The offer described below has expired. Original content follows…

Everyone is excited about Chase’s new 100,000 point offer for the Sapphire Preferred card. It is, without question, a fantastic and exciting offer. Pretty much anyone who can qualify ought to consider applying. But many people have questions about whether they qualify or how to qualify. Here’s what you need to know…

100K Offer Basics

| Card Offer and Details |

|---|

ⓘ $985 1st Yr Value Estimate$50 prepaid hotel credit valued at $35 Click to learn about first year value estimates 75K Points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Earn 75,000 bonus points after spending $5,000 within the first three months from account opening.$95 Annual Fee Recent better offer: Expired 5/14/25: 100K after $5K spend FM Mini Review: Great welcome offer. Unlocks ability to transfer points to hotel & airline partners. Solid option to pair with no annual fee Ultimate Rewards cards such as the Freedom cards, Ink Business Cash, and Ink Business Unlimited. Earning rate: 5X Travel booked through Chase Travel℠ (2X all other travel) ✦ 5X Lyft through 9/30/27 ✦3X Dining ✦ 3X Select streaming services ✦ 3X Online grocery ✦ 10% annual point bonus Base: 1X (1.5%) Travel: 2X (3%) Flights: 2X (3%) Portal Flights: 5X (7.5%) Hotels: 2X (3%) Portal Hotels: 5X (7.5%) Dine: 3X (4.5%) Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: Primary auto rental collision damage waiver ✦ Free DoorDash DashPass (min. one year, must activate by 12/31/27)✦ $10 off each month on one non-restaurant orders from DoorDash ✦ Transfer points to airline & hotel partners ✦ $50 back for hotel stays booked through Chase per cardmember year in the form of a statement credit ✦ Each account anniversary earn bonus points equal to 10% of total purchases made the previous year. |

In order to qualify for the Chase Sapphire Preferred 100K bonus, you must meet the following criteria:

- Under 5/24: If your credit report shows that you opened 5 or more new cards from any card issuers in the past 24 months, then you will most likely not be approved for a new Chase card. More details can be found here.

- No current Sapphire card: You must not currently be the primary cardholder of the Sapphire Reserve, Sapphire Preferred, or no-fee Sapphire card. It’s okay if you are an authorized user with any of those cards, but not a primary cardholder.

- No Sapphire bonus in last 48 months: If you received a welcome bonus for either the Sapphire Preferred or Sapphire Reserve card in the past 48 months, then you are not eligible for this bonus.

- Meet minimum spend requirements: Once you are approved for the Sapphire Preferred, you have 3 months to make purchases totaling $5,000 or more. Keep in mind that the $95 annual fee (and any other card fees you incur) do not count towards that total. Also, any charges that count as cash advances will not count towards the total.

Questions and Answers

100K Offer Questions

How do I apply?

You will find our link for this offer on our dedicated Sapphire Preferred Card page here. The same page includes a full guide to the card’s perks and rewards.

How much are 100,000 points worth?

The answer depends upon how you use the points:

- $1,000: You can directly cash out your points for a penny each

- $1,250 towards travel: Points are worth 1.25 cents each when you use points to book travel through Chase Travel℠.

- $1,500 towards travel. If someone in your household has the Sapphire Reserve card, you can move your points to their account to make them more valuable. Or, after a year with the Sapphire Preferred, you can ask to upgrade to the Sapphire Reserve. Either way, you’ll get 1.5 cents per point value when booking travel through Chase Travel with the Sapphire Reserve card.

- $2,000 or more towards travel. Chase Ultimate Rewards points can be transferred to a number of travel partners (see details here). In many cases, if you know what you’re doing, it’s possible to get far outsized value (2 cents per point value or more).

How long will this offer last?

Update 5/8/25: We’ve received notice that this offer will end at 9 AM EST on 5/15/2025.

