NOTICE: This post references card features that have changed, expired, or are not currently available

Chase has released the full details of the new IHG cards and application links are now live for both cards (we have added links to both to our Best Offers page). The Premier card ($89 annual fee) matches details we previously reported, while the Traveler card ($29 annual fee) has more benefits than we may have expected. That said, neither one is as good as the old IHG card. That doesn’t mean that these cards won’t make sense for some people to keep, but the end of the annual free night everywhere is a tough blow to IHG credit card enthusiasts. However, according to Chase’s Twitter account, those who have recently openend the old IHG Rewards Club Select card up to and including April 5, 2018 will still receive 1 uncapped free night. The details on that are a bit sketchy, but I think it might still make the most sense to apply for the old version of this card today (April 5th, 2018) if you’re looking for an uncapped night. More on that after the info on the new cards below.

The Offers

IHG Rewards Club Premier

The Offer

- Earn 80,000 IHG points after spending $2,000 in the first 3 months

- Earn 5,000 bonus points after you add your first authorized user and make a purchase within 3 months of account opening

- Link to offer can be found on our Best Offers page or our IHG Rewards Club Premier card page

Key Card Details

- $89 annual fee

- Earn 10x at IHG hotels

- Earn 2x at gas stations, grocery stores, and restaurants

- Earn 1x everywhere else

- Automatic Platinum status

- Free night annually at any hotel that costs up to 40,000 IHG points per night

- Fourth night free when you redeem points for a stay of 4 or more nights

- Save 20% on points purchases

- Earn 10,000 bonus points after you spend $20,000 and make one additional purchase each cardmember year

Offer Analysis

Let’s get this out of the way: the new IHG Premier card no longer comes with a free night at any IHG hotel worldwide. This new version of the card comes with a free night that is capped at hotels that cost 40,000 points or less. That stinks. It’s not altogether surprising — the uncapped free night of the previous version of the card was by far the most generous repeating annual benefit on a card with an annual fee of less than $100. Quite frankly, I’m surprised it lasted as long as it did. But it’s nonetheless disappointing to bid that benefit farewell. I’m somewhat surprised that IHG created a webpage highlighting the hotels where the annual free night certificate does not work rather than highlighting the hotels at which the certificate is valid…but that’s what they did, and you can look at the list of places you can’t go with your free night certificate here.

With that out of the way, the new card is more or less on par with hotel card offerings from Hyatt and Marriott in the sense that it comes with a free night certificate that is capped somewhere in the mid-tier range. That means the card is no longer a no-brainer, but it will be worth more than the pricetag for some people.

