Thanks to the almost unbelievably good welcome bonuses that have been available in recent times for both consumer and business Platinum cards, I expect that many readers have a Platinum card of one type or another. Here’s a checklist of things to do to get great value from your Platinum card.

For more details about Platinum cards, see these posts:

- Platinum Forever Free (After Rebate)

- How to use your Amex Point fortune

- Amex Membership Rewards sweet spots

- Amex Transfer Partners: Which are Best?

- Amex Platinum Complete Guide

- Don’t want to pay that $695 annual fee? Here’s the strategy before you cancel.

And now, back to maximizing value from your Platinum card…

#1 Become elite

Platinum Amex cards offer a number of elite status upgrades, but you have to actively enroll in each one:

- Hilton Honors Gold Status: Hilton Gold members receive free breakfast (or food & beverage credits), room upgrades when available, and other perks at Hilton hotels. To get Gold status, go to benefit page, find the Hilton Honors Gold benefit, and click “Enroll Now”.

- Marriott Gold Status: Marriott Gold members receive a points welcome gift with each stay, room upgrades when available, 2pm late checkout, and other perks (details here). To get Gold status, go to benefit page, find the Marriott Bonvoy Gold benefit, and click “Enroll Now”.

- National Car Rental Executive status: Book midsize cars and select any car from the Executive Aisle for no extra charge. This can be a really valuable perk. Don’t pass this one up. Enroll here.

- Hertz President Circle status: Guaranteed one-class upgrade and the ability to pick any vehicle from the President’s Circle section. Also gives complimentary use of Hertz Valet, a terminal drive-back service at participating locations, up to four times per year. Enroll here.

- Avis Preferred Plus: Complimentary upgrade when available every time you book and additional Avis Preferred points for every qualifying dollar you spend. Use your Platinum AWD discount code A756900 to receive discounts off your rental. Receive a free 2-day weekend rental coupon after 2 completed qualifying rentals from Avis of 2 or more days each in a 6-month period. Enroll here.

- Uber VIP: Add your consumer Platinum card to your Uber account to become an Uber VIP. Read more about this in the next section.

- Neiman Marcus InCircle: Your Platinum card qualifies you to join the InCircle program. With this program, you can earn InCircle points for spend at Neiman Marcus, Bergdorf Goodman, Last Call and Horchow. More details can be found on the Platinum benefits page. Note that from August 15, 2024, you’ll no longer be able to enroll in this benefit. Card Members enrolled by August 14, 2024 can continue earning InCircle points and maintain InCircle status through December 31, 2024.

#2 Enhance your travel experiences

Platinum cards offer many perks that make traveling easier, cheaper, and better…

- Global Entry: Sign up! Platinum cards offer full reimbursement of the Global Entry signup fee once every 4 years. Global Entry includes TSA Pre-Check, so you’ll speed through security on domestic flights, and speed through re-entry to the US thanks to Global Entry. Sign up for Global Entry here. Pay the $100 with your Platinum card. Reimbursement should happen automatically. If you already have Global Entry, you can use your card to pay for a friend or family member’s Global Entry instead.

- Access Delta SkyClubs (when flying Delta), Amex Centurion Lounges, Escape Lounges, and Airspace Lounges: Simply bring your Platinum card with you when you travel. Delta SkyClub access is free only for the Platinum cardholder. You can currently bring two free guests with you to the other lounges: Amex Centurion Lounges, Escape Lounges, and Airspace Lounges. Note that since Feb 2023, guest access to Centurion Lounges has been restricted. See this post for details. Starting Feb 1, 2025 access to Delta SkyClubs is limited to 10 SkyClub visit-days per year unless cardmember has spent $75K in the current or preceding calendar year. See this post for details.

- Airport Lounge Access via Priority Pass Select: This version of Priority Pass Select membership allows you and 2 guests free entrance to participating lounges, but does not include non-lounge Priority Pass benefits (neither Priority Pass participating restaurants nor Be Relax spas are included). You must sign up for Priority Pass Select to get this benefit. Go to the Amex benefit page, look for the “Global Lounge Collection,” and click “Enroll”. You will receive a membership card by mail. Present your Priority Pass card and boarding pass at the lounge entrance. NOTE: If you have one of the very few remaining non-Amex cards that offer free Priority Pass Select membership which also provide access to free meals at participating Priority Pass restaurants and free massages at Be Relax spas, I recommend enrolling through that card instead.

