NOTICE: This post references card features that have changed, expired, or are not currently available

This week on Frequent Miler on the Air, we talked rewards for rent. No, we’re not talking about renting out your Disney timeshare points or using your checked baggage allowance for a courier company but rather earning rewards while paying rent. While that became a hot topic this week, it has long been possible to earn rewards for paying your rent — and at much greater return with some simple techniques. We also talk about Alliant’s crazy changes, buying gift cards, and more. Watch or listen below or read on for this week’s posts about how to save 50% on hotels, Schwab’s coming devaluation, and more.

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe (if we get enough people to subscribe, we might be able to earn some income from this someday. So far, the podcast is just a labor of love).

Our podcast is available on all popular podcast platforms, including:

Apple |

Spotify |

You can also listen from your browser:

This week at Frequent Miler

Plastiq Guide: Pay Bills via Credit Card

Have you got a big bill that you just wish could be paid with a credit card? Maybe it can and Plastiq could help. While it wouldn’t be worth the fee to use this service in ordinary circumstances, it can absolutely be worth the cost when triggering new card welcome bonuses. While the Bilt Rewards program drew a lot of attention this week, the truth is that using a service like Plastiq a couple of times per year to pay the rent could easily trigger far more rewards if it helps you meet the spending requirement for a couple of new card bonuses.

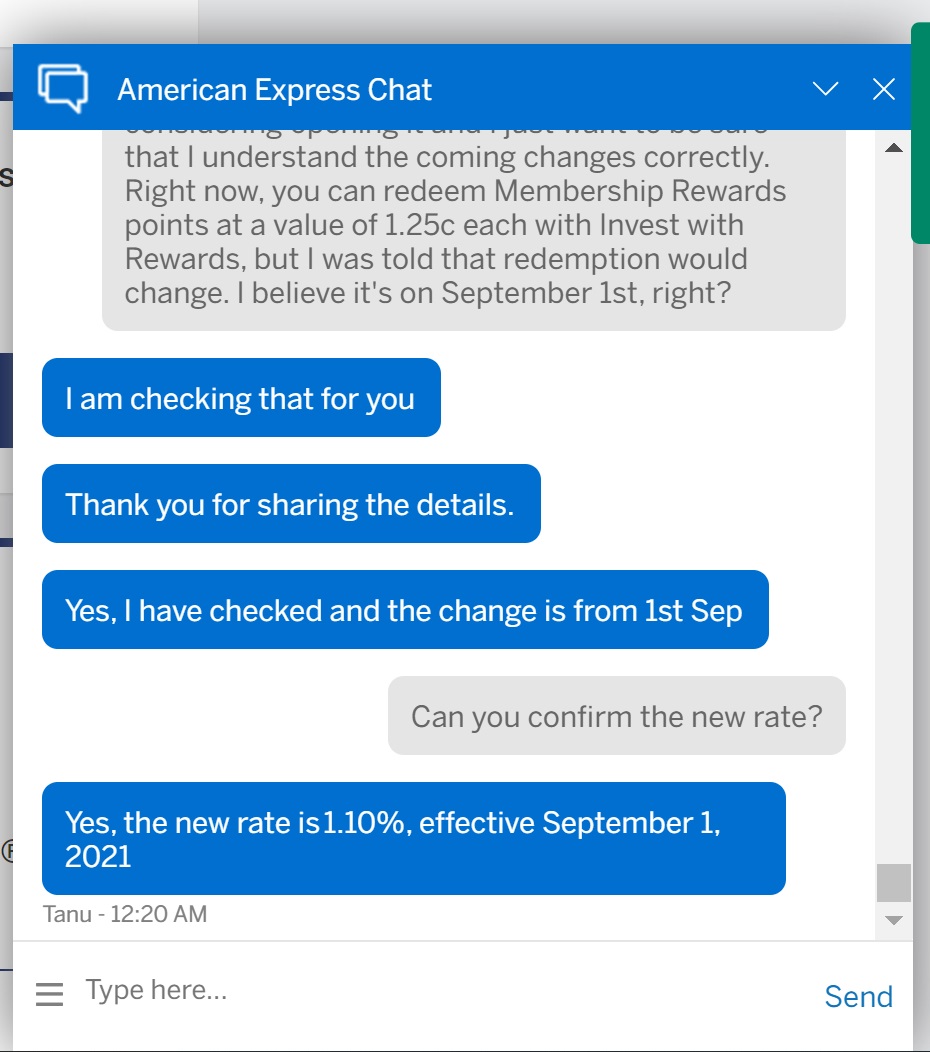

Reps: Schwab Platinum Invest with Rewards at 1.1c starting 9/1/21

The Schwab Platinum card makes it possible to cash out Membership Rewards points into an investment account at a favorable rate. There had been recent rumors that the rate at which you can convert points to cash would soon change. Unfortunately, the word on the street appears to be correct and the end result will likely be a reduced rate of 1.1c per point beginning on September 1, 2021. Sadly, existing cardholders will not be grandfathered in to the current rates. If you’ve been thinking about converting points to cash, you probably need to hop on board before the gravy train departs. The Schwab Platinum is certainly on my radar in the near-term given that I probably should cash out some Membership Rewards points and my interest has been piqued by conversation in Frequent Miler Insiders about the best ways to leverage the Invest With Rewards program while it’s still around.