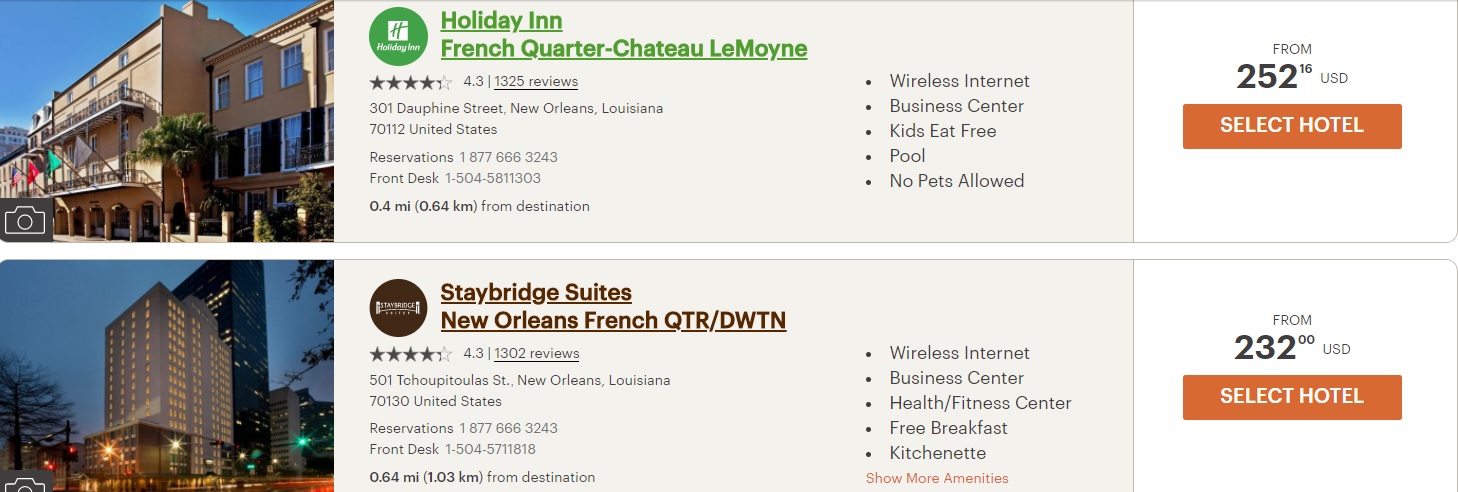

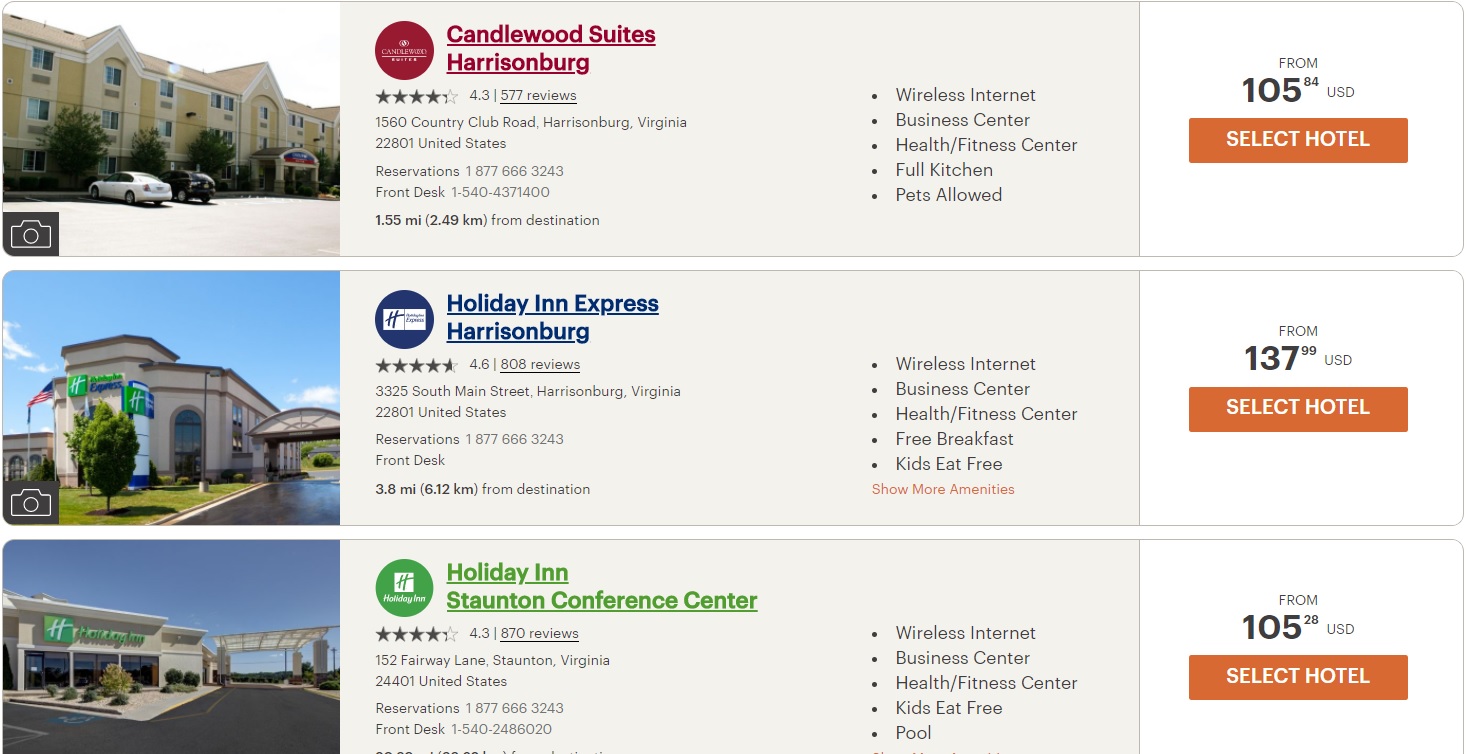

For example, if you wanted to stay in New Orleans next week, both the Holiday Inn French Quarter and Staybridge Suites French Quarter/Downtown are available and have going rates well over $89.

If you’re going to Europe, there are more than a dozen hotels within 5 miles of the Paris city center that cost 40K or less. A random weekday in October returned cash rates of around 200 Euros or more at several of them.

