UPDATE: Please also see: US Bank Real-Time Mobile Rewards. What works where?

Wow. I didn’t see this coming. US Bank has just become relevant again in the travel rewards space. Via a feature called “Real-Time Mobile Rewards,” the US Bank Altitude Reserve and the US Bank FlexPerks cards now allow you to redeem points for travel at 1.5 cents per point without requiring you to book through US Bank’s travel portal. I never thought I’d say this about a US Bank product, but… this is a feature that I really wish Chase, Amex, and Citi would mimic.

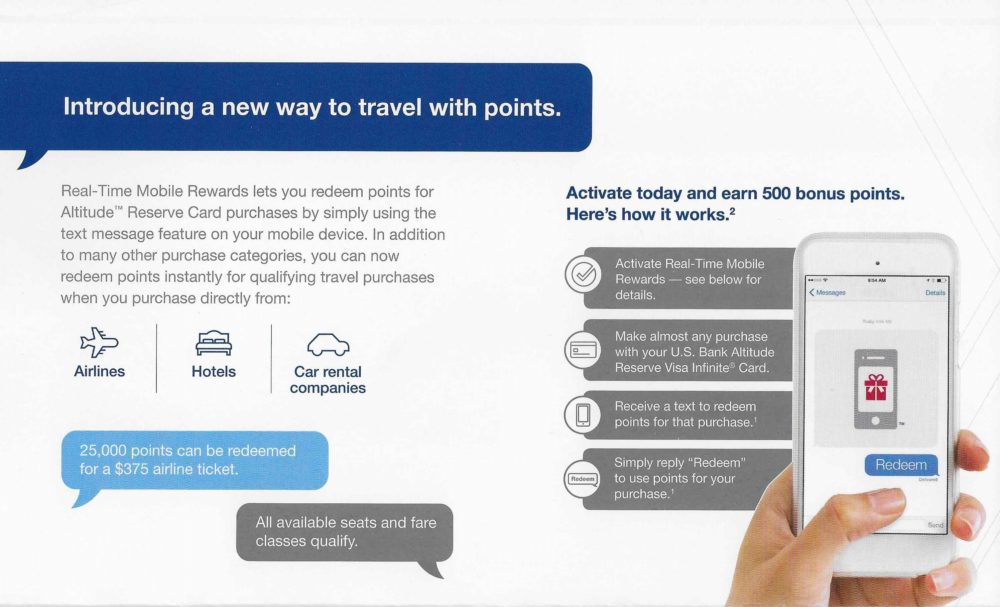

This enhancement came to my attention yesterday when I received mailers like the one shown above for my Altitude Reserve card and my FlexPerks card. The mailers indicate that you can now redeem points for travel, at 1.5 cents per point value, regardless of how you bought that travel. That’s huge.

Due to an issue I’m having with not being able to log into my US Bank account (the darn issue is going to take a week to solve!), I asked a friend to test this out for me. He followed the directions in the mailer to activate Real Time Mobile Rewards and selected all available categories. Then he booked just under $500 in airfare through Expedia and paid with his Altitude Reserve card. Instantly he received a text asking if he’d like to redeem about 33,000 points the purchase. All he had to do was text back “REDEEM” and he was done.

Why this is huge

Quite a few travel rewards cards offer more than 1 cent per point value when redeeming points for travel. Popular cards that do this include Chase Sapphire Reserve (1.5 cents per point), Sapphire Preferred and Ink Business Preferred (1.25 cents per point), Citi Premier (1.25 cents per point), and US Bank’s Altitude Reserve and FlexPerks cards (1.5 cents per point). With the new exception of US Bank, though, in all of these cases you must book travel through the bank’s travel portal in order to get that enhanced value.

The ability to circumvent the bank’s travel portal and still get good value for your points is huge for a number of reasons:

- Bank travel portals sometimes have worse prices than can be found elsewhere. You can now shop around and buy from wherever you want!

- Often it is impossible to find the flights, hotels, etc. that you really want through a bank’s portal.

- You can now click through a rewards portal to book travel in order to earn extra rewards

- There is no effort required to use your rewards. Simply use your card to pay for travel and then decide whether to offset those charges with points!

- By paying with your credit card and then offsetting the charge with points, you should earn credit card rewards for those travel purchases.

Note that cards like the Capital One Venture Rewards card and Barclaycard Arrival Plus already work the same way: you do not need to book travel through a special portal in order to get full value rewards. The difference is that the Capital One and Barclaycard cards offer just 1 cent per point value whereas US Bank offers 1.5 cents per point value (granted, though, each of these cards earn 2 points per dollar for all spend).

