NOTICE: This post references card features that have changed, expired, or are not currently available

Many people are calling the Brex Cash bonus the early front-runner for Deal of the Year. It’s hard to argue: 110,000 transferrable points that could alternatively be worth $1,100 cash with very easy requirements indeed is hard to beat. The likely roadblock for some readers is the same one that I faced: Brex requires you to have an LLC, S-Corp, or some other type of registered business that is not a sole proprietorship in order to apply. It just so happens that I had a side hustle that was a nice fit for an LLC, so I went ahead and created one. It was surprisingly easy to create and register a new company, though I do question whether it makes sense for someone without a fairly serious side hustle.

Basics for forming an LLC

I have a good friend who has created several successful companies and who now primarily consults start-ups and companies that are looking for help with growth and planning. Since my friend has experience creating businesses in several states, I asked him about the general procedure that one might follow to create a new LLC. He was careful to advise me that the exact details would vary by state and that anyone considering this should talk to an accountant and in many cases a lawyer in advance. You can also hire a company to handle all or parts of the process. However, the general steps he explained are:

- Get an EIN from the IRS. This can be done instantly online here. It only takes a few minutes to enter the necessary information. At the end of the process, they give you the ability to get a PDF copy of your EIN information. Save that. I’m told that it can be a headache getting that document replaced if you forget to open it or save it.

- Get registered with your state. Generally speaking, your state likely has some sort of “Secretary of State” website (here is a link to New York’s as an example). You’ll look for the business section and instructions for how to organize the company with Articles of Organization (or incorporation or something of the sort depending on your company structure). This document can range from a simple template with a few lines to fill in (I used my state’s template here). There will be a fee to do this (New York was $200). Some states allow this to ne done online (New York does) and you may be able to expedite it (I planned to do this but then couldn’t find a way to add expedited processing; it happened so quickly anyway that I’m glad I didn’t waste money on that). You will receive a form with a state business ID and you’ll usually need that ID number to log in to your state business portal (which you should figure out and create an account once you have that info).

- Register with the Department of Finance / Taxation. Each state has a department that handles tax registration for the business and you must register with them. If you intend to have employees, you may need to register for things like worker’s compensation insurance.

- You may need to publish notice in the newspaper. This is a New York requirement, though I imagine it is not uniform in all states. In New York State, one must publish notice of formation of the LLC in 2 newspapers within the county where the business is to operate for 6 consecutive weeks and then file an affidavit proving this has been done (New York charges an additional $50 for this plus the newspapers charge a fee).

- You may also need to register with your city Department of Finance / Taxation. For example, New York City requires this.

- Keep in mind ongoing costs. In future years, you will need to pay a fee to keep the company open every year. I hear this can range from $50 per year in some states to $700 per year in California, so it is worth doing your research here. You must also file an annual report. You may additionally encounter significantly increased accounting costs, so it makes sense to speak to your accountant about this in advance.

While that may sound a bit intimidating, I found that it’s actually quite easy to do. As noted above, you certainly may want to consult with a professional depending on the type of business you are starting. However, it certainly can be done for oneself. If you have questions, don’t be afraid to call the department that handles registration of companies in your state. I also found my local chamber of commerce website had clearer instructions and more direct links to forms than my local county clerk’s office website, so that could be a resource.

Messing up my first attempt

Before speaking with my startup-experienced friend, my first instinct was to create an LLC for my Amazon / eBay sales side hustle. While I had wound that down over the past couple of years (just not enough time for everything), it was the first thing I thought to turn into an LLC.

Unfortunately (though not necessarily), I messed it up. The first thing I did last week was to go to the IRS website to get an EIN for the business. That process asks you to identify the type of legal structure you intend to use. I chose Limited Liability Company (LLC).

A page or two later, it asks you to enter the the legal name of the LLC, which it notes must match the articles of organization. The fine print notes, “The legal name may not contain any of the following endings: Corp, Inc, PA. The trade name may not contain an ending such as ‘LLC’, ‘LC’, ‘PLLC’, ‘PA’, ‘Corp’, or ‘Inc’.

