NOTICE: This post references card features that have changed, expired, or are not currently available

Today, Southwest announced new benefits available immediately for current and new cardholders. New features include extra bonus points in various categories of spend, the uncapped ability to earn A-List status with spend, free EarlyBird Check-Ins, and rebates on in-flight purchases. Additionally, two of the business cards get an innovative new feature: up to $500 per year back when paying to transfer points.

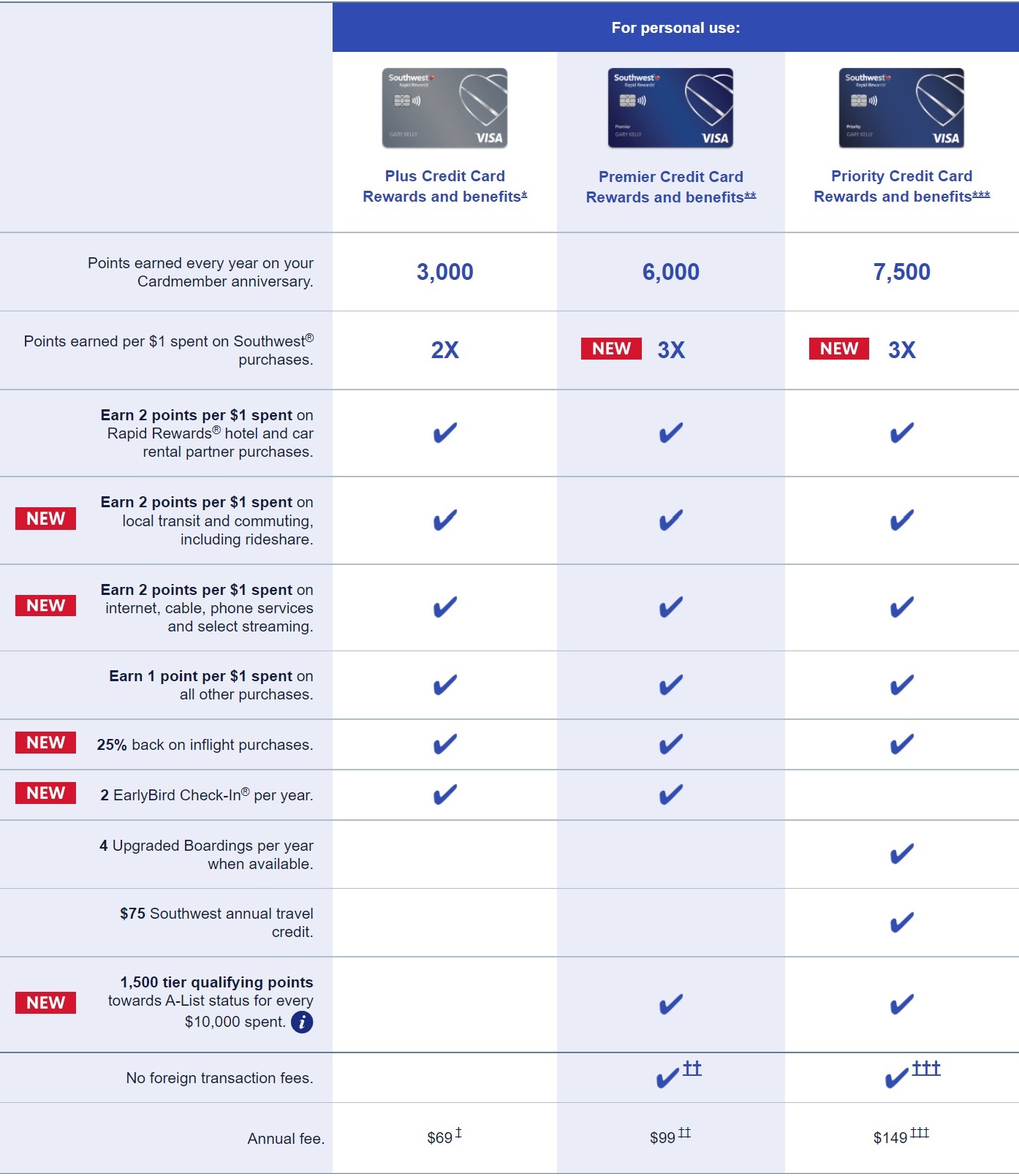

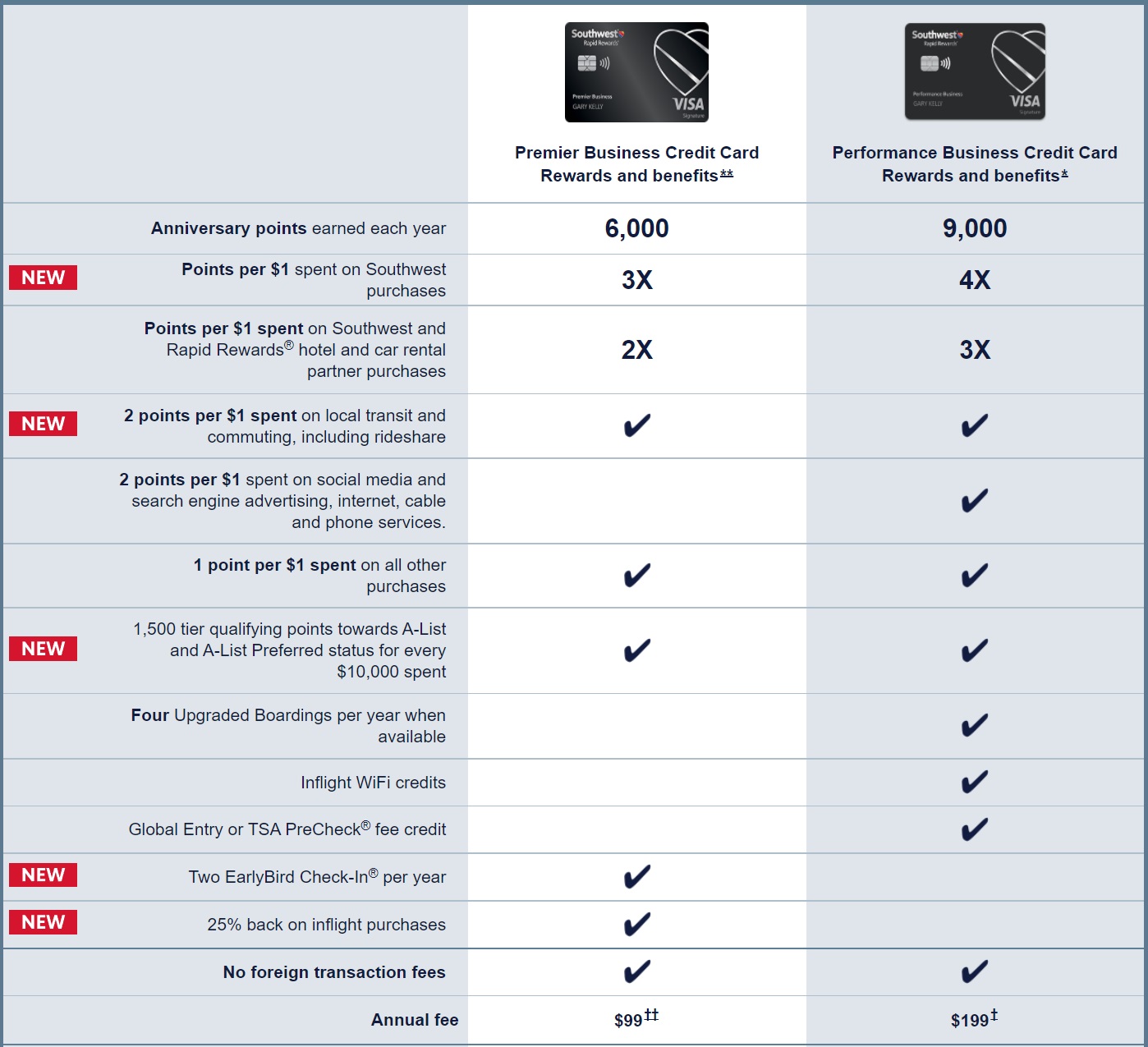

Card Benefits Overview

Personal Cards

Business Cards

New Features Explained

