NOTICE: This post references card features that have changed, expired, or are not currently available

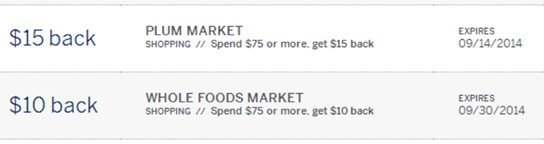

If you have an American Express credit card or charge card, then you’ll find a tab titled “Amex Offers for You” on your American Express online account. When I logged in recently I found two offers that I was particularly happy to see: $15 back with $75 or more spend at Plum Market (a small southeast Michigan and Chicago grocery chain); and $10 back with $75 or more spend at Whole Foods.

Between my wife and I, we currently have 12 Amex cards (not counting prepaid cards). That doesn’t mean we have 12 separate primary accounts, though. Instead, for most of my cards, I have a primary card and my wife has a free authorized user card on my account. Similarly, for most of my wife’s cards, I have an authorized user card. The great thing about Amex authorized user cards is that they are separately eligible for Amex offers.

Not all Amex Offers appear on all accounts. In this case, though, all 12 cards had the Plum Market offer and 11 had the Whole Foods offer. So, the first thing I did was log into my account and open a separate tab for each of my 7 cards. On each tab I made sure that the grocery store offers were visible, then I went from tab to tab to enroll each of my cards. I then logged into my wife’s account (shhh, don’t tell her I have her password) and repeated the process with her 5 cards. This multi-tab process was necessary because otherwise I wouldn’t have been able to register more than one card per person with each offer. For complete details about this (and other solutions), please see:

With 13 cards in my wallet, I went first to Whole Foods, to the customer service counter. There I explained that I wanted to buy a $450 gift card and a $375 gift card, and that I wanted to pay $75 at a time (yes, I really did). The customer service agent was happy to help. She swiped a gift card, typed in $75, and told me to go ahead and swipe my card, whereupon I swiped card #1. She repeated the process and I swiped card #2, etc.

We hit a small snag with payment #3. The register wouldn’t allow a third duplicate charge. We switched to another register for two more payments, but then alternated between $75 and $76 payments. During this whole process, emails were popping in from Amex thanking me for using my enrolled card. My wife was somewhat surprised to get similar emails as well. The result of this effort was that we now have two Whole Foods gift cards that were effectively purchased for 13.3% off, plus we’ll earn points from each rewards credit card used.

I then repeated the gift card buying process at Plum Market. The registers had no trouble with many repeated equal transactions. The result of this effort was that we now have two Plum Market gift cards that were effectively purchased for 20% off, plus we’ll earn points from each rewards credit card used.

As if grocery discounts weren’t enough, this past weekend I also noticed that Amex has a Twitter Sync Offer for $20 back with $100 or more spent at a Courtyard Marriott hotel (details here). I used my Amex Sync Machine to enroll using hashtag #AmexCourtyard. I didn’t have immediate plans to stay at a Courtyard, though, so I called a local Courtyard hotel to see if they sold gift cards. They did. The terms of the Sync Offer excludes gift cards, but I had a feeling that if I bought the gift card at the hotel it would still work. I hopped in my car and headed to the hotel. There, I bought a single $100 Marriott gift card (usable at any Marriott property worldwide). Immediately, I received email acknowledgment from Amex. It read (bolding is mine):

Thanks for using your synced Card!

Thank you for using your synced American Express® Card

ending in ….Look out for a 20.00 statement credit within 90 days.

Its clear from the email that I was right. Buying a gift card at a Courtyard hotel (at least, at this one) works with the Amex Sync promotion despite the terms saying otherwise.

Your turn

Amex “Offers for You” are hit or miss in that you may or may not get targeted for any given offer (Doctor of Credit explains more about this here). Amex Sync Twitter offers are better because its possible to enroll all of your cards including Amex Serve prepaid cards and Serve subaccounts. Please see these posts for info about syncing multiple cards with Twitter:

- Maximizing Amex Sync offers. Part 1: sync multiple cards

- Create an Amex Sync Machine

- More free cash from Amex via Serve subaccounts

- SyncAssist: Making AmEx Sync easy

When you find offers relevant to you, its often possible to maximize the deal by buying gift cards as I described above. For other ideas, please also see:

- Maximizing Amex Sync offers. Part 2: extreme savings

- Maximizing Amex Sync offers. Part 3: shopping elsewhere

- Maximizing Amex Sync offers. Part 4: forget shopping, get points and cash for free

A few current and useful Twitter offers include:

- #AmexWholeFoods (Spend $75, get $10 = 13.3% off)

- #AmexCourtyard (Spend $100, get $20 = 20% off)

- #AmexBestBuy (Spend $250, get $25 = 10% off)

- #AmexHilton (Spend $250, get $50 = 20% off) [No longer available]

Have you used any of the techniques described here, or innovated new ones? Please comment below. I’m especially interested in hearing if anyone has tried the gift card trick at a Hilton property?

[…] important tip: Frequentmiler reported in the past that the Whole Foods registers won’t allow three charges of the same amount, one […]

Hi Greg,

Do you know if I buy $250 worth of e-gift cards from best buy, will I get the $25 credit? I know e-gc’s are excluded in the terms, but so is with the walmart offer and I still got credit from the walmart offer.

Any thoughts? Thanks!

Since the terms specifically exclude e-gift cards, I don’t think those would work. Stick with physical gift cards. The Walmart offer doesn’t exclude gift cards, it excludes gift card reloads and prepaid cards.

[…] This is exciting because they ran a similar promotion in August with their Courtyard chain in which I found that one could buy gift cards and still get the rebate. That offer was: Spend $100 and get $20 back. During that promotion, I went to a nearby Courtyard hotel and bought $100 gift cards (good at any Marriott property). I paid for each $100 gift card with a separate enrolled Amex card and I got back $20 for each one. In other words, I bought Marriott gift cards for 20% off. Details of my experiment with that prior deal can be found here. […]

I went to near by courtyard hotel to purchase a gift card but they have only courtyard gift card ( Green color ), I am not sure whether this would counts. please let me now

Yes, those work. That’s what I bought. The Courtyard gift cards work at any Marriott

[…] On Friday morning, I went to my local Courtyard Marriott and bought 2 $100 Marriott gift cards to receive the $20 cash back offer (link). I will use these gift cards to pay for my stay at the FTU Advanced Marriott in Chicago. Thanks to Frequent Miler for the idea (link). […]

[…] My buddy Greg (aka Frequent Miler) was able to buy a physical gift card at his local Courtyard Marriott and receive the $20 statement credit (link). […]

@Marianna. Love to buy Kindle gift cards at Bestbuy. Works for everything on Amazon, so score. Bestbuy cashiers always assume I’m buying alot of books. Haha, I’m showrooming at BestBuy to buy on Amazon.

Does Best Buy sells gift cards for other merchants?

[…] otherwise, being that the Terms and Conditions explicitly exclude gift card purchases. However, FrequentMiler experimented and found that purchasing a $100 gift card at a Courtyard Marriot did trigger the […]

I love Amex sync offers and have 12 ccs between me and hubby and 2 Serve cards(me+hubby as sub-account). I used quite a lot of the sync offers and loving to see all those credit show up in my statements. But I do have one question: ALL my transactions are sync offers,100%!!! I am still working on meeting spending requirement of the Citi AA executive cards I snatched when the zombie came back to life. So I have zero purchase other than sync offer. Will Amex flag me because of this spending pattern?

I don’t think you’re in any danger. Amex has given you incentives to make these purchases so they’re unlikely to blame you for doing so.

@Jacinto I didn’t buy JCPenney GCs, but others that they sell such as Amazon.

Standing up. Auto correct! Grrr

Lol, I need a shoe-heel wallet to make me taller

With 13 cards in your wallet you were probably taller sitting down than stabbing up. 🙂

Great post and super ideas. Wish I had thought of going to the Courtyard!

I bought $50 GCs at Buca di Beppo and it worked as well.

@Jacinto I bought GCs at JC Penney last time there was an AmexSync and it worked great. Plan to do the same again. They have a variety of cards, often near the registers.

Thanks smittytabb.

Once you get JC Penney GCs, can you use them to buy VGCs or MCGCs?

It appears Dollartree.com only sells their own GCs, so maybe only opportunity is resale?

Thanks for the post. I don’t plan to do any real spending at whole Foods or Marriott, so just looking for MS opportunities. What about JC Penney amex offer [$50 – $10) or Dollartree.com ($101 – $20)? Maybe buy GCs there can be MSed?