NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

Delta is the only major airline that makes it possible to achieve top tier status through credit card spend alone. It’s not easy to do, but it is possible. Over the past several years, I’ve earned high level Platinum status for myself and top tier Diamond status for my wife almost entirely through credit card spend. And this year I spent both of us to Diamond status.

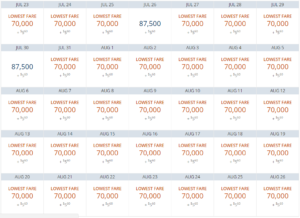

The top-end value of Delta SkyMiles has arguably decreased over recent years due to Delta’s frequent price increases for international business class awards. I agree. International premium awards have long been the primary sweet spot for getting value from airline miles. Through wave after wave of award price increases, Delta has lowered the upper bound value of SkyMiles. For example, instead of getting maybe 3.5 cents per mile value as you used to, today you may get 2.5 cents per mile value from international business class awards. Yes that pales to the upper end value still possible through other mileage programs, but it is still good value for your Delta SkyMiles. And, even more importantly, availability of saver level awards has risen dramatically in the past few years.

More good news is that the value of miles when used for economy awards has mostly gone up. While Delta has repeatedly raised award prices for international business class, in most cases they have kept economy award prices stable and have even reduced them in some cases. And with economy awards within North America, I find it is almost always possible to get at least 1.4 cents per mile value, if not much more. That is far better value than I usually find with AA or United domestic awards. For more, please see: Delta SkyMiles sheds SkyPeso moniker.

More good news is that the value of miles when used for economy awards has mostly gone up. While Delta has repeatedly raised award prices for international business class, in most cases they have kept economy award prices stable and have even reduced them in some cases. And with economy awards within North America, I find it is almost always possible to get at least 1.4 cents per mile value, if not much more. That is far better value than I usually find with AA or United domestic awards. For more, please see: Delta SkyMiles sheds SkyPeso moniker.

Many will disagree with me regarding the value of Delta SkyMiles (I know that Gary will). That’s fine. But I think that most will agree that in recent years Delta has improved their elite program for Platinum and Diamond elites:

- Elite status is now the first consideration when it comes to complementary upgrades (fare class used to be first).

- If you have high level status and you’re traveling with one companion with lower or no elite status, your companion now qualifies for complementary upgrades based on your status. Delta used to lower both people to the lowest status level on the same reservation.

- Platinum elites now get to pick 4 regional upgrade certificates as their Choice Benefit. These can be used to upgrade domestic flights at the time of booking (if available) or at least to push you to the top of the complementary upgrade queue. It’s great to be able to use these for flights in which upgrades are most important to you.

- Diamond elites now get to pick 4 global upgrade certificates as their Choice Benefit. These can be used to upgrade international flights to business class.

- Diamond elites now get free CLEAR membership.

Delta Elite Status Requirements

Here are the basics:

MQMs: Medallion Qualifying Miles, or MQMs, are the currency you need to earn each year to qualify for elite status for the rest of that year, all of the next year, and January of the year after that. Most people earn MQMs through flying. In that case, MQMs are earned based on the distance you fly.

MQDs: Medallion Qualifying Dollars, or MQDs, are another requirement for status, but if you spend $25,000 per year or more on Delta credit cards, you get an MQD waiver and can conveniently forget all about this requirement.

Medallion Elite Tiers: Here are the MQM requirements for each of Delta’s published elite tiers:

- Silver: 25,000 MQMs

- Gold: 50,000 MQMs

- Platinum: 75,000 MQMs

- Diamond: 125,000 MQMs

Earning Delta Elite Status Through Spend

The post “How to manufacture Delta elite status” steps through the details, but here is the minimum you need to know:

Through Delta’s partnership with American Express, their are four credit cards that make it possible to earn MQMs through spend:

- Delta Platinum Personal ($350 annual fee)

- Delta Platinum Business ($350 annual fee)

- Delta Reserve Personal ($650 annual fee)

- Delta Reserve Business ($650 annual fee)

Each card often offers the chance to earn bonus MQMs as part of their introductory offers (See our Best Offers page for current offer information). For this post, though, I’m looking at repeatable MQM earning through spend. Delta Platinum cardholders earn 10,000 MQMs after $25,000 in spend within a calendar year, and again at $50,000 spend. Delta Reserve cardholders earn 15,000 MQMs after $30,000 in spend within a calendar year, and again at $60,000 spend.

MQM Spend Limits

Earning MQMs through spend has the following one-person limits:

- Delta Platinum Personal: Spend $50K within a calendar year and earned 20K MQMs.

