NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

Chase announced today newly increased offers on the Chase Marriott Bonvoy Bold and the Chase Marriott Bonvoy Boundless. Both offers include a nice haul of points for modest spend and could be worthwhile for those who are eligible under Marriott’s complicated rules.

The Offers & Key Card Details

For more information about this card and to find an application link, click the card info below to go to our dedicated page for this card.

| Card Offer and Details |

|---|

ⓘ $585 1st Yr Value Estimate2 Marriott 50K Free Night valued at $608 Click to learn about first year value estimates 2x 50K Free Night Certificates ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 2x 50K free night certificates after spending $1k on eligible purchases within the first 3 monthsNo Annual Fee This card is subject to Chase's 5/24 rule. Click here for details. Recent better offer: 60K points + Free Night Certificate after $2K spend (Expired 7/17/25) FM Mini Review: The best use for this card is probably to downgrade from the Ritz or Boundless card to avoid the annual fee. That way, you can always upgrade again when you need the annual free night or other perks Earning rate: ✦ 3X Marriott Bonvoy ✦ 2X grocery stores, rideshare, select food delivery, select streaming, and internet, cable and phone services ✦ 1X everywhere else Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: Automatic Silver status ✦ 5 nights of elite credit each year ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit See also: Marriott Bonvoy Complete Guide |

| Card Offer and Details |

|---|

ⓘ $1378 1st Yr Value Estimate5 Marriott 50K Free Nights valued at $1520 Click to learn about first year value estimates Five 50K Free Night Certificates ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Five 50K free night certificates after spending $3k on eligible purchases within the first 3 months + get up to $100 in statement credits after spending $500 on eligible airline purchases. That's up to $50 in statement credits semi-annually.$95 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Earning rate: ✦ 6X Marriott Bonvoy ✦ 3X gas stations, grocery stores, and dining on up to $6K in combined purchases each year ✦ 2X everywhere else Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Earn Gold status when you spend $35K each year ✦ 1 Elite Night Credit towards elite status for every $5K spent Noteworthy perks: Annual free night certificate for 1 night at a hotel redemption level up to 35K ✦ Automatic Silver status ✦ 15 nights of elite credit each year ✦ 1 Elite Night Credit for every $5K spent ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit See also: Marriott Bonvoy Complete Guide |

Quick Thoughts

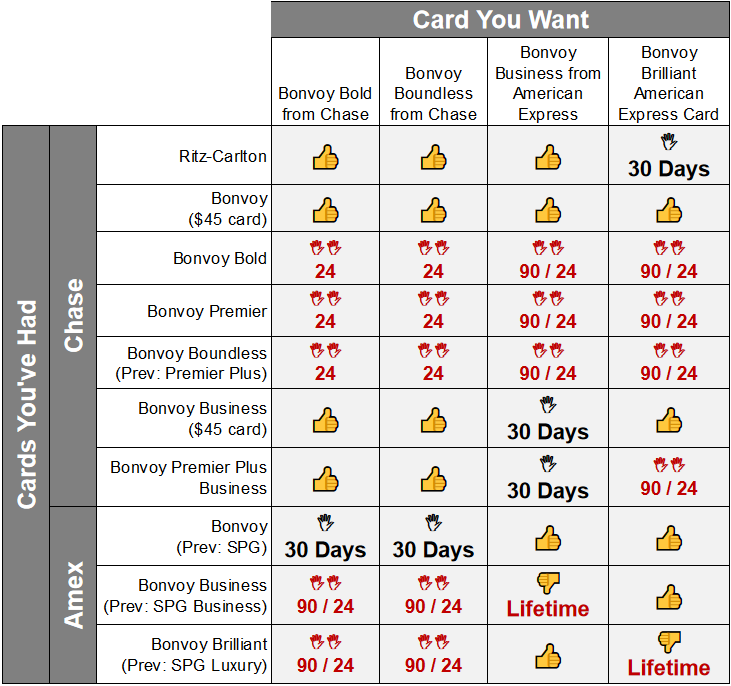

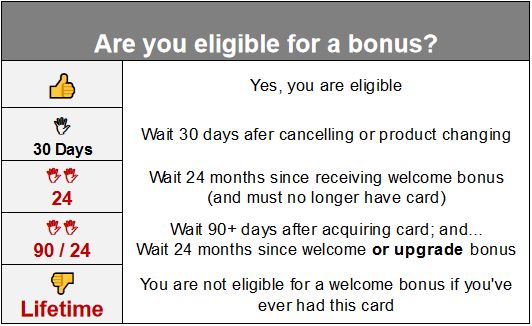

Keep in mind that Marriott has really complicated rules regarding credit card bonus eligibility. Check this chart and the key below it to determine whether or not you are eligible for a welcome bonus:

As you can see, you are not eligible to get both of these cards and will not be eligible to receive the welcome bonus on either if you have received a welcome or upgrade bonus on any of the Marriott credit cards in the past 24 months.

As you can see, you are not eligible to get both of these cards and will not be eligible to receive the welcome bonus on either if you have received a welcome or upgrade bonus on any of the Marriott credit cards in the past 24 months.

Given these draconian rules, I would only recommend considering the 100K Boundless offer between these two. There’s just no sense in getting the bold in my mind: pick up the 100K bonus offer, get a 35K free night certificate at anniversary, and then if you decide that you don’t want to keep the card you can consider downgrading it to the Bold before paying next year’s annual fee. The additional 50K points combined with the free night certificate that you could pick up before downgrading means that it’s worth paying the $95 annual fee up front.

Of course, you’ll need to be under 5/24 to consider either card, which is a hurdle in itself.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

Then you’ll also need to get somewhat lucky given that all issuers have anecdotally tightened up approval standards in the current environment. Finally, you’ll need to want Marriott points. At the moment, they may not seem terribly attractive — though, on the other hand, since you’ll be locked out of other bonuses for a while, it might be worth picking this up now if you’re eligible in order to stack these points with those you earn when you’re finally eligible again in 2022. Still, given that this would add a card to your 5/24 count, I’d want to have thought my strategy through and to know which other Chase cards I want and why and when I’ll apply before opening one of these on a whim. They can be worthwhile for Marriott enthusiasts (especially the boundless as the annual free night certificate certainly can be worth well over the $95 annual fee — but that depends on whether or not the nicer 35K properties fit your travel patterns).

To someone planning to choose between 1) this 100k boundless offer and 2) the altitude reserve, which would you recommend? Obviously, they’re really different cards. I’m considering the boundless for the potential ritz PC and elevated SUB.

@Nick Reyes will adding this personal card to an Amex SPG Business card

Will this Give me 30 elite nights? Can you mix JPMC/AMEX SPG cards?

Granted 2021 might have a tidal wave of new Platinum elites ~ if COVID is still a factor – then the free COVID breakfast and Elite guarantees.

Suites may or may not be an issue – likely not as many business road warriors may not see much travel in the future.

I’ve had AMEX Bonvoy Business and Chase Business for ~ 2 yrs when I closed them this spring. It looks like I should be in the clear for Boundless bonus. Hopefully it’ll be around for a couple of month, got an IHG card with 140k bonus and need to give Chase a bit of a rest.