NOTICE: This post references card features that have changed, expired, or are not currently available

We wrote this morning about the newly-improved Bilt Rewards Mastercard. It is now possible to earn 1x on rent payments by making just 5 credit card purchases per month and cardholders can now earn 2x on travel and 3x on dining when making those 5 purchases per month. More details about that can be found here: Re-Bilt: rent rewards card makes big improvements. In that post, I noted that Bilt still has a waitlist for the card. However, Frequent Miler readers can skip the wait with code FM4BILT.

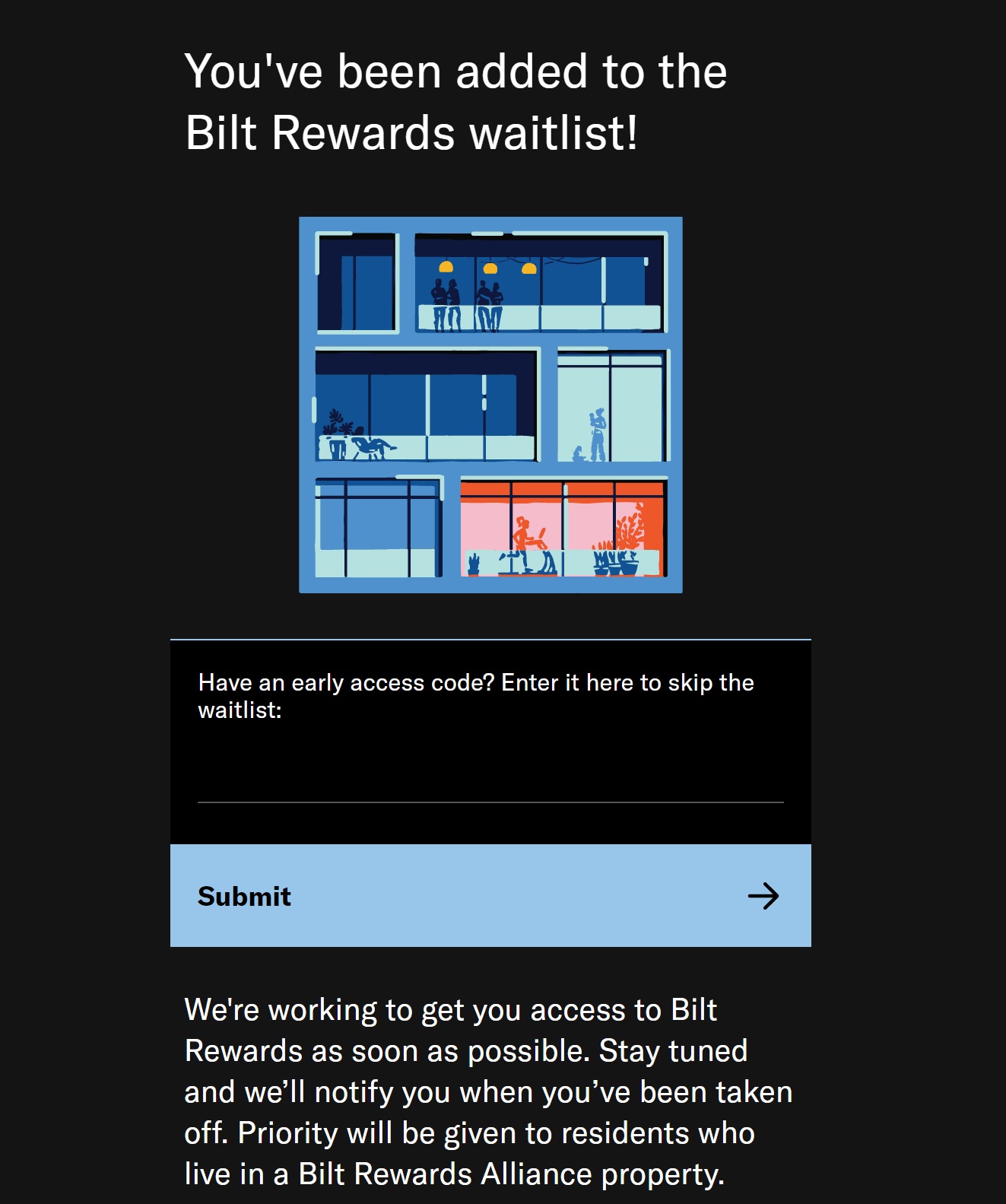

To apply for the Bilt Rewards Mastercard, you first need to join the waitlist at https://www.biltrewards.com/waitlist. After entering your email, it will ask for your name and address. Then, on the page seen above, it will ask if you have an early access code. Enter FM4BILT in the early access code field and then submit.

