NOTICE: This post references card features that have changed, expired, or are not currently available

Update:Since this post was written, additional great offers have surfaced. Please click here to see every option.

Yesterday, news spread of an amazing but targeted Amex Platinum offer. The offer is for 100K points after $5K spend plus the ability to earn 10X points at US gas stations and US supermarkets for 6 months (on up to $15K spend). That’s an absolutely awesome offer.

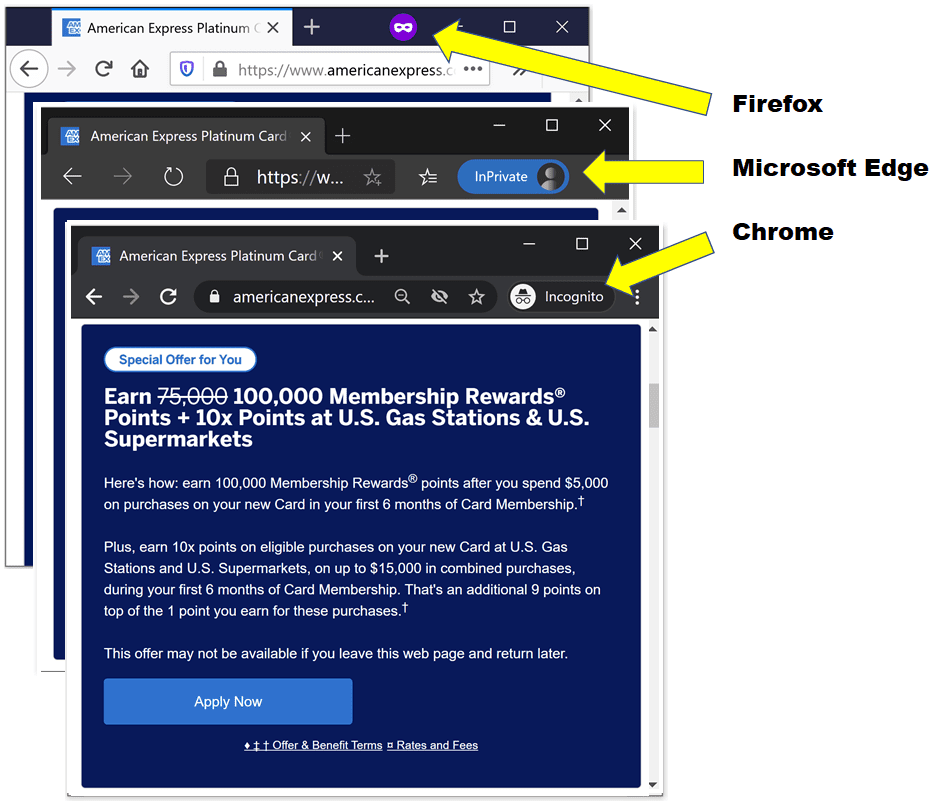

I have several browsers installed on my laptop, and so I tried browsing to this magic page in each browser: www.americanexpress.com/us/credit-cards/card/platinum/. Firefox showed me a 75K offer. Same with Microsoft Edge. Not interested. I can do better than that even without a targeted offer. Chrome, though, showed me the magic 100K + 10X offer! (Later the 100K + 10X offer showed up in Microsoft Edge as well — it seems almost random).

Now that I knew I could find the 100K + 10X offer, I set about finding out who in my family was eligible. With this offer (and with most Amex offers), you can’t get a welcome bonus if you already have the card or have had it in the past. I currently have a Schwab Platinum card and my wife and I have each had Mercedes Platinum cards in the past, but those are considered different products from the generic Platinum card. From that point of view, we were good to go. Unfortunately, both of us have also had the generic Platinum card in the past. Here’s what I found in my records for each person in my immediate family:

- Me: I signed up for the Platinum card on 4/14/2014 and cancelled it on 5/14/2015

- My Wife: Signed up on 1/8/2013, and cancelled on 3/7/2014

- Son: Never had the card

It’s generally believed that Amex “forgets” that you’ve had a card about 7 years after you cancel it. My Platinum card was cancelled just over 5 years ago and my wife’s was cancelled just over 6 years ago. Since these cancellations were less than 7 years old, neither of us were necessarily qualified to get the new card and bonus. That said, I’ve heard reports in the past (including my own experience with a couple of other cards) where people have received welcome bonuses despite having had the same card more recently than 7 years ago. Still, it seemed that my son was the most likely to be eligible.

Now or later?

Usually I like to apply for Amex Platinum cards (there are several flavors) in early December. This way, if I end up cancelling when the second year annual fee comes due, it’s possible to triple-dip the calendar year credits. For example, one could earn $200 in airline fee credits in December 2020, $200 January through December 2021, and $200 in January 2022.

In this case, though, I doubt the offer will be available a few weeks from now. The almost-as-good Resy offer might be available then, but I don’t know for sure. I decided that it was worth giving up the triple dip to ensure getting in on the offer while I could.

