Note: On January 8, 2015 American Express sent out a notice to a large number of Bluebird & Serve cardholders informing them that loading capabilities on their accounts had been terminated. For more information, see: Amex kills Bluebird and Serve for manufactured spend

I don’t know how long it will last, but as of the time of this writing it is possible to manufacture credit card spend for free (see “Better than free manufactured spend“). This means that you can collect points and miles for free. You can meet minimum spend requirements for free. You can earn high spend bonuses for free (see “Best Big Spend Bonuses“). Sometimes you can even make a profit while collecting points this way.

In the past I’ve often compared various manufactured spend techniques by calculating the cost per point of each technique. Now, though, the cost per point is zero or less. It’s time to look for a new comparative metric.

Bluebird as a limited resource

Currently, I’d argue that American Express’ Bluebird product is the single best and easiest way to turn Visa gift cards and Vanilla Reload cards into cash. Vanilla Reload cards can be loaded to your Bluebird account online via the site vanillareload.com. Visa gift cards can be loaded to your Bluebird account at Walmart stores via “swipe reloads” (see “Gift card PINs“). Both techniques for unloading the cards are free.

Importantly, Bluebird limits reloads to $5000/month per person (swipe reloads and Vanilla reloads combined). So, I think that a useful new metric is to compare techniques with Bluebird’s $5000/month limit in mind. Which combination of credit card, gift card, portal, and gift card merchant results in the most value for $5000 per month in spend?

The Bluebird Metric

Here’s how the Bluebird Metric works:

For each technique, calculate the following for $5K of manufactured spend:

- Calculate out of pocket cost. For example:

- If you buy 10 $500 Visa gift cards, each with a $5.95 fee then out of pocket cost = 10 x $5.95 = $59.50

- Estimate the cost of your time, gas to drive to/from Walmart, and car wear and tear.

- Calculate credit card value

- # Points earned via credit card (or cash back earned)

- Value of points earned via credit card

- Estimated cash value of other benefits earned (e.g. “Travel Together ticket”, elite status, etc.)

- Calculate value of other rewards

- # Points earned via other means (e.g. fuel points from grocery store, points from online portal, etc.)

- Value of points earned via other means

- Cash earned via non-credit card means (cash back portals, for example)

- Add up all of the above benefits and subtract all of the costs.

In the end, you should have an estimate of the total value of $5000 worth of manufactured spend. This value can be compared across multiple manufactured spend techniques to help decide which is best.

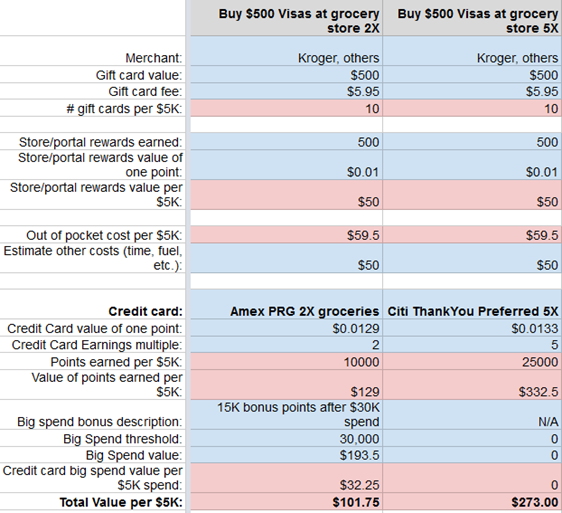

To help calculate all of this, I created a Google Docs spreadsheet and entered in a number of different scenarios. Here is what I found:

Grocery 2X vs. 5X

The example below shows two similar scenarios. In both cases, the idea is to manufacture spend by buying $500 Visa gift cards at a grocery store and then liquidate them through Bluebird at Walmart. The biggest difference between the two scenarios is that one uses a credit card that earns 2X at grocery stores and the other earns 5X.

The samples above show an estimated value of manufacturing $5000 in spend. In my experience, Kroger awards fuel points for gift card purchases. For me, fuel points are worth about 1 cent each, but the value for you would depend completely on how much you fill your gas tank (and/or friend’s gas tanks) each time (see “What is a fuel point worth?“). Next to “Estimate other costs” I entered “$50” to cover the cost/time/pain of visiting Walmart several times in a month. Everyone has different circumstances that would warrant very different values here.

The two columns above vary by credit card: The Amex PRG (Premier Rewards Gold) card (which earns 2X at gas and grocery stores) vs. the Citibank ThankYou Preferred card (the one that earns 5X at groceries, drug stores, and gas stations for the first year). For the PRG card, I entered a very conservative value of 1.29 cents per point (based on the estimated Fair Trading Price). For the Citi card, I entered a value of 1.33 cents per point (see “ThankYou!“). The PRG card earns a big spend bonus of 15,000 points after $30K spend, so I entered that in as well. Note that the calculations assume that once the big spend bonus is achieved, the card will no longer be used in the same calendar year.

