The American Express Business Platinum card is loaded with high end perks: hundreds of dollars per year in various credit reimbursements, access to multiple types of airport lounges, hotel and car elite statuses and more. But, all of this goodness comes at a steep price, as it has an annual fee of $695. Is it worth it?

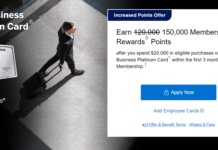

Amex Business Platinum Current Welcome Offer

| Card Offer |

|---|

150K points ⓘ Affiliate 150K points after $20K spend in the first 3 months. Terms apply. (Rates & Fees)$695 Annual Fee Alternate Offer: Targeted online offer of 170K points after $15K spend in the first 3 months See this post for details. |

Amex Business Platinum Review

At some point, many people that are into points and miles will have an American Express Business Platinum…and for good reason. The welcome offers are stratospheric, usually the highest amount of raw points within the Membership Rewards universe. When we rank cards in terms of first year value, the Business Platinum is almost always near the top, due not only to the gaudy welcome offers, but also to the plethora of credits, benefits and rebates that come with it. In addition, in past years, there have been copious “no lifetime language” offers, meaning folks could get several welcome bonuses, oftentimes within a year or two. To top if off, those that find themselves in “pop-up” prison with Amex consumer cards often find clear sailing on the business side, specifically with the Business Platinum and Business Gold cards. Sure the coupon book of credits can be irritating, Delta lounge benefits are worsening and some of the benefits overlap with other super-premium cards. But it’s still a very rewarding card with a ton to offer…for the first year.

- Annual Fee: $695

- Authorized User Annual Fee (Platinum, w/perks): $350

- Authorized User Annual Fee (Green, no perks): $0

- Foreign Transaction Fee: None

- What points are worth: The Amex Business Platinum earns Membership Rewards points. Our current Reasonable Redemption Values pegs them at 1.55 cents each.

- Best Use for Points: Membership Rewards can be transferred to travel partners at a 1:1 ratio and this will almost always yield the most value. There’s three hotel partners (Choice, Hilton, Marriott), but the transfer ratios make them unappealing most of the time. On the other hand, airline partners are excellent, and include Air Canada Aeroplan, Air France/KLM Flying Blue, ANA Mileage Club and Avianca LifeMiles. Business Platinum cardholders can also redeem points through Amex Travel for their selected airline, or towards business and first class flights on any airline, at a rate of 1.54 cents each. These redemptions can often represent excellent value, since they book as cash fares and earn elite-qualifying and redeemable miles. You can cash out the points that you earn with the Business Platinum card at 1 cent each, but you need an Amex Business Checking account to do it.

- Earning Categories:

- 5X – Flights and prepaid hotels at AmexTravel.com

- 1.5X – Purchases of $5000 or more (on up to $2 million of those purchases per year)

- 1.5x – US construction/hardware stores, US electronic goods, and US shipping

- 1x – everywhere else

- Credits:

- $200 airline incidentals (calendar year)

- $400 Dell ($200 from January through June; $200 July through December.)

- $120 Wireless ($10/month)

- $360 Indeed ($90 per quarter)

- $150 Adobe

- $100 Global Entry/TSA PreCheck (once every 5 years)

- $189 CLEAR fee reimbursement

- Additional Perks (apply to Platinum authorized users):

- Centurion Lounges, Airspace Lounges, Escape Lounges Access: Cardholder is allowed free into Centurion Lounges. Additional guests are $50/each, unless you reach $75k of annual spend.

- Delta SkyClub Access: Cardholder is allowed free when flying Delta same day.

- Priority Pass Lounge Membership: Cardholder and 2 guests. Like many other card-linked Priority Pass memberships, this one does not include access to restaurants within the Priority Pass network.

- Plaza Premium Lounge Access: Cardholders and one guest get complimentary access to Plaza Premium Lounges.

- Select Lufthansa Lounges Access: Valid only when flying Lufthansa, SWISS or Austrian Airlines.

- 35% points rebate on airfare: Pay with points for airfare on your selected airline or for business or first class with any airline and get 35% of your points back.

- Hilton HHonors Gold Status.

- Marriott Gold Status.

- National Car Rental Executive status.

- Complimentary Hertz President’s Circle Status plus four hour grace period for rental car returns.

- Fine Hotels & Resorts: Book high-end hotels through Amex Fine Hotels & Resorts and get a room upgrade, daily breakfast for 2, 4pm late checkout, noon check-in, free wifi, and unique property amenity.