Application Results

My son applied for the card, but received his first ever “talk to the hand” from Amex:

We’re sorry. We can’t approve your application at this time.

You’ll receive a letter within the next 10 business days explaining why we were unable to approve your application. We thank you for your interest in American Express.

Next, I decided to give it a shot. Yes, I’ve definitely had the card before, but it’s been a while. Maybe they would approve me? Yep!

Maximizing the deal

There are three buckets of benefits I hope to make the most of: welcome bonus benefits (100K points + 10X earnings), COVID rebates ($20 streaming and $20 wireless credit in November and December), and standard ongoing credits. The Platinum card has many other benefits too (elite status, fine hotels & resorts, airline savings, etc.), but since I also have the Schwab Platinum card, it doesn’t do me any good to get those benefits again. See this post for more about Platinum card benefits: Amex Platinum Complete Guide.

Here are the benefits that matter to me:

Welcome Bonus

- 100K points after $5K spend in your first 6 months.

- 10X points at U.S. Gas Stations and U.S. Supermarkets, on up to $15,000 in combined purchases, during your first 6 months.

COVID Credits

- $20 per month cell service rebate through December 2020

- $20 per month streaming service rebate through December 2020

Standard Credits

- $200 airline fee credit: Amex automatically reimburses up to $200 per calendar year for airline fees for your selected airline only.

- $200 in Uber & Uber Eats Credits: Amex reimburses $15 per month ($35 in December) for Uber & Uber Eats charges.

- $100 in Saks Fifth Avenue Credits: Up to $50 in credits each year from January through June; and another $50 July through December.

- Variis by Equinox: $25 back each month in statement credits (up to 9 uses / $225 back).

With all of the above combined (except the Equinox credits, which I probably won’t use), here’s how much I could earn in the next 12 months:

- 250K Membership Rewards points (100K from the bonus plus 150K from 10X spend). Since I have the Schwab Platinum card and since that card allows for cashing out points at 1.25 cents each, the 250K points are worth at least $3,125 to me.

- $80 in COVID credits.

- $400 in airline fee rebates ($200 in 2020 plus $200 in 2021)

- $250 in Uber & Uber Eats credits ($50 in 2020 plus $200 in 2021)

- $150 in Saks credits

Total: $4,005 if I cash in the points. Or 250K points + $880. Either way, it’s a fantastic haul for a $550 card!

My Spend Calendar

Here’s how I hope to get all of those points and credits. I’m assuming that I’ll spend $2500 per month at U.S. Gas Stations and U.S. Supermarkets for the first 6 months to max out the $15K of 10X earnings. This equates to about $600 per week. That’s more than I usually spend, but I’m hoping that it will be OK to mix in a gift card now and then with my purchases. Amex doesn’t like people to run up spend by buying gift cards, but my hope is that they’ll be OK with the occasional gift card thrown in with regular groceries.

Nov and Dec 2020 Spend:

- Spend $200 on airline fees (award fees)

- Spend $50 at Saks.com (I’ve always been able to find a nice present for a family member in the sale section)

- November 2020

- Spend $2500 at grocery stores & gas stations

- Pay $20 towards phone service (AT&T)

- Pay $20 towards streaming services (Youtube TV)

- Spend $15 with Uber Eats (Already done! I ordered delivery last night)

- December 2020

- Spend $2500 at grocery stores & gas stations

- Pay $20 towards phone service (AT&T)

- Pay $20 towards streaming services (Youtube TV)

- Spend $35 with Uber Eats

2021 Spend:

- Spend $200 on airline fees (award fees)

- Jan – June 2021

- Spend $50 at Saks.com

- January 2021

- Spend $2500 at grocery stores & gas stations

- Spend $15 with Uber Eats

- February 2021

- Spend $2500 at grocery stores & gas stations

- Spend $15 with Uber Eats

- March 2021

- Spend $2500 at grocery stores & gas stations

- Spend $15 with Uber Eats

- April 2021

- Spend $2500 at grocery stores & gas stations

- Spend $15 with Uber Eats

- May 2021

- Spend $15 with Uber Eats

- June 2021

- Spend $15 with Uber Eats

- July – December 2021

- Spend $50 at Saks.com

- Spend $15 with Uber Eats each month, and $35 in December before cancelling the card.

Wrap Up

We’ve seen a lot of amazing offers recently, but this one is super-special. If you do it right, it’s possible to earn 250,000 points with $15K spend in 6 months! If you can’t spend that much, it’s still a great offer. Suppose, for example that you spend $300 per week on gas and groceries. In 26 weeks, that would amount to $7800 spend earning 10X points. Between the 10X offer and the 100K welcome bonus, you would earn a total of 178,000 points with only $7,800 spend! That’s insane.

What if you aren’t targeted for the 100K offer? Well, the 75K offer with $300 restaurant credits is insanely good too!