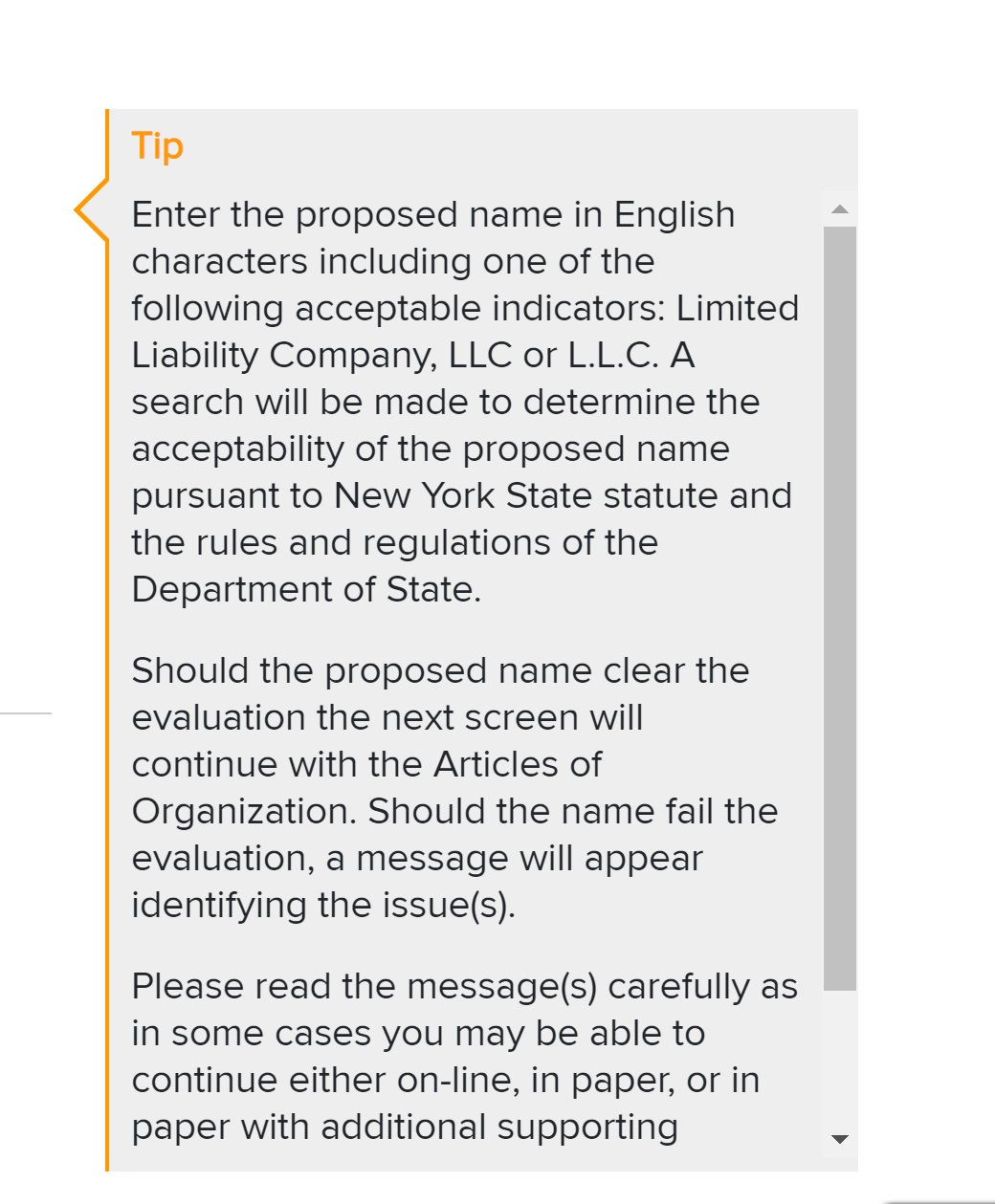

Here’s the key part they leave out: while the trade name can’t contain ‘LLC’, the legal name can and your state might (probably does?) require LLC in the legal name. My state (New York) does require LLC in the legal name. I didn’t know that right away because New York State’s online fillable Articles of Organization template just says to insert the name of the Limited Liability Company.

I would have thought it redundant to fill in the blank above “Insert name of Limited Liability Company” with something that also says Limited Liability Company, but I’d have thought wrong. Later, after acquiring an EIN for a business name that matches my eBay / Amazon name, I went to file the Articles of Organization with the New York Secretary of State. I initially left LLC out of my company name and it gave me an error and the following tip:

I would have thought it redundant to fill in the blank above “Insert name of Limited Liability Company” with something that also says Limited Liability Company, but I’d have thought wrong. Later, after acquiring an EIN for a business name that matches my eBay / Amazon name, I went to file the Articles of Organization with the New York Secretary of State. I initially left LLC out of my company name and it gave me an error and the following tip:

If I added LLC on the New York State form, it wouldn’t match the legal name on my EIN form. Unfortunately, there is no easy fix for this online with the IRS. You can send a letter to the IRS requesting a change (in my case to add “LLC”), but I wasn’t interested in waiting weeks for a response. The same was true for shutting down an EIN – it looks like that can only be done via mail also (otherwise perhaps I’d have just closed out the first EIN and started a new one). I ultimately found this reddit discussion from someone who made the same mistake in leaving out “LLC”. Following through the discussion there, I found that the original poster was able to get it fixed over the phone in under 10 minutes once they got through to someone at the IRS. I gave it a shot. After 43 minutes on hold, it took two minutes for the gentleman who answered to look up my EIN and tell me that it was too new to fix and I’d have to call back in 2-3 weeks once it is “fully in the system” and then they could fix it over the phone.

I thought I had struck out for now.

A second business venture

When my entrepreneurial friend and I caught up and chatted about life and business over the weekend (and I lamented my silly mistake), he helped me realize that I had some other business activity that might be a great fit for an LLC.

I had a different full time job before I began working for Frequent Miler in 2017 and I had worked for the same company for many years. When I began working here at the blog full time, I turned that previous full-time job into a part-time side hustle because I still enjoyed it, could squeeze it into my free time, and it was reasonably lucrative. My free time has since squeezed down considerably now that I have two kids, but I have nonetheless maintained the side hustle to some extent. Recently, the company I worked for changed ownership and structure significantly, which my friend realized might present an opportunity to turn that side hustle into a business of its own and I found that there could be some advantages to doing that apart from the Brex bonus. And so early this week, I created a new LLC.

I first went to the IRS EIN website on Tuesday and created a new EIN — this time including LLC in the name. Then, I went to the New York State Department of State website (they have a lot of good information about forming an LLC here). They have an easily fillable online form for Articles of Organization (I’ll note that you certainly may want to speak to a lawyer about drafting something more tailored to your business). I then went to the online filing system for New York State businesses to register my LLC’s Articles of Organization. In New York State, the fee to file the Articles of Organization is $200. I paid an extra $10 for a certified copy (I don’t know as though I need it, but for ten bucks I figured I’d take an official copy rather than chase it down later).

As noted above, my state requires that I publish the information in two newspapers (chosen by the county clerk where the business is to operate) for 6 weeks within the next 120 days, so that will bring additional cost. I called my local county clerk’s office to confirm which two papers (a daily and a weekly) and get the contact information for the appropriate offices at those papers. In a big city, this might be a challenge and you might just want to hire a company to handle it.