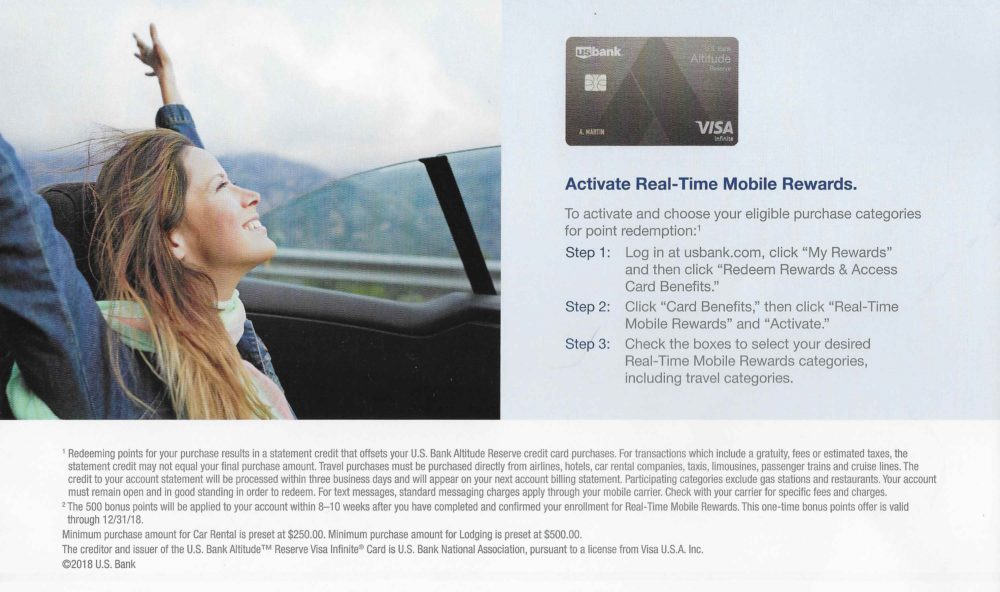

How to setup Real Time Rewards

- Log in your US Bank account from a desktop browser, click “My Rewards”, then “Redeeom Rewards & Access Card Benefits”

- Click “Card Benefits” then “Real Time Mobile Rewards”, then “Activate”

- Check the boxes to select your desired rewards categories (or select all).

Now when you use your US Bank card to make purchases within your selected categories you should be texted the option to redeem points for those charges. For travel purchases only, the number of points required should make the points worth 1.5 cents each. For all other purchases, you’ll get only 1 cent per point value.

Note that this feature is available to FlexPerks Visa, FlexPerks Business, and the Altitude Reserve, but not to the Amex FlexPerks card.

See Also: US Bank Altitude Reserve Complete Guide.

Irksome Minimums

If you’d like to use Real Time Rewards for hotels or car rentals, note that it will only work with charges of $500 or more for lodging, or $250 or more for car rentals. The Real Time Rewards preferences page notes the following:

Minimum purchase amount for Lodging is pre-set at $500.00. Minimum purchase amount for Car Rental is pre-set at $250.00. All other participating categories will follow the minimum purchase amount selected below.

[…] per point. Better yet, US Bank earlier this year rolled out their Real-Time Mobile Rewards (See: US Bank makes Real-Time Mobile Rewards awesome. Are you listening Chase? Amex? Citi?). In a nutshell, Real-Time Mobile Rewards allows you to book directly with a hotel, airline, etc […]

Just signed up. From a marketing perspective this is actually very smart. They’re not spending any more on the rewards. But this does 1) encourage users to put more spend on the card in the hopes of being able to redeem points, even spend that doesn’t get the 3X bonus; and 2) greatly increase cardmember interaction, increasing “mindshare” and thus – US Bank hopes – wallet share. Very smart.

[…] US Bank makes Real-Time Mobile Rewards awesome […]

[…] sounds great, actually, is being able to use bank points to book directly while realizing uplift. US Bank Real-Time Rewards are an example of this I wish other banks would […]

Has anybody tried this with Uber? Uber transactions do get reimbursed toward the $325 travel credit so I would imagine it would work but I want to confirm.