![[Update] E*Trade account now qualifies for American Express Platinum Card® Exclusively for Morgan Stanley](https://frequentmiler.com/wp-content/uploads/2025/11/Morgan-Stanley-Platinum-card-etrade-218x150.jpg)

I was able to sign up for the card with the 100k offer. Just met the 15k spend with all but a few dollars coding as grocery. I did a test on a vendor we use to make sure it coded properly and then used this card for 2 weeks of purchases. It took about 3 days from the last charge and all my points posted. Sweet Deal!

Amex Gold card normally has a $100 airline fee credit (akin to Platinum’s $200 airline fee credit). I got a free Gold card for my wife as an AU on my new Platinum card. Would she also get a $100 airline fee credit in addition to the $200 that I get on my Platinum? Does it stack that way?

No, the Gold cards that you get free as AUs with Platinum cards do not have any of the real Gold card perks.

Gotcha. Thanks!

Hi Greg, you might want to elaborate in bold that if you do not enroll your card first via the online Amex interface’s “Benefits” section, you will not get the SAKS $50 credit! Almost made that mistake. A bit deceptive on the part of Amex. You have to enroll in this SAKS benefit yourself prior to the actual SAKS purchase

FYI — UberEats did not work on my phone for 30 mins and kept crashing after I made several different types of orders at least 7-8 times. Then I realized that I could also order via the UberEats online website and that worked immediately! Make sure to use your Amex cash bonus balance and not your default saved credit card to pay.

Make sure to Google for Saks coupons before spending your free $50. Just managed to get two coupons to work together (a 15% off and a Free Shipping)

And I missed out in going to the SAKS site through a portal (e.g., TopCashBack) or else would have been a triple combo!

Hi Greg,

I’m curious to hear how your 10x spend is going. Approximately what % of your grocery/gas purchases are gift cards?

So far the only gift cards I’ve bought were with a local grocery chain that was doing a Cyber Monday deal. I bought almost $500 worth of gcs for that deal. So, I’d say I’m far behind on my plan so far. Honestly I don’t mind if I don’t maximize the 10X deal fully.

Thanks Greg! And thanks for answering the question on the live “ask us anything” session yesterday too. I think I might slip in a $50 or $100 amazon GC when I do some regular shopping later today. Doing that on occasion seems safe enough.

[…] My plan for maximizing the incredible Amex Platinum offer […]

As a new AMEX platinum owner, that also has a nice amex offer on purchase of amex gift cards, this brings up 2 questions:

1- regarding points earning: with all of the clawbacks AMEX has been doing on GC purchases, will the purchase of these (via the amex website) earn points? Or will the RAT team take it back?

2- regarding liquidation: when used on line do these work as credit or debit cards (respective fees are significantly different as you are aware)? I see various blog articles with differing information, albeit nothing recent.

I checked your article https://frequentmiler.com/amex-gift-cards-qa/

but I did not see those answers in there

Thanks!!

per chat with amex rep:

1- buying amex gift cards do not count towards SUB or earn points

2- these gift cards code as credit cards when used on line

As far as the annual airline fee credit, can you select an airline for 2020, use the $200 then switch to a different airline in January for the second $200?

Yes

Uh-oh. I got the offer. When you say “Gift Cards” is that referring to any cards, including ones of the grocery store/gas station I’m purchasing from? Or just those that have MasterCard/Visa numbers?

All gift cards, not just Visa/MC

Greg, you inspired me to give it a shot. I cxl’ed my Platinum Vanilla in Sept 2015. Did not get any popup. We shall see..

“With this offer (and with most Amex offers), you can’t get the card if you already have the card or have had it in the past.”

What gives you this impression? Per Amex, you’re not eligible for the bonus if you’ve had the card in the past, but there’s nothing stopping you from being approved for the card.

You’re right, it’s the bonus that’s the issue. I’ll update.

Fingers crossed that you get the bonus! We’re all rooting for you.

I got the 100K, but my wife couldn’t. My wife is traveling on AA to Punta Cana with a friend next month with a 2ish hour layover in CLT. Is there anything I can do with my credits/benefits to get them lounge access in CLT? I know the Centurion would check the name on the card and she’d likely be denied, but can she purchase access elsewhere like the Admirals lounge and I receive credit back? Sorry, new to the platinum.

If your interest in getting your wife a card is lounge access (rather than earning the second bonus), get an authorized user card for her. Three users for $175 including lounge access is a better deal than paying a full annual fee.

Hi greg

Will the authorized users on the gold card also get 10X on gas and groceries?

Will the gold and platinum points add up to reach the 250,000 goal?

Thanks

Yes

[…] 6 months, you’ll want to make sure to use your Platinum card for those purchases (see also my plan for maximizing the incredible Amex Platinum offer). But, the card offers many, many more perks beyond the welcome bonus. Here’s what to do to […]