| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

Southwest travel funds can now be converted to points. This planned functionality was announced a few months ago, but Southwest was slow in bringing it live. Thankfully, the conversion is now live on the website — and it’s a great deal. You can convert funds to points at a rate of 1.28 cents per point!

The Deal

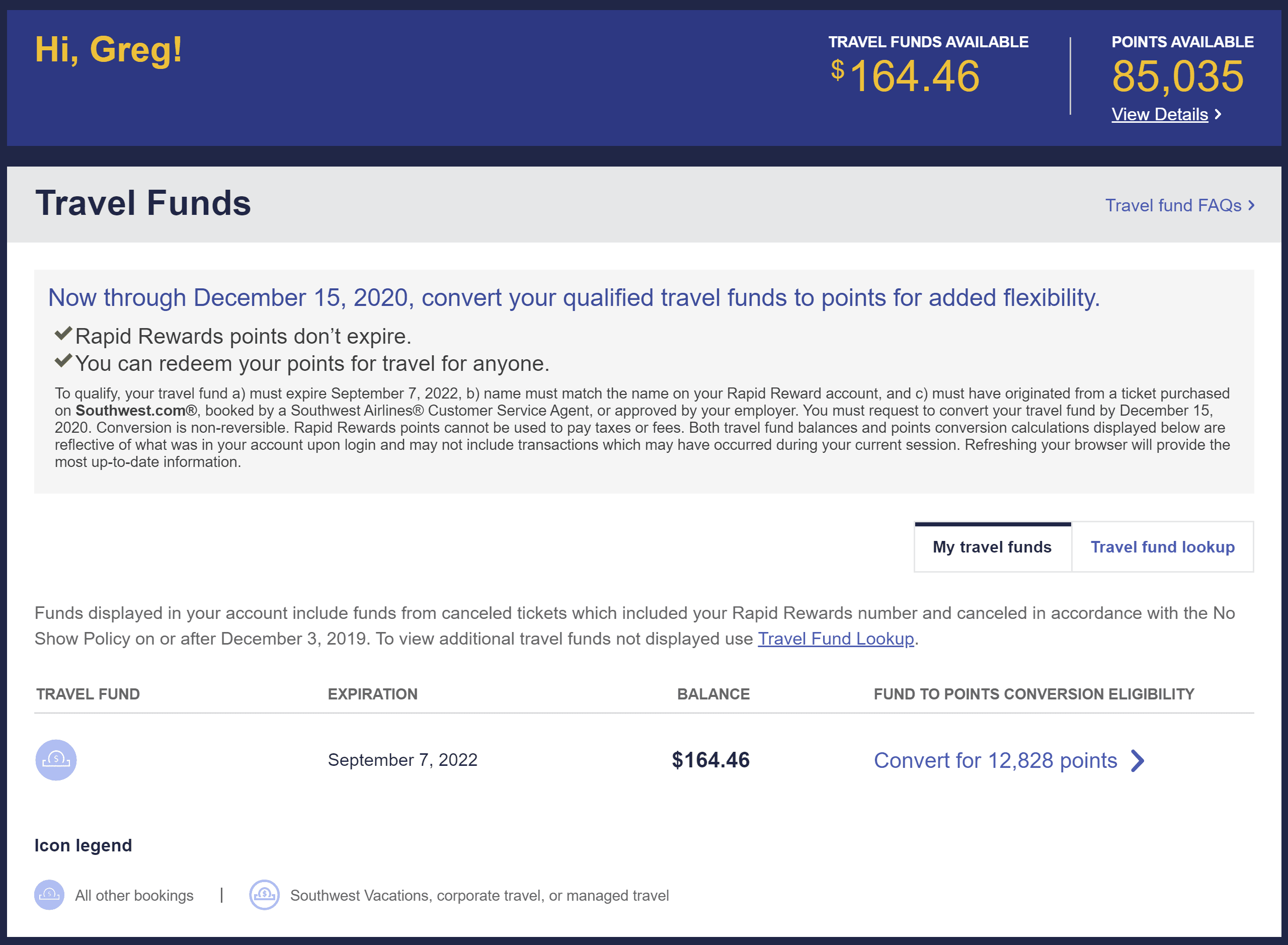

- You can now convert Southwest travel funds to Rapid Rewards points. The conversion ratio is 1.28c per point and the ability to do this is at the top of “My Account” when you log in to Southwest.com

- Direct link to My Travel Funds (you’ll need to log in)

Key Details

- To qualify, your travel fund:

- a) must expire September 7, 2022

- b) name must match the name on your Rapid Reward account

- c) must have originated from a ticket purchased on Southwest.com®, booked by a Southwest Airlines® Customer Service Agent, or approved by your employer.

- You must request to convert your travel fund by December 15, 2020.

- Conversion is non-reversible.

- Rapid Rewards points cannot be used to pay taxes or fees (FM note: but travel credits from taxes and fees can be converted to points)

- Both travel fund balances and points conversion calculations displayed are reflective of what was in your account upon login and may not include transactions which may have occurred during your current session. Refreshing your browser will provide the most up-to-date information.