- Uber / Uber Eats Credits and VIP Status: Add your consumer Platinum card to your Uber account in order to get $15 in Uber / Uber Eats credits per month and $35 in December. Adding your card also gives you Uber VIP status which is supposed to automatically connect you with top rated drivers in select cities. The Uber benefit is not available to Business Platinum cardholders.

- Cruise Benefits: Pay for your cruise with your Platinum card and receive $100 to $300 per stateroom shipboard credit plus additional amenities unique to each cruise line. Participating cruise lines and other info can be found here.

- Book hotels through Fine Hotels & Resorts or The Hotel Collection: Get elite-like perks and hotel credits by booking through Amex here. Consumer Platinum cards also offer $200 per calendar year in rebates for prepaid bookings with Fine Hotels & Resorts or The Hotel Collection. Find available hotels, by destination, here. More details about these credits can be found below. MaxFHR can also be a useful tool for finding low-priced properties.

- International Airline Program: Get access to savings on international First, Business and Premium Economy fares on participating airlines with American Express Travel®. There’s a limit of 8 tickets per booking and flights have to both originate from the US and return there.

#3 Earn $200 back on prepaid hotel bookings each year

This benefit is available via all consumer Platinum cards, but not Business Platinum cards. Get $200 back in statement credits each calendar year on prepaid Fine Hotels + Resorts or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card. Note that most prepaid bookings are fully refundable. One awesome aspect of these bookings is that you can add your hotel chain loyalty number in order to earn hotel points and receive elite benefits. That’s extremely unusual for 3rd party hotel bookings, especially when they are prepaid!

Booking a 2-night or longer stay through The Hotel Collection gives you $100 in hotel credits to spend on qualifying dining, spa, and resort activities; plus a room upgrade when available.

Booking any Fine Hotels & Resorts stay, even a 1-night stay, will give you noon check-in (when available), room upgrade upon arrival (when available), daily breakfast for two, guaranteed 4pm late check-out, complimentary Wi-Fi, and a special amenity unique to each property. Find participating hotels, by destination, here.

See also: Find your own Fine Hotels & Resorts deals.

#4 Earn $200 in Airline Fee Credits each calendar year

Airline fee credits are supposed to be for incidental fees: checked bags, change fees, in-flight snacks, etc. However, in practice, many small purchases (under $200 or so) charged by your selected airline receive the credit. This often includes award booking fees, for example. You must select your preferred airline before these charges hit your account in order to get reimbursed.

- Go to your card’s benefits page and click “Select a Qualifying Airline”.

- Spending up to $200 on airline incidental fees with your chosen airline each calendar year.

For details about which charges are likely to be reimbursed, please see: Amex Airline Fee Reimbursements. What still works?

#5 Earn up to $189 per calendar year in CLEAR credits

CLEAR is a service that uses your eyes or fingerprints to confirm your identity. This is used at many airport and some stadiums to help you speed through security checks. CLEAR isn’t yet available at all airports in the US, but thanks to partnerships with Delta and United, CLEAR is rapidly expanding.

At supported airports, CLEAR makes it possible to skip the sometimes very long ID check lines (just before security). Instead, of waiting to show your ID, you can go to the CLEAR aisle (where available) and simply scan your eyes or fingerprints.

Use your Platinum card to pay for CLEAR to receive up to $189 back each year.

#6 Use $200 in Uber credits each calendar year

This benefit is available via all consumer Platinum cards, but not Business Platinum cards. Add your consumer Platinum card as a Payment Method to your Uber account in order to get $15 in Uber credits per month and $35 in December. You don’t have to pay with your Platinum card in order to use this benefit.

Uber Eats: Another great way to use these credits is to order food delivery through Uber Eats. Enter your location in the Uber Eats website to find out if delivery is available in your area. You can also save on delivery fees by placing a pickup order.

Those who ride Uber often, or order through Uber Eats often, will likely have no problem in getting full value from this perk. Alternatively, if someone in the household other than the primary cardholder is a frequent Uber rider or Uber Eats eater, consider adding your card to their Uber account instead of yours.

If you are new to Uber Eats, you can use our code at check-out to get $20 off your first Uber Eats order of $25 or more: eats-uberfrequentmiler

Note that the credits get added as Uber Cash which is how Uber gift card get loaded too. Uber will sometimes choose to redeem your non-expiring gift card credits first rather than your expiring Amex Platinum credits, so keep an eye on that.

#7 Get $20 per month back in rebates on select digital entertainment services

This benefit is available via all consumer Platinum cards, but not Business Platinum cards.