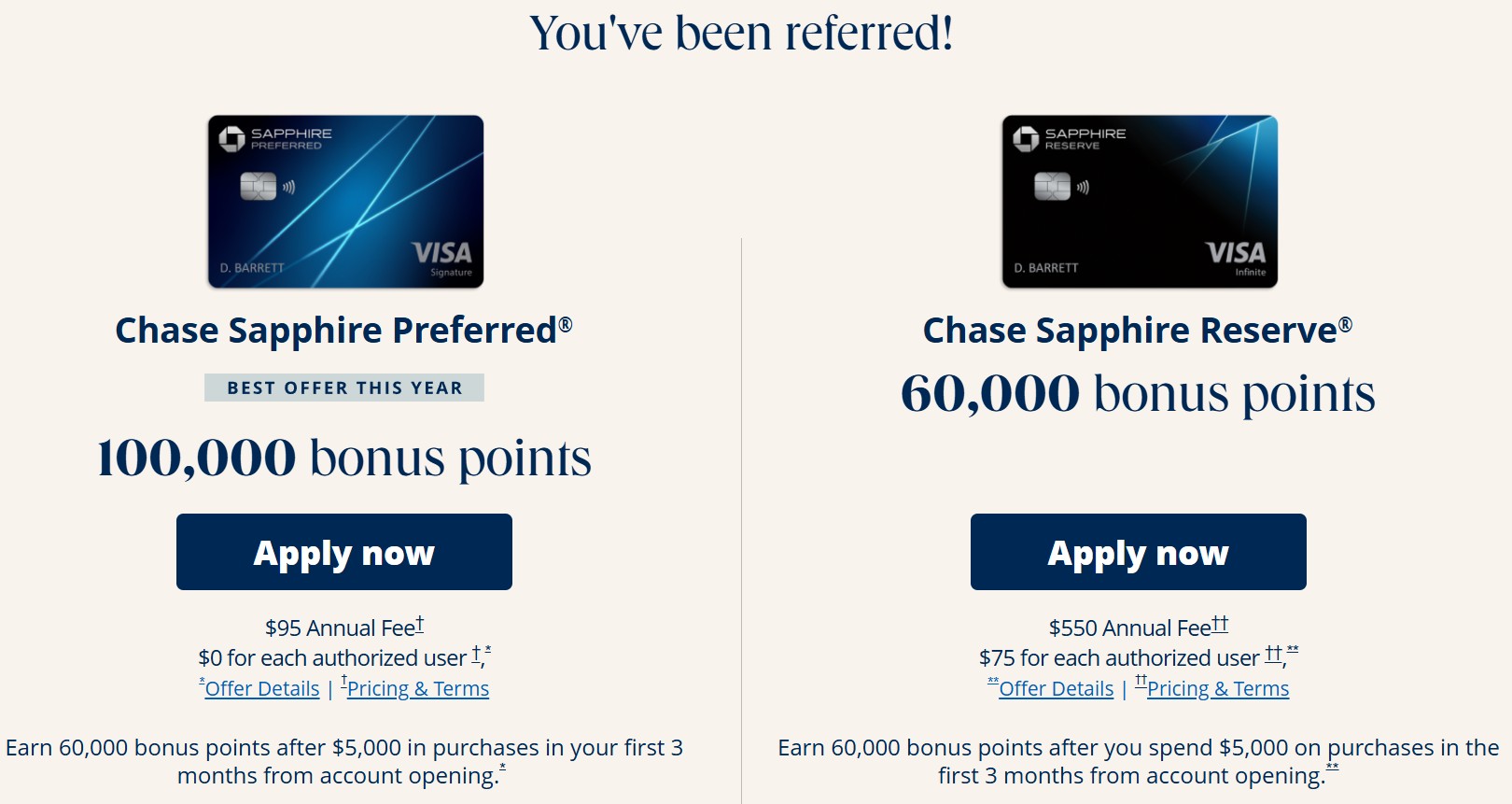

Can I refer friends to this offer? I am a current Sapphire Preferred or Sapphire Reserve cardholder.

Yes! If you are a Sapphire Preferred or Sapphire Reserve cardholder, you can log into your Chase account to get a refer-a-friend link to share with friends. Your friend can qualify for the 100,000 bonus points offer if they are approved for the Sapphire Preferred card (or 60,000 points for the Sapphire Reserve card) and you will earn 10,000 points. You can earn a maximum of 100,000 points by referring friends to this offer.

Please note: At the time of this writing, the fine print under the 100,000 bonus points offer still says “Earn 60,000 bonus points…” I’m sure that’s a simple mistake, but as long as that’s there, I strongly advise anyone who applies through a referral like this to take a screenshot of the landing page that shows the 100,000 bonus point offer in big print.

Can I refer family members to this offer? I am a current Sapphire Preferred or Sapphire Reserve cardholder.

Yes

Can I refer myself to this offer? I am a current Sapphire Preferred or Sapphire Reserve cardholder.

No

I applied and was denied. Is there anything I can do?

Yes! When denied for a Chase card, call the reconsideration line (1-888-270-2127) to ask for the decision to be reconsidered. If you currently hold other consumer Chase cards, tell the agent that you are not looking for more credit and you are happy to move credit from another card to open this one.

I recently applied for a lesser offer. Will Chase match me to the 100K offer if I ask?

Possibly. It’s definitely worth calling to ask.

