NOTICE: This post references card features that have changed, expired, or are not currently available

Over the past year, I’ve become a growing fan of Citi ThankYou points. They were my currency of choice for the 40K to Far Away challenge and had it not been for some poor budgetary planning on my part, I think I’d have given Greg and Stephen a pretty strong run for their money. Regardless of where I stood competitively, I think many would have underestimated ThankYou points and not believed it possible to get from Washington DC to Honolulu, Tokyo, Australia, New Zealand, and Niue on 40K points and even the ~$650 that I spent. Greg wrote yesterday about how the Citi Double Cash may now be the best starter rewards card and he makes a pretty good argument. But despite all that, today’s post isn’t a gushing love fest for Citi, but rather the opposite: the case against bothering to collect Citi ThankYou points at all — at least right now.

A question on diversification

Our question of the week on the podcast a couple of weeks ago came from a reader named Al wondering when the time is right for diversification. Here was the question:

Hey guys!

Love your site and podcast. I appreciate you guys keeping things about points/miles event with things so COVID-y. As a physician, I appreciate the escape.

Question for you;

I have a healthy, though not crazy, amount of MR and UR (300K+ each). Only me and P2. Have a good amount of spend coming up. Would u keep on accruing MR/UR or would u change to another currency (TYP??). I have all UR cards already, but only a couple MR cards (personal gold, plat and bus plat). When did u guys make a transition to another transferrable currency? Is diversification better than maximizing particular currencies?

PS cash back sparks no joy!

Thank you and keep up the good work!

(For those thrown by the abbreviations, MR = Amex Membership Rewards points, UR = Chase Ultimate Rewards points, TYP = Citi ThankYou points, and P2 = Player 2 (spouse/partner).)

I thought the question was excellent. Most people who delve deep enough into this points and miles game eventually extol the virtue of diversification. That is to say that many of us value having all of the major points currencies in order to be able to take advantage of whichever sweet spot is the sweetest in our time of need.

Based on that, when I first read Al’s question and just focused on the numbers (300K+ in both Membership Rewards and Ultimate Rewards), it seemed like perhaps he was indeed at a point where venturing into Citi points could make some sense.

But then I looked at his list of cards. Al says he has all of the Ultimate Rewards cards, but only lists 3 cards that earn Membership Rewards points. There are currently 12 different cards that earn Membership Rewards points on our Best Offers page. Given that both Al and his Player 2 could theoretically eventually open all 12, that’s 24 total potential welcome bonuses — of which they have so far only gotten three. When you consider that Al and Al’s Player 2 can earn not only those 24 potential welcome bonuses but also referral bonuses as they refer each other to these new cards, there are a lot of potential Membership Rewards points still on the table.

And so, in short, we recommended that Al continue to focus on Membership Rewards points for now since there is a lot of low-hanging fruit to be picked there.

But the question has lingered in my mind: When is it time to diversify into Citi ThankYou points? Will it be when he reaches 400K or 500K Membership Rewards? A million Membership Rewards? Some other milestone?

Despite the fact that I’m a big fan of ThankYou rewards and the fact that I think the Double Cash was a powerhouse card before Greg discovered that you could get 2.66% back toward gift cards with no annual fee (and that discovery obviously adds even more strength), I couldn’t think of when the right time to diversify to ThankYou points would be in Al’s case. In fact, the more I think about it, the more I agree with Greg’s assertion that the Double Cash is a great starter rewards card. And if you value the Shop Your Way gift card conversion like cash, it certainly can be a great deal for ongoing unbonused spend. But if you already have other currencies, and if you mostly value earning transferable points for airline and hotel transfer partners, the time to start with ThankYou points seems to me to be the easiest answer: when you need them.

That feels like an obvious conclusion, but yet it is as flawed as any “perfect” answer: once you need the points, it will be too late to collect them. So I’ll have to modify that to the second-best answer: when you think you’re going to need them.

When do you need ThankYou points?

That begs the question above: when do you need ThankYou points? The obvious answer is when you need to book an award that requires ThankYou points.

However, Citi only has two unique transfer partner over Al’s collection between Amex Membership Rewards points and Chase Ultimate Rewards points: Turkish Miles & Smiles and EVA Air Infinity MileageLands. If Al wants to book the best deal for economy class tickets within the United States and/or other North American countries (or if he can find domestic saver business availability), he might highly value ThankYou points. Apart from that use case, Al has pretty good coverage with Amex and Chase. Turkish has some other strengths, and EVA may give him expanded availability to its own flights, but Al mostly has equally good options at his disposal for booking Star Alliance awards (along with all of the other major alliances).