Earn up to $20 per month in credits for subscriptions to Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enroll here and then setup the service to charge your Platinum card monthly. Note that the maximum rebate is $20 altogether — you do not get up to $20 per service.

You can often earn rewards when subscribing to these services after clicking through a shopping portal. Most of these services also offer a discounted subscription in the first year. At the end of that year, you can often chat to them online or over the phone and get a discounted retention offer.

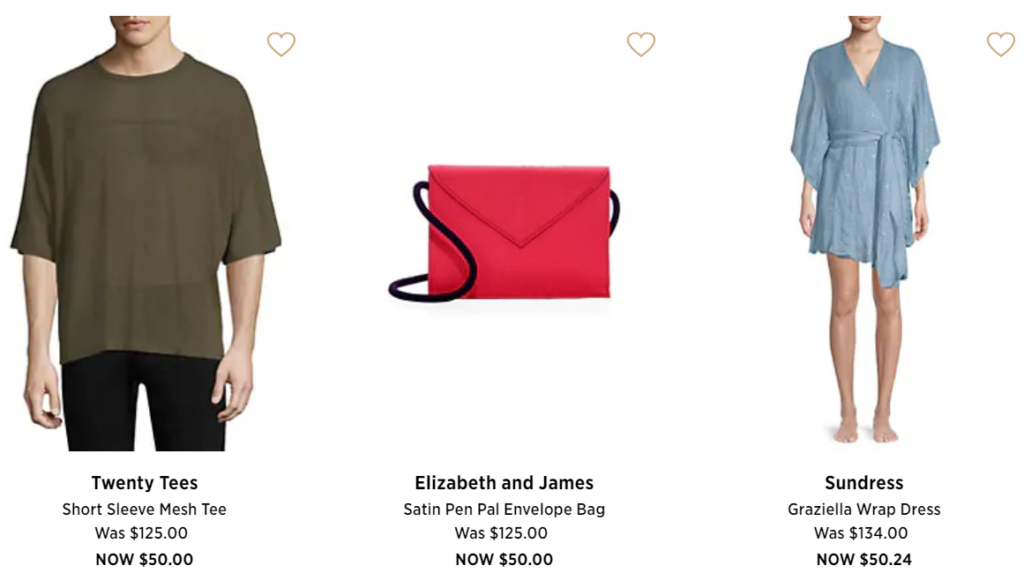

#8 Earn up $100 per year in rebates at Saks Fifth Avenue

This benefit is available with all consumer Platinum cards, but not Business Platinum cards. Use your card to shop at Saks Fifth Avenue, either in-store or online, and get $50 statement credit for purchases made from January through June, and another $50 statement credit from July through December.

- Go to your card’s benefits page and enroll in the “Shop Saks with Platinum” benefit.

- January – June:

- Use your consumer Platinum card to make a purchase at Saks Fifth Avenue in-store or online.

- Up to $50 should be credited to your account automatically.

- July – December:

- Use your consumer Platinum card to make a purchase at Saks Fifth Avenue in-store or online.

- Up to $50 should be credited to your account automatically.

Personally, I’ve had good luck getting nice $50-ish items twice a year from the saksfifthavenue.com sale section. However, be aware that there’s now a minimum purchase requirement of $300 in order to get free shipping.

Portal Rewards

Before shopping at Saks online, start your shopping on an online shopping portal to earn extra rewards. Cashback Monitor is a great tool for finding the best current reward opportunities.

Many portals offer signup bonuses when you first shop through the portal, as well as miscellaneous spend bonuses throughout the year. Shopping at Saks, even if you don’t want anything, can be a great way to trigger those bonuses.

Rakuten also sometimes gives 10x-20x returns when clicking through from their portal, particularly over the holidays.

#9 Get ShopRunner for Free

ShopRunner is a service offered for free to all US Amex cardholders. Once enrolled, you get free shipping from a number of stores. Register for ShopRunner here.

#10 Get Walmart+ for Free

This benefit is available with all consumer Platinum cards, but not Business Platinum cards. There is no need to enroll.

Use your consumer Platinum card to pay for a monthly (not annual) Walmart+ membership and your entire charge will be refunded each month. Walmart+ offers many perks including the following:

- Free Paramount+ subscription: This can be a very useful benefit if this streaming service has shows you want to watch.

- Black Friday Early access: Shop Black Friday deals 4 hours before everyone else.

- Free shipping: No order minimum. Excludes oversized and Marketplace items.

