NOTICE: This post references card features that have changed, expired, or are not currently available

Southwest made an unannounced devaluation of its Rapid Rewards program overnight, increasing the number of points needed for award flights. Thankfully the devaluation isn’t as severe as it could’ve been as the value of points have only dropped by ~6%.

Before this change Southwest points could ostensibly be redeemed for Wanna Get Away fares at a rate of 78 points per dollar, while now they can be redeemed for 83 points per dollar.

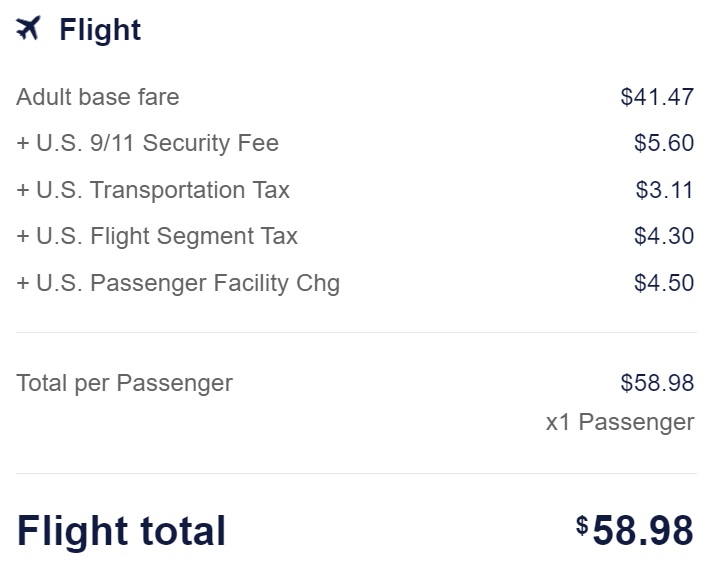

That doesn’t really tell the whole story though because of how Southwest does – and doesn’t – charge taxes and fees. When booking paid fares, you pay several taxes and fees on domestic flights. For example, a $58.98 flight from ATL to FLL costs $41.47 for the base fare and has $17.51 in fees added on:

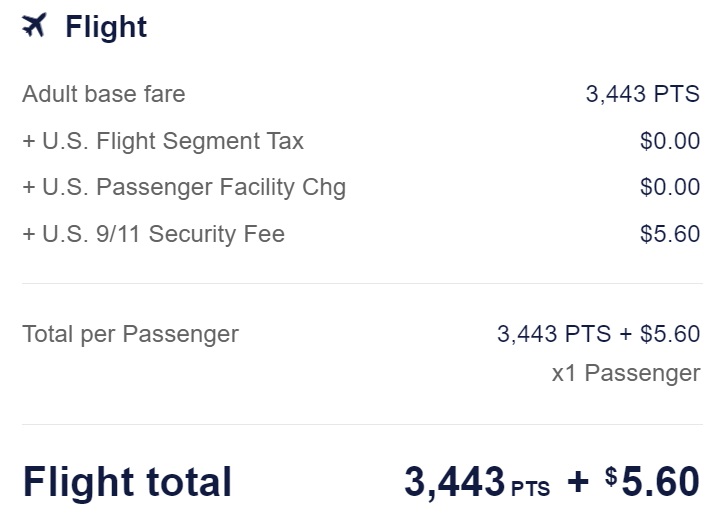

When booking that same flight as an award ticket, you’re charged 3,443 Rapid Rewards points and the $5.60 fee, but other taxes and fees aren’t charged.

With this example, that means that 3,443 points aren’t only saving you the $41.47 – they’re saving you $11.91 in fees too. That means redeeming points would be saving you a total of $53.38 or a rate of 1.55cpp.