Overall, you can see that the net estimated benefit of manufacturing $5K of spend in this way would be $101 for the PRG card vs. a whopping $273 for the Citi card.

Let’s look at other examples…

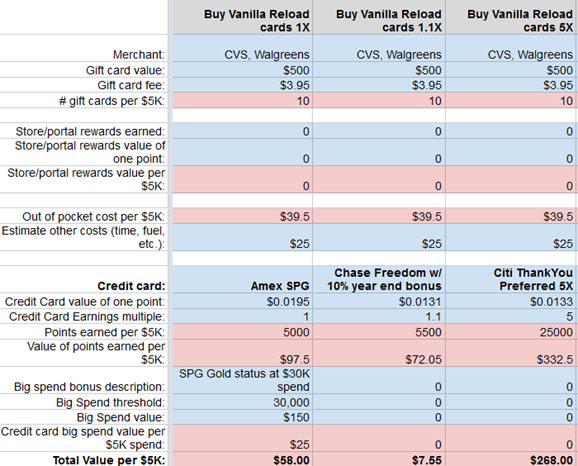

Vanilla Reload cards 1X vs. 1.1X vs. 5X

In this scenario, I compared three cards:

The American Express SPG (Starwood Preferred Guest) card earns only one point per dollar. My Chase Freedom card earns 1.1 points per dollar thanks to the annual 10% bonus I get for having a Chase checking account (see “The new king of the Ultimate Rewards Mall“). And, my Citi ThankYou Preferred card earns 5X at drug stores for the first year (). With the estimated values I plugged in, you can see that only the 5X scenario results in much gain.

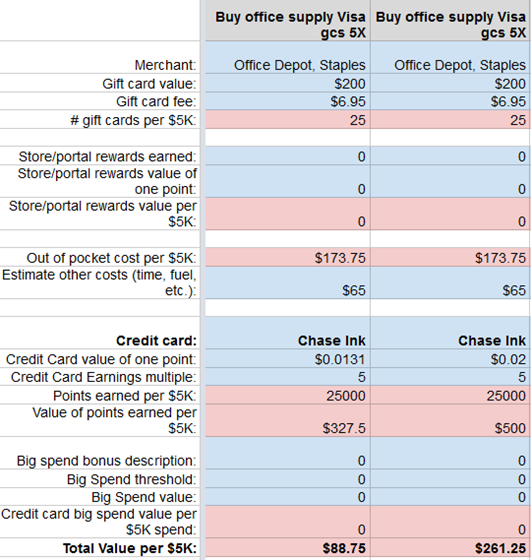

Office Supply Stores

Here are my estimates for the value of buying $200 Visa gift cards at office supply stores with a card that earns 5X:

The only difference between the two columns above is that I used the conservative Fair Trading Price of 1.31 cents per point for the left-hand column, and I used a much higher 2 cent per point estimate for the right-hand column. With the 1.31 cents per point value, this approach results in $88 of value per month. The 2 cents per point option results in a whopping $261 of value per month.

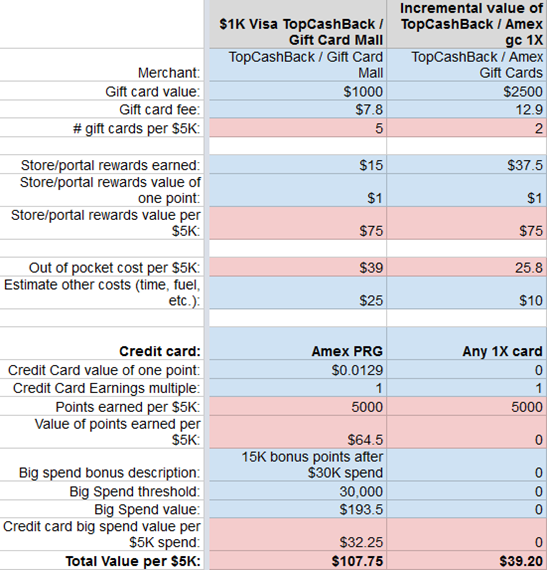

Cash Back Portals

In my recent post “Better than free manufactured spend” I showed that it was possible to earn money when manufacturing spend by going through a cash back portal to GiftCardMall to buy $1000 Visa gift cards. I also pointed out that you could earn even more money by getting cash back buying Amex gift cards, and then get more cash back by using those Amex gift cards to buy Visa gift cards. The table below shows the value of the first approach (buying $1K Visa cards at GiftCardMall) and just the incremental value of adding on the step of buying American Express gift cards:

Basically what this shows is that there is decent value to be had by manufacturing spend via GiftCardMall, but the incremental benefit of buying Amex gift cards is pretty small. I don’t think it’s worth the extra hassle.