- Free delivery from store: Groceries & more delivered as soon as same day. $35 order minimum.

- Rx for less: “Get select prescriptions for as little as $0. Save up to 85% on thousands more”.

- Member prices on fuel: Save 10¢ per gallon on fuel at Exxon, Mobil, Walmart & Murphy stations.

- Scan & go: Scan items as you shop in stores and pay with your phone.

Sign up here for Walmart+ (Note: this is an affiliate link, but it’s not at all clear to me that we will earn anything from this).

#11 Get back up to $300 annually at Equinox Or For A SoulCycle At-Home Bike

This benefit is available with all consumer Platinum cards, but not Business Platinum cards. Primary cardholders and authorized users are eligible to receive up to a total of $300 in statement credits per each calendar year on an Equinox+ subscription or an Equinox club membership (subject to auto-renewal). Plus, get $300 back when you purchase a SoulCycle at-home Bike in full. Enroll here.

#12 Earn 5x for airfare and prepaid hotels

Consumer Platinum cards earn 5 points per dollar for flights booked directly with airlines or with American Express Travel. The Business Platinum card earns 5X only for flights booked with American Express Travel. All Platinum cards earn 5x for prepaid hotels booked at amextravel.com. Note that some prepaid hotels are fully refundable (make sure to check before booking!).

5 points per dollar is an excellent rate of return for travel purchases! With flights, keep in mind that this is in addition to any miles earned from the airline flown. With hotels, you won’t earn hotel points with prepaid bookings except for those booked through Fine Hotels & Resorts or The Hotel Collection.

One caveat: Platinum cards offer good travel insurance, but you may get even better automatic travel insurance with other cards you own. See: Ultra-Premium Credit Card Travel Insurance.

#13 Get good value redeeming points for flights (Business Platinum only)

The Business Platinum card offers 35% points back when paying with points through American Express Travel for a flight with your selected airline. Cardholders will also receive this benefit when booking a first or business class ticket with any airline. This perk makes your Membership Rewards points worth just over 1.5 cents per point towards paid flights.

Consumer Platinum cards do not get this benefit, so using points to pay for flights results in poor value (1 cent per point).

#14 Use points primarily with transfer partners

The best use of Membership Rewards points, in my opinion, is to hold on to them until you see an opportunity to get great value by transferring to an airline transfer partner such as Aeroplan or ANA for Star Alliance flights (e.g. fly Air Canada, ANA, Turkish, United, etc.). Cathay Pacific, Virgin Atlantic, and other partners also have some excellent sweet spot award opportunities.

See these posts for ideas:

#15 Use your Amex Offers

Amex regularly comes out with awesome offers that can be loaded to your Amex card. See our list of all current Amex Offers that gets updated frequently.

The Platinum Perk Checklist

Here’s a nearly complete list of Platinum perks. Go through each one to make sure you’re getting the most from your Platinum card…

Perks for all Platinum cards

| Benefit | How to access or enroll | Available to Platinum Authorized users? |

|---|---|---|

| 5X points through American Express Travel® : Earn 5X points for prepaid hotel and airline bookings via American Express Travel® | This benefit is automatic. | Yes. Points and bonus points are added to the primary card holder's account. |

| $200 airline fee credit: Amex will automatically reimburse up to $200 per calendar year for airline fees for your selected airline only. Eligible fees include: baggage fees, flight-change fees, in-flight food and beverage purchases, and airport lounge day passes. | Log in and go to Benefit page and click “Select a Qualifying Airline”. For tips on using this benefit, please see: Amex airline fee reimbursements. What still works? | No. Spend on authorized user cards does count, but only $200 per year will be reimbursed altogether. |

| Airport Lounge Access - Centurion Lounges, Airspace Lounges, Escape Lounges, Plaza Premium Lounges: Cardholder is allowed free in Centurion Lounges. In most cases guests will be charged $50 each (details here). Cardholder plus two guests are allowed free in Escape, Airspace, and Plaza Premium Lounges. | No need to enroll. Simply show your Platinum card when visiting a Centurion Lounge. | Yes |

| Airport Lounge Access - Delta Sky Clubs: Cardholder is allowed 10 Sky Club visit-days per year (unless cardmember has spent $75K in a calendar year). | No need to enroll. Simply show your Platinum card and same day boarding pass when visiting a Delta Sky Club. | Yes |

