NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

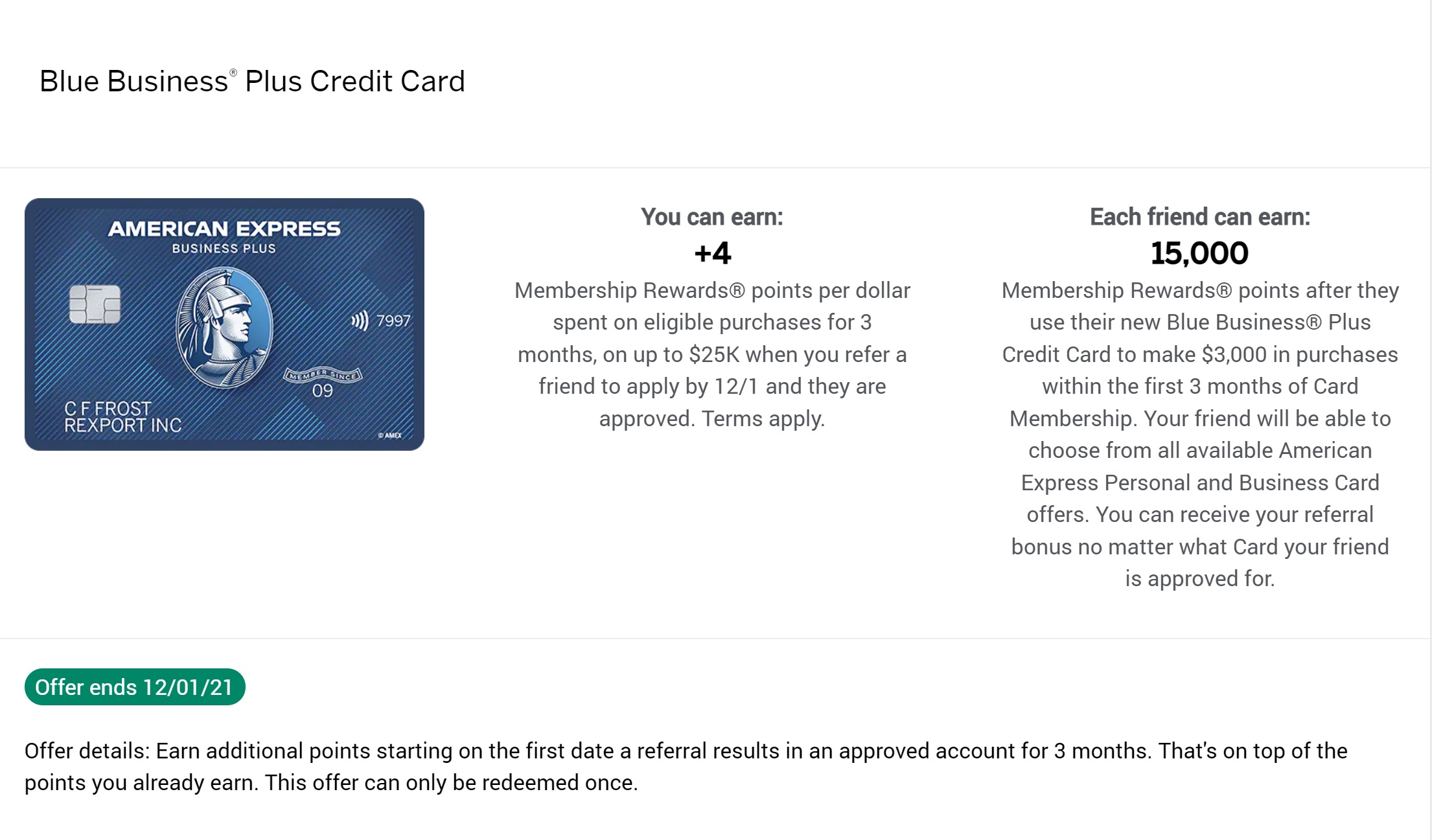

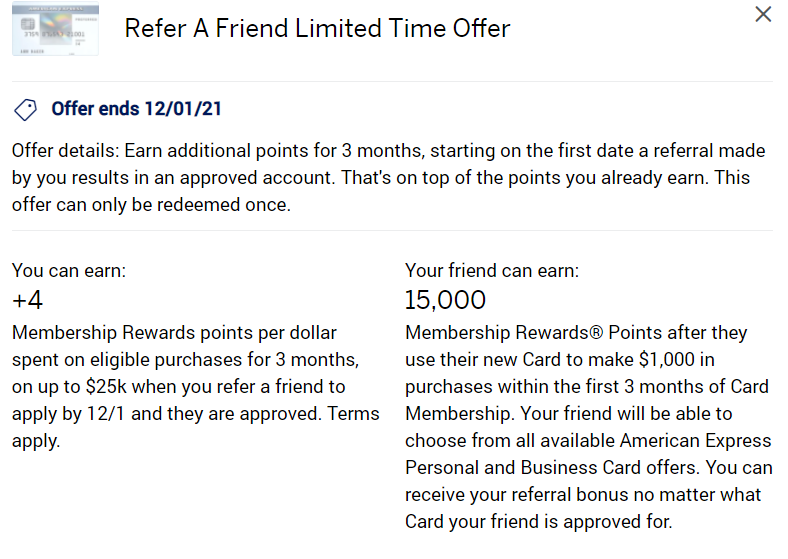

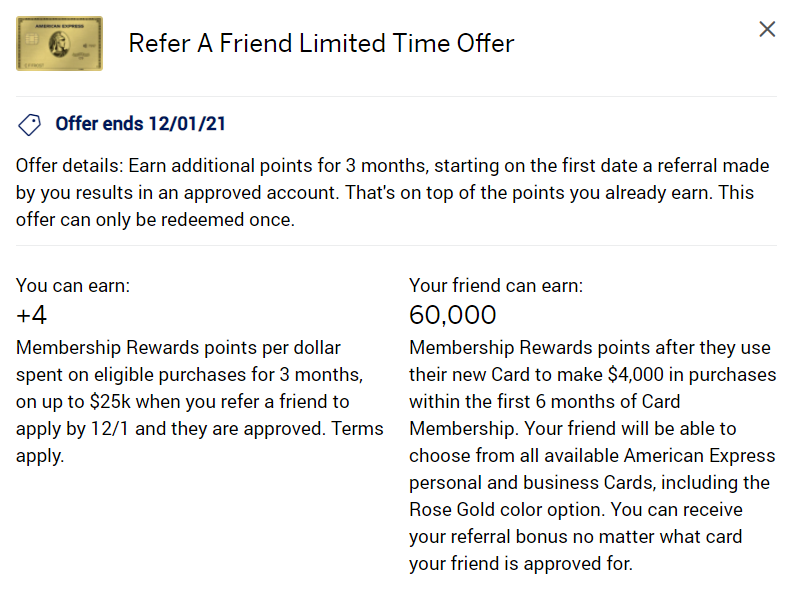

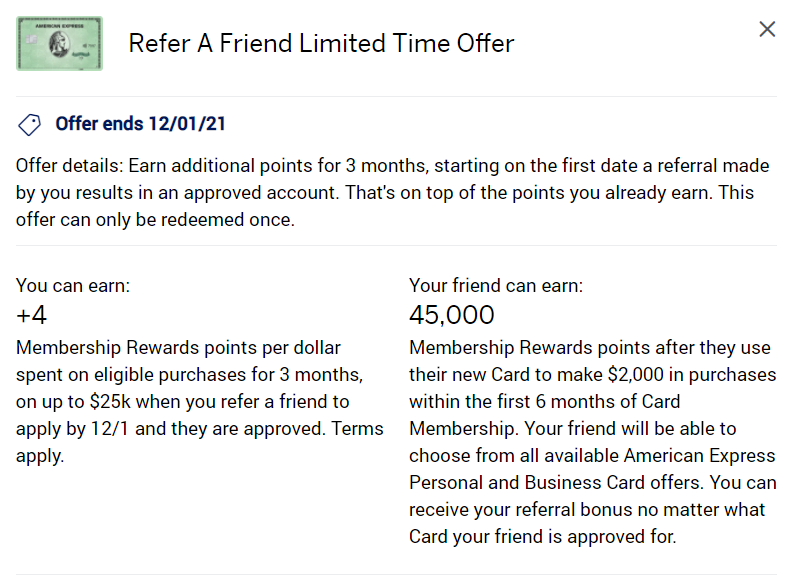

We’ve written before about how Amex’s referral system has improved remarkably over the past couple of years, making it possible to use your card to generate a referral link that you can share with a friend and be rewarded even when they sign up for a different card. Cards that earn Membership Rewards points or cash back can refer to almost any other Amex card and earn a reward based on the card you used to generate the link (more on that here). Today the referral offers on many of the personal cards have changed and instead of a points bonus for referring a friend in many cases you will instead get +4x on all qualifying purchases for 3 months on up to $25K in purchases as long as they apply and are approved by 12/1/21. That could be an awesome offer if you have some big expenses coming up.