In fact, when I made a chart to show airline transfer partners, it became visually clear how little advantage Citi ThankYou points offers over Al’s current Amex & Chase collection. Note that this chart includes Capital one and does not include transfer ratios (see our Transfer Partner Master List for full info, including transfer ratios and also including Marriott transfer partners). Note that I’ve entirely left out transfer partners as the only truly relevant hotel transfer partner in any of these programs is Hyatt (a Chase Ultimate Rewards transfer partner). In most other cases, you could buy hotel points for rates so cheap that it isn’t worth transferring in large quantity.

| Amex Membership Rewards | Chase Ultimate Rewards | Citi ThankYou points | Capital One |

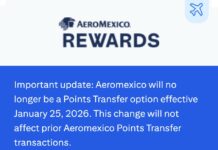

| AeroMexico | AeroMexico | ||

| Air Canada Aeroplan | Air Canada Aeroplan | ||

| Air France KLM Flying Blue | Air France KLM Flyling Blue | Air France KLM Flying Blue | Air France KLM Flying Blue |

| Alitalia MileMiglia | Alitalia Milemiglia | ||

| ANA Mileage Club | |||

| Avianca LifeMiles | Avianca LifeMiles | Avianca LifeMiles | |

| Avios | Avios | ||

| Cathay Pacific Asia Miles | Cathay Pacific Asia Miles | Cathay Pacific Asia Miles | |

| Delta SkyMiles | |||

| El Al Israel Airlines | |||

| Emirates Skywards | Emirates Skywards | Emirates Skywards | Emirates Skywards |

| Etihad Guest | Etihad Guest | Etihad Guest | |

| EVA Air Infinity MileageLands | EVA Air Infinity MileageLands | ||

| Finnair Plus+ | |||

| Hawaiian Miles | |||

| JetBlue TrueBlue | JetBlue TrueBlue | JetBlue TrueBlue | JetBlue TrueBlue |

| Malaysia Airways Enrich | |||

| Qantas Frequent Flyer | Qantas Frequent Flyer | Qantas Frequent Flyer | |

| Qatar Airways Privilege Club | |||

| Singapore Airlines KrisFlyer | Singapore Airlines KrisFlyer | Singapore Airlines KrisFlyer | Singapore Airlines KrisFlyer |

| Southwest Rapid Rewards | |||

| Thai Airways Royal Orchid Plus | |||

| Turkish Miles & Smiles | |||

| United MileagePlus | |||

| Virgin Atlantic Flying Club | Virgin Atlantic Flying Club | Virgin Atlantic Flying Club | Virgin Atlantic Flying Club |

As you can see from that chart and as noted above, the only really useful partners Citi adds to the mix are Turkish Miles & Smiles and EVA Air (also added are Qatar Airways Privilege Club, Malaysia Enrich, and Thai Royal Orchid Plus, these programs don’t add many notable sweet spots. Thai Royal Orchid Plus may have some decent spots, but I haven’t found much about the award booking process and the airline itself could be on shaky ground at the moment.). If Al wants miles in those two programs, he might consider the Citi Premier card (and combining it with the Double Cash and Rewards+).

Since Citi shares so many great transfer partners with Amex and Chase, Citi can also be a good way of easily boosting a balance in a shared program. For instance, if Al anticipates using Virgin Atlantic miles sometime next year to book a big trip, he may decide to pick up an easy welcome bonus on the Premier card, which gives him enough points with one welcome bonus to fly Delta One suites one way between Japan and the US or Delta One from the US to Europe among other sweet spots. The same is true with other partners Citi shares with Amex and Chase, like Air France / KLM Flying Blue and Singapore KrisFlyer. The welcome bonus on the Premier could help add to the mix for a particularly valuable award ticket.

However, given the current state of travel, I find the case for Citi ThankYou points somewhat weak. That might seem counter-intuitive: with many people likely to focus on domestic travel for the foreseeable future, Turkish seems like a potentially great option. However, Avianca LifeMiles offers an option that in many cases is as good or nearly as good and likely easier to book. Looking beyond domestic travel, I think now is a bad time to begin holding a card that costs $95 per year (i.e. the Premier) if your primary reason is that you might eventually need to transfer the points to a partner. Citi does make it pretty easy to product change your way around so you could downgrade and then later upgrade when you’re ready to use the points, but it isn’t easy and compelling to keep the ability to transfer to partners.

To be clear, for its part, the Premier is no slouch of a card. With 3x groceries and 3x dining as well as 3x flights and hotels, it has an excellent earning structure. It’s just that with the Amex Gold card eating Citi’s lunch in terms of US supermarkets and restaurants, the Premier struggles if you’re also going to have an Amex Gold. That ignores those folks who will max out the $25,000 annual cap on the Amex Gold’s US Supermarket bonus category: for those people, it makes sense to have another excellent grocery card. Heavy manufactured spenders, or those without the Amex Gold card, may well find the Premier worth $95 per year. Citi is also well known for generally generous retention offers that can be quite rewarding. I don’t mean tot say that the Premier card is bad or that the Premier/Double Cash/Rewards+ combination isn’t strong. It is. Just perhaps not strong enough.