I recently applied for a lesser offer, but a decision is pending. What should I do?

Call and ask to rescind the application. You should then be able to apply separately for the 100K offer.

Can my significant other also apply so that we will earn 200,000 points?

Yes. If you can both qualify and can both meet the minimum spend requirements then it absolutely makes sense for both of you to apply. Chase even allows people within the same household to share points and so you could move the points all to one account as needed (you’ll have to call Chase to setup the initial transfer though). There usually isn’t a good reason for two people in the household to keep these cards long term, so after a year I recommend that one of you product change to a fee-free Freedom Flex or Freedom Unlimited card.

Can I earn the bonus by product changing to the Sapphire Preferred from another Chase card?

No.

Can I apply and earn the bonus even if I have other Chase Ultimate Rewards cards such as Chase Freedom Unlimited or Chase Ink?

Yes.

5/24 Questions

How do I know my 5/24 status?

See this post: 3 Easy Ways to Count Your 5/24 Status.

I am over 5/24 due to being an authorized user on several accounts. Can I qualify?

Yes. When you apply for the Sapphire Preferred, you may be initially denied, but you can then call the reconsideration line (1-888-270-2127) to explain that you are not responsible for the credit lines where you are an authorized user. They should then be able to reconsider your application and approve you if your are under 5/24 with your primary cardholder accounts.

Current Sapphire Card Questions

I currently have the Sapphire Reserve card. Can I qualify for the Sapphire Preferred?

No. Chase treats these, and the no-fee Sapphire card, as a single product family. You are only allowed to have one Sapphire card at any time.

I currently have a Sapphire card. Can I cancel it and then apply for the Sapphire Preferred?

Yes, but I recommend product changing instead to a no-annual-fee Chase Freedom card (Freedom Unlimited or Freedom Flex). Product changing will preserve your points and your credit line. Plus, if you aren’t approved for the Sapphire Preferred, you could then try to product change back.

After cancelling or product changing, wait two business days before applying.

I currently have a Sapphire card. Can I product change it and then apply for the Sapphire Preferred?

Yes! Chase even mentions that option directly in the card’s offer terms. They state: “If you are an existing Sapphire customer and would like this product, please call the number on the back of your card to see if you are eligible for a product change”

Product changing will preserve your points and your credit line. Plus, if you aren’t approved for the Sapphire Preferred, you could then product change back.

After product changing, wait two business days before applying.

I currently have a Sapphire card but only because I’m an authorized user. Can I apply for the Sapphire Preferred?

Yes! Only the primary cardholder of a Sapphire account is prohibited from applying for a new Sapphire card.

Product Change Questions

I currently have a Sapphire card. Which card should I product change to?

Any Chase Freedom card will work. If you don’t already have the Freedom Unlimited card, that’s a great one to have anyway, so I’d go for that. See our guides here:

If I product change, what happens to the points in my account?

If you product change to any kind of Freedom card, your points will be preserved in your Freedom account. Once your Sapphire Preferred account is open, you can then move your Freedom card’s points to your Sapphire Preferred account in order to make them more valuable again.

If I product change and then I’m denied for the Sapphire Preferred, can I product change back?

Yes — most likely. I can’t guarantee that Chase will offer you that product change option, but it is very likely.

What happens to travel booked recently on my Sapphire card for the travel protections? If I product change to a Freedom card, will I keep the travel insurance protections for my trips?

I don’t know. My guess is that your travel protections will be based on the card you have at the time that you file a claim, but I’m not sure.

48 Month Rule Questions

How long has it been since I earned my last Sapphire bonus? I don’t remember.

A rough approach is to check when your account was opened and then estimate that you received the bonus about 3 months later. If you don’t have your own records, you can find out when your account was opened from just about any credit reporting tool. That should give you a good enough timeline. If you don’t know when you opened your card or you need a more precise answer, I recommend calling Chase or sending them a secure message to ask.

It has been more than 48 months since I received a welcome bonus, but less than 48 months since I cancelled my Sapphire Preferred or Sapphire Reserve card. Can I qualify?

Yes. The 48 month rule is specific to the date in which you last received a welcome bonus for the Sapphire Preferred or Sapphire Reserve card. It’s okay if you have recently had one of those cards as long as you no longer have it at the time you apply.

I previously had a Sapphire card, but I never earned a welcome bonus. Can I qualify?

Yes. As long as you don’t currently have a Sapphire card (Sapphire, Sapphire Preferred, or Sapphire Reserve) you can qualify.

Hi Greg,

I applied using a 100K referral link on Monday night but I was requested to unfreeze my Transunion in order to continue. Now that referral links are expired, is the 100k referral offer still attached to my application?

