Update 10/30/22: Today, Doctor of Credit reported that that there is another fresh round of no-lifetime-language offers out for the Amex Business Platinum and Amex Business Golds. I checked my account and P2’s and, sure enough, we both had offers for the Business Platinum and were targeted for the Business Gold as well. I applied and was approved for both of us. It’s worth checking your accounts under “featured offers” and/or trying the links below. For both of us, our targeted cards were already-existing Business Platinums.

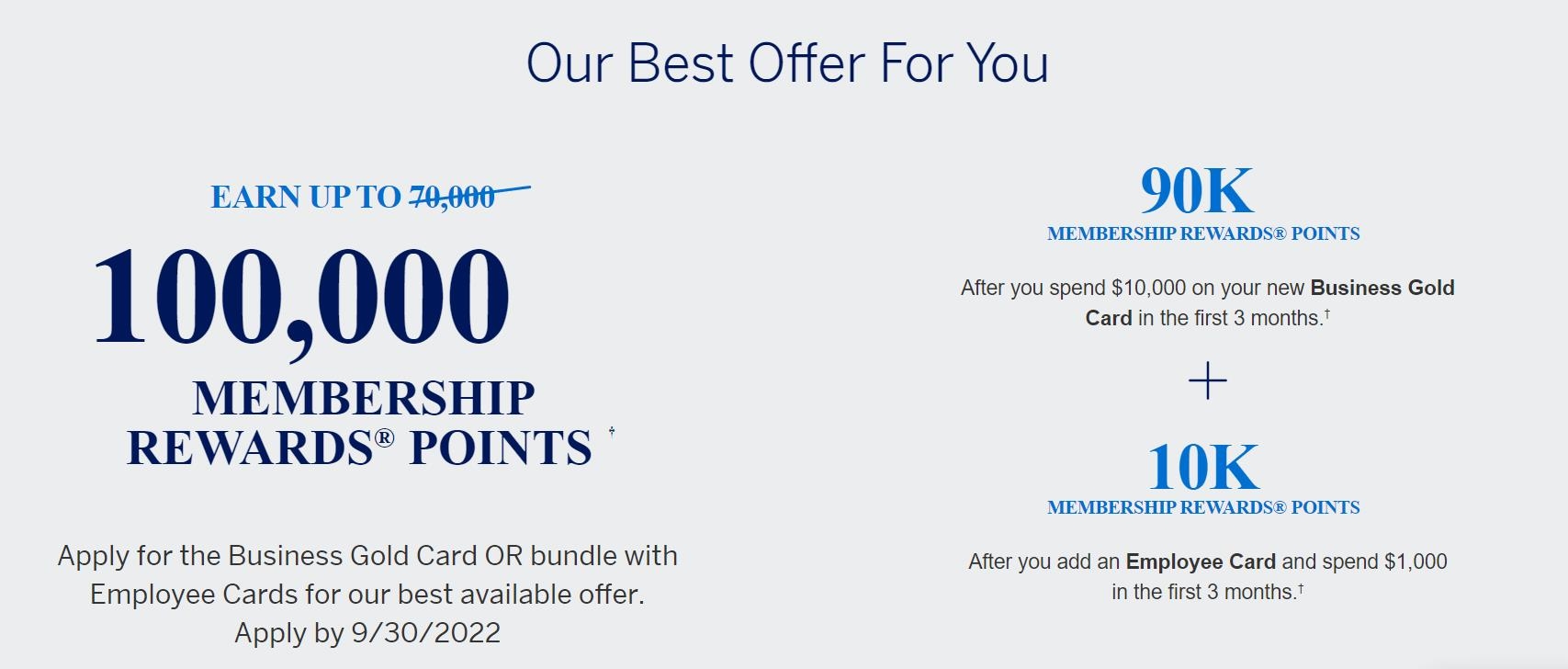

American Express has yet another round of massive targeted offers for the Business Gold and Business Platinum cards that are both No Lifetime Language offers (NLL). This means that even cardholders who have already had (or currently have) the cards are eligible for the welcome offer. These new links appear to be widely targeted.