The Deal

- Many American Express credit cards are offering a new referral bonus of +4x on all eligible purchases for up to 3 months on up to $25K in purchases when you refer a friend and they are approved by 12/1/21 (see your account for your referral offers)

Key Terms

- Offer details: Earn additional points starting on the first date a referral results in an approved account for 3 months. That’s on top of the points you already earn. This offer can only be redeemed once.

- Note that this is targeted, so you’ll want to check your account for your referral offer

Quick Thoughts

Most cards that earn Membership Rewards points typically offer the referrer (that is the cardholder who is referring a new cardholder) a set number of points per referral. That set number of points varies by card and cardholder, but we’ve seen anything from 7,500 points per referral up to 35,000 points per referral — but typically with a cap of 55,000 points per year per Amex card (that is to say that if you have 3 cards that earn Membership Rewards points, you can earn up to 55,000 points per year on each of those 3 cards from referring friends).

This new offer is different: instead of earning a set number of points, the person making the referral will earn +4x Membership Rewards points. That is a potentially awesome deal as it means that you could earn up to 100,000 bonus points thanks to a single referral.

These 4x bonus points are in addition to the points you already earn with your card. For instance, if you use your Blue Business Plus card to refer someone to a new card, you would receive 4x bonus points on top of the 2x you already earn everywhere on the first $50K in purchases per year (as seen in the screen shot above). That would be a killer return for someone who has a large tax bill or or other large unbonused purchases to make.

Keep in mind that in most cases, the referral offer generated is the best publicly-available offer, so your friend won’t sacrifice anything by using tour link. We’re seeing these increased +4x offers on many cards including the Platinum card, Gold Card, Green Card, Everyday Preferred Card, and Blue Business Plus.

Interestingly, the offer on our Business Platinum card is the same +4 deal, but it also includes 15K points per referral up to 55K total points plus 15K points.

Interestingly, the offer on our Business Platinum card is the same +4 deal, but it also includes 15K points per referral up to 55K total points plus 15K points.