Yes. As long as you don’t apply again but instead call and ask them to push through the application, the referral should track

I downgraded to freedom flex on Wednesday evening May 7. I tried to apply for the CSP on Friday evening but it still said I had the CSP, but luckily it said it didn’t pull a credit report. I tried to apply on Monday 5/12 and it did pull a credit report but said it would take 7-10 business days to review. My question is if I submitted my application before the bonus offer ends and they approve it after Thursday do I still qualify for the 100 K bonus?

Great question. Yes, if approved you will definitely get the bonus you applied for even if it’s no longer available by then

Question about time needed to wait between downgrading CSR to Freedom card and then applying for the CSP. I have had my CSR for over 48 months and on Saturday, I downgraded to the Freedom Ultimate Rewards. I read somewhere to wait two days before applying for the new CSP – is that two business days, or since I did the downgrade on Saturday, is Monday good to apply? I know this deal ends this Thursday…

It seems to be business days. You should be good to apply on Wednesday

[…] Frequent Miler […]

My question – I applied for the CSP in June 2021, and got the bonus in July 2021. If I apply now and wait to hit the spending until August, would I be able to get the bonus?

No.

Can’t be approved if still within the 48 months. Automatic denial without a hard pull.

FYI saw this language, so most likely ending 5/12

“Your friend gets rewarded too with 100,000 bonus points when they open a new Sapphire Preferred card and complete qualifying activities. Make sure they apply by 5/12/2025.”

[…] Chase Sapphire Preferred FAQ […]

My exact 48 months from earning the SUB is 5/15/25. Since the offer is ending soon, is my best bet to freeze my credit reports in hopes I get a pending application asking to unfreeze and then wait until 5/16/25 to unfreeze and call Chase?

They won’t attempt a pull if within 48 months of last bonus, automatic denial, so freezing doesn’t help.

I have the no-annual fee saphhire card (downgraded from CSP 4 years ago), do I have to cancel it before I can apply the CSP and get the bonus? Or I can upgrade it to CSP but still get the bonus?

Oh how I wish there were a nifty little FAQ that would answer all those questions. Oh, wait…

You have to either cancel it or product change it to a Freedom card and then you can apply for the Sapphire Preferred card. Upgrading it won’t get you a bonus.

Can my spouse apply and get the sapphire preferred bonus, and then transfer those points to me (I have the reserve) so I can use them for the higher value?

I have my husband’s Chase account linked with mine. I have the Reserve card…. Point transfers from his account to mine work instantly.

Yep

My question — should I product change a Freedom card to the Sapphire (fee-free basic card) so I can refer P2 to get the Sapphire Pref bonus.

I’m thinking its not worth the effort, even though it’s worth 10,000 points.

They really should just merge the Visa Freedom card and fee-free Sapphire into one card and call it the Sapphire Freedom.

I have a friend with the basic Sapphire, and I asked him to refer me, but he couldn’t generate the link. The catchall referral site wouldn’t even load on his account.

Please check me on this, but it seems that you can’t refer from the free Sapphire.

He loves that card for some strange reason, but he doesn’t have any way of transferring tons of points he organically accumulated.

I assume you’re not eligible to sign up new for the Sapphire Preferred?

Just went over 5/24 a few months ago

I was in the branch and asked if they could check when I got the bonus.

She couldn’t do it, so she called, and they said the following:

Since I’ve converted it to the Freedom (Visa Freedom before it got extinct) and since the number didn’t change (I had my old CSP and she could physically see that the number is same with my freedom ) that I have to cancel that Freedom, because they “think” it’s the Sapphire

I’m probably well past the 48m after the bonus (I’ve applied in Nov 2022 +3 Months), just wanted to verify, and now they’re telling me that I can’t.

Moreover, the banker added that I have to cancel this Freedom and wait 48 months, which I don’t believe, but the other person on the other end of the line sounded knowledgeable and persuasive about the same number.

Is there a chance that it’s true? If I PCed the CSP to the Freedom Visa and the number didn’t change, does it mean that I have my Freedom as “CSP” somehow in their system?

I PC’d the CSP to the Freedom Visa like you, and this past year I PC’d that to the Freedom Flex MC and got a new card number. That may be a solution for you.

Thanks for your reply!

I thought of it and told it to a banker. She kept insisting that I needed to cancel it, which is obviously incorrect, since the first digit determines whether it’s a Visa or a Mastercard. IIRC, I kept it on Visa because the Freedom Visa was being nerfed, and I had the new Freedom Flex Mastercard (I got it the same day with CSP). I don’t recall the exact reason I needed the Visa, but if this whole theory isn’t debunked, I’ll have to PC that card to Mastercard just to be safe. Aside from Sapphire cards, what else is out there? Slate is Visa or MC?

