welcome offers or to meet the best big spend bonuses, you may need to find ways to increase your credit card spend. Buying groups present an opportunity to increase your spend without increasing your cost of living. This is a technique that isn’t a fit for everyone, as there are risks and complexities. In the 2026 update to this post, Tim adds some updated opportunities.

Frontier’s free miles made me look (and get the whole family involved)

Frontier got me to give them some attention with their new promo this week, awarding 5,000 free miles (all you have to do is show a screenshot proving that you have at least 5,000 miles in another program). I signed up my entire family and subsequently took a look at some sample routes to get an idea of award pricing. This promo is especially easy to pull off with a family/friends if you have Atmos points and a Hawaiian Airlines credit card, which allows you to transfer to others for free (to give them the 5,000 miles they need). There is a very real chance that these miles will expire a year from now unused, but, on the flip side, if I find a good use for them, all I would need to do is open the credit card to be able to pool the 30,000 free miles.

Capital One Venture Rewards Credit Card Review (2026)

The Capital One Venture Rewards card used to occupy a unique place in the credit card space. Ever since the launch of the Venture X card a few years ago, the Venture card has gotten less attention. But it’s still out there kicking, and if you’re really put off by the Venture X card’s annual fee and annual travel coupon, this can be a good one-card solution. I still think it’s worth at least considering the Venture X if you’ll spend at least $300 on travel over the course of the year, because it would be pretty easy to turn the Venture X into a better deal just with its travel credit and annual anniversary miles, to say nothing of its primary rental car coverage (the Venture card only offers secondary coverage), lounge access, and elite statuses. In short, I don’t really see the place for the Venture card anymore, but it’s worth being aware of this card and what it is and isn’t, so you can compare the two effectively.

Southwest Airlines Rapid Rewards Complete Guide

Southwest Airlines recently launched assigned seating and its new boarding process, so we’ve updated our complete guide to the program with everything you need to know about cardholder seating/boarding benefits, elite status changes, and more. We also added some information about flight credits and the best way to play them in order to avoid having your funds expire. Given that the companion pass with a single credit card offer came back this week via referrals, maximizing Rapid Rewards is likely top of mind for many.