| Airport Lounge Access - Priority Pass Select Lounges: Priority Pass Select member plus two guests are allowed free entrance. Unfortunately, this membership does not include Priority Pass restaurants. | You must sign up for Priority Pass Select. Go to benefit page and click “Enroll in Priority Pass”. You will receive a membership card by mail. Present Priority Pass card and boarding pass at lounge entrance. | Yes. Each authorized user must sign up for Priority Pass Select. |

| Airport Lounge Access - select Lufthansa Lounges | Free access to Lufthansa Business Lounges (with confirmed ticket) or to Senator Lounges (with Business Class ticket) in the satellite building of Terminal 2 at Munich Airport and in Terminal 1, Departure Area B, at Frankfurt Airport. Valid only when flying Lufthansa, SWISS or Austrian Airlines. | Yes |

| Cell Phone Protection: Max $800 per claim, $50 deductible. | No need to enroll. Pay your cell phone bill with your Platinum card. | Yes |

| CLEAR® Plus credit: Get up to $209 per year reimbursed for CLEAR® Plus subscriptions. Business Platinum cards get a $209 credit; personal Platinum cards get a $199 credit. | No need to enroll. Pay for CLEAR® Plus with your Platinum card. See also: 5 ways to get CLEAR® Plus for less. | No. Spend on authorized user cards does count, but only up to $209 per year will be reimbursed altogether. |

| Global Entry or TSA Pre fee credit: Full reimbursement for signup fee once every 5 years, per card. Note: signup for Global Entry since that includes TSA Pre. | Sign up for Global Entry here. Pay with your Platinum card. Reimbursement should happen automatically. | Yes. Pay with the authorized user card in order to get reimbursed. Terms state “Additional Cards on eligible Consumer and Business accounts are also eligible for the $120 statement credit”. This works with no fee Green and Gold authorized user cards too. |

| Emergency Medical Transportation Assistance | Call the Premium Global Assist Hotline: 1-800-333-Amex (toll free), or 1-715-343-7977 (direct-dial collect) | Yes |

| Hilton Honors™ Gold Status: Hilton Gold members receive free breakfast, room upgrades when available, and other perks at Hilton hotels. | Go to benefit page, find the Hilton Honors Gold benefit, and click “Enroll Now”. | Yes. Authorized users may have to call Amex to enroll. |

| Marriott Gold Status: Marriott Gold members receive a points welcome gift with each stay, room upgrades when available, 2pm late checkout, and other perks (details here). | Go to benefit page, find the Marriott Gold benefit, and click “Enroll in Marriott Gold”. | Yes. Authorized users may have to call Amex to enroll. |

| International Airline Program: Save money when booking premium cabin international flights originating in the US or Canada. | Book your flight through American Express Travel®. Make sure to log into your Amex account to see flight discounts. | Yes |

| Fine Hotels + Resorts®: Book high-end hotels through Amex Fine Hotels + Resorts and get: room upgrade, daily breakfast for 2, 4pm late checkout, noon check-in, free wifi, and unique property amenity. Also: Earn 5X Membership Rewards for prepaid bookings. | Browse to www.americanexpressfhr.com and log into your Platinum account. | Yes |

| National Car Rental Executive status: Book midsize cars and select any car from the Executive Aisle for no extra charge. | Enroll here. | Yes |

| Hertz Rental Car Privileges: President's Circle Status, discounts, plus four hour grace period for rental car returns. | Details and enrollment form found here. | Yes |

| Avis Preferred status: Priority service at the counter, discounts on rentals and a one car class upgrade for groups C-E (Intermediate, Standard, and Full size) | Details and enrollment form found here. | Yes |

| Cruise Benefits: Pay for your cruise with your Platinum card and receive $100 to $300 per stateroom shipboard credit plus additional amenities unique to each cruise line | Detailed terms can be found here. | Yes |

| ShopRunner: Free shipping at a number of merchants. | Sign up here. | Yes |

Additional Consumer Platinum Perks

| Benefit | How to access or enroll | Available to Platinum Authorized Users? |

|---|---|---|

| $200 in Uber / Uber Eats Credits: Amex will reimburse $15 per month ($35 in December) for Uber charges. You will also get Uber VIP status. | Add your Platinum card number to your Uber account as a payment method. You do not have to pay with the Platinum card in order to get this benefit. Important: when requesting a ride, select Uber Cash for payment in order to use your credits. | No. Authorized user cards do not receive their own $200 in Uber credits or VIP status. |