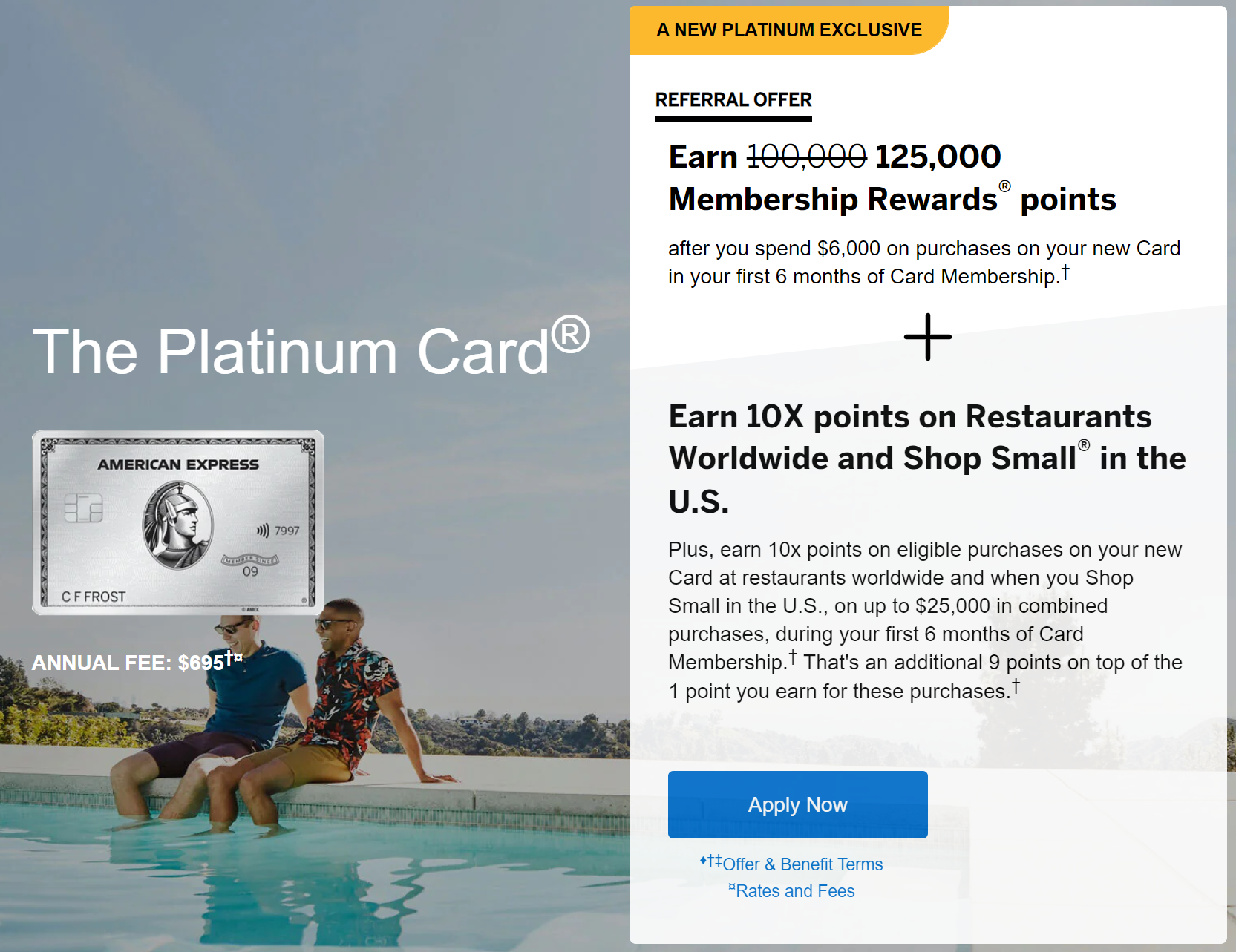

Also interesting is that the referral link from one of Greg’s Platinum cards now brings up an offer for 125K points after $6K in purchases in the first 6 months + 10x at US restaurants and US Shop Small merchants rather than the 100K offer.

Hopefully most readers know that our Best Offers page lists an even better offer of 125K points after $6K in purchases and 15x at US restaurants and US Shop Small merchants that is available through Resy. We’ve talked a lot about how that offer is the best offer on any credit card right now.

However, if you’re playing in 2-player mode and you have the above offer and you don’t think that you can spend much at restaurants and small businesses, you may prefer the referral offer since you’ll still get 10x on those two bonus categories for Player 2 when they sign up for the Platinum card, but you’ll also get 5x total on all purchases on up to $25K in spend for Player 1. In fact, if you have something like a large 4th quarter tax payment to make and you know that you wouldn’t max out restaurants and small businesses, you’ll come out ahead with the referral if you’re in 2-player mode.

Overall, these new offers are exciting for those who spend enough to earn more points than they otherwise would have with the referral bonus. Do note that you won’t get the usual 7.5K – 35K points per referral but will get the +4x instead. If you wouldn’t be able to put much spend on an Amex card in the next 3 months, it might be worth waiting to see if a points offer comes back in December before referring friends and family.

Hi, I have seen some of the bonus points hit my account but I have already spent the $25,000 and have received only about 1/3 of the points so far. Does it usually take a long time for them to show up in my account?

Thanks

In my experience, it usually takes about 3 days from the date of purchase. Note that only the additional +4 posts right away like that — the base (1x) earnings from the card post after your statement cuts and you pay the bill.

I did have a day this weekend where nothing posted for an extra day beyond what I expected (so make that 4 days from purchase I guess). Any longer than that would be unexpected — though Amex does hit bottlenecks now and then on things like airline fee credits where it suddenly takes a couple of weeks to get a credit that ordinarily posts in 2 days, so it wouldn’t be completely shocking if you ran into that. But if it’s been like a month, that sounds like something isn’t right.

Where can I put my referral link? I haven’t found any takers (I’ve asked everyone I know).

Nick: My wife referred me from her Business Blue card, and I was approved for a Hilton Business card. She got the confirmation email re: the 4x points. However, the offer now appears again under her Business Blue card online. If she refers me to another card and I’m approved (I would do another business card) would she then be getting another 4x (so 10x total on the Business Blue card)?

No. You only get this referral bonus once per card. If she has another Amex card that earns Membership Rewards points, she could refer you from that card and earn plus 4 on a second card, but they don’t stack on a single card.

Thanks!

Wow, great info. I had similar question and really liked that you are so sure about this. Saves me a useless referral bonus…

I’m wondering if this deal will come back at some point? I missed it because I was over thinking it.

Detail question: I did this with my daughter. She was approved this morning. Will my purchases today get 4x? It looks like yes, but I want to confirm before I go crazy on Cyber Monday. Thanks!

We believe it starts right away with approval, but that’s hard to guarantee. The email says it begins with the date of the email, but in some cases the email doesn’t come through for a day or two and some people have reported getting the points before seeing email. If it were me, I would go ahead and spend and think you’re likely to get the points, but I can’t say that with 100% certainty.

Nevermind, I got the confirmation email. Starting today.

Thanks for the “inspiration” to do this, Nick! I got it with just a couple days to spare!