- Travel Protections (apply to Platinum authorized users):

- Auto Rental Coverage: Secondary auto rental CDW (collision damage waiver). Provides reimbursement for theft and collision damage for rental cars in the U.S. and abroad.

- Trip Delay Reimbursement: Covers delays of more than 6 hours or that require an overnight stay. Up to $500 per trip.

- Trip Cancellation / Interruption Insurance: Up to $10,000/trip, $20,000/card per 12 months.

- Lost Luggage Reimbursement: Up to $3,000 per passenger.

- Emergency Medical Transportation Assistance: Complimentary emergency medical transportation or evacuation.

- Purchase Protections (apply to Platinum authorized users):

- Cell Phone Insurance: $800/claim and a $50 deductible/claim.

- Extended Warranty: One additional year, on eligible warranties of five years or less (US warranties only, max $10,000/claim, $50,000/account/year).

- Damage and Theft Protection: 90 days against damage or theft (up to $10,000 per claim and $50,000 per year).

- Return Protection: Within 90 days of purchase (US purchases only, max $10,000/claim, $50,000/account/year).

- Who’s this card for? Anyone that’s looking for a heathy stash of Membership Rewards as a welcome offer and/or who can maximize the plethora of credits and benefits that the card provides.

- Is the Amex Business Platinum a keeper? This is a tough one. The Business Platinum could easily pay for itself if you’re able to maximize its laundry list of credits and take advantage of the travel perks and 35% flight rebate. That said, it’s also among the easier cards within the Membership Rewards portfolio to get repeatedly. If you’re not into churning cards and can take advantage of enough of the benefits, I could see this being a keeper.

Amex Business Platinum Pros and Cons

Pros

- ~$1700 in possible annual credits

- Overall, excellent lounge excess

- 35% rebate on flights can be very valuable

- Often has the best welcome offer in the Membership Rewards ecosphere

- One of the easier Amex cards to get repeatedly

- Excellent travel and purchase protections

- Terrific airline partners

- Gives Gold status for both Hilton and Marriott

Cons

- High annual fee ($695)

- High authorized user fee ($350)

- Credits can be difficult to use and most are split up throughout the year (#couponbook)

- Airline credits are much less straightforward than many other premium cards

- Poor bonused spending categories

American Express Transfer Partners

| Rewards Program | Amex Transfer Ratio | Best Uses |

|---|---|---|

| Aer Lingus Avios | 1 to 1 | Fuel surcharges are sometimes lower when booking with Aer Lingus (Avios.com) rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| AeroMexico ClubPremier | 1 to 1.6 | AeroMexico is a SkyTeam partner. Club Premier points can be used to book flights on AeroMexico, SkyTeam alliance members (such as Delta or Korean Air), or on select partner airlines. Unfortunately many have reported that awards are extremely difficult to book through AeroMexico so we do not recommend transferring points to this program. If you want to fly AeroMexico, look to transfer points to another SkyTeam partner (such as Air France) and then book AeroMexico with that program. |

| Air Canada Aeroplan | 1 to 1 | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. |

| Air France KLM Flying Blue | 1 to 1 | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. |

| ANA Mileage Club | 1 to 1 | Redeem for Star Alliance flights. Multiple stopovers allowed. ANA offers many great sweet-spot awards, including flying around the world in business class for as few as 115K miles! See also: ANA - a terrific Membership Rewards gem. |

| Avianca LifeMiles | 1 to 1 | Avianca LifeMiles can be great for Star Alliance awards. They offer reasonable award prices and no fuel surcharges on awards. They also offer shorthaul awards within the US (for flying United, for example) for as few as 7,500 miles one-way. Best of all, their mixed-cabin pricing can lead to fantastic first-class award prices. See this post for details. |

| British Airways Avios | 1 to 1 | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can be had in redeeming BA points for short distance flights. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Cathay Pacific Asia Miles | 1 to 1 | Cathay Pacific has a decent distance based award chart, but they no longer allow stopovers longer than 24 hours. Cathay Pacific Asia Miles can be a good option for booking American Airlines flights with a distance based award chart, especially if other OneWorld Alliance miles aren't available. For long distance flights, it is possible to reduce the cost of a premium cabin award by adding on a lower cabin segment. See this post for details. |