| $200 Hotel Credit: Get $200 back per calendar year towards prepaid Fine Hotels + Resorts or The Hotel Collection bookings | No need to enroll. Book through American Express Travel® and pay with your Platinum card. Hotel Collection bookings require a minimum two-night stay. | No. Spend on Authorized user cards does count, but only $200 per year will be reimbursed altogether. |

| $240 Digital Entertainment Credit: Up to $20 per month rebate for select digital entertainment services (Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal) | Enroll here. Enroll in any of the listed services and pay with your Platinum card. | No. Spend on Authorized user cards does count, but only $20 per month will be reimbursed altogether. |

| $100 in Saks Fifth Avenue Credits: Up to $50 in credits each year from January through June; and another $50 July through December. | Enroll here. Pay with your consumer Platinum card at Saks Fifth Avenue online or at locations in the US and US Territories. | No. Spend on Authorized user cards does count, but only $50 per 6 months will be reimbursed altogether. |

| Free Walmart+ Subscription: Get back the full cost, including taxes, for a Walmart+ monthly subscription. | No need to enroll. Use your Platinum card to pay for a monthly Walmart+ subscription. | No. You can use an Authorized user card to pay, but you won't get more than one credit per month. |

| $300 Equinox Credit: Get $300 back per year in statement credits for a digital or club membership at Equinox. There is a yearly option for Equinox+ (the app) membership that is $300 annually. | Enroll here. Use your Platinum card to pay for a digital or club membership at Equinox. | No. Spend on Authorized user cards does count, but only $300 will be reimbursed altogether. |

| $300 SoulCycle Rebate: Charge the full price of a SoulCycle at-home bike and get $300 back in statement credits. | Must join Equinox first (see above). | Sort of: Each Platinum account can get $300 back on each of 15 bikes purchased per year. |

| 5X points on flights booked directly with airlines. With business cards you must book through American Express Travel® to get 5X. | Automatic benefit | Yes. Points and bonus points are added to the primary card holder's account. |

| Active Military Fee Waiver: Amex will waive consumer card fees (including annual fees) for US active military personnel. | Call the number of the back of your card and tell them you are serving on active duty military and had heard that AMEX offers to handle your account in accordance with the Military Lending Act (MLA) | Yes (primary user must call and can get fees waived for additional cardholders) |

Additional Morgan Stanley Platinum Perks

| Benefit | How to access or enroll | Available to Platinum Authorized Users? |

|---|---|---|

| First authorized user free: Add one Platinum authorized user for free. Additional AU's are $195 each. | Simply add an authorized user to your account | N/A |

| Invest with rewards: Liquidate Membership Rewards points for 1 cent each when deposited to your Morgan Stanley brokerage account. | Log into your account to redeem points to your brokerage account. | No. |

| $500 anniversary spend award: Spend $100K in a cardmember year to get $500. If you spend exactly $100K per year, that amounts to a bonus of half of 1 cent per dollar spent. | This benefit is automatic | Not really. Authorized user card spend does contribute towards the required $100K spend, but authorized users do not get their own $500. |

| $695 Annual Engagement Bonus: Platinum CashPlus clients can get a $695 Annual Engagement Bonus. | Details here: Morgan Stanley Platinum Card Fee Free (how to earn the Annual Engagement Bonus) | No |

Additional Schwab Platinum Perks

| Benefit | How to access or enroll | Available to Platinum Authorized Users? |

|---|---|---|

| Invest with Rewards: Liquidate Membership Rewards points for 1.1 cents each when deposited to your eligible Schwab account. | Log into your account to redeem points to your Schwab account. | No. |

| $100 to $1,000 statement credit | Receive a statement credit each year based on your qualifying Schwab holdings: $250,000 invested = $100 statement credit; $1,000,000 invested = $200 statement credit; $10,000,000 invested = $1,000 statement credit | No. |

Additional Business Platinum Perks

| Benefit | How to access or enroll | Available to Platinum Employee Cards? |

|---|---|---|

| 1.5X points per dollar: Earn 1.5X on individual purchases of $5000 or more; and on select categories: Construction material & hardware, Electronic goods retailers and software & cloud system providers, and Shipping providers | Automatic | Yes. Points and bonus points are added to the primary card holder's account. |

| $1,150 in Dell Credits: Up to $150 in credits each calendar year, plus an additional $1,000 back when spending $5,000 in a calendar year | Go to benefit page to enroll. | No. Employee cards do not receive their own Dell credits. |

| $200 in Hilton Credits: Up to $50 per quarter when you use your card directly with a Hilton property. | Go to benefit page to enroll. | No. Employee cards do not receive their own Hilton credits. |