Two quirky things to mention: The IRS website only allows creation of an EIN between 7am and 10pm Eastern. It seems weird to see a website shut down for business at night, but the IRS does. On my state side, I handled the New York filing late at night and the website gave me a message that because I was submitting my paperwork outside of business hours (I did it at 10 or 11pm), my application wouldn’t be processed until the next business day during normal business hours. Despite the fact that the New York Secretary of State website notes a 7 day processing time, I filed around 11pm on Tuesday night and I had an email confirming that my business was approved around 6:30am Wednesday morning.

Before applying for the Brex business account, I took a further step that may not have been necessary but I thought it wouldn’t hurt: I set up a website and email address.

Setting up a business website and email

I remembered hearing in the past that Brex preferred it if you had an actual business email rather than something like a gmail account. I don’t know if that’s still true, but I thought that it wouldn’t hurt the legitimacy if I had my own domain and email address and it could be useful for the business.

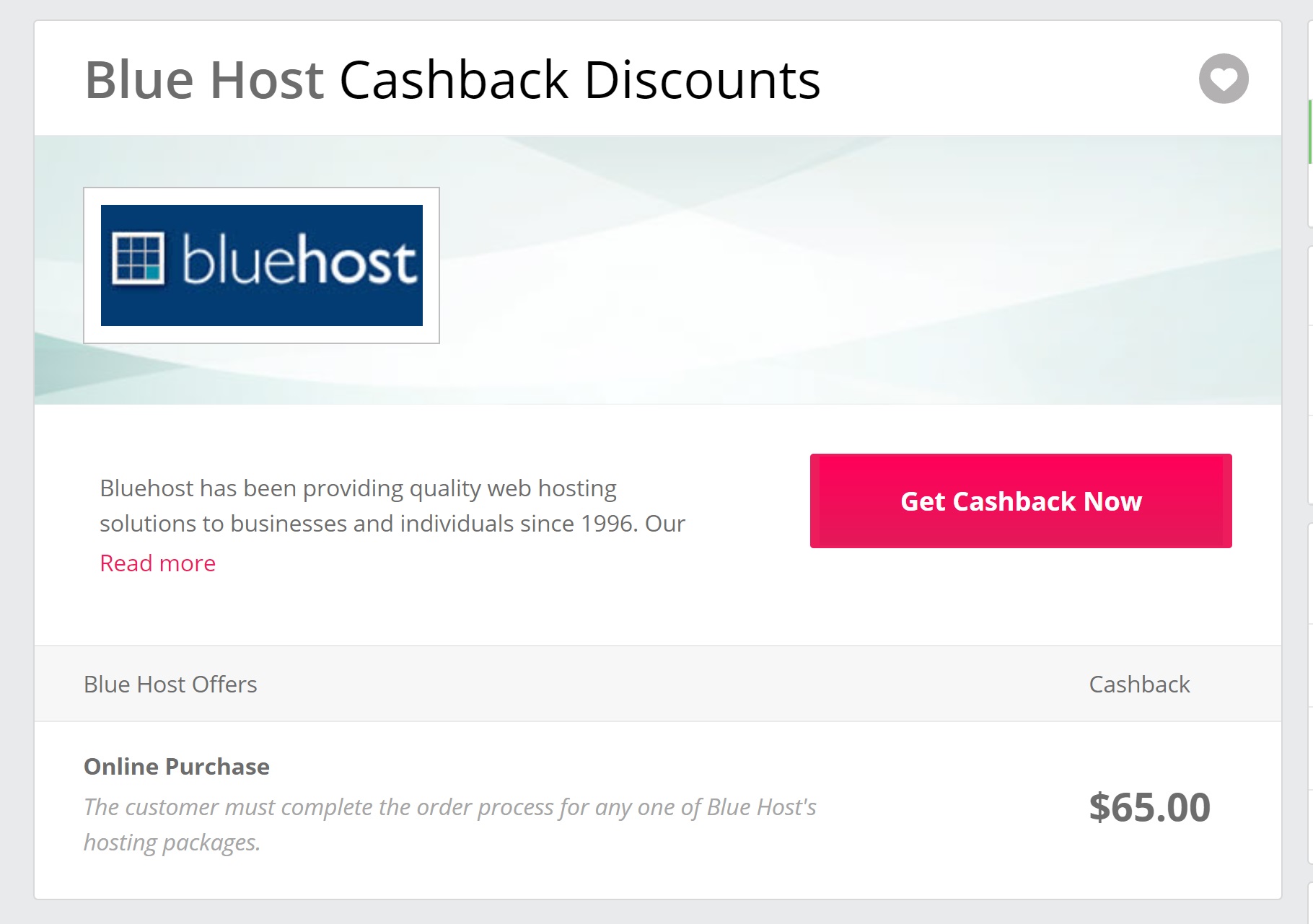

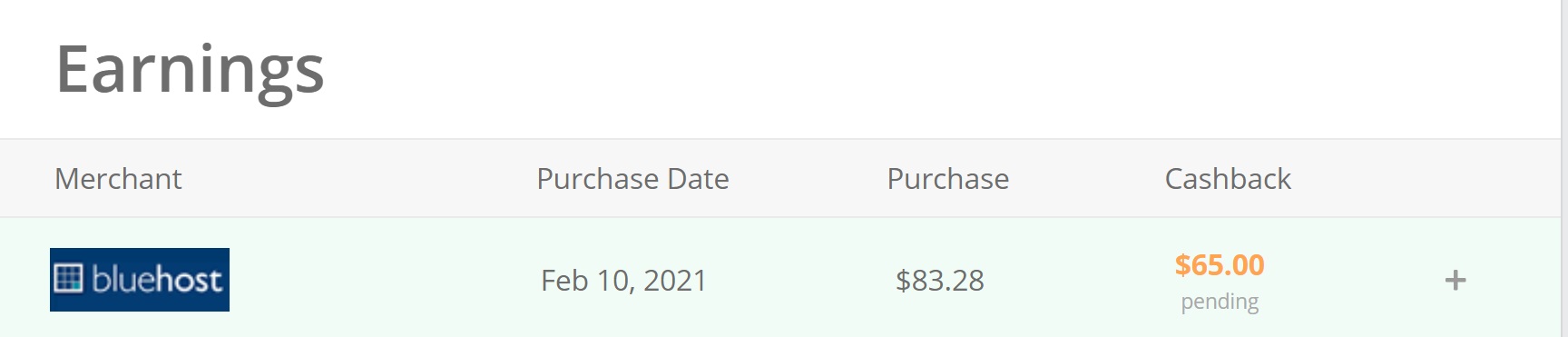

After a little bit of research and conferring with Stephen and Carrie, who already have more combined experience in setting up websites than I am likely to ever accumulate, I settled on what I thought was a pretty good deal: Bluehost.com