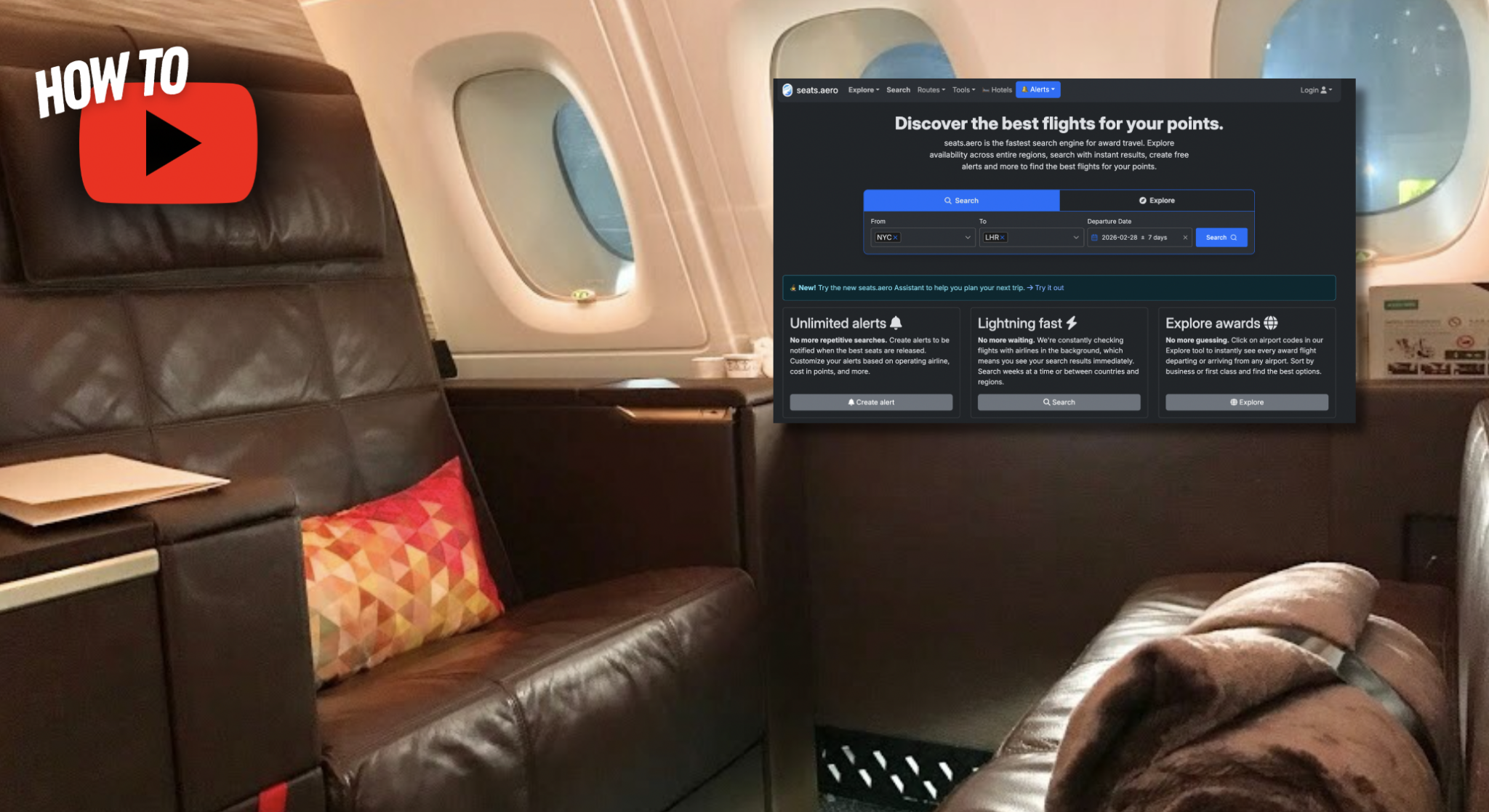

How to find amazing award flights with Seats.Aero (Video)

I’ve found Seats.aero increasingly useful in helping me explore for valuable award seats. In this “how to” video, we demonstrate how to use the tool to find a few sweet spot awards, and hopefully, these examples make it easier for you to use it to explore other programs for great awards, too. While I think that most beginners will find tools like Award Tool or Pointsyeah more intuitive to start, Seats.aero is an awesome tool for those with a lot of flexibility and who already have a decent handle on award booking.

Join Nick and Greg at Points Travel Festival Toronto, April 18, 2026

Greg and I will be heading (a little bit) north to speak at the Points Travel Festival Toronto on April 18, 2026. It looks like Greg and I will likely be on the program a couple of times on Saturday, and both of us are planning to attend the Friday night add-on event as well. While this conference will understandably include a fair amount of Canadian focus, Greg and I (and some of the other presenters) will be focusing on topics with broad appeal on both sides of the border. If you come out to this event, please say hello to us!

Rove “Built Better” promo: 7X on hotel stays, bonus earnings & free miles

I’m including this quick deal post about Rove’s latest promotion because it is only valid for a few days (starting today), and it offers the opportunity to stack earning redeemable miles through Rove with earning hotel points and elite credit. That can certainly make Rove worth considering for any upcoming bookings you’ll be making in the next few days.

Updated for February 2026

The following resources are constantly kept up to date, with the latest offer information changed as soon as we are aware. As a reminder, you can bookmark these and always find the latest offer information here.

- Best Credit Card Offers for February 2026

- Current Hotel Promotions for February 2026

- Current point transfer bonuses for February 2026

That’s it for this week at Frequent Miler. Keep an eye out for this week’s last chance deals and grab them before they’re gone.

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

![Re-Bilt already, Fixing Marriott, the best Hyatts for Free Night Certificates and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2026/01/wp-1768653765552601913603261308925-218x150.jpg)