NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

SoFi has several interlocking offers out right now, both direct and through SwagBucks/MyPoints. There are separate welcome offers for checking, SoFi Invest and the credit card. They can all be combined for an immediate bonus of ~$450 as well as 3% cashback everywhere on the credit card for a full year or up to $360 total.

The Deal

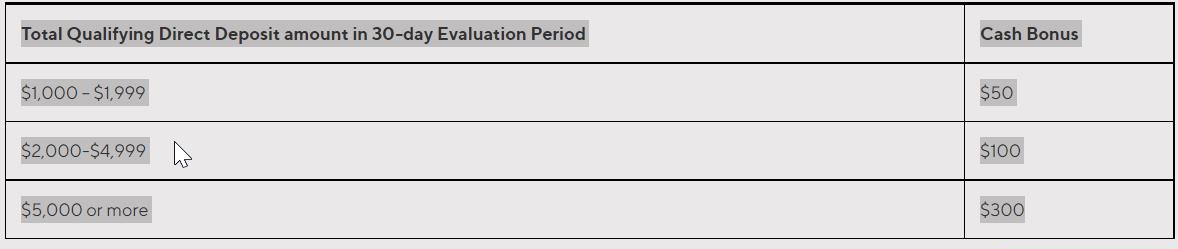

- Open SoFi Checking/Savings account and get a $50-300 bonus by completing a qualifying direct deposit by 5/31/22.

- Open SoFi Invest account and get $56-60 in MyPoints/SwagBucks by depositing $100.

- Direct links to offer:

- Get approved for SoFi Credit Card and get $75/$97 from Swagbucks/MyPoints.

- Direct links to offer:

- Upon approval and for each month that a qualifying direct deposit is made, earn 3% cashback (instead of 2%) for up to 12 months or $360 cashback ($12,000 total spend).

Key Terms

Sofi Checking/Savings

- Promotion Period: 4/5/22 12:01AM ET to 5/31/22 11:59PM ET.

- Must be a new user to SoFi.

- In order to qualify for eligibility for a bonus, SoFi must receive at least one Qualifying Direct Deposit from an Eligible Participant during the Promotion Period. Qualifying Direct Deposits are defined as deposits from enrolled member’s employer, payroll, or benefits provider via ACH deposit. Deposits that are not from an employer (such as check deposits; P2P transfers such as from PayPal or Venmo, etc.; merchant transactions such as from PayPal, Stripe, Square, etc.; and bank ACH transfers not from employers) do not qualify for this promotion. The amount of the bonus, if any, is described below. No bonuses shall be paid for qualifying Direct Deposits of less than $1,000 during the Evaluation Period (defined below).

- Evaluation Period: Defined as 30 days from the date your first Qualifying Direct Deposit is received. For example, if you receive $1,000-$1,999 in Qualifying Direct Deposits in the Evaluation Period, you will receive a cash bonus of $50. A member may only qualify for one bonus tier and will not be eligible for future bonus payments if inflows subsequently increase beyond the Evaluation Period.

- SoFi will credit members who meet qualification criteria within 14 days of the end of the Evaluation Period.

SoFi Invest

- Requires a deposit of at least $100.

- Award will Pend for 32 days. Allow up to 5 days for award to appear as Pending.

- Must be first deposit.

- Must be a new user to SoFi Invest

SoFi Credit Card

- SB will appear as Pending for 7 days.

- Must enter valid sign-up information to earn SB.

- Must be approved to earn.

Quick Thoughts

In contrast to the recent bank account bonuses that overall have been quite simple (Varo, Investr, Public, Chime and SoFi, etc), there’s a few hoops to this one. The ideal combination would be to sign-up for the checking account, do a $5000 direct deposit, sign-up for the Invest account through SB for $60, and then sign-up for the credit card through MyPoints for $97.

It’s unclear how long it will take for the 3% cashback to be activated by the direct deposit, but once it’s in, there doesn’t appear to be any minimum to the monthly direct deposit that keeps the 3% going. For some folks, $12,000 will last a year’s worth of spend, for others, it might be a week or less.

The credit card is a decent offer that could be worth considering if you’re over 5/24 or don’t care about whether you are (and it will require a hard pull unlike the other two accounts). I’ve never seen MYP or SB offer a bonus on this card, so, while it’s not huge, it’s better than nothing. Normally, the card offers 2% cashback (which is easily matched/beaten by the no annual fee Citi DoubleCash), but the 3% kicker does it make it interesting. I currently am getting 3.2% cashback from the Curve/Nearside combo, so this isn’t really worth a hard pull for me…and it’s definitely worth considering if the spending would be better put towards a new sign-up bonus.

I’m pretty sure that $300 is the largest bonus we’ve seen directly from SoFi Money, however SwagBucks was recently as high as $175. The direct deposit is significant at $5,000 and SoFi is known for being quite strict with what it considers a direct deposit (see DOC methods list here). Earlier this year, when the SwagBucks bonus was $175, I was able to trigger both SB and SoFi by making a $5,000 deposit from Wells Fargo and putting “Payroll Direct Deposit T. Steinke” in the reference (this was based on a few positive comments I saw in the DOC thread). But, of course, YMMV.

In terms of timing, if you make your first direct deposit on April 25, then you have until May 25th to meet the $5,000 in combined total direct deposits to qualify for the full $300 bonus…it doesn’t need to happen all in one shot. SoFi Money offers 1.25% APY for account holders who havee a monthly direct deposit set-up (with no cap), so it can be a decent regular option.

The invest account bonus is harmless and easy, there’s no dd requirement or even a requirement that you actually purchases any products, so long as the deposit is made. The bonuses aren’t huge, but in a brief search, I couldn’t find any offers that were signifcantly better.

Personally, I’ll pass on the credit card, because I already have a better setup for the near future. As I said earlier, I’ve already done the checking bonus, but would probably go for this one if I hadn’t. While it’s a bummer that the SwagBucks bonus isn’t higher, $360 for a one-time $5,000 deposit is tempting enough as it is. I’ll probably also pass on the invest bonus for now and keep an eye on where it goes over the next couple of months.

I got on offer for a $100 bonus after $1,000 in DD after signing up with the 17,500 SB offer