Bonus Points

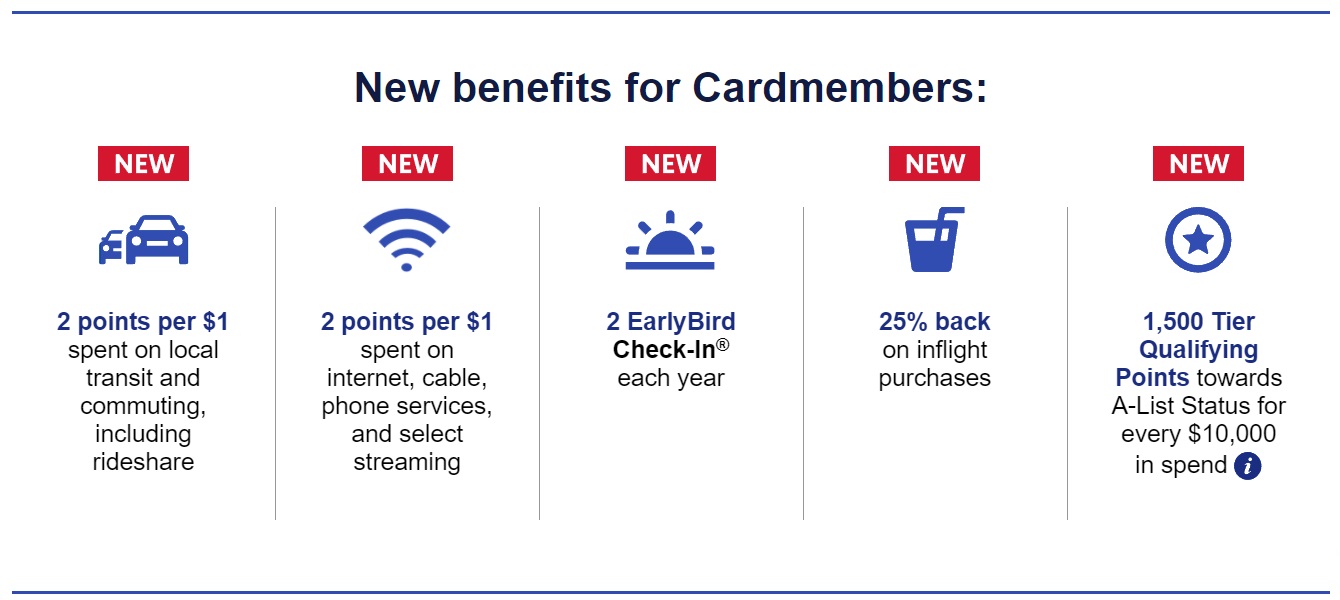

- 2X local transit and commuting: All 5 cards now earn 2X on local transit and commuting, including rideshare.

- 2X internet, cable, phone, streaming: All 3 personal cards now earn 2X on internet, cable, phone services, and select streaming.

- 3X Southwest: The Southwest Premier Card, Southwest Priority Card, and Southwest Premier Business Card now earn 3X for all Southwest spend.

- 4X Southwest: The Southwest Performance Business Card now earns 4X for all Southwest spend.

EarlyBird Check-Ins

Southwest passengers without A-List status or upgraded boarding privileges get their boarding priority based on how early they check in for a flight. One way to ensure getting a decent boarding priority is with EarlyBird Check-Ins. Southwest normally charges $15 to $25 per person for this feature, but with several Southwest cards you’ll now get 2 EarlyBird Check-Ins each year for free. This feature applies to the following cards:

The remaining cards do not get this feature because they already have a better feature: Four upgraded boardings (A1-A15 boarding) per year. This applies to:

25% Back on Inflight Purchases

I think this feature is self explanatory. For some reason the Southwest Performance Business Card doesn’t get this feature, but all of the other cards do.