Yes it works with Uber and Lyft. See: https://frequentmiler.com/us-bank-real-time-mobile-rewards-what-works-where

[…] Readers may remember that I was pretty excited about US Bank’s Real-Time Mobile Rewards when I learned that they’ve expanded them to include travel. If you have the Altitude Reserve card, or a Visa card that earns FlexPerks points, you can now apply your rewards to travel purchases at 1.5 cents per point value without having to book travel through US Bank. This is huge because it means that we can have our travel cake and eat it too. By that I mean we can book travel any way we want… including going through portals, using promo codes, etc., and still use US Bank points to pay for that travel at 1.5 cents per point value. For more on this exciting new feature, see: US Bank makes Real-Time Mobile Rewards awesome. Are you listening Chase? Amex? Citi?. […]

This post may need an update with data points. I am travelling in Canada and did not get the text for hotel purchase in excess of 500 USD and a rental car purchase in excess of 250 usd. I did get the text for my airline baggage charge before we left the US but did not send the “redeem” text until the next day and got the response that the time to redeem had elapsed. So RRR was a big fail for me. Do the rules say purchases need to be in the US or made in USD? I had been really excited, especially since I just got a samsung. Now I worry I will never be able to redeem because I rarely pay cash for US hotel stays.

Just spoke with a FlexPerks rep because I haven’t been getting texts, and she didn’t know what I was talking about with the redeeming 1.5 cents via RTR. I told her to talk with the rest of the reps in the office and make sure the company was on the same page with what they were mailing out. Which is it?

I can confirm from personal experience it is 1.5 cents for RTR on Altitude card…I haven’t tried my Flexperks CC yet

I just called FlexPerks and the rep had no idea what I was talking about. I haven’t received a text, and I set my charges for travel. Spent $120 on the card for a RyanAir flight. Which is it?

Did you purchase the ticket directly from Ryan Air? If not, the charge may have come through as from the travel agency rather than from the airline. Or, it’s possible that RyanAir isn’t coded properly as an airline (but this seems less likely to me). Also, make sure that you’ve checked “Airline” as a type of purchase you would like to use Real Time Mobile Rewards with, and make sure to set the minimum low ($10 is the lowest you can go).

Yep, bought direct. I’ll check everything I have in RTR to make sure I don’t miss anything. Does it make a difference that I have a FlexPerks Visa vs. Altitude Reserve?

No, it should work the same with the FlexPerks Visa. I’ll double check that though

Looks the same with FlexPerks as with Altitude

Great. Thanks Greg

would buy AA or southwest gift cards trigger this?

Good question. I’d expect so, but I haven’t tested it.

[…] – good news if you have a US Bank Altitude or Flexperks card you can now redeem at the elevated 1.5 cents per point rate for ANY travel charge […]

[…] fellow blogger Frequent Miler was the first one I saw post about the change to allow US Bank FlexPerks to be redeemed instantly […]

I can finally access my account now. I see (as others have pointed out) that the minimums for lodging ($500) and car rentals ($250) can’t be changed. I’ve added a section to this post about that. It’s interesting that they don’t have a mandatory minimum for airfare.

Dang, wish I’d seen this last weekend (insert comment about the irony of being at FTU and getting behind on related blogs). I had a Fairmont stay (using a free night certificate from their long-gone CC) and put the food charges (beyond the $50 credit) on my Altitude Reserve. Alas, I hadn’t known to update Real-Time Mobile Rewards settings, so I didn’t get an alert for that purchase as the amount was < $100. Of course, I likely wouldn't have noticed that the number required for redemption was a better value than the usual 1¢ (that I would never use). I don't know why US Bank couldn't have sent this major update via email instead of (or in addition to) snail mail. But sure enough, I had two of these mailers awaiting me when I returned to town. Such a quirky company. I've long had difficulty doing redemptions via the terrible portal, as it's almost impossible to find fares that aren't Basic Economy. So, this is a major step forward and helps me see my four (!) USB travel cards in a new light. I immediately used Altitude to purchase a DL ticket (via Delta.com so I'd earn Starpoints), and I got the notification and redeemed about a minute later. Both the ticket purchase and travel credit show as pending on that card. Works for me!

Hey Greg. The information below is pretty important regarding your post if true.

I just called US Bank Flexperks customer service to inquire whether the $25 airline allowance applied to Real Time Rewards redemptions for an airline ticket which according to the supervisor I spoke with, it does not.

More surprisingly though, the supervisor told me that the redemption value for Real Time Rewards in the travel category is the same 1 cent per point despite the postcard showing a sample redemption at 1.5 cents per point.

I hope this is not accurate, but can you please double-check with your sources at US Bank?

I just spent $158.60 on an airline ticket and got a notification to redeem 10,573 points, which I accepted. Now a RTR Credit of $158.60 is showing on that account. It’s possible that since this is a very recent change that only seems to be documented via postcard, workers may not have been informed. Previously, RTR was indeed 1¢ across the board (but excluded some categories like fuel and restaurants).

[…] H/T: Frequent Miler […]