- Delta Platinum Business: Spend $50K within a calendar year and earn 20K MQMs.

- Delta Reserve Personal: Spend $60K within a calendar year and earn 30K MQMs.

- Delta Reserve Business: Spend $60K within a calendar year and earn 30K MQMs.

It is possible for one person to have each of the above cards. This leads us to the following theoretical limit for one person:

- One Person Max: Spend $220K within a calendar year and earn 100K MQMs

Testing the Limits

Over the summer, I tested this theoretical limit when I applied for a Delta Platinum Business card through a second business I own. I was surprised and delighted that I earned the intro bonus offer which included both MQMs and bonus miles despite the fact that I’ve had the Platinum Business card before through a different business. In fact, I had maxed out the spend on that other Delta Platinum Business card earlier the same year and then upgraded it to a Reserve Business card just a few weeks before applying for the new card.

I then proceeded to put lots of spend on my new Delta Platinum Business card. After spending enough to earn bonus MQMs, I waited for my statement to close and was disappointed to find that I didn’t earn the bonus. I called Amex customer service. Both the first line agent and the supervisor said that there is a hard limit to how many high spend bonuses can be earned per card type. In other words, since I had already earned the maximum possible through my other Platinum Business card, I couldn’t earn any more from this one. The supervisor was able to give me 10,000 SkyMiles for my trouble, but claimed that she couldn’t award MQMs. Lesson learned!

This was a long way of saying that the one-person max for earning MQMs from spend, across cards, is fixed at 100K MQMs even if you manage to get additional cards.

Exceeding the Limits

In the beginning of this post I said that it is possible to earn top tier status through spend alone. Then I said that Diamond status requires 125K MQMs per year, and that there is a hard limit to earning 100K MQMs per year through spend. What gives?

Obviously you can earn extra MQMs through actual flying, or from intro offers and other promotions. My wife and I do earn some MQMs through those means. But, there are also two ways to exceed the credit card spending limits…

MQM Roll-Overs

Any Delta MQMs earned in a calendar year in excess of those needed to get to elite status automatically roll-over to the next year. Given this, a single person could spend their way to Diamond status in two years:

- Year 1: Earn 100,000 MQMs to achieve Platinum status (which requires 75,000 MQMs) and roll-over 25,000 MQMs

- Year 2: Earn 100,000 MQMs. When combined with the 25,000 MQM roll-over, this person gets Diamond status

MQM Gifting

The MQMs earned through spend with the Delta Reserve card (both personal and business) are giftable. When a cardholder earns 15,000 MQMs through spend, they can either accept those MQMs into their own account or gift them to someone else.

Thanks to this capability, there is no theoretical limit to how many MQMs a person can earn through spend. OK, if you want to be picky, there is a limit to how many people exist that can get Delta Reserve cards. But, the practical limit has more to do with trying to find people willing to do this for you!

Multi-Player Variations

I frequently make use of MQM gifting with my wife. I’ll gift MQMs to her, or her to me, depending upon the situation. This can be used to accelerate earning elite status for one of us when necessary. Or, it can be used to avoid getting to the next level of status at the end of a year so that more MQMs roll-over. I’ve also swapped MQMs with friends in the past for similar reasons.

One reasonable two-person approach is to alternate years in which each person earns status. If you earn status early in a calendar year, you keep that status for the rest of that year, all of the next year, and through January of the year after that. If two people each had two Reserve cards (personal and business), and they had the ability to put huge spend on those cards very quickly, then they could do the following:

- Year 1: Earn 30K x 4 = 120K MQMs. Assign all MQMs to person A. With 5K more MQMs (through flying, introductory bonus offers, or roll-over), that person gets Diamond status and can optionally gift Gold status to person B. Diamond status is good through January of Year 3.

- Year 2: Earn 120K MQMs and assign to person B. With 5K more MQMs, person B now has Diamond status through January of Year 4.

- Year 3: Earn 120K MQMs for person A…

With the above plan, two people can keep Diamond status indefinitely if they are somehow able to generate all of the required spend each January. Of course it’s unlikely that anyone would really do this, but it is at least theoretically possible.

Delta elite status through spend: Is it worth it?

Manufacturing Delta status is expensive: It requires paying large credit card annual fees, and putting a huge amount of spend on Delta credit cards. The rewards can be great, but only if you use them. Personally, I’ve found that the rewards have exceeded the costs, but my situation may not match yours. For full coverage of this question, I highly recommend reading this post: Manufacturing Delta Diamond, retrospective.

