NOTICE: This post references card features that have changed, expired, or are not currently available

Background: Million Mile Madness was the mad quest to earn a million points in one month. Throughout March, I did everything I could to earn as many points as possible while keeping within my ethical boundaries. I didn’t expect to have a million points credited to my account by March 31st: points often take quite a while to get credited. Instead, I tracked all of the points that I expected, and I declared victory when the expected total topped one million.

This week I’m on vacation so I’ll milk the Million Mile Madness theme a bit with several simple retrospectives. Please forgive me in advance for not answering comments.

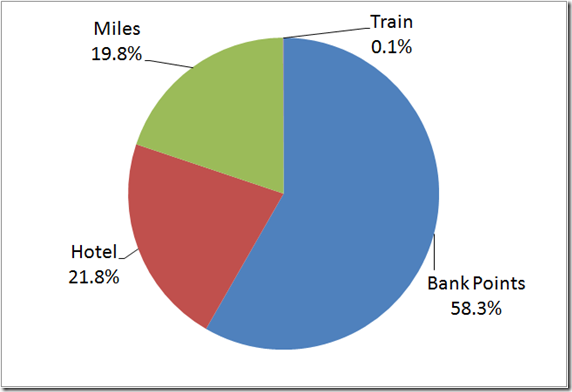

I stuffed the Million Mile Madness data into Excel and created a pivot table which let me easily slice and dice the data. Today, I’ll show you the types of points I earned last month:

Out of all 1 Million points, you can see below that the vast majority were “bank points” (Chase Ultimate Rewards, Amex Membership Rewards, and Citi ThankYou). Airline miles and hotels each weighed in at around 20%. I collected a few Amtrak points as well…

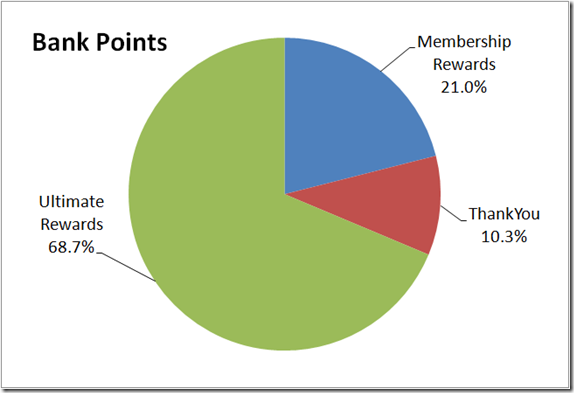

Bank Points

Looking just at the bank points earned, you can see below that the majority were Ultimate Rewards points (almost 70%!). Membership Rewards were next at 21%. ThankYou points trailed the pack with around 10%. I love these ratios because they are in order of how much I value each type of point. I love Ultimate Rewards points for the ability to transfer to United, BA, Southwest, Hyatt, etc. I’m almost as fond of Membership Rewards points because of how easy it is to transfer points to Singapore Airlines (can’t wait to fly Suites class again!). Finally, I really like ThankYou points, primarily for domestic travel, because of the ability to buy airfare at 1.33 cents per point (see “ThankYou!“).