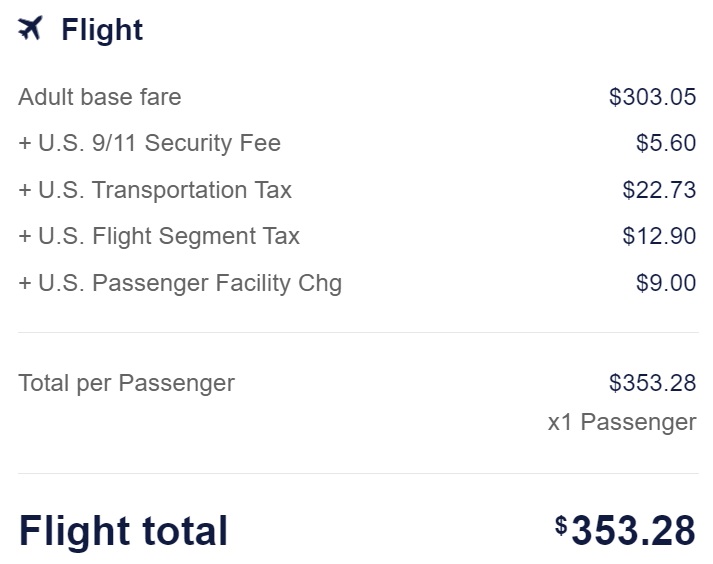

Those are the figures for a cheap flight though where taxes and fees make up a larger proportion of the overall cost. The redemption value therefore isn’t as good when booking flights that are more expensive. For example, a flight from ORF to LAX can cost $353.28.

When redeeming Rapid Rewards points that same flight will cost you 25,154 points plus $5.60 in fees. Although the other taxes and fees are also higher at $44.63, the points are saving you 1.38cpp.

Last year Southwest generously allowed people to convert travel funds to points at a rate of 1.28cpp. While I’m still glad that I took advantage of that opportunity, it’s a shame that so relatively soon after allowing Rapid Rewards members to redeem your travel funds for points that they’re reducing the value of your newly converted points.

Ben at One Mile At A Time has also made the good point that with Rapid Rewards being a revenue-based program, it doesn’t really make sense that devaluations like these need to be conducted in the first place. If Southwest raises the cash price of flights then the number of points needed to book those same flights as an award go up automatically, so why do they then need to devalue points further by requiring even more points per dollar of airfare?

This is therefore a disappointing change that’ll need to be taken into account when deciding whether to book with points or cash, as well as when deciding whether to transfer Ultimate Rewards to Southwest, but as devaluations go things could certainly have been worse.

[…] the negative side, Southwest Airlines surprised its Rapid Rewards members with a devaluation of their point system. This is never a good thing for those of us playing The Game, but we […]

[…] the negative side, Southwest Airlines surprised its Rapid Rewards members with a devaluation of their point system. This is never a good thing for those of us playing The Game, but we […]

Dirty pool after cashing in travel funds at the higher rate and after govt handout.

Exactly, anonymous. This is extremely shady on Southwest Loyalty Divisions part. No announcement in advance and devaluing points for a revenue based program shows how much they think of their existing customer’s loyalty. There’s no defending this customer unfriendly stance.

I agree. Thanks for pointing out about devaluing points by simply raising the cash price of a flight. Cash price change is the next step in devaluation of points. Then, there will effectively be a double-devaluation of points in a shorter time frame.

But doesn’t this concept devalue other airline points when the cost is fairly fixed and the cash price goes down – which has been the case over the last year? I saw no outcry to lower required “miles” when fares went way down to keep cpp the same.

Yes, airlines that offer only fixed award prices have always had that issue: miles are worth less for the least expensive flights and so if airfare prices drop altogether, the miles are worth less. For better or worse, we don’t have much of that going on in the U.S. anymore: Delta and United vary award prices based on cash rates; AA offers web special awards to do the same; JetBlue and Southwest have always done this; Spirit does this;…

“That doesn’t really tell the whole story though because of how Southwest does – and doesn’t – charge taxes and fees.”

Wasn’t this also true BEFORE they devalued by 6%?

Absolutely, yes. It was more just to point out that you shouldn’t just calculate the cpp on the base fare which is a mistake I’d made in the past, rather than that changing with this latest deval.