| Choice | 1 to 1 | Choice Privileges points seem to be randomly valuable within the US, but dependably valuable internationally in expensive locations such as Scandinavia and Japan. Points can sometimes offer great value when used towards participating Preferred Hotels of the World. |

| Delta SkyMiles | 1 to 1 plus excise tax | Delta no longer charges change or cancellation fees on awards originating in North America. Flash award sales and flights to/from locations other than the U.S. or Canada can offer great value. See: Best uses for Delta miles. |

| Emirates Skywards | 1 to 1 | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be steep. See: Emirates Sweet Spot Awards - First class from 30K miles round trip. |

| Etihad Guest | 1 to 1 | Etihad offers a distance based award chart for flying Etihad and another for its partners. Points may offer good value for expensive but short-distance flights. |

| Hawaiian Miles | 1 to 1 plus excise tax | Hawaiian Airlines’ award prices tend to be quite high, but there are some not-terrible uses: fly to neighboring islands for 7.5K miles, fly first class round-trip from Hawaii to South Pacific islands for as few as 95K miles, fly first class round-trip from Hawaii to Australia for as few as 130K miles, or use miles to upgrade paid flights. |

| Hilton | 1 to 2 | 5th Night Free awards. Best value is usually found with very low end or very high end Hilton hotels. Bonus: award nights are not subject to resort fees. |

| Iberia Avios | 1 to 1 | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| JetBlue | 250 to 200 plus excise tax | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. |

| Marriott Bonvoy | 1 to 1 | 5th Night Free awards. Opportunities to get outsized value exist but can be hard to find. |

| Qantas Frequent Flyer | 1 to 1 | Best use is probably for flights on El Al with no fuel surcharges. Also useful for short AA flights. Qantas offers distance based award charts similar to Cathay Pacific. Both are OneWorld Alliance members. I recommend comparing award prices across both programs before transferring to either. Qantas offers round the world business class awards for only 280,000 points (but with many restrictions) |

| Qatar Privilege Club Avios | 1 to 1 | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. |

| Singapore Airlines KrisFlyer | 1 to 1 | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). |

| Virgin Atlantic Flying Club | 1 to 1 | Virgin Atlantic offers a few great sweet spot awards including US to Europe on Delta One business class for 50K points one-way. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). |

Other Amex Platinum Cards

| Card Offer and Details |

|---|

150K points ⓘ Affiliate 150K points after $20K spend in the first 3 months. Terms apply. (Rates & Fees)$695 Annual Fee Alternate Offer: Targeted online offer of 170K points after $15K spend in the first 3 months See this post for details. FM Mini Review: This card is absolutely loaded with high end perks. Depending upon your situation, those perks may be worth the annual fee or much more. Click here for our complete card review Earning rate: 5X flights and prepaid hotels at AmexTravel.com ✦ 1.5X points per dollar on eligible purchases of $5000 or more (on up to $2 million of those purchases per year) ✦ 1.5x on US construction/hardware stores, US electronic goods, and US shipping ✦ 1X elsewhere ✦ Terms apply. Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Select one qualifying airline and receive up to $200 in statement credits per calendar year for qualifying charges ✦ Up to $400 a year in statement credits for Dell purchases ($200, twice-yearly) ✦ Up to $120 in wireless services credits per year ($10 per month) ✦ $100 Global Entry fee reimbursement.✦ Priority Pass membership (Lounges only) with 2 guests and other airport lounge benefits (Centurion and Delta) ✦ Rental car elite status ✦ Marriott Gold status ✦ Hilton Gold status. ✦ $189 CLEAR fee reimbursement annually ✦ 35% Airline Bonus: Get 35% points back after you Pay With Points for flights with your selected airline (or premium cabin with any airline). Enrollment required for select benefits See also: Amex Platinum Guide |

