NOTICE: This post references card features that have changed, expired, or are not currently available

It’s real! For years now, I’ve been applying for Amex cards and hadn’t ever seen the popup that tells you that you’re not eligible for an Amex welcome bonus. In fact, in 2018, I tried to get the popup on purpose so that I could get a screen grab for the blog. I picked a card that I had before and so shouldn’t have been eligible for the welcome bonus (the SPG card — now Marriott Bonvoy), and applied. Not only did I not get the popup, but I was instantly approved. Figuring that was just a one time fluke, I tried again with the SPG Business card (now Marriott Bonvoy Business) and it happened again! No popup and instant approval. Later, I earned the welcome bonus on both cards.

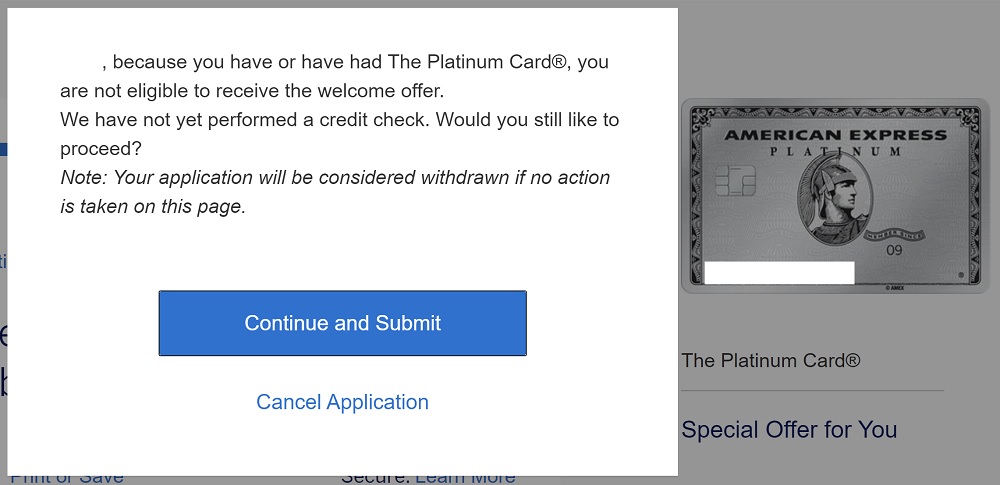

In the 2+ years since my double SPG win, I still haven’t seen the popup with any of my card applications or those for my wife or son. Until now. I was worried that the awesome Amex Platinum 100K + 10X offer would end soon (we have no idea how long it will last), so I decided that my wife should apply.

As I explained in my post, Bending Amex’s Lifetime Rule, my wife and I had each had the Platinum card before:

- Me: Last had card 5+ years ago (I signed up for the Platinum card on 4/14/2014 and cancelled it on 5/14/2015).

- My Wife: Last had card 6+ years ago (Signed up on 1/8/2013, and cancelled on 3/7/2014)

Despite my having had the card before, I was approved for a new Platinum card and earned the 100K + 10X bonus. Now, my wife tried the same, but nope: pop-up happened! We cancelled the application and went on with our day.

Obviously I knew that the popup was a real thing, but it was still a surprise to finally see it after all this time. I now know that my family isn’t immune to the popup. But maybe I am for some reason? Time will tell…

I forgot where I saw the DP, probably on r/churning, but at least 1 person claimed to have applied for and received the 100k/10x Plat offer despite going through the pop up.

Regarding multiple SUBs, and past card records, I have no DP to say this works with AMEX, but it worked with BOA for me. I had the BOA Spirit MC for about a year; on a flight, the attendants offered a large SUB for the same BOA card if application filled out during flight. I did that, but I used a shorter version of my first name. The card was approved, SUB earned. I now had 2 of the same cards, everything the same with respect to SSN, type, address, etc., except the newer card had my shorter 4-letter name versus the original card that had my longer legal 7-letter first name.

