NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

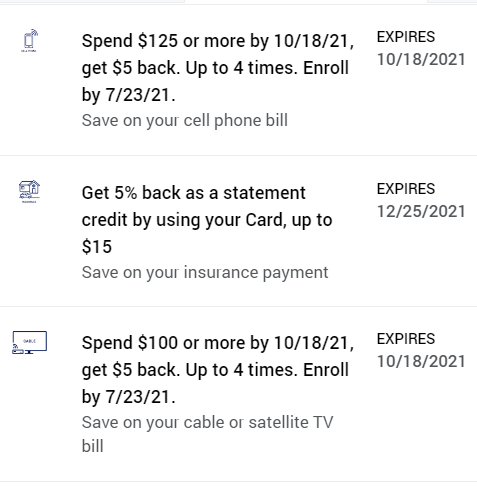

There are some targeted Amex Offers giving statement credits when paying three different kinds of bills.

The Deals

- Spend $125+ on your cell phone bill & get $5 back up to 4 times.

- Get 5% back as a statement credit on your insurance payment up to $15 back.

- Spend $100+ on your cable or satellite TV bill & get $5 back up to 4 times.

Key Terms

- Cell phone bill offer – Enroll by 7/23/2021. Get a $5 statement credit by using your enrolled Card to spend a minimum of $125 in one or more transactions to pay your cell phone bill directly with a US wireless telephone service provider by 10/18/2021. Limit of 4 statement credits (total of $20). See terms for exclusions.

- Insurance payment offer – Get 5% back as a statement credit by using your enrolled Card to make a payment on your insurance bill by 12/25/2021. Limit of $15 in total statement credits. See terms for exclusions.

- Cable/satellite TV bill offer – Enroll by 7/23/2021. Get a $5 statement credit by using your enrolled Card to spend a minimum of $100 in one or more transactions on US bill payments for cable and satellite television services made directly with the provider by 10/18/2021. Limit of 4 statement credits (total of $20). See terms for exclusions.

Quick Thoughts

While the statement credits aren’t overly generous, these could still be some useful Amex Offers, especially if they stack with other Amex Offers.

For example, some Amex business cards (e.g. Hilton, Marriott & Delta) currently have an Amex Offer giving $10, $15 or $20 in statement credits each month when paying your cell phone bill, so the $5 statement credit from this new $125+ Amex Offer should stack with that provided your cell phone bill is high enough. Note that the $125 is cumulative, so if your bill is $65 per month you’ll get a $5 statement credit every two months.

The insurance payment Amex Offer can also come in handy seeing as very few cards offer insurance payments as a bonus category, so earning 5% back is a decent bonus unless you’d be better off putting that spend on a card where you’re working on a minimum spend requirement.

Do all kinds of insurance qualify?

I wasn’t targeted for that offer and so I’m not sure. If you have it on one of your cards, the terms will state if it’s only valid on certain types of insurance.

Could always prepay some of these to capture all available

.

“One or more” payments. Does that mean I have to pay my bill for a few months in a row and let it add up before the credit is given?

It’ll depend on the cost of your cell phone bill. If your bill is $125+, you should get the $5 each time. If your bill is $65 per month, you’d get a $5 statement every two months.

I’ve noticed a lot hotel offers like that too. $250 in “one or more” charges. Doesn’t work when on a driving trip in US and stopping after 7 hours of driving unless it’s allowed to accumulate.

They all say something like this:

Get a one-time $50 statement credit by using your enrolled Card to spend a minimum of $250 in one or more transactions on room rate and room charges…

Except Marriott:

Get a one-time $40 statement credit by using your enrolled Card to spend a minimum of $200 USD on room rate and room charges…

I called about the Marriott: it had to be a single charge.

Amex really brought out some low ball offers this time.