I think PCs from Freedom to FFlex depend on the agent. I tried when the FFlex came out and was denied but I was able to just a few months ago and coincidently picked my old Saphhire card because it was the card number I had for the shortest amt of time.

Only advantage of the Freedom is a visa can be used at Costco.

Good luck.

That’s nonsense, some agents are poorly informed. However, if you applied for the CSP in Nov ’22 (and earned a bonus), then I expect your application to be denied for having received a bonus in the past 48 months.

Oops, my mistake. I meant that I got my CSP (& Freedom Flex the same day) in November 2020. I called, and the agent told me that I received the bonus in January 2021, so I’m good

Thanks for pointing that out

Also, he told me that besides the Sapphires and the slate and Freedom Flex, I can convert to the Freedom Ultimate Rewards. I told him that’s what I have, he said no, but said that actually he’s not able to see any difference. So I’m guessing there are two equal products, mine as Classic Freedom and another one, called Freedom Ultimate Rewards

My Freedom is Visa Signature, and I’ve never used any benefit of that, but I guess there are some.

I strongly suspect they’re the same card, with FUR being the official name.

I’m in the same boat. One CSP and one CSR now freedom visas with the numbers the same. Are we in agreement that these will have to be product changed or canceled before applying for CSP?

So just called Chase and the rep said my freedom card is not a Sapphire card even though it has the same card number. Anyone have an opinion?

You definitely do not need to worry about having one or more Freedom cards regardless of whether card numbers stayed the same. You can apply for the Sapphire Preferred as long as you don’t have another Sapphire card open.

The Sapphire and Freedom are different cards. I meant aram’s Freedom Visa Signature is probably the same as the Freedom Ultimate Rewards, with FUR being the official name of what he’s calling Visa Signature. If you don’t have any Sapphires, then you’re good to apply. At worst, the app will tell you you’re not eligible.

So I’ve just got an instant approval without changing any Freedom Visa I had, so this was fake information, a conspiracy between the banker and their phone line.

Yes, You will get better information here than from the reps. Had a friend once listen to the reps advice instead of mine and he paid for it!

My referral link only shows 60,000! I’m not sure why.

My wife applied but forgot to unfreeze her credit. She then unfroze her credit and reapplied but then received an error message. Has anyone else had this happen? Is calling the reconsideration line the best course of action for us?

Yes, definitely call and ask for the initial application to be reconsidered now that she unfroze her credit

My referral link as of 4/7/25 shows both the 100K offer as well as the 60K offer – confusing!

The 60K offer is for the Sapphire Reserve whereas the 100K offer is for the Sapphire Preferred

I currently have a CSP and have had it since 2018 so I’m good in terms of the 5/24. My other cards are Ink products. I have a few friends/family members who are waiting on me to be able to refer them for the 100k SUB deal, but I also want to do the downgrade/product change and apply for a new CSP myself. Am I “doing too much” by trying to do all of the above? If not, is there an advisable way to navigate this plan? TIA!

It’s hard to say. You can now refer your friends, but I think you should wait until you actually earn the 10K referral bonuses before product changing and applying new. The question is whether the 100K offer will still be available by then. We have no way of knowing.

The Chase rep can see if you have a pending referral bonus. I made the “mistake” of canceling an Ink card just after referring P2 for a new Ink card. The rep didn’t tell me until after I closed the account because after closing she checked to make sure I didn’t have any points in the account. She told me I had a referral bonus pending and that since the points will be credited within 30 days of canceling the Ink card, I just have to move the points right after the referral bonus is credited.

I downgraded and have my new Freedom card now. Can my husband refer me to get the new CSP offer? I can’t remember but thought I read some time ago that we can’t do referrals between P1 and P2. Is that correct?

Yes family members CAN refer each other

Hubby referred me and I applied but didn’t get instant approval. Said they need to review my application and if approved, I’ll receive a card in 7-10 days. Is that typical? I just did a product change two weeks ago and am well under the 5/24. I waited until I had the physical card in hand plus a few days before applying. Not issues with my credit score either.

Yes that’s common. If they don’t approve you, call the reconsideration line and offer to move credit from another card in order to get this one approved. You’d be surprised how often that works.

Thanks, will do!

Or you could downgrade your card right away and then apply 5 days later for sapphire. Then refer.

I like this approach; especially since I would gain more with my own card vs the referral