Quick Thoughts

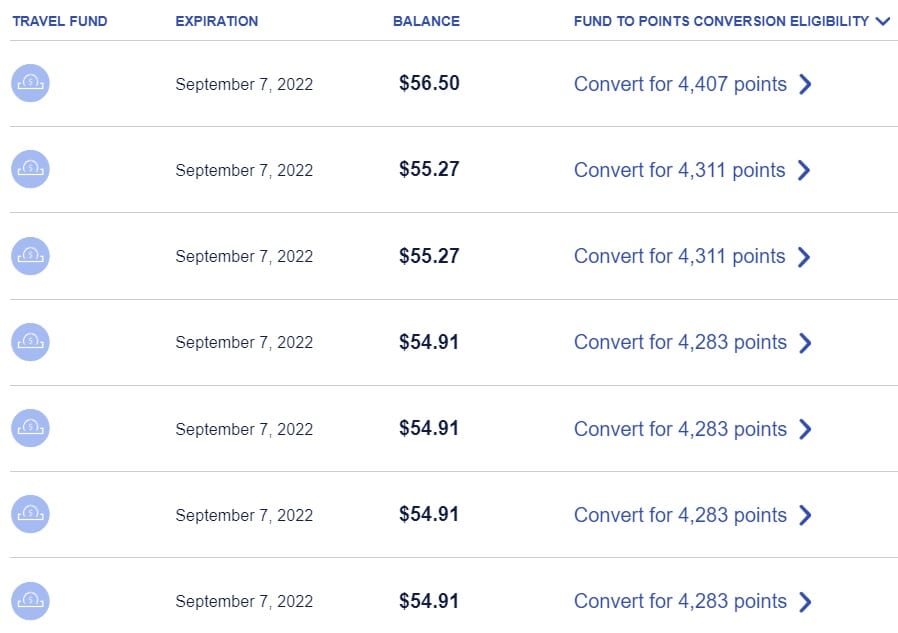

As you can see in the screen shot above, $54.91 in travel funds can be converted to 4.283 points. That’s a rate of 1.28c per point. Considering the fact that Southwest points are generally worth about 1.4c per point (and sometimes as high as 1.9c per point) and are worth at least something north of 1.3c per point even with the current suspension of some taxes, that’s a great deal. At the very least, you should gain some value when converting to points. Furthermore, you’ll gain a lot more flexibility. Southwest points no longer expire and they can be used to book travel for anyone. If you cancel a trip, the points are immediately redeposited without an expiration date (unlike travel funds, which do expire).

That ratio (1.28c per point) holds true on other reservations from the Frequent Miler team as well.

In order to make this conversion, you’ll need to have travel funds with an expiration date of September 7, 2022. Any trips booked and canceled in recent months (up until September 7th) will have been refunded in travel funds with a September 7, 2022 expiration date and would qualify for this conversion.

The process itself is simple. Just log in to your Southwest account and you’ll see a bar at the top to convert qualified travel funds to points.

To be clear, the conversion ratio isn’t so good as to mean you should go out and buy a lot of Southwest cash reservations in order to convert them. Rather, this is particularly good news for those with airline fee credits to use as sometimes cheap Southwest tickets (or some add-on fees) trigger incidental credits. Being able to then convert those credits to points without an expiration date and for a slight bump in value is a great deal. Will those credits get clawed back down the road? If used to purchase a ticket, it is obviously possible that they could get clawed back, but there is certainly less risk here than if the airline were refunding your ticket to the card used to purchase it.

Note that another good play might be purchasing discounted Southwest gift cards in order to make reservations and convert travel funds to points. For instance, we posted last week about the chance to save 8% on Southwest Airlines Gift Cards from a grocery store online. If you used those to book a trip and then canceled and converted the travel funds to points, you’d essentially be buying points for around 1.18cpp (not considering any credit card rewards for grocery spend). That could save you some more down the road.

Keep in mind that conversion will be available until December 15, 2020 for qualifying travel funds. Those funds need to have an expiration date of September 7, 2022 — so you’ll need to have canceled a qualifying trip by September 7th in order for it to be convertible.

H/T: Miles to Memories

I had travel funds created last December, 2019 remaining from a trip I did not take. They expire tomorrow and Southwest says I lose the credit unless I complete travel by tomorrow which will not happen. So much for the generosity of Southwest.

Bummer! That is generally the way that Southwest travel funds work. The play for you would have been to book a trip and cancel it before September 7th so that it would have created travel funds valid for 2 years and you could have then converted to points. Unfortunately, the ability to do that ended several months ago. I’m sorry that you’re not going to be able to make use of the travel funds.

I get that Southwest travel funds expire in 12 months from original ticketed date. However, for 9 out of the past 12 months, we have experienced the worst public health crisis in our lieftime. Every other airline has been making exceptions and extending expiration dates. Even if I had booked a trip before September 7th, wouldn’t the travel funds have retained their original expiration date of 12 months from December 14, 2019? In any case, why not make an exception this year.