Note that the Amex gift card column is just an estimate of the value you would get per $5000. In reality, you probably wouldn’t buy cards with exactly $2500 in value (a number I used for convenience to fit the spreadsheet). In fact, that would be an inconvenient amount if the purpose was to use them to buy $1000 Visa gift cards. In reality, one might buy Amex gift cards each with $3K in value and use them to buy Visa gift cards with values of just under $1K each (in order to account for fees).

Note also that the Amex gift card approach can be mixed with other manufactured spend approaches. For example, you can use the Amex gift cards to buy Visa gift cards at grocery stores. So, you can estimate that the added value of doing this (if you were going to use a 1X card anyway) would be about $39 per month. Again, its probably not worth the effort for most people.

Your Miles May Will Vary

The estimated value of each manufactured spend approach shown above is highly dependent upon my situation: how much I value different types of points, which credit cards I own, how much I dislike visiting Walmart, etc. The numbers will be more meaningful if you plug in your own estimates and even add new scenarios.

Here is the Google Docs spreadsheet:

To make changes, you will need your own copy. Do the following from the opened spreadsheet:

- Select File… Make a Copy.

- Give the new file a distinctive name so that you can tell it apart from mine.

Note that the blue cells are ones that should be edited to fit your circumstances. Red cells are calculated automatically from the others so its best to leave those alone.

Conclusion

Its interesting to see that manufacturing spend is probably not worth the hassle except under certain circumstances:

- You are working towards a big spend bonus that you find especially valuable.

- You need to meet minimum spend requirements for new credit card sign-ups.

- You can earn a high multiple through category bonuses (e.g. 5X is very good)

- You have specific award redemptions in mind that are worth more than 1 to 2 cents per point

What do you think of the Bluebird Metric? Is it a good way to evaluate various manufactured spend techniques? Are there better or simpler options?

Now bluebird metrics are much clearer for me, thank you!

Any one know if you can purchase visa or Amex gift cards with cash in the UK then upload the money into bluebird? Thank you!

I believe that the answer is no, unfortunately

David D: yes, at Walmart you can do a Bluebird “swipe reload” and use a debit card to pay. With the OneVanilla cards, use any 4 digit combination as your PIN (I always use the last 4 numbers on the card).

I purchased two onevanilla cards at 500 ea. is it possible to load these to bluebird?

They do say debit on them.

I don’t “think” so…I think you can use those to buy a vanilla reload card (at least I can at CVS)

Steph: Yes, Bluebird can be used internationally with no foreign transaction fee and it even works at many ATMs. When using it as a credit card, just make sure to find a place that accepts Amex

Hey FM, trying to read all the FAQ on BB….can I use it out of the country?

@Steph – it seems they just did the same to my account after I had a withdrawal yersterday…not sure if I left any money in the card but will give them a call later tonight to find out.

FM or any one with experience – what would be a good prepaid card to use mainly for bean uploads and getting out cash? Thanks for any input!

gottoloveink: Bluebird

Thanks FM! I’m shocked that they shut it down after $5500-$6000 over 4 months! Whatever! I did the BB online and going to start trying my rewards cards. Thank you for posting this info! Greatly appreciated!!

Steph: I assume you mean that you were using the MyVanilla card? Anyway, yes, many people have gotten shut down. I’ve never heard of anyone getting shut down with Bluebird so definitely give that a try.

DonT: Great!

FM, I was able to load the card at a different walmart.

I was using the vanilla reload card to cash in visa gift cards. Had it for 4 months…only cashed in a total of $6000 over that time IF that!!! Today my card was closed by vanilla for “improper use”…said I loaded money and withdrew it out (not same day so what’s the problem???) my fiancé loaded even less…like $2k and his card was closed too….thinking of getting a bluebird card. Am I asking for trouble because I will purchase the vanilla reload card to load BB?

Don T: Those US Bank cards are flaky. Most likely it is an issue with that particular card, not Walmart/bluebird

Greg, bought a 500 variable Visa US Bank Card at Kroger today, couldn’t load it a Walmart. Hope this isn’t a sign of things to come.

Chris D: Thanks! Good to know!

Datapoint: Walmart neighborhood markets are super convenient but do not have Money Centers. But the one near me has a Walmart ATM. It is right up at the front and looks like an ugly version of the Money Center machine at a Super Walmart. It has the same moneycard reload options as the Money Center machine. Worked perfectly for the BB reload with a Visa gc and pin.