You’ll then immediately receive an email with a link to sign up for a Bilt account which will take you to the credit card application once you’ve set up a password. The process is quite simple and intuitive.

As I noted in this morning’s post, the Bilt Rewards Mastercard isn’t necessarily for everyone, but for those who are paying rent without earning rewards this seems like a near no-brainer since you’ll earn 1x on rent with minimal activity necessary on the credit card.

Obviously this is a new credit card account, so expect it to count against 5/24. I wouldn’t recommend sacrificing a 5/24 slot if you would otherwise be signing up for Chase cards. In terms of a welcome bonus, the Bilt card offers 2x on all purchases for the first 30 days. That’s a relatively weak new card bonus — there are some much more rewarding new card bonuses available in the current environment. However, if you are looking for a way to earn rewards for paying your rent and like the idea of transferable points with no annual fee, this card could certainly make sense. For more about the card and its latest enhancements, see this morning’s post: Re-Bilt: rent rewards card makes big improvements.

code not working anymore… new code??

Not available in the state of North Dakota.

It’s rather odd that multiple blog in this category are pumping out Bilt‘s marketing message at the same time, without being compensated.

I don’t find it that odd. When something good comes out, we write about it regardless of affiliate relationships. When the Wyndham cards came out with new offers that are pretty awesome (including 8x gas on the business card) and Vacasa began offering great value, we wrote all about those things without any affiliate relationships there. Other blogs did, too.

Bilt happens to be offering a really unique product and also loyalty program with a very unique set of transfer partners. It doesn’t at all surprise me that they are getting attention for that.

What I think you may be noticing that is somewhat unique here is information coming out on various blogs at the same time. One thing I really appreciate is when a company shares details of planned changes in advance with enough time for us to think about and digest them. That doesn’t actually happen often — a lot of companies in this space probably don’t understand the value in that, but Bilt clearly does. Obviously a number of people had access to information at about the same time (hence posts you may have noticed at about the same time on a number of blogs). Yeah, that’s a marketing tool for Bilt — but it is also good for readers because it gives us a chance to ask questions and have clarity before we post information. It doesn’t hurt that Bilt hired someone well known in the miles and points community to connect with bloggers so that we had an easy avenue for getting questions answered.

So all that is to say that yeah, they did do a good job of getting their message out. And if the message was “hey we have this cool product” and we thought the product stunk, we’d say so. In this case, we were like “yeah, that’s pretty cool” and I think a lot of people have had that reaction. We share our honest opinions about stuff whether we have affiliate relationships or not. To be clear, I have no idea whether or not we will have an affiliate relationship with them in the future — I don’t handle that stuff by design. But whether or not we have an affiliate link for a card, we’ll still write about both good and bad changes that issuers make or products they put out. If anything, I take the enthusiasm for Bilt despite the fact that people don’t have affiliate links as a sign that Bilt has actually built a product that is good.

My rent for the year exceeds $50,000, is there any option to get points going over $50,000? Can I setup 2 accounts, one for my personal rent and one for my office? Thank you.

Bilt is only for residential rent. You won’t be able to pay your office rent with it.

Got it. Thank you. Any news if they will increase the $50,000 cap?

Can I use it in Puerto Rico?

Thank you guys. Used your link and am approved and up and running already! Excited to have an easy way to earn point on rent, which I have not previously been able to do…

Can you use this to pay mortgage then?

Nope.

Wouldn’t you still pay something like a 2.5% fee for paying rent with a credit card? Doesn’t make sense unless you have no credit card fees when paying rent. I can pay rent on any 2% back card and get a better return it seems.

The idea with Bilt is that you won’t pay fees on rent payments and it will actually prevent you from making a payment through landlord portals if it would trigger a fee.

No. I linked to this post in several places — it explains how Bilt works in more detail:

https://frequentmiler.com/re-bilt-rent-rewards-card-makes-big-improvements/

The short version of the story is that Bilt charges no fee and sends your landlord a check and you earn rewards. You don’t physically use the Bilt credit card to pay your rent — you use the Bilt app.

If your landlord accepts rent payments with no credit card fee, then you would do better using a 2% card (or a 2x card like the Blue Business Plus or Citi Double Cash or better still with the Bank of America Premium Rewards card if you have Platinum Honors status, etc). Most landlords charge a fee if they accept credit cards though. In this case, you won’t pay a fee and still earn rewards. Again, see the post above for more.

How can I find out if my landlord is supported by their app before signing up for the card?

It will work with any landlord. See the post I link to from earlier today. If they don’t participate in the bill to alliance, Bilt sends them a check just like plastiq would.