100K Points ⓘ Non-Affiliate 100K points after $8K spend in 6 months + 10x on dining for 6 months (on up to $25K in purchases). Terms apply.$695 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 175K after $8k spend (referral only, expired 4/8/24) FM Mini Review: This card is absolutely loaded with high end perks. Depending upon your situation, those perks may be worth the annual fee or much more. Earning rate: 5X points for flights booked directly with airlines or with American Express Travel ✦ 5X points for prepaid hotels booked through American Express Travel Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Up to $200 a year in statement credits for incidental fees at one qualifying airline per calendar year ✦ $200 prepaid hotel credit per calendar year valid on Fine Hotels & Resorts and The Hotel Collection bookings ✦ Up to $20 per month rebate for Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, SiriusXM, and/or The Wall Street Journal ✦ $15 monthly Uber or Uber Eats credit ($20 in December, use it or lose it each month) ✦ $189 CLEAR fee reimbursement per calendar year ✦ $12.95 (+tax) monthly credit for Walmart+ monthly membership subscription credit when you pay with Platinum card ✦ Up to $100 in credits annually for purchases at Saks Fifth Avenue (up to $50 in credits semi-annually) ✦ Priority Pass membership (Lounges only) with 2 guests and other airport lounge benefits (Centurion and Delta) ✦ Rental car elite status ✦ Marriott Gold status ✦ Hilton Honors Gold status Enrollement required for some benefits. Terms Apply. (Rates & Fees) See also: Amex Platinum Guide |

80K points ⓘ Non-Affiliate 80kK after $6K spend in first 6 months. Terms apply. (Rates & Fees)$695 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 125K points after 6k spend [Expired 11/8/23] FM Mini Review: In my opinion, this is the best of the consumer Amex Platinum cards when you need two cards thanks to Morgan Stanley offering one free authorized user. Unfortunately you do need to have a Morgan Stanley account to apply. Earning rate: ✦ 5X points for flights booked directly with airlines or with American Express Travel ✦ 5X prepaid hotels booked with American Express Travel Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: $500 after $100K cardmember year spend Noteworthy perks: This card includes all of the great perks that come with the American Express Platinum Card, plus: ✦ 1 Free Authorized User ✦ Redeem points for 1 cent each into your Morgage Stanley account ✦ $695 Annual Engagement Bonus for Platinum CashPlus accounts See also: Amex Platinum Guide |

80K points ⓘ Non-Affiliate 80K after $8K spend in first 6 months. Terms apply. (Rates & Fees)$695 Annual Fee This card is only available to clients that maintain an eligible Schwab brokerage account. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 100K points + 10x when you Shop Small in the US & at restaurants worldwide [Expired 1/20/22] Earning rate: ✦ 5X points for flights booked directly with airlines or with American Express Travel ✦ 5X points for prepaid hotels booked through American Express Travel Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: This card includes all of the great perks that come with the American Express Platinum Card, plus: ✦ Use Membership Rewards® points for deposits by Schwab to your eligible brokerage account. (For example, 10,000 points = $110) ✦ $100 credit with Schwab holdings of $250,000+ or $200 credit with holdings of $1,000,000+ on approval & each year. See also: Amex Platinum Guide |

The second column of your transfer partner table says “Capital One”. #ProofReading

Thanks for pointing that out. That’s actually code that we put in posts to draw data into a table from a centralized spreadsheet we maintain. The incorrect column number was in the code, both here and in a couple of other posts. I appreciate you letting us know so that we could fix it!

I don’t understand how Amex points are valued do high unless you are flying a premium class of airfare. What ways are people reaping 2cpm that aren’t doing aspirational redemptions??

It’s entirely premium airfare.

If you’re not interested in that, you should come up with your own (lower) valuation.

I see. You are right I am not interested in premium airfare…I’d rather see more do more. Be interested to see what others who aren’t interested in premium air travel do with membership points.

I think in many instances you can still do well with economy class redemptions.

Interestingly, I started my miles and points journey in the same way: it made no sense to me that people redeemed for premium cabin travel. I wanted to travel as much as I could.

Over time, my perspective changed completely, mainly due to two things:

1) I realized the the award price difference between economy class and business class isn’t nearly so drastic as it is with cash, yet the level of comfort is exponentially higher. This has allowed me to eat well and get a restful night’s sleep on the plane and arrive ready to hit the ground running. I find it to be both fun (the flight becomes part of the trip) and practical (in arriving rested and ready to rock and roll). So in cases where, for example, my options are economy class for 30K or business class for 45K or something like that, I see a ton of value in paying not that much more.

2) I realized that with a little effort, I could easily earn more points each year than I would need to travel as much as time and schedule would allow. I could see the argument for cashing out excess points, but since I’ve been able to continually generate plenty of points, using them for premium cabins hasn’t meant fewer trips — it’s just meant significantly more comfortable trips.

Obviously we don’t all have the same situation or value the same things. I recognize and respect that, but I share that because I originally came at this game with the same perspective.

Now back to your economy class redemptions. A couple of thoughts there:

1) In some (perhaps many?) instances, you’ll still get over 2cpp for international economy class redemptions. For instance, a round trip economy class ticket from most of the United States to most of Africa is probably going to be pretty pricey. It probably isn’t hard to get 2cpp or more in value.