Last week, I wrote about needing a hotel near Harrisonburg, Virginia on a road trip. I just looked up rates in Harrisonburg next weekend and even there I could come out ahead on the $89 annual fee (albeit not by a lot). Keep in mind that these are advance purchase rates — the flexible rates are higher.

Do I like the new version as much as the old version that came with an uncapped free night? Of course not. Is it still an annual keeper card? That depends on your cost, ability, and interest in manufacturing IHG points (most likely through Chase Ultimate Rewards) and your desire to stay in IHG hotels. If you’re using your annual free night certificate at hotels that usually cost thirty or fourty thousand points per night, you probably won’t do better by manufacturing spend unless you have some ultra low-cost methods.

On the flip side, since you can often buy points for as little as half a penny each, you might as well just buy points for hotels than cost 20K or less since the cost is about the same as or less than the annual fee and your points won’t expire as long as you have activity, whereas your annual free night certificate will expire 1 year from issuance.

The fourth night free on award stays will appeal to those who often redeem for those longer IHG stays. On the surface, it looks better than the 10% rebate on awards that has been a benefit of the previous IHG card since you’re saving 25% of the cost of a 4-night stay. However, if you rarely stay in 4-night increments, this is definitely a devaluation as you will no longer receive any rebate. The good news is that the 4th night free benefit isn’t a rebate but is rather a discount — meaning that you will only need to have the points to cover 3 nights (whereas with a rebate you would need to have the full cost up front). Note that the 4th night free applies to full award stays only. Paid rates or cash & points rates do not qualify. I do not believe that a booking including your annual free night certificate would work (e.g. booking Night 1 with annual free night cert and nights 2 & 3 on points to try to get night 4 for free). The terms state you’ll be charged the points rate for the first 3 nights and 0 points for the 4th night, so I don’t think you’ll be able to stack this discount with the annual free night certificate.

The annual 10K bonus points with $20K spend is a pretty poor value. Ten thousand IHG points are worth around $50 when you consider the fact that IHG points can often be purchased for around half a cent each. Spending $20,000 for a $50 bonus doesn’t make much sense. I think the only situation that justifies earning this bonus is if you’re a business traveler getting reimbursed for your stays and you spend something close to $20K per year on those stays. It then may make sense to use the IHG Rewards Club Premier card to pay for your stays since you’ll earn 10x with it on paid IHG stays. Otherwise, I can’t see spending $20K on this card. Note that the bonus terms state you must spend $20K in your cardmember year and then make one additional purchase at least one day after reaching $20K in purchases.

The good news is that Chase doesn’t appear to have excluded IHG Rewards Club Select cardholders from earning the signup bonus. The terms state:

This product is not available to either (i) current cardmembers of this credit card, or (ii) previous cardmembers of this credit card who received a new cardmember bonus for this credit card within the last 24 months.

We don’t yet have data points to know whether or not this card is subject to the Chase 5/24 rule. The old version was not subject to 5/24, so there is a chance this won’t be either — meaning that it could be an opportunity to earn 80K points even for those over 5/24.

IHG Rewards Club Traveler

The Offer

- Earn 60,000 IHG points after spending $2,000 in the first 3 months

- Earn 5,000 bonus points after you add your first authorized user and make a purchase within 3 months of account opening

- Link to offer can be found on our Best Offers page or our IHG Rewards Club Traveler page

Key Card Details

- $29 annual fee

- Earn 5x at IHG Hotels

- Earn 2x at gas stations, grocery stores, and restaurants

- Earn 1x everywhere else

- Earn Gold status when you spend $10,000 on purchases each calendar year

- Fourth night free when you redeem points for a stay of 4 or more nights

- Save 20% on points purchases

Offer Analysis

Like the IHG Rewards Club Premier card above, Chase does not appear to be excluding previous IHG Rewards Club Select members from earning the signup bonus as they have the same language on this offer that only excludes people who currently have this card or have received a new cardmember bonus on this card in the past 24 months. Since this is a new card, everyone should qualify. That makes this card worth it for the signup bonus alone in most instances.

I find it interesting that this card carries the same 4th night free benefit and the same 20% discount on points purchases as the Premier card. I would have expected these benefits to have been differentiators for the Premier; instead, they will be available to holders of either card. If either of those benefits is your main draw to an IHG card, you could save $60 by holding the Traveler version.