is a hosting platform that will sell you a domain name and hosting package. I found that their “Basic” package, which includes 5 email accounts, would cost about $83.28 for 1 year with private domain name registration. The good news is that TopCashBack was offering $65 cash back on any package purchase.

That would drop my net cost to about $18.28 to have a website for a year and up to 5 email addresses. That sounded well worth it to me. I went through TopCashBack and bought the package. I was glad to see an email confirming that my purchased tracked just a little while later and then the purchase was pending in my TopCashBack account.

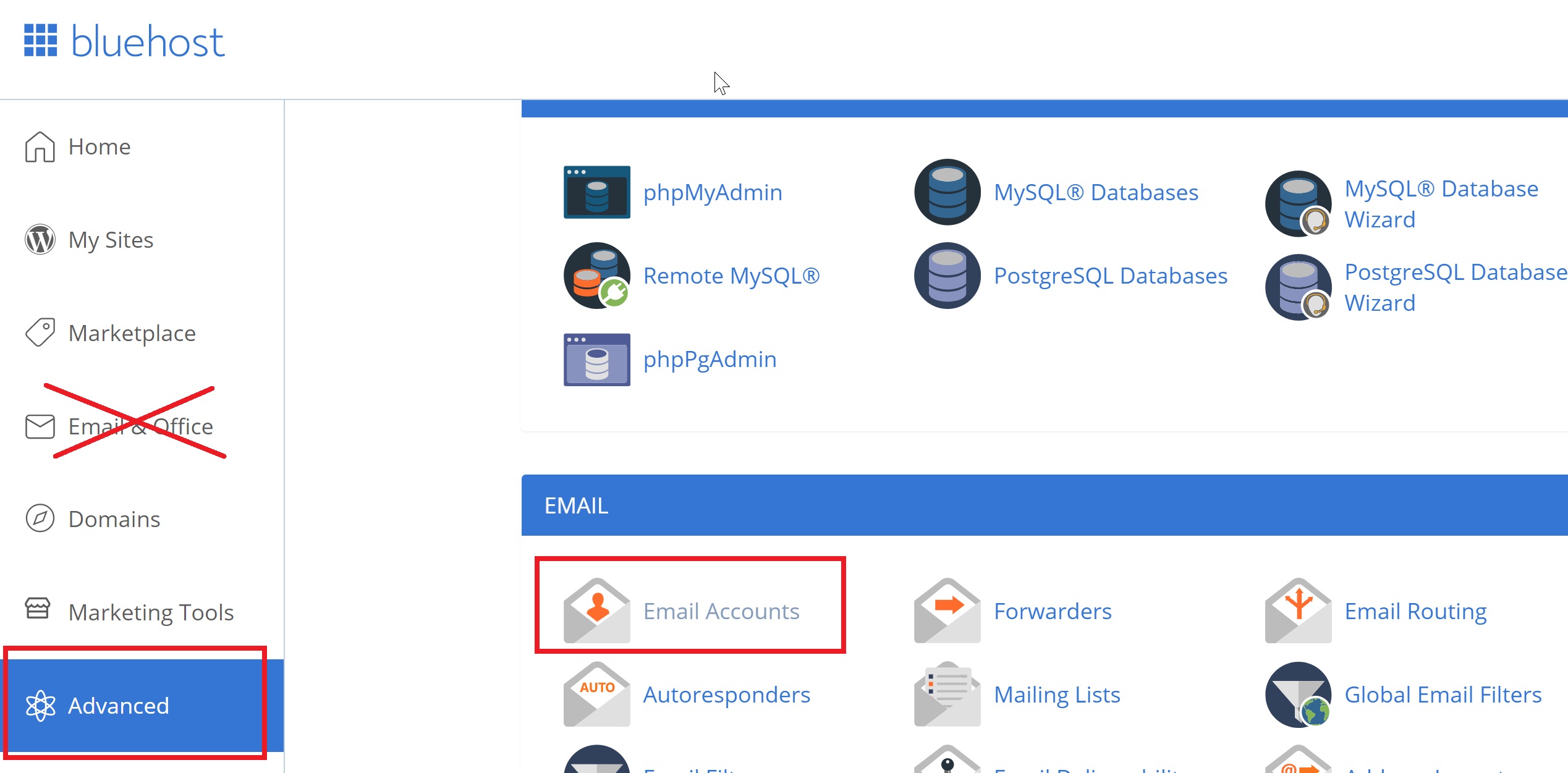

Since I am familiar with WordPress thanks to Frequent Miler, it was really easy for me to set up a basic landing page and “contact us” form. What was less easy was figuring out how to set up the included free email accounts. When logged in to Bluehost, the tab that says “Email” & Office” brings you to a page that tries to sell you an integration with Office 365 or Google for five or six bucks a month. That didn’t seem right since the package said it included 5 email addresses. Still, I couldn’t figure out how to set them up. I chatted with support and found that email account setup is under “advanced” and “email”. Who woulda known?

The free web interface for that email is ugly and slow and awful. Luckily, the first email they send you explains how to set it up with Outlook or Gmail. I had the email account loaded on my phone within minutes.

