It has recently become easier than ever to get 2 cents per Citi ThankYou point or Wells Fargo Autograph point thanks to the partnership (and transfer ratio) that both programs have with Choice Privileges and that Choice has with Preferred Hotels, and Greg shares some valuable options this week. Tim and Stephen have updated useful resources like how to maximize the value of your coupon books and the shopping portal myths you should stop believing. All that and more in this Frequent Miler week in review.

This week on the Frequent Miler blog…

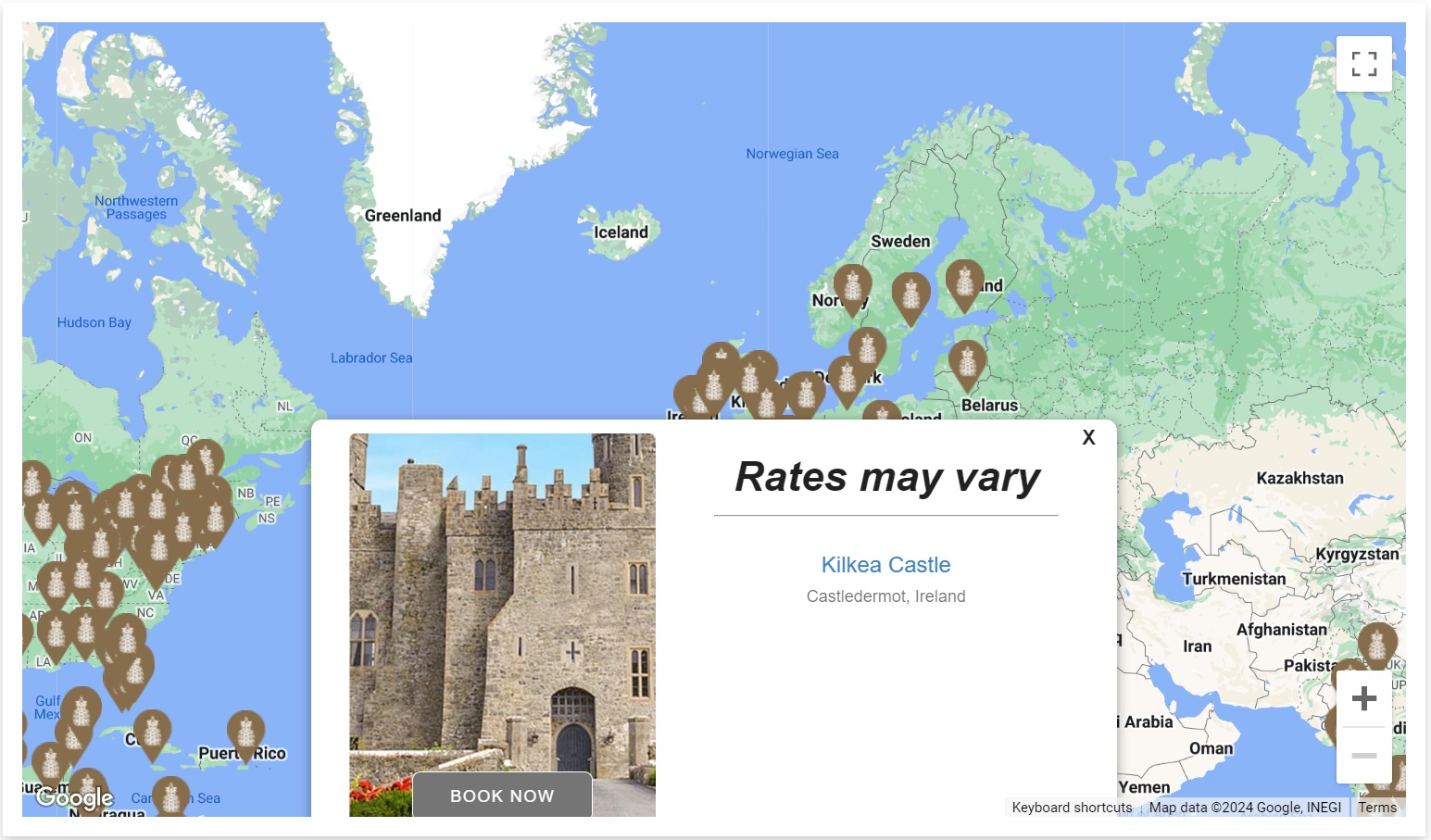

Great value Preferred Hotels bookable with Choice points

Greg curated a list of Preferred Hotels that will always yield 2c per Citi or Wells Fargo point when available, regardless of season. This list obviously leaves out some incredible properties that see big swings in pricing between in-season dates and out-of-season dates, but I thought it was interesting to scroll a list of places that will always present good value. Many of these properties look very nice indeed, so this post is a good reminder to take a look at this partnership from time to time to see if a great hotel redemption lines up with your travels.