However, the Traveler card doesn’t come with an annual free night certificate. While the annual 40K-or-less free night certificate for $89 is far from a no-brainer, I can’t imagine why you would be willing to pay $29 and not see any reason to kick in the additional $60 for the free night certificate (apart from wanting to pick up the signup bonuses on both cards). I can’t imagine any reason to keep the $29 card over the $89 card.

As with the Premier card, we don’t yet have data points to know whether or not this card is subject to the Chase 5/24 rule. Since the old version was not subject to 5/24, there is a chance this won’t be either — meaning that it could be an opportunity to earn 60K points even for those over 5/24.

You might want to apply for the old version today

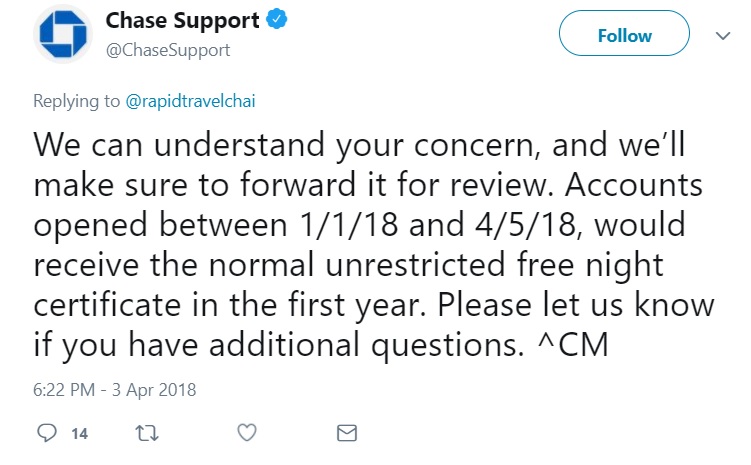

The application page link for the old IHG Rewards Club Select card is still active on our Best Offers page at the time of writing this morning. If you’re interested in an IHG credit card, it might make the most sense to pick up that card by 4/5/18. I say might because it’s about as clear as mud how this will work out. This is what Chase’s Twitter support team has to say about it:

Click that image to go through to Twitter and read the entire discussion. Several times within that discussion, the Twitter team reaffirms that accounts opened between 1/1/18 and 4/5/18 will receive an uncapped free night certificate at first anniversary. That’s good news for those who applied recently and those who apply today (4/5).

However, that same discussion also reiterates several times that certificates issued after May 1, 2018 will be capped at hotels that cost up to 40K per night. Add to that the confusion for cardholders who applied on or after May 1st, 2017 but before January 1st, 2018. According to the Twitter rep, those cardholders will not receive an uncapped night. That doesn’t make much sense to me. Someone who applied on December 31st, 2017 had the same expectation of a free uncapped night at first anniversary as somsone who applied on January 1st, 2018. It would make the most sense to me if they offered the uncapped free night to anyone who applied between May 1st, 2017 and April 5th, 2018. It doesn’t sound like that will happen. I’m also somewhat skeptical that certificates issued in June, July, and August of this year will be limited to 40K-or-less hotels and a certificate issued on April 5, 2019 for someone who opens an account today will be uncapped. I could at least imagine a world where you would have to go back and forth with Chase to get that honored.

That said, keep a screen shot of the Twitter conversation and a link to the tweet and I imagine Chase will have to find a way to honor it. It might not be smooth sailing, but I think I’d still consider opening the $49 card today based on that tweet.

Of course, the $49 version makes sense for reasons beyond that first uncapped free night: based on the information we’ve seen, Chase is not going to automatically upgrade IHG Rewards Club Select accounts. This means that current cardholders should maintain the $49 fee structure and the 10% rebate on rewards and Platinum status in addition to getting an annual free night at hotels up to 40K. That certainly sounds like a better deal than paying $89 for the Premier card. If you really value the 4th night free and 20% points rebate, you could keep the $49 card and open the $29 card and get most of the benefits of the Premier card for $78 instead of paying $89 fee for the Premier. The only thing you’d be losing would be the extra 5x at IHG hotels since the Premier earns 10x at IHG properties.

You can find a link to the $49 IHG card on our Best Offers page or our card-specific IHG Rewards Club Select page (which also has additional information on this card).

Bottom line

The new IHG cards are out. They aren’t exciting, but the Premier might still be worth it for some people. However, if you don’t yet have the IHG Rewards Club Select card, it might make the most sense to apply for that one by the end of the day on 4/5/18 if you want an IHG card as it should still come with 1 uncapped free night at first anniversary and then in future years it should maintain the ongoing annual 40K night plus Platinum status and a 10% rebate on rewards for less than the fee on the new Premier card.