Once I set up my email account and website, I went ahead and applies for Brex Cash.

Brex Cash

Greg has previously covered the Brex Cash account with a couple of posts:

- Brex bonus: 110K transferrable points without a credit inquiry

- How I earned 20K depositing sales revenue with Brex Cash

- You can also see our Brex Cash card page for more information and a link to apply.

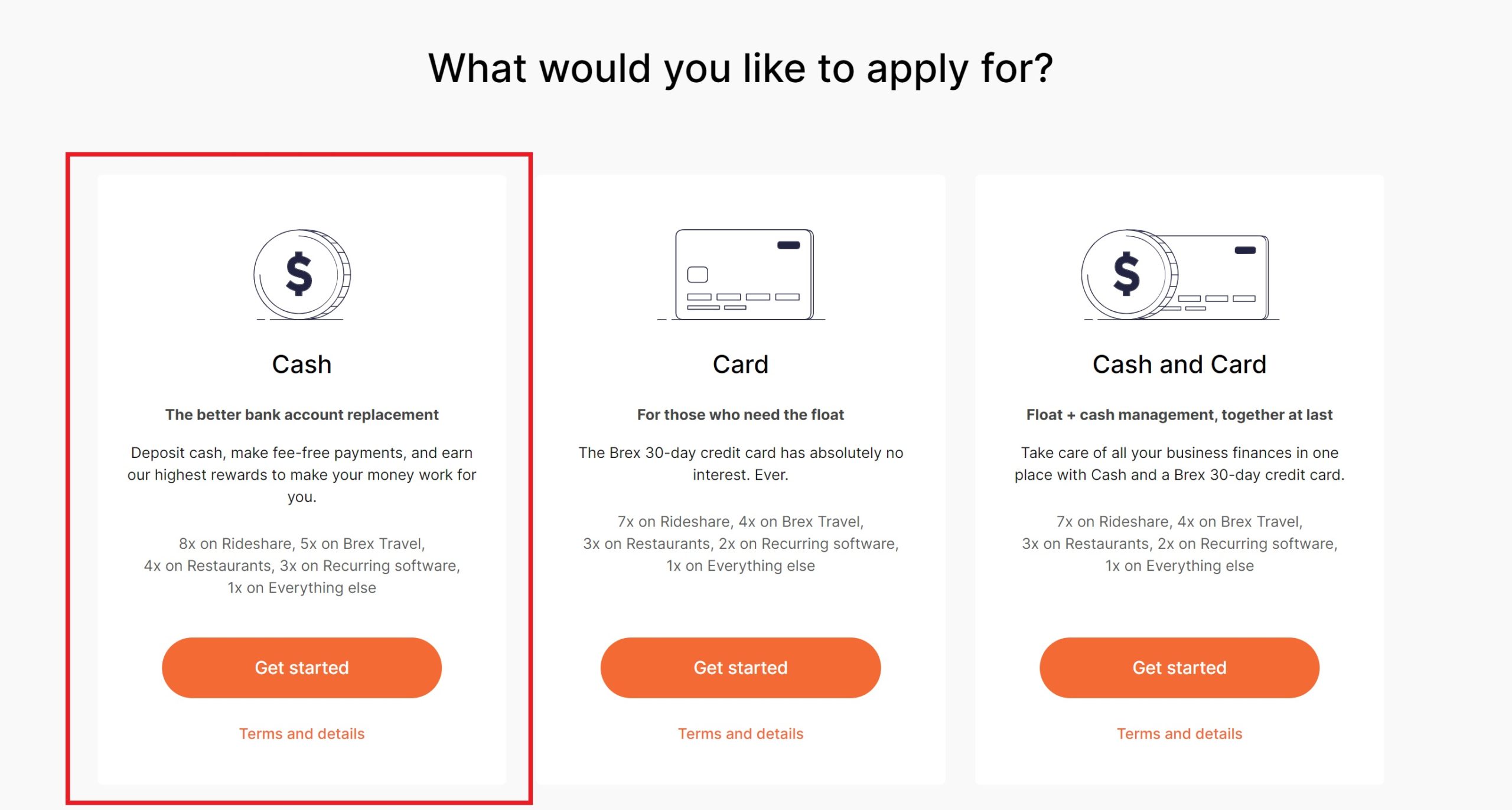

Since those other resources explain the process, I won’t go into extensive detail here. The application is really simple. One part threw me: I didn’t immediately know which of the following account types to apply for. However, the One Mile at a Time landing page for the offer notes the Cash Account on the left is the one that most businesses probably want (and indeed it is what I thought I wanted, I just wanted to confirm it was the right selection for the purposes of the bonus).

I ran into one snag in the process: after submitting the application and verifying my email, it asked me to upload a copy of my photo ID. I tried my license and it gave me an error saying that they couldn’t scan it despite the fact that it was a very clear photo. I then tried a scan of my passport next and it said they were having a connection issue. In the end, I had to upload a photo and it says that the team will manually process it. Unfortunately, that meant that I couldn’t immediately get the account number I need to transfer cash into the account. However, I was able to get the Brex card number itself, so I’ll be ready once I can fund it.

Again, I did instantly receive an approval message and a “Welcome to Brex” message. After the ID snafu, it asked me to upload a copy of my EIN document, which I did immediately. Now I’ll just have to wait to be able to fund it and I should be off and running. I’m certainly excited about that.

Bottom line

The process of forming an LLC was surprisingly easy: I set up an EIN and filed my Articles of Organization with my state on Tuesday, received confirmation that everything was approved on Wednesday morning, set up a website and email Wednesday evening, and successfully applied for Brex that same night. My total time investment for the EIN and New York State filing was well under an hour and the process of setting up my website and email through Bluehost was also under an hour. My cash cost for initial setup will be a bit over three hundred dollars ($200 for New York State filing, $10 for a certified copy, $50 for newspaper affidavit, TBD newspaper filing cost, net $18.28 for my website and email). That’s not bad at all, but the real cost is going to be accounting. I expect long-term savings of making this change to be worth the additional cost, but you should talk to your accountant to be sure that tax time isn’t going to eat up the entire Brex bonus.