Daily Getaways 2024: Complete preview of all the deals

The U.S. Travel Association’s Daily Getaways is back once again starting on Monday, April 15th. Years ago, I recall eagerly awaiting these sales, but they aren’t what they used to be. Still, Tim does a great job explaining which ones might actually be worth a look this time around. Just keep in mind that over the years it has become harder and harder to snag even the ones where there are many packages available. Recognize that you’ll need an alarm set to remind you and to be actively refreshing your page at 1pm and then have the approximate luck of a lottery ticket winner to get packages like the Choice Privileges points (forget about the Hyatt points altogether), but as Tim points out a few deals could be doable.

Greg’s top 10 picks (best of the best card offers)

I remember during the pandemic thinking that once issuers got consumers used to offers of 100,000 points or more it was going to be hard to put that Genie back in the bottle. While Greg’s latest picks finally features a couple of sub-100K offers on the consumer side, check out those business card offers. You know it’s still a hot time still for business credit cards when a $900 cash back offer on a card with a waived first-year annual fee doesn’t even make the top 6. If you don’t think you can get business credit cards, I encourage you to make your 2024 goal to be “develop a more entrepreneurial spirit”.

A real-world starter plan for a newbie to credit card rewards

Someone approached me this week with a question that seemed simple — essentially, the question was “I have never thought I needed a credit card, but I’m interested in going to Disney World in a few years. Do you have a recommendation for reducing the cost?”. While I had immediate thoughts about the answer, I realized that the answer is more complex for a complete newcomer who probably isn’t going to want to open many new credit cards and needs more plane tickets than there are likely to be award seats and who is starting at square one in terms of knowledge of rewards programs. Plenty of readers have chimed in with their thoughts in the comments — what’s your opinion?

United blocking award space from Star Alliance partners

In a piece of sad news, there has been further confirmation that United is intentionally blocking access to its “saver” awards, preventing them from being booked by airline partners even when there are X-class seats available (that were previously always available to Star Alliance airlines). This is a real shame for those of us who have been accustomed to booking United awards for fewer miles via their foreign partners. I find this to be a particularly big hit to both Turkish Miles & Smiles since it means that many desirable routes to Hawaii just aren’t available to partners and also to Avianca LifeMiles, which I’ve always found useful for regional United flights.

Top 6 shopping portal myths

I find shopping portals to be one of the most highly misunderstood aspects of our game. Just yesterday, someone on Youtube asked if booking a hotel via Capital One Shopping is different than booking via Capital One Travel (yes, those are entirely different things since you aren’t actually booking via Capital One Shopping but rather clicking their shopping portal link to go to the hotel’s website and book direct rather than booking via an online travel agency!). In this updated post, we address some common myths (no, you don’t need to use the airline’s credit card when shopping through their portal!) and provide a few relevant tips.

Podcast: 10 Tips for Rocking IHG One Rewards | Frequent Miler on the Air Ep250

Speaking of tips, on this week’s Frequent Miler on the Air, Greg and I discuss IHG One Rewards and 10 tips for really rocking the program. IHG is a program that I don’t pay attention to very often, but there’s no doubt that there are opportunities to get excellent value. In particular, I’d say that there are some useful nuggets of wisdom in the 10 tips we share, so this is worth a listen whether you’re an IHG fan or just occasionally dip your toes in a Holiday Inn pool.

U.S. Bank Altitude Reserve: What counts as a mobile wallet payment?

The U.S. Bank Altitude Reserve card is hands-down the best card to use for any sort of in-person purchase that can be paid for by tapping your phone or smartwatch since you’ll earn 3 points per dollar that are effectively worth 1.5c per point. That’s a 4.5% return on spend, which is why this card gas become my go-to for many day to day purchases (and that’s been particularly true when I’m traveling abroad, where tap-to-pay has long been the norm). In this post, I report on what’s working where — and what isn’t.

Which program do you have the most love/hate relationship with? | Ask Us Anything Ep66 | 4-3-24

The Frequent Miler team got together for our monthly Ask Us Anything last week and published the audio in the podcast feed this week. As a reminder, we go live on Youtube on the first Wednesday of every month at 9pm Eastern to field your questions about anything related to points & miles, credit cards, loyalty programs, and more.

Maximizing American Express credit card rebates & credits

As some cards have grown to be more and more like a coupon book, we’ve had to sharpen our scissors and get to clipping. Tim has fully updated our guide for how to apply your coupons and make sure you get full value out of your Amex card credits.

That’s it for this week at Frequent Miler. Keep an eye on this week’s last chance deals to make sure you don’t miss the ones ending this week.

![Viral marketing proves infectious for two more airlines, a new card lands with a thud and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/viral-airline-marketing-218x150.jpg)

![Prices rise, benefits cut: The new normal coming for ultra-premium cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/Increasing-fees-218x150.jpg)

![Juicy rumors, but how far will cardholders be squeezed? [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/Juicy-rumors-218x150.jpg)