“You can find a link to the $49 IHG card on our Best Offers page or our card-specific IHG Rewards Club Select page (which also has additional information on this card).”

Not locating. Any links?

Can you apply to the new IHG even if you have the old card

Yes, absolutely. The 4th night free on award stays from the Premier (new card) even stacks with 10% back from the old card.

kind of late to the discussion, but my question is what happens if i keep both cards (the old and the new)? do i get both cards’ benefits? will it mean that i get two nights per year (capped or not) if I keep both cards?

Today’s my anniversary date for the Select card (i’ve had it for a few years now) and i just checked my account and the free night has been credited online. I opened the T&C’s and it surprisingly doesn’t mention the 40k limit. I then tried to book the free night at a 70k location (Manza Beach in Okinawa where i just used my previous year’s free night), and it works! Hope this info helps.

Yes – Chase and IHG announced a change on that about a month after this post. All certificates and issued before May 1, 2019 will be valid anywhere.

https://frequentmiler.com/2018/05/04/another-uncapped-free-night-chase-and-ihg-do-the-right-thing/

I have old ihg card for the last few years. If I get the new premier card, will I get both the 10% back and the 4th night free ?

I got the IHG card last year. If I apply for the new premier can I still get the new bonus?

[…] is good advice here: New IHG cards available (but get the old one today). The new IHG cards are not recommended. To me the IHG Rewards program has become irrelevant. I am […]

don’t want to take up 2 chase slots both IHG. One IHG is enough.

They just began allowing redemption of IHG points/free night for the Kimpton Hotels. Does anyone know how many Kimpton hotels, if any, fall in the 40k or below point range because I couldn’t find any in San Francisco and Seattle?

Considering that IHG/Chase reneged on their promises with the current CC, why would anyone expect to get a 4th night free?

That $20k spend to get a $50 value will probably change just about the time that you have spent $19,500 with no concern from the liars at IHG/Chase.

Take these “benefits” at face value — which, in total, about equal a single IHG point: 1/2 a cent

I applied September 2017. My interaction with Chase and IHG on Twitter is laughable, as is the phone calls with both. Chase blames IHG, IHG blames Chase. I even have a DM from IHG saying their stakeholders will be reevaluating their relationship with Chase (paraphrasing their response).

One IHG rep on the phone explained that people who applied in this calendar year get the uncapped free night because they have to honor the terms, this calendar year but for those who applied last year, for us they can change terms because it is a different calendar year… WHAT? By the these certificates are to be handed out next year it will he a different calender year.

If they don’t resolve this, we will cancel both our cards plus several other cards that we regularly spend on and move our business to American Express. I will move my husbands business stays twi another chain and he is Spire through those stays

This move is below Chase they should honor the terms in the offer they sent to me – unsolicited.

right….what people do vs what people say….

I applied and was approved for the Premier card this morning. I was sitting right at 5/24 (6/24 if you include a chase business card I opened earlier this year). When I applied, my application was pending approval. I called in, assuming I would have to move credit lines around but the representative on the phone took about 5 minutes and then approved me without any questions or changes to my other credit lines with chase.

Any idea on whether the approval has to be final by 4/5, or merely the application submitted by 4/5? I submitted an application a few days ago that went pending. Got the 30 day message, so have no reason to believe I won’t be approved.

Good question. No idea. Might be worth calling recon if you’re counting on the uncapped cert….

Keeping the old card and adding the $29 one will cost $78, not $68.

Sure will. Fixed that, thanks!

I think it’s a bad idea to apply for the old card today. I spoke with a Chase rep yesterday who informed me that people applying for a card in 2018 will not receive an uncapped night. She said that the Chase Support twitter folks didn’t know what they were tweeting about.

I generally put very little stock in anything that a front line customer service rep says. I rarely ever ask important questions on a phone call as it’s so common for phone reps to be wrong. What I like about the Twitter comment is that it’s in writing in a place where the entire world can see it. I’d feel better about that than anything told to me on the phone. Even if it’s incorrect, it’s a lot easier to leverage that than a phone call. I know they record calls. That can be helpful…but just last week I had an instance (not with Chase, but with a company that records calls) where they went to pull the recording and told me that the rep was no longer with the company and they were “having trouble accessing the recording”.

I’m not arguing that the Twitter rep is right, just that putting it out in print on Twitter makes it harder to take back / fail to honor.