I have not had credit card for 20 years so my ? If I want to get one now I will accept $2000 credit line to start / no annual fee and 12%_18% charges if I have to pay but if I pay everything on time will and should be 000 if you wish to send me platinum I,am ready to accept

Any guesses as to why your wife got the pop-up but you didn’t even though it has been longer since she last had the card? Have you had more AmEx cards since you closed it than your wife has? Maybe in addition to their data falling off after 7 years, they also only have slots available to hold data for the last X number of cards you’ve had?

You would think if they know you’ve had the product before and are ineligible for the bonus, they would know not to target you for the offer. I guess I expect too much.

Say if I don’t qualify for the SUB, would I still get the 10x groceries/gas?

I don’t think so.

I’m sorry that your wife received that message, but that message was kind of expected, no? Honestly @Greg The Frequent Miler you’re the only person I’ve heard of to get a bonus in less than 7 years on a non-NLL amex offer.

On the other hand, the popup that most other people refer to goes something like this:

“Aloha808, based on your history with American Express welcome offers, introductory APR offers, or the number of cards you have opened and closed, you are not eligible to receive this welcome offer.

We have not yet performed a credit check. Would you still like to proceed?”

Quite a few readers have had success with the 100K + 10X offer despite having had the card in the last few years. You’ll find some examples in the comments here: https://frequentmiler.com/bending-amexs-lifetime-rule/#comments

Thanks, I hadn’t seen that before! Still, I’d argue the message she received is different (and expected) compared to the popup most others receive (and i listed above), which seems to be punitive.

I see. In the same article I linked to above (https://frequentmiler.com/bending-amexs-lifetime-rule/) I showed both versions of the popup. I have yet to see the second (punitive) one. And this is the first time I’ve seen the first one in the wild even though there have been many times where I should have seen it.

Oh well. If I get SUB again <7 yrs, I won’t talk about it. Go figure.

I got gold after no pop up having had it about 4.5 years before.

This is my 3rd Platinum within 5 years. The one in the middle was NLL, but I was shocked when I got approved for this one with no popup. I confirmed the 100K offer was attached to the card before putting spend on it. DW though got the same popup as above about having had the card before. I also tried signing up for a Green card even though I just canceled one a year ago, and that one also went through with the signup bonus attached. So it’s definitely worth a shot to try.

I had a somewhat problem with Amex. I didn’t get the pop up when applying for a Hilton card, met the spend, the points never showed and when I called to ask why, I was told it was because I’d had the card in the past. D’oh!

what # did you call AMEX on? this is the scary part. I had chat repS saying they dont see Gold on me, but still got the popup. now I worry the opposite can happen

Happened to me about 4 years ago. But this was before the pop-up warning. They probably had a lot of us complaining, which triggered them to implement the pop-up warning.

Any thoughts on how to get the pop up to go away?? I want to apply for the platinum card for my husband but keep getting that darn pop up! He has never had the platinum, currently has a no annual fee Hilton amex that is rarely used. Hasn’t churned anything from amex, that Hilton card that he’s had for about 4 years I think is the only amex he’s ever had. So weird.

Some people think that putting regular spend on Amex cards for a while is the key to loosening up Amex’s strange popup algorithm. I honestly have no idea if that’s true or not. It seems similar to the time that a friend discovered that her favorite football team performed better when she wasn’t in the same room as the TV set and so she would listen to games from another room. But I guess the spend more theory is more likely to be real.

I’m pretty sure that’s how I got P2 out of the pop-up last year. The “more spend” part that is. We didn’t try standing in different rooms or wearing tinfoil hats. I think it’s better left to the experts at FM to try out those methods.

LOL

I thought that the more spend would be it for me to get out too (over a year now), but don’t think so. Had the personal Gold and put an average of $500-$1000/monthly on it…have the Hilton and put some here and there (say average $100/month) and the Blue Bus. Plus and had regular spend on it as well (average $200-$400/month) but have been getting popups throughout last year–most recently got denied in Nov & Sept of 2020. I’m giving up on Amex for a while & going back to Chase as I’m 2/24.