For that reason, despite the relative ease, I don’t necessarily recommend converting your sole proprietorship to an LLC – at least not without doing your homework as to how that may affect your taxes and administrative costs. In my case, I anticipate that it will be worth it, but your situation may be different. I recommend doing some reading and consulting with your experts before you jump off the deep end. Still, this Brex bonus alone is huge. My wife has also been pondering a new business of her own for quite some time and Brex may just be the kick in the butt we needed to get the wheels in motion on that. Whether we take the bonus as $1100 or 110,000 points, it will sure go a long way in offsetting startup costs — and I guess that is exactly why Brex is offering a bonus like this. Long term, I am also excited about 4x airline miles with no annual fee. While I love Membership Rewards points, this might make me question the value in keeping the Amex Gold card long-term, but that’s a question for another day. For now, Brex got me in business.

I accidentally uploaded the PDF to the summary page after creating the LLC’s EIN (still contains company name and #), and not the PDF of the document itself, oops. I don’t see a way to upload a different file, so I guess I wait until they either approve and re-ask for the EIN documentation.

Wondering how scalable this might be? My friend (nudge nudge say no more) has several rental properties…

Great info Nick. Out of curiosity; If not for the sake of writing content for FM, would you have set up an LLC soley to earn the bonus ?

Let me first answer that differently than you intended: without the Brex bonus, I probably wouldn’t have looked into the LLC. Knowing what I know now, I wish I had looked into doing it a few years ago as it probably would have made a lot of sense for me financially. That is unique to my circumstances, but I’m glad that the Brex bonus gave me the push to ask some questions and do a little research.

But back to your real question, would I have set up the LLC solely to earn the bonus. The truthful answer is I probably would have because I’d have a hard time turning away from what looks like such an easy bonus with what turned out to be such low effort. But as I conclude in the post, I’m not sure that would have been a good decision if I were doing it just for the bonus since the up-front cost combined with administrative and accounting cost might have wiped out the value of the bonus. For example, let’s say it costs me $400 to start the LLC. Even if it only costs a couple hundred extra dollars for the accountant at tax time, I’m talking a cost of maybe $600. That makes it only a $500 win — and I haven’t checked past DPs to know whether or not to expect a 1099 for the $1100 bonus. The win here becomes fairly small, especially when you consider the fact that I opened multiple new checking accounts last year with bonuses worth $400-$700 each. Through that lens, the Brex bonus doesn’t seem worth it if you’re setting up an LLC just to earn the bonus. Of course, if you’re doing your taxes yourself and if Brex treats the bonus as a credit card bonus (i.e. no 1099) and you’re able to leverage the points for international business / first class rather than just the $1100 cash value, it’s not impossible that it could be worth it just for the bonus. It just isn’t necessarily an obvious win.

I think that for anyone who already has an LLC (or S-corp or qualifying business), the Brex bonus is a hands-down absolute no-brainer, but it’s questionable at best for someone without that type of business yet. That said, I’m sure there are some readers who have a legit side hustle that might benefit from being run as an LLC — and in my case, having the LLC should save me money, so it was worth the cost independent of writing about it (and really my start-up cost isn’t much of a consideration against the bonus because I should get that back and more). But without the Brex bonus and perhaps even just without the impetus to write about my experience doing it, I probably wouldn’t have looked into that. So in my case, I might have done it just for the bonus and lucked into finding that it made financial sense in my circumstances, but I think it probably wouldn’t make financial sense for most people. Of course, if you live in a state where it is extraordinarily cheap to start an LLC, maybe the balance tips.

I hope my question didn’t sound dubious in any fashion. I know you provide valuable info, and from a perspective of writing content, it’s a great service to your readers to demonstrate the entire actual process of setting up the company (however cumbersome it may look)….Thanks again for your response and I think your post has convinced me to pass on this since I don’t already have an LLC.

In regard to your problem of uploading a photo ID, I ran into something similar with the Betterment $75 deal through Rakuten. I was unable to upload at all and the app would close whenever I tried. After some research, I discovered they require the photo to be in a PNG, JPG or JPEG format. If you are using an iPhone, which I have, the photos you take are HEIF/HEVC high efficiency format, but you can change it to JPEG in the camera settings. I did that and still can’t upload a photo. However, it was interesting to note these facts.

How does Brex make money? I read that it’s not a bank account, but a cash management account, I’m not clear on difference. Why can they afford to give out such massive bonuses? Making money on the float, or some other services? This whole deal triggers my “if it’s too good to be true it probably is” instinct.

I don’t know, but my assumption is that they aren’t concerned about it yet because they are likely burning through venture capital. The same question could be asked about any bank account bonus. I wrote about how my wife and I earned $4680 in bank account bonuses last year. How did any of those banks make money on that? They likely didn’t.

My only bet here is that Brex is counting on making something in terms of interest on the holdings people need to have with Brex in the long-run. Since this works kind of like a secured credit card account (where your limit on the card is only 80% of what you have on deposit), they are essentially making a play to be a business’s main cash deposit account at all times. I don’t know that can be profitable enough long-term, but neither is offering 100K points + 10x gas and grocery on the Platinum card — yet I won’t hesitate to take a great offer just because it’s great.

That’s not to say there is no risk I guess, just that we don’t often see banking apps collapse unexpectedly and we do frequently see generous bonuses from banking accounts. I’m sure the generosity will slow down eventually just as it has with SoFi, but just like with SoFi I’m glad I got in while the gettin’ was good. I’m not going to transfer my life savings to Brex — I’ll transfer what I need to meet the expenses for which I’ll use the card — but in the meantime I’m happy to give them a shot with such a generous offer. Indeed that’s the way I look at a lot of bank account bonuses. With 4x restaurants, I’ll probably keep enough in the account long-term to have a few meals out.

