NOTICE: This post references card features that have changed, expired, or are not currently available

At the end of an unprecedented week, Greg and I talked travel: Is this a good time to book future travel? We obviously don’t know when “safe” will be, but maybe this is a good time to book for the future? We also talked about credit cards: is it time to cut the cord and give up on our annual fees, or is there a better strategy? (Hint: there’s something you should be doing before you cancel). We also talk collapsing customer service, where we’d rather be right now, and more. Watch, listen or read: here’s this week’s Frequent Miler week in review.

FM on the Air Podcast

For those who would like to listen during the morning commute or while you’re working, the audio of our weekly broadcast is available for download as a podcast on all of your favorite services, including:

You can even listen right here in this browser:

You’ll also find us on Spotify and hopefully your other favorite platforms. If you’re not finding the podcast via your favorite source of good podcasts, send us a message and let us know what you’d like us to add.

This week at Frequent Miler:

COVID-19 from a miles-and-points perspective

Shifting strategies in light of coronavirus

I’m sure most people have read about how New York State has ordered all non-essential employees not to report to work. As such, I have a lot of friends and family members who have found themselves suddenly and unexpectedly out of jobs, so I can sympathize with those who are facing an uncertain future and trying to figure out what to do next. From a rewards perspective, I lay out some of my initial thoughts (before the New York State restrictions were put into place) about what I’ll do in terms of earning cash back, going after bank account bonuses, and doing what else I can to position myself to weather the storm. My plans aren’t necessarily transferable to your situation, but take some of the pieces and apply them to your strategy as we all search for a way though.

Best cash back credit card offers

Now is a compelling time to consider cash back bonuses. We don’t know when we’ll have normalcy and grabbing some extra money while we can can be a good plan. There are thousands of dollars available in cash back welcome offers, enabling a pair playing in 2-player mode to bring in extra cash that could really come in handy over the next couple of months.

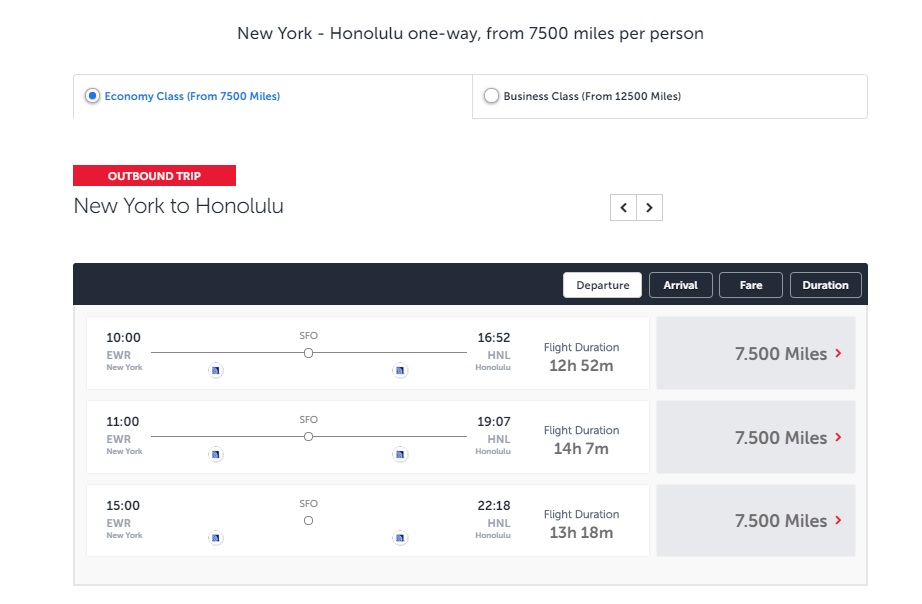

Premium routes with wide open awards

As we sit in isolation wondering when COVID-19 will be a thing of the past that we reflect back upon, we also find ourselves looking to the future with the hope that life will eventually return to normal and we will one day be able to once again connect with the rest of the world face-to-face. Will it be safe to travel again this summer? This fall? Next year? Nobody knows for sure. Does that make for opportunities to book premium cabin awards for future travel given the uncertainty as to whether that travel will even be possible? In some cases, yes. In version 1.0 of this post, Greg looks at routes served by American, Delta, and United — though this post also led us to report wide open availability in Qatar Qsuites in early 2021. We’ll continue to monitor the new opportunities that arise to book future trips with the hopes to be able to take them.

7 ways to increase credit card spend from home

Whether you’re going after some of those cash back bonuses or you’re looking for a way to earn some rewards while maintaining your distance from others for the greater good of society, you can find some strategies to spend your way to rewards without leaving your room in this post. With Simon Malls closed and non-essential travel suspended in many areas, ideas like these are some of your best options left in these turbulent times.

Coronavirus cancellation policies: Cruises, Flights, Hotels, and more

Speaking of turbulent times, we’ve been working to keep this resource page up to date as policies have evolved and changed over the past couple of weeks. This post is actually due for a fresh update this weekend to bring it back up to speed and we’ll be doing that over the course of the weekend and as things continue to change in coming days and weeks.

In award travel:

My Top 10 Category 1 & 2 Hotels In The US

I found Stephen’s post on his favorite Category 1 and 2 hotels really interesting, in part because I’ve been looking to do more domestic travel over the next couple of years and because these days I tend to enjoy random towns i’ve never heard of before more than major cities. While I do enjoy unique aspects of major cities, there are many things that feel the same from one big city to the next; stays in random less-touristed towns or outskirts of a city are more interesting to me in many ways. Traveling with a now-toddler, I’ve also come to enjoy the space of a suite and they are often easier to come by at these types of properties. Stephen has given me some really easy trips to consider when this period of social isolation subsides.

