NOTICE: This post references card features that have changed, expired, or are not currently available

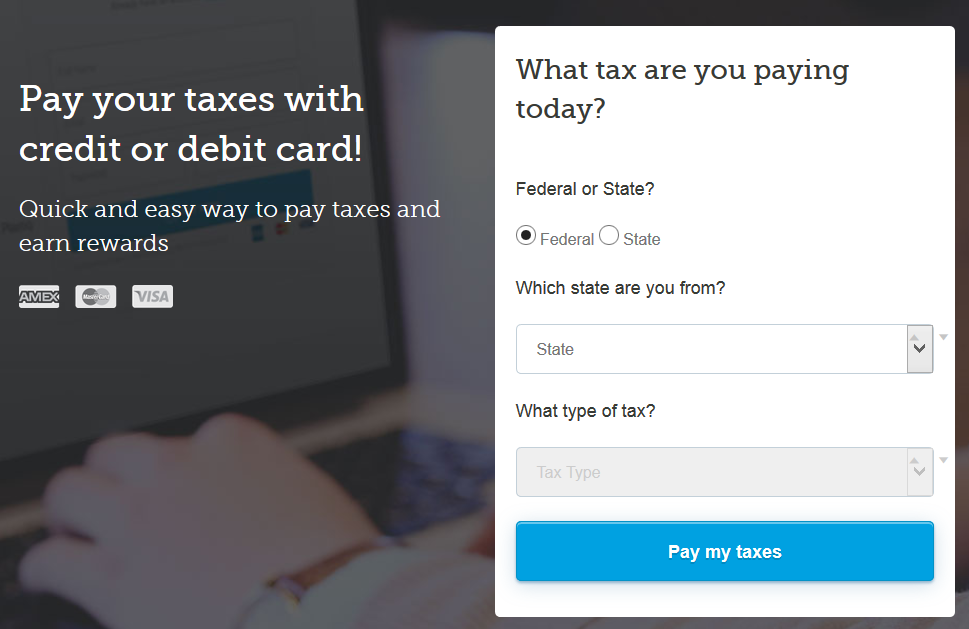

The bill payment service, Plastiq, has just announced a promotion in which you can pay your federal or state taxes with a MasterCard credit card with a lower than usual fee of 1.75% (Plasitiq usually charges 2.5% for all bill payments). To access this offer, use this link (this is not an affiliate link).

This offer is valid through April 18, 2016 at 5 p.m. PT.

For more details about Plastiq, please see: Complete guide to Plastiq credit card payments.

For more details about paying taxes with a credit card, please see: Top 5 reasons to pay federal taxes with a credit card or gift card.

Note that even though this rate is only slightly better than the 1.87% rate for paying federal taxes, Plastiq offers the additional benefit of allowing state tax payments as well.

Never miss a Quick Deal, Subscribe here.

[…] Pay Federal or State Taxes by MasterCard for 1.75% […]

I tried Friday and yesterday to pay my MA state taxes with a MasterCard credit card and Plastiq. They “rang it up” at 2%. I sent them a msg asking why I didn’t get the 1.75% rate. No answer.

[…] Plastiq Promotion for 1.75% Fees on State & Federal Taxes […]

The IRS “supposedly” has a limitation of two payments via their “official” channels of: Pay1040.com, PayUSAtax.com & OfficialPayments.com. Does that two payment limitation apply to Plastiq? E.g. Can I make three different payments on three different cards via Plastiq towards my Federal income tax?

Good question. No, I don’t believe it applies to Plastiq.

If I pay today using plastiq, cheque will be delivered on March 28th.

So it looks like a 10-11 day delay.

Does that mean I should pay by April 8 using Plastiq so as to NOT incur a penalty for late payment by Fed/State?

Good catch. Yes, I would recommend paying even earlier than that just to be safe.

What would be the best card to use to pay taxes? Would it be best for meeting minimum spend or is there a card that deducting just 1.75% could actually be profitable if you owe a lot?

Please read the linked post for suggestions. Both are good options (meeting min spend, or earning profit): https://frequentmiler.com/2016/03/17/top-5-reasons-to-pay-federal-taxes-with-a-credit-card-or-gift-card/