Well, CC companies are offering SUBs bc they know many will screw it up, still use the card long term, pay another few AFs, carry a balance, etc. It’s easy to understand how their model can be profitable. Banks offering checking bonuses hope to sell you additional financial services, charge you fees, make money on the float, etc…and checking accounts tend to be stickier, not as easily dumped as a credit card (if you’re actually using it), so I can see that model too, though less so than CCs, but checking bonuses are less than CC too.

But with Brex, well, I don’t know what other services they could be up selling, I don’t know what kind of fees they hope to charge, and I don’t know how safe my money is with them. It seems like a model less lucrative than a checking account even, but with upfront bonuses bigger than CCs. Something doesn’t add up, so I’ll be sitting this one out while people with higher risk tolerances act as guinea pigs.

I would bet that selling additional services to business customers is far more lucrative for a banking entity than selling additional services to the average personal checking account customer. They could have all sorts of affiliate tie-ins long term with Quickbooks or accounting services or business lending or a myriad of stuff that is likely to be far more profitable than trying to sell someone on a personal loan. And the deposits should be FDIC insured (same as all of these neo-banking-app things like SoFi, NorthOne, Betterment, Aspiration, and the myriad of other apps that run over some other bank on the back end).

https://www.brex.com/posts/brex-cash-fdic/

I’m not trying to convince you to do Brex — if you’re not comfortable, you should absolutely sit it out and I totally respect that. Healthy skepticism helps us avoid risk with which we aren’t comfortable, and that’s fine. But I think it’s worth noting that Brex isn’t much different than many other similar opportunities.

Be aware that in CA you will pay a tax of $800 to own an S-corp or LLC.

Is it an incremental tax of $800, or that you must pay a minimum of $800 taxes every year?

Or is that the annual fee to renew your business registration with the state that I mentioned in the post? (I don’t know as I have never lived or done business in California).

It’s sort of a fee, really. It’s $800 per business regardless of reason: Every LLC that is doing business or organized in California must pay an annual tax of $800. https://www.ftb.ca.gov/file/business/types/limited-liability-company/index.html

As someone else pointed out to me somewhere else though, with the passage of CA AB85 the tax/fee is waived for newly organized companies, for the first year only, for years 2021-2024. So there is a unique opportunity right now.

I’m not sure what you mean by incremental, but you are paying that $800 every year no matter what. I have an S-corp and it is the same.

Here is a link from the state: https://www.ftb.ca.gov/file/business/types/limited-liability-company/index.html

I was going to make this correction as well..there is a minimum franchise tax of $800 due each year in California even if taxable income is $0 or a loss on LLCs and SCorps. The first year is exempt, however. It used to be exempt the first year for SCorps only, but now includes LLCs through December 31, 2023.

So I can start a new CA LLC this year for free as long as I shut it down within a year?

Knowing California you’ll pay an exit tax. It takes a process to close down just like starting. Seriously, department of taxation I would think have to sign-off on any dissolution filing corp or LLC.

Just a FYI, you’ve got a TBD on the newspaper publication costs for a NYS LLC and those can be substantial. For LLCs with a principal place of business in New York County (Manhattan), it is routinely over $1,000 to publish (in addition to the $50 state fee to file the affidavits from the newspapers). I think you live upstate and so it is typically significantly less, but we’re still talking hundreds of dollars. Proceed with caution if you’re doing this in NYS just for the Brex bonus.

I’m certainly not surprised to hear that the cost is substantial in Manhattan. Annoyingly, neither of the papers here could give me even a ballpark range until I submit the listing. I explained to the first paper that I’m looking to get an idea of startup costs and just wanted to get an idea of the range. They told me they had no idea until I submitted. I explained that I was wondering if it’s going to cost me $50 or $100 or $1,000 and she told me “oh it would be nowhere near a thousand dollars”. So clearly there is a range, but they don’t want to share it. Similar experience at the other paper when I emailed inquiring in a similar way (trying to figure out start up costs, wondering if they charge by the word or ad so I can figure out how much it would be). They told me they charge by the line plus $15 for the affidavit. No word as to how much per line.

As you note, I’m in a rural area, so I’m sure it will be reasonable, but I found the inability to even give me a ballpark number or two very annoying.

By way of update, the fees for my two newspapers were $42.93 and $72.37. I expected they would be quite low because they are very small papers, but thought it worth an update to note the wide potential variance on this.

Nick, I typically don’t comment but I read most of your articles. Excellent as always! In my case, I found it easier using LegalZoom. I know it is an added expense but it is not too much and you can write it off.

That makes sense. In this case, I wanted to try to full process myself to write about it, but I could see the LegalZoom route being attractive for some folks, particularly in markets where this stuff is more complex.

It wasn’t that easy for me. I submitted an EIN # & info, and rec’d the card….but haven’t been approved. I am now waiting for an IRS confirmation letter and hope I will then receive approval. I started the process several weeks ago.

That’s a bummer. Do you mean you weren’t approved for the Brex account or weren’t approved for the EIN? If you’re saying you weren’t approved for the Brex account, what letter are you waiting for from the IRS? Is it by chance the PDF copy of your EIN info that I highlighted saving? I’m guessing maybe yes — like I said, I heard it was a pain getting that replaced. I was glad I got that tip up front because I would have otherwise been in the same boat.

I am in the same boat. They wanted the confirmation that the biz was in “good standing”…still waiting on that.

Just 76 easy steps to make under $1000.