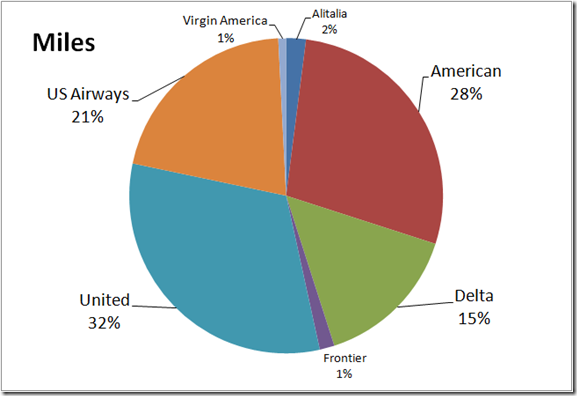

Airline Miles

United Airlines led the pack in this category with 32%. However, with the upcoming merger between American Airlines and US Airways (which came in at 28% and 21%, respectively), you could consider American Airlines to lead the pack with a combined total of 49%. Last up (of the major players) was Delta with 15%. All of these percentages work well for me. I’ve been slow to amass American Airlines miles, so I’m psyched to have such a big leg up here. Specifically, I’m looking forward to booking a family trip on Cathay Pacific in first class sometime in the next year or two. United miles are always great thanks to being part of the Star Alliance, and their flexible international (and Hawaii) routing rules are awesome. Delta miles are less valuable, but as a Platinum Elite with Delta I can book awards prospectively and cancel them or change them for free (up to 72 hours in advance), so I’ve been able to get great value from Delta in the past. Plus, Delta has the most flexible domestic award routing rules of the big airlines, and I’ve been able to really stretch the value of my points by taking full advantage (see, for example, “Delta SkyMiles: Value from domestic flights“).

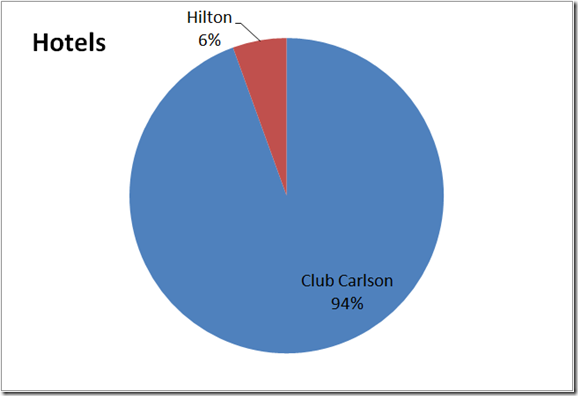

Hotels

The vast majority of earned hotel points came from Club Carlson at 94%. Hilton rounded out the category with 6%. Despite the recent Hilton devaluation, I believe that there will still be value to be had so I’m not ready to throw away those points, but I am glad to earn more Club Carlson points. With my new Club Carlson credit card, their points became much more valuable thanks to their Bonus Award Nights feature. (Note: The Bonus Award Night feature was discontinued as of 6/1/2015.) Sure I would have much preferred to earn SPG or Hyatt points, but I’m still happy with what I got.

Data

For those who prefer looking at numbers instead of charts, here is the data from Excel:

[…] You can find a full breakdown of the types of points earned in the post “Million Mile Madness: Which points?“ […]

Marie: Membership Rewards are points from American Express that are somewhat similar to Ultimate Rewards. Like Ultimate Rewards, the points can be transferred to various airline programs. ThankYou points are from CitiBank. Thankyou points can’t be transferred to airline programs (but can be transferred to Hilton), but can be used to buy things including travel

I am somewhat new to this. I know what Ultimate Rewards points are but I do not know what Membership Rewards points and ThankYou points are. Can someone explain?

Thank you for helping

FlisALot: I want to succeed at thisnchallenge without leveraging my blogger status to do so

I’m not seeing how advertising here would be unfair? Isn’t that the point of websites? Draw in hits with wanted /needed content, then advertise to profit?

Personally I find that more above board then lying to Lowe’s about moving. But as you said previously we all draw the line in different places.

Enjoy the vacation!

I’m trying to avoid getting sales unfairly by advertising through the blog. Fortunately, everything is selling quickly.

Do you have an Amazon store front you could publish?

drooling over those UR points…..

It’s too soon to know how much I spent. It looks like I actually earned money in addition to the points earned, but I need to wait until everything that I bought for resale has sold to do final calculations.

+1 Emily

I’m also curious how much you spent.

May Madness…2 million miles/points! 🙂

Great work, FMer! I knew that you could complete that challenge if anyone could. Next time try for 2 million.

Pretty impressive haul of UR points! I know you didn’t count the Kohl’s “bonus bucks” (or whatever they are) in your total, but how much Kohl’s money did you end up with? That could be quite an award in itself: “Here honey…I won a shopping spree!”

Incredible!! Congrats. This is my first month of “churning” and I have started with your Kohl’s article. Very helpful. I am just waiting for my Chase statement to see if it worked. Thank you again for sharing your wisdom and experience.