I think I have goofed. I used my travel credit with AX Gold on Southwest a few days ago, OW =$98.98.I see the airline fee credit on AX this morning I intend to cancel the ticket and then cancel my AX Gold card (the AF hits 28 Dec).

Should I wait until after the AF occurs to cancel AX?

Do I cancel the ticket now or after I cancel AX?

I was thinking I would be able to convert the travel funds to points, now i think not. So now my $98.98 funds with Southwest will exp in 1 year. Correct?

Was there a deadline to when the flight had to be booked/canceled to get the 2022 expiry? I booked flights last month for January.

Yes, September 7th. You’ll see that in the final paragraph of the post (as well as somewhere in the middle). In hindsight, maybe it wasn’t clear enough that you had to have canceled by Sept 7, 2020, but since the conversion is only available until Dec 15, 2020, I didn’t think to include the year. Unfortunately, something you cancel now would be too late.

Totally missed this. Is it too late to be able to book / cancel a flight to use this?

If your travel funds expire 9/7/22, you have until the end of this year to convert.

bummer yeah my funds expire 12/31/20, missed the boat on fake booking a flight this summer and canceling it to get the newly dated funds.

[…] As you can see, Amazon and prepaid debit cards are excluded. Still, this includes brands like Best Buy, eBay, and all of the other various gift cards sold by Meijer. I haven’t been to a Meijer in years, but I imagine they likely sell things like Southwest or Delta gift cards (Southwest may be particularly useful to convert to points). […]

I posted this on DoC but figured I’d post here as well to add to the below discussion.

I just pulled up a $128.98 flight from LAX to PHX. The same flight is available for 9,204 points + $5.60. Factoring out the $5.60 taxes, I’d get (128.98-5.60)/.01282 = 9,624 points for the equivalent cash fare. So it seems I’d be 620 points ahead by converting to points first.

But if I purchase the cash fare, I’d earn 714 points on this flight, meaning I’d be losing 94 points by converting my credit to points, not to mention elite qualifying.

On an international fare such as LAX to CUN, I’m looking at $155.18 vs 8,970 + $31.18. So (155.18-31.18)/.01282 = 9,672 points. This time I’d be ahead 702 points but would lose out on earning 690 points on the cash fare.

Bottom line, it’s so close to a wash we shouldn’t factor this into our consideration on converting. It should come down to your preference of no expiration + booking for others vs. earning elite status. For me, I’ll likely be converting all of my credits in December, but we’ll see.

[…] Those who want to go a step further can convert the Southwest Gift Card to Rapid Rewards points by using it to create travel funds that are eligible for conversion. […]

[…] Those who want to go a step further can convert the Southwest Gift Card to Rapid Rewards points by using it to create travel funds that are eligible for conversion. […]

Thanks Nick! You guys always deliver the stuff that I otherwise wouldn’t have found out.

does anyone know if these points count towards companion pass as I am just a lil over 10,000 short currently for qualifying for the year

I don’t think so.

The points do not count towards the companion pass.

[…] the fact that Southwest travel funds can now be converted to Southwest Rapid Rewards points (See: Southwest travel funds conversion live & it’s a good deal). We noted within that post that one option that may now be interesting is the ability to convert […]

If you have a current travel fund that expires before dec 7 2022, can you purchase a ticket with the travel fund, cancel the flight, and get a travel fund that expires dec 7 2022?

Yes

Yes, but wait a day as the funds start with the old expiry the instant you cancel.

I did the mistake and cancelled right away . It gave the same expiry date

Jason, that’s fine. Just wait a day or two. It takes a while for SW to update the system.

just saw this, thank you!!

Did the date actually update for you?

nope 🙁

I don’t understand the comment “ If used to purchase a ticket, it is obviously possible that they could get clawed back, but there is certainly less risk here than if the airline were refunding your ticket to the card used to purchase it.”

why would they claw your ticket back? your travel funds were legit, and you legitimately converted them to points. where is the wrong in anything here?

Because airline incidental credits from AMEX specifically excludes tickets. However in some cases, if the value of the ticket is low enough, it gets counted as an incidental purchase (food, fees, etc.) and you get reimbursed. The risk is that you will have made this conversion and AMEX will go back and reverse this credit.

Sorry if it wasn’t clear. I’m not talking about Southwest clawing anything back. I’m talking about the airline incidental credits. Sometimes, cheap tickets trigger those incidental credits. If you get reimbursed for a charge that shouldn’t qualify for an airline incidental credit, there is a chance that your credit card issuer could claw that credit back. Your Southwest travel funds / points are safe.

Ben (Lucky) mentioned anytime and business select funds may convert at a different rate (78 vs 76-78 for wanna get away). Any advantage to rebooking at anytime?

Nick

Good call on that I got 15k points now in like 30 seconds.I was going to cancel my SW $149 cc BUT may need it for a Good seat later on .I got TWO YEARS ON THE YACHT CLUB membership u Cheap person . I got 700k points I wonder IF I’ll ever fly internationally again the ONLY Flt. I want .

CHEERs

#stayincave