Are some non-saver United awards bookable via partners?

The short answer here is “yes, maybe”. Oddly, I’ve started noticing times when United awards appear bookable via either Avianca LifeMiles or Turkish Miles & Smiles that aren’t available as Saver awards. That’s notable as it means you’ll need to approach searches differently. Is United giving Turkish access to expanded availability, or is this an inevitable byproduct of a dynamic award chart? It’s hard to say, but it’s worth checking out this post if you intend to fly United down the road.

In Marriott news:

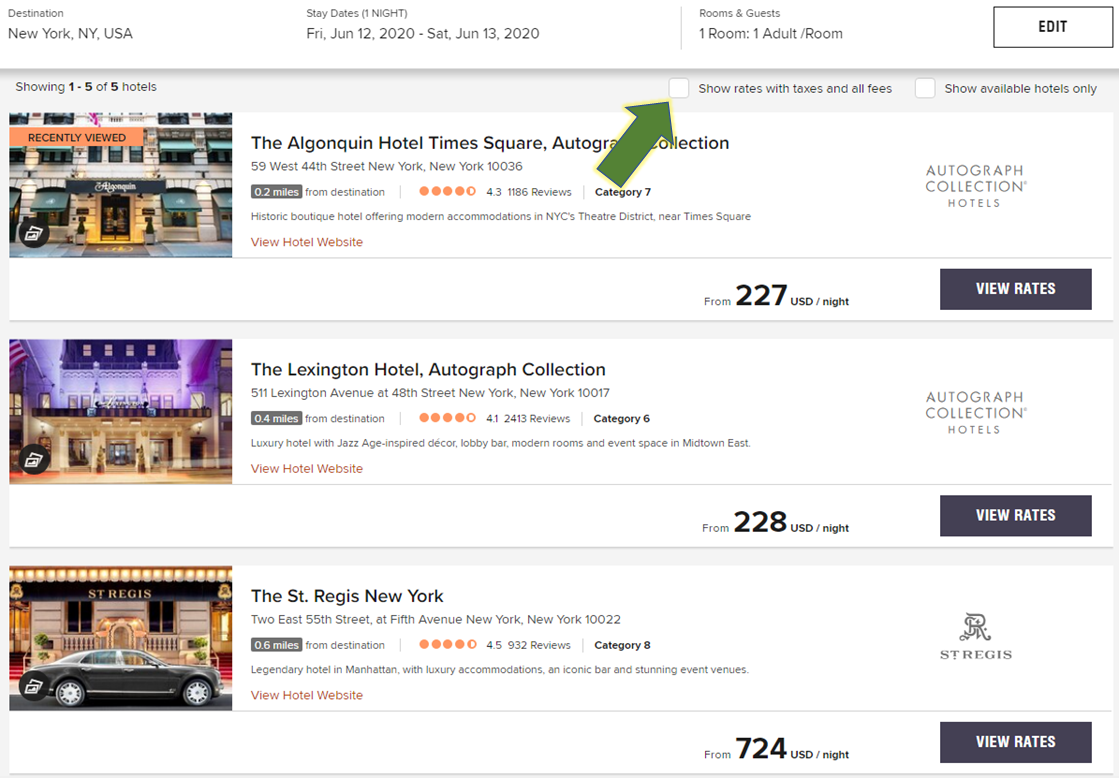

Marriott shows rates with taxes and ALL fees (price transparency checkbox)

Credit where credit is due: you go with your bad self, Marriott. In this one, Greg covers an awesome adjustment on the Marriott website: you can now check a box to view all-in rates, including any taxes and fees. Rather than having to click all the way through to checkout, you can now compare prices and availability directly from search results. This is a great change. Now if we could just get online travel agencies to display the same transparency…..

That’s it for this week at Frequent Miler. Check back soon for our week in review around the web and this week’s last chance deals.

![A coupon book with a credit card, a credit card program with an airline, and more [Week in Review] a person reading a magazine on a couch](https://frequentmiler.com/wp-content/uploads/2017/05/kick-back.jpg)

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)

Thanks for the shoutout in the podcast. Hopefully I will be able to get future retention offers / credits to offset the annual fee on upcoming CCs. I’ll keep you guys posted.

I’m seriously considering closing all my Amex cards with annual fees. It’s getting annoying how it takes too long to get your points or cash back after your statement closes. I hope they improve this with people in lockdown, a recession coming and fewer people again use credit cards.

Keep one because the CL ..

Is there any reason to have both the Bonvoy Business and Bonvoy personal Amex since they only give one set of qualifying nights? Which do I keep?

The reason would be to have two annual free night certificates. That said, the value of those certificates is questionable:

https://frequentmiler.com/what-are-marriott-35k-certificates-worth/

If you know you’ll use the certificates to good value, maybe you’d want to keep both cards.

As to which to keep: first, I assume you have both the Amex biz and Amex personal (old SPG card) rather than one of those being a Chase card or the $450 Bonvoy card. If my assumption there is correct, the answer to which you should keep is that it depends whether or not and how much you use the bonus categories on the business card. The biz card has a higher annual fee ($125 vs $95), but it offers 4x U.S. restaurants, U.S. gas stations, wireless telephone services purchased from U.S. suppliers and on U.S. purchases for shipping. If you use those bonus categories, you might keep the business card. Otherwise, you might keep the Bonvoy personal Amex because that card is no longer available for new applicants (and especially if you don’t use the bonus categories, then you’d be better off paying $95 for your annual free night certificate rather than $125).

same question if you have Amex personal and CHASE