Alliant looks to reclaim the throne as cash back king

Alliant has announced that its Cashback Visa will get better next month, but in order to do so they made it so complex that I just can’t see this card holding the average person’s interest long enough to understand how it works. I think the hoops one has to jump through here are so easy as to make this card a keeper for existing cardholders, I just can’t see many newbies who are looking for the simplicity of cash back finding themselves drawn to a card with two tiers of cash back that requires a high-rate checking account with its own requirements to earn half a percent more than a no-effort strategy with another bank.

How to Earn Rewards by Paying Rent

Renters rejoice: Bilt Mastercard offers points for rent. Transfer to Hyatt, AA, and more.

This week, Bilt Rewards launched its program and credit card to some fanfare and the two posts above address both this new program and a number of other ways to earn rewards when paying your rent. As we said on this week’s show, Bilt is going to be great for introducing newcomers to miles and points by giving them a chance to earn worthwhile rewards when paying their most significant monthly expense, but with just a little study and minimal effort, it is possible to earn far more with just one or two new card welcome bonuses each year.

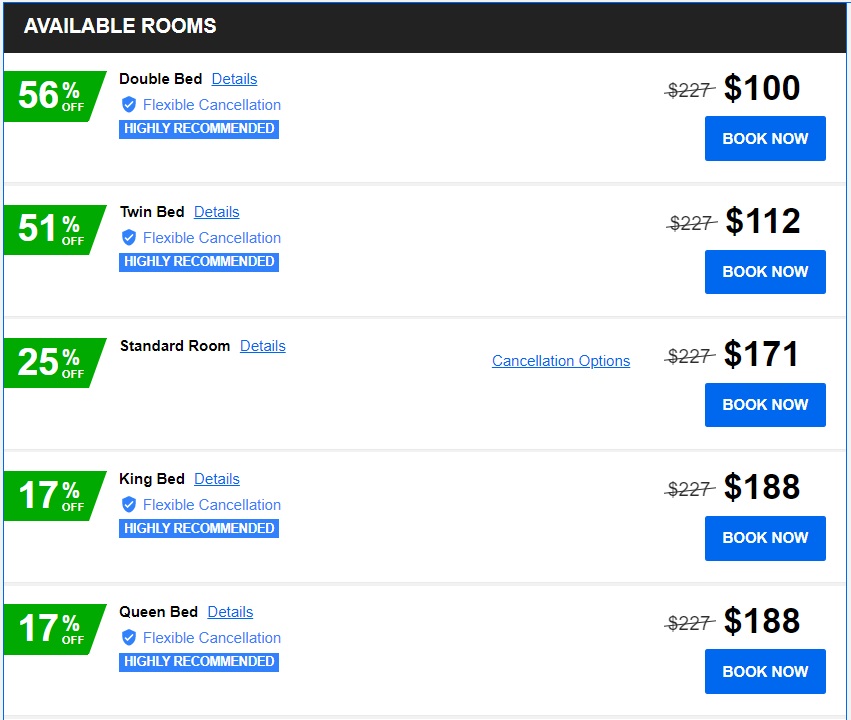

No Joke: Capital One Spring & Priceline Really Can Save You 50%+ On Hotels (No Capital One Card Needed)

You know that feeling of skepticism any time you see a discount advertised as “up to X% off?” It sometimes almost always causes me to ignore the source of that claim altogether. But you and I and everyone else may have been missing something yuuuge: Stephen Pepper found that Capital One Spring actually produces results even better than advertised. You’ll give up stuff like hotel points and elite perks, but you can easily buy yourself a breakfast sandwich with the savings. Check this post out if you like saving money.

What are Radisson Hotels Americas points worth?

The burning question on the minds of miles and points enthusiasts everywhere for the past many months likely hasn’t been how much Radisson points are worth. Nonetheless, Greg is powering through the various programs with his formula for observed-value measurements as to the reasonable redemption values of points. Next up on the docket was Radisson Rewards. While the value there has dropped a bit, it is surprising to see Radisson’s consistency here. Their points consistently aren’t worth much, but they are still worth something in the right situations.

That’s it for this week at Frequent Miler. Keep an eye out for this week’s month-ending last chance deals.

![A coupon book with a credit card, a credit card program with an airline, and more [Week in Review] a person reading a magazine on a couch](https://frequentmiler.com/wp-content/uploads/2017/05/kick-back.jpg)