Hi Nick,

Any reason not to refer to the amex lowe’s biz card with no annual fee as a throwaway (requires no min spend) to just get the extra 4x? We’ve got an amex resy plat in play so getting 19x is more important than meeting signup bonus on any card. want to stick to biz for 5/24.

And, I am seeing a 20K bonus for $4K spend when adding authorized user on amex plat biz – one can add up to 5 users for a total of 100K bonus. is this worth the effort in your opinion? If so, that makes it even more important that the referred card doesn’t require much or any spend. Hard to generate so much spend so quickly.

@Nick Reyes, question for you. I have the dreaded popup on amex now so I cant apply on my wife’s Resy Platinum referral link. We are buying a car in 2 weeks time. so this is ideal as they are allowing me 20K with no fees with Amex.

My question around her getting referral credit. Technically, with the popup, it just means you wont get the sign up bonus, but you can still get approved for said applied card. Does that mean I can apply for say any biz card, take a hardpull hit, get not sign on bonus, but my wife’s Resy Plat would now get 4X more? Thoughts?

Yes, that works. We talked about it on last weekend’s podcast. There is no requirement for you to get the welcome bonus – being approved (which is possible even when you’re not eligible for the welcome bonus) is what triggers +4.

Also, Amex typically does not hard pull for existing cardholders even when applying for a new card. YMMV – they always can, but they often don’t.

@Nick Reyes,

Another question. Do you know if we can refer from the Charles Schwab Platinum Card to get 10X to 14X on Small Business and Food? Same as we can with the plain Platinum?

The Schwab Platinum does not have the +4 referral offer, only the Amex-branded Membership Rewards cards have that. The Schwab Platinum just has a flat $100 bonus per referral.

Is there an appropriate place to post my referral link? If that’s allowed… thanks!

Thanks for asking, but no, we don’t allow referrals on the site. Our spam filter automatically filters out comments with links and if we allowed referrals in the comments, the comments would just become a sea of referrals. We want to keep comments for discussion and questions.

Yep, that’s fair, thanks for the response! I guess I’ll just have to find some friends who want the Gold card 🙂

Or any Amex card. You can refer them to almost any Amex card.

I have an amex green and am I eligible for this offer if my friend applied for a different type of amex card (say gold or platinum) and got approved?

thanks

Yes. This video should help you: https://youtu.be/Tx4o3X7TgMQ

Is there a way to check if someone signed up through my referral?

No. Amex won’t discuss someone else’s application with you. If you haven’t gotten credit, you could have the person you referred reach out to Amex to ask about it, but it’s usually automatic and just takes a few days.

Understandable, I just wish I knew when to start spending on the card and/or when to switch my referral to another card.

What are eligible purchases?

time to make a referral and paying property tax and 1040 ES!

btw, any data point recently that Amex doesn’t count tax payment as eligible spending? I’ve heard some rare cases few months ago.

I haven’t heard any data points about that. I recently made several property tax payments on Amex cards via Plastiq and had no issue (if only those weren’t due on 9/30!)

Would Authorized Users’ spending also generate +4X MRs?

In the terms it says you will earn an additional 4x by spending by additional card members on your account

Thanks TravelMom! I see this +4X offer today on my phone app.

Found what you noted (“Additional Card Members on your account are not eligible to participate in this offer, but you will earn 4 additional rewards per dollar on qualifying purchases made by any Additional Card Members on your account.”).

If accurate, this looks amazing. I can generate 4 addt’l auth user cards on my (Business) green card, trigger the +4 with a cheap referral, and get 20,000 points per auth user w. $4,000 spend each. I can do 4 of those over 3 months (I think… paying rent for family), if I spent $4K per card, that would be 80,000 points from the auth users, plus $16K spend @ 1x + 4X = 80,000 for 160,000 MR points without opening a single new card (other than having someone to open a Everyday card of something like that.)

Since today is the last day of this, it’s worth trying, eh?

No more 1099?

Oh wow, I think you’re right! Now that they have the referral bonus tied to spend I don’t think they’ll issue 1099s. That’s great!

I have been considering the Amex Marriott Bonvoy Brilliant and the referral offer is considerably worse than on your Best Offer page. I see 75k sign up bonus +$200 restaurant credit. Your offer is 150k plus a free 85k night certificate. I am guessing the restaurant credits will probably get added anyway if the upcoming annual fee rumors are true.

That’s true. That’s one case where the referral offer is far worse than the best publicly available offer elsewhere. Other examples include the Resy offers for Platinum and Gold cards. Both are better through Resy than through a referral.