The Business Platinum is the best points per dollar of spend offer that we’ve seen thus far at 150,000 Membership Rewards points for $15,000 spend with an additional 10,000 points for spending $1,000 on an employee card needed.

The Business Gold offer has an expiration date of 5/31/23, while the Business Platinum doesn’t have an expiration listed.

The both linkscame from a targeted pop-up that appeared on my wife’s account over the weekend (she was just approved for a second Business Platinum within the last month). It requires you to log-in first and then click the link to find out if you’re targeted.

The Offer

You must log into your account first, then click the link.

If you see the message below or see a screen with no offer listed, it means you’re not targeted. If you get a pop-up telling you that you are not eligible for the welcome offer, you aren’t.

Quick Thoughts and Key Card Details

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This card is absolutely loaded with high end perks. Depending upon your situation, those perks may be worth the annual fee or much more. Click here for our complete card review $695 Annual Fee Earning rate: Earn 5X flights, prepaid hotels, and short-term rentals and prepaid flight + hotel packages booked at AmexTravel.com. ✦ 1.5X points per dollar on eligible purchases of $5000 or more (on up to $2 million of those purchases per year) ✦ 1.5x on US construction/hardware stores, US electronic goods, and US shipping ✦ 1X elsewhere ✦ Terms apply. Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Select one qualifying airline and receive up to $200 in statement credits per calendar year for qualifying charges ✦ Up to $400 a year in statement credits for Dell purchases ($200, twice-yearly) ✦ Up to $200 in Hilton credits ($50 per quarter) ✦ Up to $120 in wireless services credits per year ($10 per month) ✦ Global Entry statement credit every 4 years ($120) or TSA PreCheck statement credit every 4.5 years ✦ Global Lounge Access benefits: Priority Pass membership (Lounges only) with 2 guests, Centurion Lounge access. Also, Delta Sky Club® access (when flying an eligible Delta flight): 10 visits per year February 1 until January 31 of the next calendar year (after 10 visits have been used, additional visits can be purchased for $50 each or earn unlimited visits after spending $75K/calendar year on the card). Access limited to eligible card members ✦ Rental car elite status ✦ Marriott Gold status ✦ Hilton Gold status. ✦ $199 CLEAR® fee reimbursement annually ✦ 35% Airline Bonus: Get 35% points back after you Pay With Points for flights with your selected airline (or premium cabin with any airline). Enrollment required for select benefits See also: Amex Platinum Guide |

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This card may be a keeper for those who use the monthly credits, but keep only if you also make good use of one or two 4X categories. Click here for our complete card review $375 Annual Fee Earning rate: Earn 4X in combined purchases in the two eligible categories where your business spends the most each month (capped at $150K spend per calendar year, then 1x): Electronic goods retailers or software and cloud system providers in the U.S. ✦U.S. purchases at restaurants ✦Monthly wireless telephone service charges made directly from a wireless telephone service provider in the U.S. ✦ U.S. purchases for advertising in select media ✦ U.S. purchases at gas stations ✦ Transit purchases including trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways. ✦ 3x on eligible purchases through AmexTravel.com ✦ 1x on all other purchases. Terms apply. Base: 1X (1.55%) Travel: 3X (4.65%) Dine: 4X (6.2%) Gas: 4X (6.2%) Shop: 4X (6.2%) Phone: 4X (6.2%) Biz: 4X (6.2%) Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Earn up to $20 in statement credits each month for eligible purchases at FedEx, Grubhub, and office supply stores. Enrollment required. ✦ Monthly Walmart+ Membership credit after you use the card to pay for one monthly Walmart+ membership ✦ Terms Apply. (Rates & Fees) |

Keep in mind that both the Business Platinum Dell and airline credits reset on the calendar year. This means that in the first year of card membership, you can get 3x Dell credits and 2x airline incidentals, adding an additional ~$400 in first year value if you only pay the annual fee once. While the various perks and credits on Amex cards can feel a little “coupon booky,” I find it pretty easy to get full advantage of these two and the wireless service credit as well.