I counted six (maybe 8 if you add two more for setting up the website and email) and under two hours. Looks like you added 70 steps there. Overall, it was pretty easy. That said, I stand to gain more than the Brex bonus in this case – as I said in the post, it certainly might not make sense for some people because despite requiring less than two hours to earn a grand, it may cost you more in other ways.

Lol, this post reads like the most complicated process I’ve seen on FM! 2 hours… after you found and talked to a consultant, messed up the first filing, 43 minutes on hold, calling back in 2-3 weeks after the system updated. Are we referring to the same post?? 😉

FM posts are great because they usually make it simple for the reader, but in this case I still have to do each painstaking step myself. Plus the process is different in every state, so there are likely a lot of other quirks and pitfalls…

If you’re creating a corp. just for the Brex bonus, sounds like a great way to cost yourself hundreds of dollars and an annual headache at tax time.

Btw, I should thank you for taking a bullet for the reader, but this just confirms this is a terrible idea for me.

OK, yes, I put in more than 2 hours for the purposes of writing this post. While my friend is a consultant, he is primarily a friend I’ve known for 15+ years, so we were just catching up initially when the business thing came up – not exactly like I sought out a business consultant (and I shared what I learned about that here so you may be able to skip that step, obviously you may not want to skip it though – fair enough). I also spent the 43 minutes on hold because I wanted to know if it would work for this piece (otherwise, I could have sent a letter that would have taken much less time). I wasn’t staring at the wall during the 43 minutes I was on hold, so it didn’t exactly feel like 43 minutes that I put primarily into starting an LLC but rather 43 minutes my phone was playing hold music while I was doing something else.

Setting up the EIN takes 10 minutes if you read slowly. Filling out the Articles of Organization might take 5 minutes if you are a hunt-and-peck typist and you want to use the fillable form (YMMV of course). Filing them with the state may have taken me 20 minutes including the time I spent looking for the credit card I wanted to use. If you know nothing about setting up a website and don’t need one, I’d probably not do that step. If you have any familiarity with WordPress, the website I created would take you less than 10 minutes to make (basically just a background pic, business name & tagline, and contact us form – I don’t need anything more than that for what I’m doing). I had to hunt around for the email setup and chat with support, so that did take at least 30 minutes. I spent a little time hunting around for that Bluehost deal initially, but the point behind a post like this is that you won’t have to spend the time shopping around for web hosting and you won’t make that LLC mistake and spend 43 minutes on hold. I did also take maybe 15 or 20 minutes on the phone with an accountant to discuss it and I spent a couple of minutes calling the newspapers. At any rate, I think that the actual steps to start the business would take most people fewer than 2 hours. If I did the same thing again, I would bet that I could get it done in less than an hour now that I know how it all works.

All that said, my overall recommendation was not to do it just for the Brex bonus, so I’m not trying to argue that you should. When we first talked about this on the podcast, I said that it was probably going to cost me more both in terms of time and money than it was worth to figure out how tough it was to set up an LLC. After doing it, I was surprised at how easy it was. If nothing else, I’m glad I’ve done it so that I now know that if I were to want to start another business I’m not intimidated by the process. But I don’t doubt that setting up an LLC just to get the Brex bonus is not a good idea for someone with no business setting up an LLC. On the other hand, for someone with a viable sole proprietorship, there may be other reasons why it is beneficial. I know that in my case, I didn’t spend much time thinking about any of that before because I assumed it was more difficult to create a business than it was.

And the risk that a year or two from now the sales tax division wants to know why you have a business in the state but haven’t filed any sales tax returns.

I’d think that’s only a “risk” if you’re not reporting something that you should be reporting. I definitely wouldn’t recommend failing to report anything that’s required. In terms of sales tax specifically, that will obviously depend on the type of business you’re doing. Like I said, I recommend talking to an accountant before you proceed with any of this. I certainly did. And I noted in the post that the fee for the accountant alone may well wipe out the bonus for the Brex account, which is why I said I wouldn’t recommend this unless you have a significant side hustle.

Agree. Mostly I was just trying to warn folks that setting up a business just to take down this bonus, then never doing anything with the business, might lead to headaches down the road.

Rut roh, my EIN doesn’t have LLC in it…..I think I’ll find out early next week whether or not I’m approved by my state and can get a certificate of good standing. Thank you for writing about your experience. I’ll be ready to make some quick adjustments if I’m not approved.

I saw your comment last night when I went to apply for Brex and instantly regretted not having paid the additional $25 to get a letter of good standing from New York when I paid to file my articles of organization (it was an option to get it at the same time), but then the Brex account hasn’t asked me for it yet so I realized that may be case-by-case and have more to do with other stuff like industry, business structure, etc.

I think you’re good. When I applied, I was instantly approved but they also immediately requested the certificate of good standing or they would shut down my account on Feb. 27 (and unfortunately they don’t allow me to load funds, or I would’ve considered spending the 3k immediately and withdrawing the bonus before the deadline). If I’m rejected by my state because I’m missing the LLC, it might be a dead end and a lost $130 for me. If I can’t change my name with the IRS because my business is too new, I don’t know what other recourse I’d have. At that point, I’d probably have to start over with a new business if I wanted to open a brex account. Is that what happened to you, and you had to pay the fee in New York twice? Or did you back out before paying the fee the first time?

I backed out before paying the fee the first time. As soon as I saw that the New York form required LLC in the name, I figured I was going to have a matching problem. I previously assumed that LLC was just a designation like “MD” or “Esq” at the end of someone’s name. But while filling out the NY info I realized it had to be in the name, so I backed out before submitting that thankfully. Hopefully you’ll be OK anyway!

To update, I was approved by my state despite forgetting “LLC” on the application on 2/13. I uploaded the certificate of good standing on the 16th and was officially approved yesterday. I can now transfer funds and start using the card. Hopefully it all works out for my 110k points. I’m relieved that not including “LLC” in my state application didn’t come back to haunt me. I also currently live in a bit of a lawless state (Florida).