Earn A-List Status with Spend

Several cards now have the ability to earn tier qualifying points towards A-List status through spend. Earn 1,500 tier qualifying points with each $10K of spend, with no cap (previously there was a $100K cap). A-List status requires earning 35,000 tier qualifying points and A-List Preferred requires 70,000 tier qualifying points.

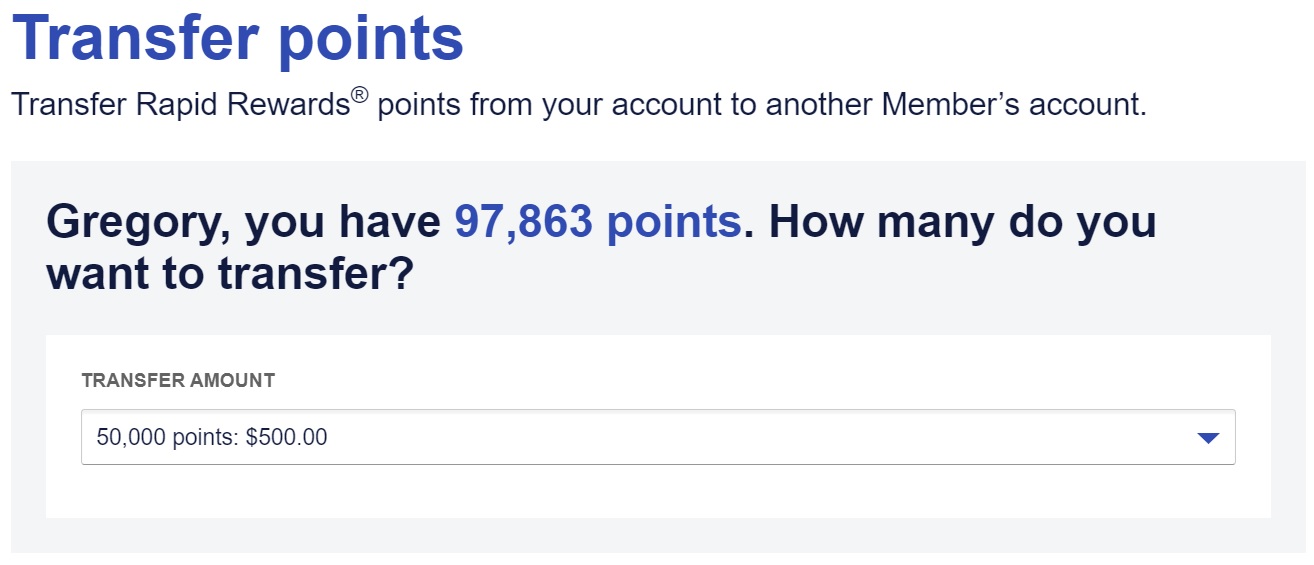

$500 Fee Credit for Point Transfers

Southwest charges a penny per point to transfer points to another Southwest member. Normally, I’d strongly advise against doing this since the cost wipes out most of the value of the points. Now, though, with either business card, you can get up to $500 per year rebated to your card. That’s 50,000 points per year that you can transfer for free if you have either the Southwest Premier Business Card or the Southwest Performance Business Card.

My Take

While improved benefits are always a good thing, it’s hard for me to get excited about most of these improvements. The ability to earn 2X in new bonus categories is downright boring when so many cards offer 3X to 5X earnings in more interesting categories. And you’d have to spend a lot in-flight for the 25% rebate to matter much. That said, I’m sure that cardholders will appreciate the new EarlyBird Checkins. And business cardholders may value the ability to transfer up to 50K points per year to others for free.

Overall, in my opinion, this is a minor net win for everybody. What do you think? Please comment below.