[…] Player Game” Credit Card Mileage Runners: In previous posts (such as this one) I’ve described how it’s possible for two people to work together to keep both at […]

[…] around on this card peviously. For those looking to earn Delta Diamond status through spend, see: Pushing the envelope on earning Delta elite status through spend. As you’ll see, this card can be a great asset towards earning top-tier status with Delta […]

[…] For a number of years now, I’ve been using Delta credit cards to manufacture elite status for my wife and me. I used to manufacture enough spend to get my wife to top tier Diamond status while I was satisfied with near-top-tier Platinum status. In recent years, though, Delta has added valuable benefits to their Diamond tier and so I stepped up my ms game to get both of us to Diamond. For background, please see: Pushing the envelope on earning Delta elite status through spend. […]

[…] signup bonuses. Or, perhaps you want to earn high level elite status or other big spend bonuses, as I do with Delta. Or, perhaps you simply want to earn extra rewards using cards with big category bonuses, or big […]

[…] my wife and I maintain top level Delta elite status almost entirely through credit card spend (see: Pushing the envelope on earning Delta elite status through spend). I always try to have that spend complete before our December statement closing dates so that […]

It’s nerve-wracking guessing at the end of the year whether you met the threshold for sure. They should have a way to show you your spend balance prior to the end of the statement. I’m using the “YTD spend” on AmEx site but there’s always the possibility something was non-qualified.

Funny, I just wrote about that issue for a post to be published in the next few days. It’s a hassle, but you can contact Amex to ask them to calculate your YTD qualified spend. They won’t include pending payments though.

I have two DL Platinum business cards under two different companies. I originally had both tied to my Delta Skymiles number but learned I couldn’t get both 10k bonuses after completing the spend req. I called Amex and changed one of the accounts to my wife’s skymiles acct. as soon as the change was effective, the 10k MQMs showed up in her acct. You should try it.

Great suggestion! Unfortunately, I’ve already downgraded it to a $55 Delta business card, so I think it is unlikely to work at this point. Plus, my wife has already maxed out her business Platinum card spend for 2016.

I’m most surprised that they let you change the SkyMiles number. That’s great to know!

[…] Pushing the envelope on earning Delta elite status through spend – Challenging the rules for earning elite status with Delta completely through credit cards. […]

Answering questions about clawbacks/FR/cards closed:

I built up this high level of spend slowly over a number of years. I do think that if you were to jump into a high level of spend like this you would be subject to an Amex Financial Review. If that happens, I recommend being completely honest about your finances and why you’re spending so much, and then hope for the best. I believe that most people make it through Financial Reviews fine.

We saw clawbacks with a particular Platinum 100K offer that wasn’t supposed to be public. I haven’t seen anything similar with Delta cards. Not that it can’t happen, but I just haven’t seen it, nor do I expect it. If it does happen, then I’ll move on to something else 🙂

[…] signup bonuses. Or, perhaps you want to earn high level elite status or other big spend bonuses, as I do with Delta. Or, perhaps you simply want to earn extra rewards using cards with big category bonuses, or big […]

Also curious on AMEX FR/clawbacks. No way I would be able to do $50k/$60k spend/yr w/o 90%+ MS.

Greg – great post. Are you at all concerned with clawbacks or your delta cards being closed for manufactured spend?

This year after spending 50k on my personal Delta Platinum Amex, I received an email from Amex telling me that I was eligible for a third $25k bonus. If I spent $75,000 on the card by the end of the year, I would receive another 10k in qualified and bonus miles. This is the first time I have seen such an offer after having the card for 5-6 years and I’m close to completing it. So that means I will earn 30k MQMs this year!

Cool. Glad you got that offer! Neither my wife nor I got it.

I never understand why someone would risk the chance to travel back of the bus and hope for an upgrade on international travel. Travel is a PITA as it is, without the added indignity of being shoehorned into economy if the upgrade doesn’t clear.

For flights to Europe (which is how we usually use the global upgrade certs), it is often possible to upgrade at the time of booking. In all other cases, our upgrades have cleared weeks in advance. I would worry most about not clearing on extremely long flights such as to South Africa, to Australia, to Asia and would probably book a business class award instead (if available)

It is not clear – if you have Delta Platinum, received 20K MQM after spend, upgrade later for Delta Reserve, did a spend and can get 30K MQM, right?

Yes, that’s correct. But, suppose you started with both a personal Platinum and personal Reserve card and earned 50K MQMs on those. If you then upgrade the Platinum card or downgrade the Reserve card, you can’t earn more MQMs that same calendar year since you’ve already maxed out your MQM earnings for that type of card.