| $120 in Wireless Credits: Up to $10 per month when you use your card to pay for wireless telephone service. | Go to benefit page to enroll. | No. Employee cards do not receive their own wireless credits. |

| $360 in Indeed Credits: Up to $90 per quarter for purchases with Indeed | Go to benefit page to enroll. | No. Employee cards do not receive their own Indeed credits. |

| $250 Adobe Credits: $250 per year on $600+ of U.S. purchases with Adobe | Go to benefit page to enroll. | No. Employee cards do not receive their own Adobe credits. |

| 35% points rebate on airfare: Pay with points for airfare on your selected airline or (until September 18, 2025) for business or first class with any airline and get 35% of your points back. | Book flights through American Express Travel® and select to pay with points. | No. |

| Cash out points for 1 cent each when combined with a Business Checking account | Automatic | N/A |

[…] When it comes to the American Express Platinum Card, I’d have to describe our relationship status as “complicated.” While I can get a decent return on the $695 annual fee, it requires taking advantage of the plethora of statement credits. This is why some refer to the AMEX Platinum Card as one of the most expensive coupon books available. […]

The schwab $1000 annual statement credit is missing from the page. Offered for 10M+

IMO, the best approach for the average person is sign up, get SUB, close after one year. The amount of work involved to obtain said credits is not worth th minuscule gain after paying the ripoff $695 AF.

$240 digital entertainment credit — set and forget

$72 Paramount+ — via Walmart+ — set and forget

One Trip to Vegas, Baby!

$200 airline credit — if you know how to do it, one flight and you’re done

$200 hotel credit — single two-night stay

$100 hotel amenity — same stay

$150 breakfast credit — same stay

Not included are any other credits or the value of lounge access and food.

I’m not certain where the difficulty comes in for the average person. Any help would be appreciated.

While in Vegas, stop by Saks and claim a $50 gift card. Or if your visit happens to straddle the end of June and beginning of July (not recommended weatherwise), you can claim two!

That reminds me of the almost totally useless Saks benefit! I personally (yes, Lee I am talking abouy MYSELF) place a negative value on this benefit since Saks.com is a scam.

Booking through FHR is extra work and the amenities are worth half those values. My Hyatt Globalist and IC RA benefits are better and automatic. Using the (Delta add-collect) $200 credit is extra work. Keeping track of whether I have used many of these items yet each year is extra work. Dealing with the NYTimes changing my subscription price every few months is extra work. Dealing with AMEX replacing entertainment credit vendors (eg Sirius XM) is extra work. I have better things to do with my time. That said, I keep the card for the 5x on airfare because I spend tens of thousands on airfare, BUT I resent AMEX wasting my time to attain these other “benefits”.

Fiannl6y, lounge food isn’t good/makes you fat and lounges are no longer a respite from the terminal.

Ah, you are talking about YOURSELF. In your original comment, you referred to the average person. I was simply responding regarding the average person. What was I thinking ?

Regarding your circumstances, sounds rough. It’s hard to imagine someone having it that rough. I guess I’ve been lucky. All the best.

Going to Vegas once a year sounds horrific, especially staying at a hotel where $200 covers two nights. It’s like living in an ashtray for two days.

You appear to be digging in your heels. And, again, you are talking about YOURSELF. To the average person, Las Vegas might not be so bad. Nick goes there enough. I don’t think Nick would tolerate staying in an ashtray. However, it doesn’t need to be Las Vegas and a person is free to pick whatever destination suits them.

Lee, I am glad you enjoy Las Vegas. However, my initial advice stands — take the SUB and run unless you spend a lot on airfare.

Which hotel offers $100 hotel credit and $150 breakfast credit? Usually it’s $100 hotel credit and free breakfast for two.

I believe Fine Hotels and Resorts do not apply to Business Platinum. Thank you!

There is no $200 annual credit but you can still book FHR stays with a Bus Plat card.

Understand. Without the credit, not much of benefits to use the card.

Some people will have *either* the personal Platinum or the Business Platinum. And, they will regularly use the one they have. And, in spite of the BP not having the $200 annual hotel credit, some find the BP has greater overall value to their specific circumstances. For me, the BP is the most valuable card in my wallet.

Let’s not forget the Goldman Sachs version of the personal Platinum. 🙂

This is lacking a bit when some articles(more?) are from 2021, and outdated. An update to those articles would be great (e.g.- Qatar included in “sweet spots”)

Appreciating the amount of work that goes into such articles, we will patiently wait for those updates and will be grateful for this great article (which is FREE).