More Details

More details about each Southwest card, including current welcome bonuses can be found below:

| Card Offer and Details |

|---|

ⓘ $651 1st Yr Value EstimateClick to learn about first year value estimates 80K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 80K points after $5K spend within first 3 months your account is open$299 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Earning rate: 4X Southwest ✦ 2X hotels ✦ 2x gas and restaurants ✦ 2X rideshare ✦ 1X on all other purchases. Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: If you earn 135,000 points in one calendar year, you'll get a companion pass good for the rest of that calendar year and all of the next year ✦ Earn 2,500 TQPs for each $5K in purchases Noteworthy perks: 9000 bonus points each year upon card renewal ✦ 10,000 Companion Pass qualifying points each year ✦ First bag free for cardholder and up to 8 companions traveling on the same reservation ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit ✦ Global Entry, Nexus or TSA Pre✔ Fee Credit ✦ Group 5 boarding ✦ Preferred seat selection at booking (if available) ✦ Extra legroom upgrades up to 48 hours pre-departure (if available) |

ⓘ $577 1st Yr Value EstimateClick to learn about first year value estimates 60K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 60K points after $3K spend within first 3 months your account is open$149 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Earning rate: 3X Southwest ✦ 2X gas station and restaurants (up to $8K in purchases combined per year) ✦ 1X on all other purchases. Card Info: Visa issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: If you earn 135,000 points in one calendar year, you'll get a companion pass good for the rest of that calendar year and all of the next year ✦ Earn 2,000 TQPs for each $5,000 spent in purchases annually. Noteworthy perks: 6000 bonus points each year upon card renewal ✦ 10,000 Companion Pass qualifying points each year ✦ First bag free for cardholder and up to 8 companions ✦ Receive a 15% promo code each year on cardmember anniversary (Excludes Basic fare) ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit ✦ Group 5 boarding ✦ Standard or Preferred seat selection up to 48 hours pre-departure (when available) |

ⓘ $201 1st Yr Value EstimateClick to learn about first year value estimates Companion Pass + 40K points ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer Companion Pass valid through 2/28/27 + 40K points after $5K spend in the first 3 months$229 Annual Fee Alternate Offer: 50K points after $1K spend in the first 3 months This card is known to be subject to Chase's 5/24 rule. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) FM Mini Review: Great for frequent Southwest flyers - this card could easily be a long-term keeper. Earning rate: 4X Southwest ✦ 2X gas & dining ✦ 1X on all other purchases. Card Info: Visa Signature or Platinum issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: If you earn 135,000 points in one calendar year, you'll get a companion pass good for the rest of that calendar year and all of the next year ✦ Earn 2,500 TQPs for each $5K in purchases Noteworthy perks: 7500 bonus points each year upon card renewal ✦ 10,000 Companion Pass qualifying points each year ✦ First bag free for cardholder and up to 8 companions ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit) ✦ Group 5 boarding ✦ Preferred seat selection at booking (if available) ✦ Extra legroom upgrades up to 48 hours pre-departure (if available) |

ⓘ $169 1st Yr Value EstimateClick to learn about first year value estimates Companion Pass + 30K points ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer Companion Pass valid through 2/28/27 + 30K points after $4K spend in the first 3 months$149 Annual Fee Alternate Offer: 50K points after $1K spend in the first 3 months This card is known to be subject to Chase's 5/24 rule. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) Earning rate: 3X Southwest ✦ 2X restaurants and grocery (up to $8K in purchases combined per year) ✦ 1X on all other purchases. Card Info: Visa Signature or Platinum issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: If you earn 135,000 points in one calendar year, you'll get a companion pass good for the rest of that calendar year and all of the next year ✦ Earn 1,500 TQPs for each $5K in purchases Noteworthy perks: 6000 bonus points each year upon card renewal ✦ 10,000 Companion Pass qualifying points each year ✦ First bag free for cardholder and up to 8 companions ✦ Receive a 15% promo code each year on cardmember anniversary (Excludes Basic fare) ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit ✦ Group 5 boarding ✦ Standard or Preferred seat selection up to 48 hours pre-departure (if available) |