These are obviously a terrific welcome offers if you can use the card and make the spend. Without even considering the additional perks and credits, the Business Platinum offer will end up being around ~$2400 based on our RRV, whereas the Business Gold would be around $1500.

![Amazon: Save up to 40% when redeeming at least 1 Membership Rewards point [Targeted] a laptop on a table](https://frequentmiler.com/wp-content/uploads/2022/07/Amazon-Laptop-Featured-Image-218x150.png)

Is the Business or Personal Platinum card sign up bonus only once for life time? Like the Gold and other AMEX card? But i see comments here about getting 3rd or 4th? The reason i am trying to apply Platinum card was i already earn Gold business and personal card bonus one each and try to apply Platinum to earn the bonus as i never had Platinum before…. Thanks.

Is everyone keeping at least 2 to 3 cards open, including the personal, and paying the fee for at least a year, based on the targeted offers after opening one of these business cards?

I normally take a retention offer after the first year and then cancel after the second (when there’s not a retention offer). That said, plenty of folks are keeping it for a year and then dumping. Just make sure you let the fee post and then cancel afterwards…

A couple of weeks ago, I was targeted every time I logged in with this 160K offer. Now when I actually need it, nothing. Tried multiple browsers spread out over the past week, and still nothing. Any ideas on how to get this offer?

Same thing happened to me, even though the offer was “good” until the end of the year.

I got a mailer for a 90k biz gold good thru 12/31 even though I cancelled my last biz gold in may 22. Went at the end of december to apply and said “not available anymore”. 🙁

I am not targeted in my account offers, though the 160k NLL link works for me.

Have not yet signed up, I am a bit worried about RAT team.

Got it. Third B’ness Platinum card. This is absurd.

Tim, do I still need to wait the 91 days from the last one?

Yes, so far I haven’t seen/heard of any way around that one. I’ve been alternating Gold/Plat signups and tried to push it by a couple of days on each one, but it went pending (and I was able to get it approved at 91

Under the “Terms and Conditions” tab at the bottom of the Amex 160k offer page that you link to it gives an expiration date of 8/1/2023 for the offer, stating “If your application is not received by 8/1/2023, we will not process your application even if we later receive your application. American Express reserves the right to modify or revoke offer at any time.”

Wow – just got my 4th Amex Biz Platinum – crazy

I have applied my 3rd NLL Amex platinum business card in May. Met the $15,000 spend immediately with the purchase of 3 CX business class air tickets. I have not got the SUB till now. I contacted online CS more than 5-6 times back and forth. They opened a case and investigated. Today they closed my case and told me I abused and would not have got the 150k MR points . What should I do? I have all screenshots confirming I’m eligible.

Hi @Tim – if I were to buy gift cards for airline (southwest) or dell, would they qualify for the credits?

Hmm, I’ve tred clicking on “Already a card member” on 3 different accounts and i don’t get any message saying “ineligible”.

I’m salivating over the 170k offer but I just can’t do another $15k spend right now. Even though I was targeted based on my existing Plat BIZ!

Just got the NLL platinum business and it comes with 0% APR for 12 months it seems.

I saw a pop-up offer for 150k on platinum and then 100k on gold, but did not apply immediately. Now when I log back in, I do not see a pop-up offer anymore. Thoughts on that?

Edit: This is for my business account, TIA!

In my experience, I have seen the pop up offers come and go when logging in to my account. Some days I would see them and other days not.

You may want to try logging in again and if not, try tomorrow and or the next day.

Good luck!

Just picked up the 170 Biz Plat right now, my second this year. I opted for it over the Biz Gold which i also have bc the Biz Plat came with 0% intro apr which is a nice bonus.