2) In many other situations, economy class just doesn’t present good value for miles (particularly if you’re looking to travel to the Caribbean or perhaps Europe if you’re New York based). In those cases, you might be better off focusing on a cash back strategy than a miles-earning strategy.

I admit that I don’t get as excited about economy class redemptions in general because they don’t always yield the opportunity for far outsized value, but in some cases they can. Having access to a wide range of transfer partners means that you can cherry pick the best redemptions and get the best value possible, which is why we tend to value transferable currencies more highly — because you can cherry pick those best redemptions thanks to a wide range of partners.

Any work-around for the $10 wireless credit with Verizon? $10 gc in store doesn’t seem to trigger it. Pre-paying the bill loses the autopay discount.

When doing the sign-up bonus, do it (insofar as possible) with no-fee employee cards. Current offer is 15000 MR points per $4000 spend, so — for example — three $5000 payments (quarterly taxes) on three such employee cards would generate an additional 67500 MR points.

Tried an incognito browser and got the ,190k offer the first time.

Technically MRs transfer to Hilton at 1:2, not 1:1.

I don’t see the fine hotels $200 credit on my business card. Only the benefits on free breakfast, late checkout, etc.

You never will see that credit. It’s only for the personal card.

Apologies! That’s a typo and shouldn’t be in there. It’s fixed.

I really like the series of card review posts/updates from Tim!

Question: any recent DP of using combination of GC and this card on refundable Delta ticket that triggers the $200 credit?

Is it still possible to use United travel bank? Last I tried a month ago it didn’t seem like it was up anymore

I’m assuming that means that you charged it and never received the credit? I haven’t seen any recent reports of issues, but I have heard some folks say that it’s taking forever for the credit to post.

My December 2 TravelBank purchases were credited December 10.

works for me, three times in the last month with three different cards.

AF just hit on P2 – unless there is a good retention offer we will likely PC -what is best option?

The cheapest option would be the Business Green. That said, until 2/1/24, the Business Gold will still be $295/yr and you’ll get $20/month in office supply/grubhub credits and some very useful 4x categories. If you can maximize those, I’d say the Gold is your best bet. If you’ just looking for the cheapest annual fee, it’s the Green.

I just realized the AF is still $595! so, now a bit torn on maybe keeping card one more year… or just closing the account – the points will still be save since P2 has a Blue Business card…

how do I get the 150k or 170k bonus? Are there links?

I used an incognito browser and on my first try received the 190,000 mile offer. No muss, no fuss.

Great post (see the note from dan on FHR). Don’t know if we’ll keep ours, but we use the Dell credit and the CLEAR. Oh, and the airline credit. And we’ve really enjoyed lounge access (first time we’ve ever used a lounge. And we got 200k points (which will stay on the Biz Gold if we cancel the Platinum, if no decent retention offer).

I like the strategy of downgrading to the Gold. That’s a good deal until the annual fee goes up.

Thanks, Tim! We already have the Gold (at the 150k SUB) which is a good deal for us as it gives 4x on internet advertising (our nonprofit’s main expense).

After writing the above, I went in and added up what value we got from the Platinum since we got it in June. Well over $700.

PS: why do most of the comments have -5 (or more) downvotes?

Take care!

One correction – the Business Platinum does not get a $200 FHR credit each year. Only the consumer Platinum gets the credit.

right! I was at first thinking I really missed the boat on that one!!

Yes, I hope Tim updates this post. That’s the kind of benefit that can tip the scales for a reader to apply for the card, but it’s not offered for the Business Platinum card.

I was legitimately hoping I missed an update about this card now offering the FHR credit.

The business Plat does not have the FHR credit correct?

Yep, thanks. That should have been overwritten by the Dell credits. Fixed.

Tim (or anyone), are you still able to find any NLL offers for Biz Plat (or Biz Gold)? I have tried several times over the past week and have not been able to find it.

Same here, but check your old emails or physical mailers. I had an old email with an offer expiring on Dec 12.

That was a good tip, Mark! I had an offer in my email that said Dec 31, though when I clicked through it said Dec 12 like yours. I gave it a shot and got a Pending Review (says they need a letter from my bank confirming my home address, despite using my existing account with 4 Amex business cards … and a bank account!). I may have to hustle to get that turned around in time to have another triple-dip opportunity.