ⓘ $107 1st Yr Value EstimateClick to learn about first year value estimates Companion Pass + 20K points ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer Companion Pass valid through 2/28/27 + 20K points after $3K spend in the first 3 months$99 Annual Fee Alternate Offer: 50K points after $1K spend in the first 3 months After clicking through, be sure to manually select the exact Southwest card in which you are interested. This card is subject to Chase's 5/24 rule (click here for details). Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) FM Mini Review: This card can be great for its new cardmember bonus, but its ongoing perks are worth the annual fee only if fully used each year. Earning rate: 2X gas station and grocery (up to $5K in purchases combined per anniversary year) ✦ 2X Southwest Card Info: Visa Signature or Platinum issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: If you earn 135,000 points in one calendar year, you'll get a companion pass good for the rest of that calendar year and all of the next year. Noteworthy perks: 3000 bonus points each year upon card renewal ✦ 10,000 Companion Pass qualifying points each year ✦ First bag free for cardholder and up to 8 companions ✦ Receive a 10% promo code each year on cardmember anniversary (Excludes Basic fare) ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit ✦ Group 5 boarding ✦ Standard seat selection up to 48 hours pre-departure (if available) |

Does it cover cell phone insurance when paid by southwest card

The 2 early birds checking only apply to one passager and they cap the refund at $50. So, let’ say you paid for an early bird for you and your spouse in November for a total of $40 they will credit your acct $40. And let’s say you use your second early check in for another $40 the following month (you and your spouse). They only credit you $10. Just clearing it up in case.

Great benefits. We already used 4 early bird check-ins for our upcoming Costa Rica trip.

I plan on transferring 50k southwest points back and forth (two player mode) to generate Southwest points on each side of the transaction.

Dan, how did you use the early-bird check-in? Did you pay for them with your card and they automatically refunded or is there a button somewhere to apply one of the early-birds?

I paid for them with our two southwest personal cards today. The charges have gone pending, and I presume I’ll be reimbursed shortly after they post.

Dan, did you get reimbursed for the EB checkins?

Any clue as to what services constitute “select” streaming? I haven’t seen a satisfactory explanation anywhere.

Yet another Chase timing/application question: currently have SW personal card. Opened four years ago. Should I cancel ASAP (say before November 1) and apply early December for new personal card? Will one full month of not having card be enough time for chase to “consider” me not presently having the card and thus work? I.e. what are the “cancel then reapply rules” with regards to SW card to get a new bonus if one is beyond the 24 month last bonus window but presently have the card?

Yes, a month should be plenty of time. Conventional wisdom is to wait at least a week, but 2-3 weeks is safer. A month should be fine.

I already have SW Plus CC. Does that mean I’m not eligible for the other two consumer SW CCs?

Yes you would have to cancel the current card and make sure that it has been more than 2 years since receiving the welcome bonus on it before applying for either of the other two. You can get either or both business cards, though

Wait, I can have only one consumer card but can have both Performance and Premier business cards?

Found the answers here: Update: Maybe you can’t get a 2nd Southwest business card after all (frequentmiler.com)

Having had the companion pass via credit cards over the past 6 years, I was looking for an improved sign up bonus on a new Southwest card. $69 for 114,000 points ($2k plus $12k spend) puts me about 11,000 points away from another 24 months of a companion pass. I agree that these added perks are not relevant based upon the ability to earn more points via other cards.

I also have the Performance Business card from SWA and the wifi credit is actually a great perk. I always purchase wifi for $8 on any flight that I am on (and for my family as well) as the $8 is a purchase rebate/credit on my account, ie. I get the SWA points for spending and then get the credit for wifi. I can say that I spend around $500 in wifi on the year which pays for the $199 annual fee.

Brian.. That is a bunch of credits….Inflight WiFi Credits on Southwest Airlines Flights: You will receive Inflight WiFi Credits in the form of credit card statement credits for purchases of WiFi access made on WiFi-enabled Southwest® aircraft with your Southwest Rapid Rewards® Performance Business Card. Inflight WiFi Credits are limited to a total of 365 $8 credits per year for all WiFi transactions on the overall business card account. You will not receive a credit for any unused portion of the annual benefit. Statement credit(s) will post to your credit card account the same day as your purchase(s) and will appear on your monthly credit card billing statement within 1-2 billing cycles. Account must be open and not in default at the time the statement credit is posted to your account. WiFi may not be available on all flights or for the full duration of a flight. In order to provide a top-notch WiFi experience Southwest prohibits access to certain high-bandwidthapplications and websites. Southwest also prohibits access to certain obscene or offensive content.