NOTICE: This post references card features that have changed, expired, or are not currently available

My son turned 18 a few weeks ago. I still can’t believe it. Anyway, yesterday we started him on his first steps towards earning his own points and miles.

As a reminder, I published a few posts about teen credit and credit cards before:

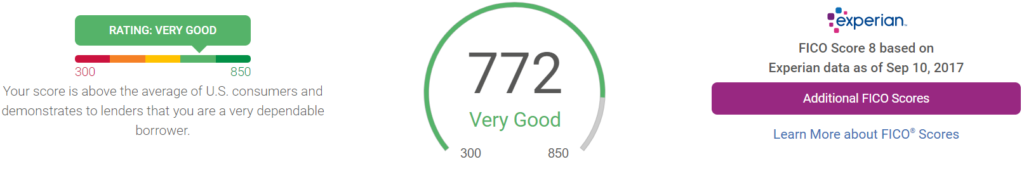

Thanks most likely to my having added my son as an authorized user to several credit cards, he already had a very good credit score without even trying:

So, we were ready to enact the plan that I had previously published. I had written:

When my son turns 18, I’ll recommend that he do the following (with my help, as needed):

- Sign up for a Discover It for Students Card; and

- Sign up for a new Chase checking account in order to get a checking account bonus, and to establish his banking relationship with Chase. And a month or two later he should check in with his banker to see if he has been pre-approved for any Chase cards. Either Freedom or Freedom Unlimited would be great first Chase cards.

We started with the second part before he turned 18: I found a good coupon for a new Chase checking account bonus and called our Chase banker to see if my son could get the account even though he wasn’t yet 18. The answer was no. Also, he pointed out that my son wasn’t qualified for the offer because the offer was only for those without a current Chase checking account. My son’s teen checking account apparently disqualified him. Bummer. I decided to wait until he turned 18 to convert his teen checking account into a regular account (with no bonus). Separately we’ll watch for bonuses from other banks.

Yesterday I emailed my Chase banker and asked him to convert my son’s teen checking account to a regular one. He said he’d take care of it. I’m hoping that this will help my son get approved for Chase cards in the future.

Next, my son applied for the Discover It card. He clicked through the regular application rather than the application for the Discover It for Students card because the Discover It card comes with a $50 bonus after first purchase. Plus, for those who sign up before the end of 2017, the $50 bonus will be doubled at the end of the first year. Most of the other aspects of the Discover It and Discover It for Students cards are exactly the same. Both offer rotating 5% categories, and both double all first year cash back earnings. The student card also offers $20 cash back each school year when your GPA is 3.0 or higher.

Even though my son clicked to apply for the regular Discover It card, the application changed to the Discover It for Students application once he entered his job as “student”. He was instantly approved with a $500 credit line. I don’t know whether he’ll still qualify for the refer-a-friend $50 bonus. I expect he will.

Immediate Next Steps

Once the Discover card arrives, I’ll have my son setup his online Discover account. And I’ll show him how to setup his account with auto-pay from his bank account. He’ll have to make sure that his bank account always has enough money to cover the charges he racks up on his Discover card. I think that will be an important thing for him to learn.

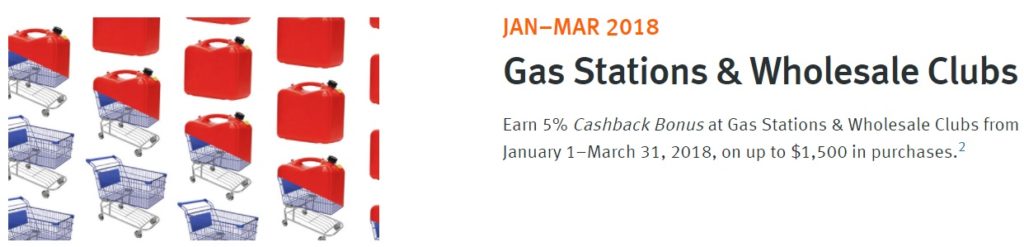

Towards earning rewards, I’ll have my son enroll in Discover’s fourth quarter 5% Cashback Bonus for Amazon.com & Target. Assuming he buys holiday presents for anyone, I know that he’s pretty likely to order through Amazon.

2018 looks pretty good for Discover 5% categories as well:

When redeeming his cash back, I’ll remind my son to look at Discover’s gift card options. They offer a wide variety of gift cards at a discount when redeeming your cash back.

I’ll also teach my son how to shop through the Discover Deals portal. For his first year, any cash back earned through the portal will be doubled just like the cash back earned directly from the credit card. Luckily he’s already familiar with TopCashBack (he is my son after all!), so I’m sure he’ll get it.

I’ll also suggest that he recommend the Discover It card to friends. He may be able to rake in some nice referral bonuses that way (Note: I’m not sure whether refer-a-friend offers are open to Discover It Student accounts or just to regular accounts).