But, since you bring it up, the “family” SUB rules need to be added to the older articles. Also, regarding the Morgan Stanley version, the “entry-level” brokerage account is no longer a player for the annual fee credit. Also, the Cash Plus account required for the annual fee credit is paying 0.1 percent interest. On the required $25k balance, a person is losing roughly 5 percent compared to prevailing interest rates — which is $1250. In rough terms, prevailing interest rates need to be below 2.75 percent for the strategy to be cash flow positive. Fed Chairman Powell might say it will be a while before that happens.

Greg, if my annual fee is due January 9th, would I still be able to take advantage of the perks those first 9 days of the month and then downgrade my card? Can’t justify the AF but hoping to double dip into 2023. Thinking of airline credit, Saks, hotel credit.

Yes. In fact you have thirty more days before you can get the full annual fee back if you cancel or downgrade (fyi there is no fee free downgrade path so you’ll get back the difference in annual fees)

Thanks so much!! Going to get some good value out of it in January.

Greg, very much enjoy reading your informative posts! QQ on Hilton Honors Gold Status and Marriott Gold Status, with a situation here. I have two Biz Platinum cards, but P2 has zero. Can I use one card for my Hilton account / Marriott account, and use another card for P2’s Hilton account / Marriott account? Do Hilton / Marriott check names — if so, then it is a moot question. Thanks!

That might work but I’m not sure. OTOH, readers have reported success doing this with free Green AU cards. In other words, add P2 as an employee with a free business Green card and then have P2 sign up for Hilton and Marriott status.

The Equionx credit with platinum is $300 per year starting in 2023. Is it possible to get that credit on my Plat card and then switch to pay with P2 plat card to get the remainder of the total Equinox yearly cost?

I expect that would work if Equinox lets you split the payment that way.

We have gone from 6 Platinum cards during COVID and will be down to one (last AF just hit on my other Platinum-will PC to gold for upgrade bonus).

For many it no longer pays to have multiple Plats (FH&R consecutive stay language) Digital credits, changes to CL on arrival and no free guest.

The CL benefit has been disappointing over the past 18-24 months (with limited hours, overcrowding, no showers, Grab and Go, can’t visit Escape/CL same day (i.e. PHX if you have a long layover or delayed flight, etc).

We did use the Plaza Premium in CUN & LHR (before VenX offered it) so that was nice as few PP options at the terminals we flew from).

Will probably play the UG/DG bonus game with our Gold2Plat (the AF are about 6 months apart)

@Greg

Also The Platinum offers access to Plaza Premium (no longer included with Priorty pass – but it is also offered with VenX).

Greg, you might mention a benefit within a benefit: with WalMart+, one receives Paramount+.

For us, between the Platinum Card, Amazon, and T-Mobile we have:

Disney+ (with Hulu and ESPN)

Paramount+

Amazon Prime

Netflix

Who needs cable TV?

How exactly did people get the cruise credits without booking through Amex?

The major problem is that they do not give you the credit outright. They divide it up as compared to other cards. For example, uber is divided into monthly and then into rides or Saks is divided into $50 per 6 months. The other issue is that the $200 airline credit is not a travel credit making it less valuable. Cards like this need to consider being more general so cardholders feel they are getting more value. Rather than streaming include mobile phone credits or rather than a specific gym include gyms in general.

We like staying in 5-star hotels, so the FHR benefits alone pay for our annual fee. We just returned from a 3-night stay in NYC. The FHR rate we got at the Peninsula was as good as any I could find. I prepaid, so got the $200 credit, and could have canceled up until the day before arrival. The breakfast benefit was $112 per night x 3 = $336.We used the $100 hotel credit for lunch on arrival day. That’s $636 in savings right there. Plus, room was upgraded, we were able to check in at 11 am, and we had a late flight so the 4 pm checkout was awesome.

In the past we have hotel-hopped daily in Las Vegas in lower rate seasons to maximize our FHR benefits. With early check-in and late checkout, we were never “homeless” between hotels. With the low seasonal rates and all the free meals and credits, it felt like they were paying us to be there!

Mary, bingo. Some people get worked up about the annual fee. Some people feel they need to justify the card with the various credits. But, in actuality, if one uses it for FHR bookings and nothing else, the card more than pays for itself. Next time you’re in NYC, try the Mandarin Oriental for park views.