Next steps for future rewards

I want my son to spend time adjusting to having a credit card and using it responsibly. Once he proves that he can do so, we’ll look into other credit card options for him. Since many of the best credit card offers are business cards (see: Best Business Card Offers), I’ll be very interested to see if he can get approved for them. Most business cards will not add to his 5/24 count, so they shouldn’t hurt his chances of getting Chase cards in the future. Additionally, since cash is more important to him than points and miles at this stage in his life, we’ll look not just at cash back credit card offer, but also at bank account offers. Many banks offer hundreds of dollars just for opening an account and meeting a few minimal requirements. Doctor of Credit maintains a list of current bank account bonuses, here.

[…] My teen’s first credit card, and his next steps towards rewards […]

[…] son hasn’t successfully signed up for any new cards since his Discover It Student card. I’m thinking that it’s time for him to start a business and try for the SPG Business […]

Hey Greg

Thinking of having my son sign up for Discover It student and wanted to try and get your son the referral bonus. Having said that while my son is 18 he is a senior in high school starting at Miami next year. He has a little income but no credit score as I mistakenly never put him on as an AU for any cards.

So not sure if I should put him on my oldest Chase card as an AU first and do the Discover app in the fall or just give the Discover a shot now. If you think the Discover is worth a shot now I will email you my sons info assuming your son is eligible for some type of bonus.

I don’t think it would hurt to try now. Worst case is that they’ll offer your son a no-fee secured card. Go with that so that he can build credit.

Thanks for offering re my son’s referral. We tried to generate one from his account but got an error. Might be because he hasn’t yet received his first statement. We’ll try again once the statement appears (should be soon)

Thanks Greg. I am not in a rush so I can wait until your son gets his statement to see if he can generate a referral link.

My son’s referral link for the Discover It card is working now: https://refer.discover.com/s/u5ip4

Thanks!

Hi Greg,

Sorry for the delay. Just want to let you know my son used your son’s link today and he was approved. Thanks for all you do.

Thanks!

Congratulations! We did something similar and my 20-year-old-son was approved for the Southwest Visa yesterday. Due to being CA residents he only has to make one purchase to earn a Companion Pass. Woo hoo!!! I shared your Gift of Education and Marvel Credit Card posts on my Scholarships Made Simple Facebook Page. Another tip we used is having our son apply for small book loans at Pt Lona Credit Union. These $500-$750 installment loans last for one semester. Total fees are approximately $8 and they show as a fully paid installment loan on his credit report. At Point Loma Credit Union the only requirement is evidence of enrollment in college and a $25 bank balance. No hard pull!

Thanks! That’s another good tip!

Love this series. I’m slowly getting older family members into this and the steps you’re taking with your teen are very similar to those new to this.

Feels reassuring to see that you are making roughly the same steps that I’ve been making!

My 18 year old just stumbled on this:

My daughter decided that she wanted a new iPhone (8 not X, lol) and we told her we would continue to keep her service plan under our family plan but we were not going to buy her a phone when her old one was still in good working order.

So she sold her old phone (to her brother) and signed up for the Apple phone plan. $40 a month with Apple care included and you can upgrade every 12 months if you want to (not a bad deal). She did it on her own with her SS# and it showed up on her credit report as an installment loan. Her score went up over 100 points. She now has a higher credit score than I do.

Wow! That’s pretty good. Amazing how a $40/month cellphone installment plan probably counts as much, or nearly as much, as a $1000/month mortgage.

And $40 a month is $480 per year. I’m not sure how good a deal that is to lease a phone worth about $800. If you get to keep the phone when you upgrade, and you can sell it for $300-400, then it is probably worth it.

Good tip! Thanks

My daughter’s student Discover IT does not have the quarterly bonus categories.

She probably has the Student It Chrome card: https://www.discover.com/credit-cards/student/chrome-card.html

Ah. Your are correct, sir. I hadn’t noticed the distinction previously.

She is graduating from college in the Spring. I don’t know what they taught her at University of Alabama, but trust me: I schooled her on 5/24.

The discover student card was my son’s first card as well. He went through the discover student link, and did not get the 50$ bonus.

The actual card does not have word student anywhere on it. The only difference between the cards that I have noticed is that it has the 20 yearly bonus for good grades. My son took some dual enrollment classes his HS senior year, did get the 20$ bonus, and it will double.

Which credit monitoring service spit out the 772 number? It took 45 days before any service we tried would give my son a score.

See my linked post: Building (and viewing) teenage credit (https://frequentmiler.com/2017/09/11/building-and-viewing-teenage-credit/)

Experian’s FreeCreditScore.com was able to give him his credit score and report details even before he turned 18.

So glad you are covering this topic! Without giving to much personal information, could you elaborate on how you handled the income issue? Thanks!

They usually ask for “household income”, so since they are still part of your household (and indeed, you, the parents, still pay the vast majority of their expenses), you would put the household income in. If they ask for wage income, you would have to put the students wages for the year (which would be low).

We simply estimated how much he’s likely to make when working next summer. We didn’t include household income because you have to be 21 or older to do so.

Some college scholarships are considered income, most are not, but some are. So if your child has any that need to be declared as income, count that too.