More generally, if you are invested in the Amex and Chase ecosystems, it becomes much harder to make the case for Citi beyond a quick welcome bonus. Yes, the Double Cash is an excellent card. Yes, Turkish Miles & Smiles offers a great sweet spot, particularly for travel to Hawaii. But overall, the ThankYou programs offers very few welcome bonuses (just 2 ThankYou cards with welcome bonuses at the moment and you can only earn one of them every 24 months) and bonus categories that can be matched or beat with Amex and Chase.

Bottom line

In a pre-pandemic environment, it was easier to say, “Yeah, pick up some ThankYou points from a welcome bonus because you’ll find a use for them”. When travel was common and easy, it was not difficult to imagine finding a way to pool ThankYou points with Amex or Chase points to book a valuable award ticket sometime within the first year on a Premier card. Before the Amex Gold card offered such strong bonus categories, a Premier and Double Cash combination would have looked very strong indeed (and they certainly still may look strong for someone unwilling to fork out $250 per year for the Gold). But overall, I find Citi’s value proposition difficult to justify in an environment where we don’t know when you’ll get use from the points. As I’ve already said, if you’re just starting out with rewards cards, a Double Cash and Rewards+ is a fantastic starter combination — and adding a $95 Premier to the mix might be a great gateway to learning about rewards cards. But for those already invested in Amex and Chase, given that Citi’s cards don’t offer much in terms of ancillary benefits and its transfer partners offer few unique options I think I’ll adjust my bottom-line answer to Al’s question one more time: When is the right time to diversify into Citi Thank You points? Not right now.

[…] The Case Against ThankYou Points: When deciding which flexible point currency to accumulate, it’s good to know the pros and the cons. Many times we only read about the pros. This article breaks it down nicely to help you decide. […]

How quickly do you typically see the 10% rebate with Citi Rewards post transfer?

Very quickly. If I remember right, I think I received an email within a few minutes each time.

I got some good value out of 1.25 redemptions and Reward+ through the TYP portal due to holding the Premier. With that going away TYP for me are just about generating 1% spend per point for student loan and mortgage payments.

So how do you spend all those gift cards? I certainly don’t spend that much money in a month.

Which gift cards are you talking about?

I think you gave bad advice. Assuming they are over 5/24, the time is now to load up on TYP by double dipping on the Premiere and Prestige. Best to get the 24 month clock started now. It’s not all about diversification, it’s also about managing bank rules.

Fair point on managing bank rules!

WR2

Real easy isn’t it Max Chase then MAX TYP..Good time to Stop getting cards after that or AMEX ..Trouble is keeping points current because no where to GO !!! People like me are getting lots of cash and points back too.

Caveworks

I’m always shocked that people value UR more than TYP. Once UR removed Korean as a transfer partner, the value was really gutted for me. I tend to redeem miles only for long-haul premium cabins, so Avios have limited appeal (aside from some Iberia redemptions) and United is garbage for that. Exchanging UR for fixed-value Southwest points? No thanks. I find LifeMiles and AsiaMiles really underrated, on the other hand. Chase has Hyatt which I love, but overall I still think Citi’s transfer partners more attractive than Chase’s.

I agree that UR is overrated — but Hyatt does present the best chance to get good value out of a hotel transfer partner and the ability to easily earn UR points at 5x makes it a better deal if you’re looking to transfer to any of the shared programs (Virgin Atlantic, Air France, Singapore, etc).

Fair point about the Freedom’s 5%, but I’ve always found that a little gimmicky. My spending is typically (non-Covid) heavy on restaurants, so I’m getting 5x all year long with the Citi Prestige. Guess it depends on what kind of spending you value, but I still think there’s slightly greater value in having LifeMiles and AsiaMiles over Hyatt as a transfer partner. Just one opinion.

What Nick said. Hyatt. Child’s play to get at least 2 cents of real value per point; adults can get closer to 3, sometimes 4.

Nick,

I’ve had the Citi Premier card for a couple years now, but I don’t use it much, so it’s probably a waste to hold on to it. I’m thinking of cancelling, so I logged in to my account to check out the rewards details. I don’t see anywhere stating 3x on groceries or dining. In fact, all that I see is 3x on “travel including gas stations”, 2x on “restaurants and entertainment” and 1x everywhere else.

Am I missing something? Are there different versions of the card and I have a bad one?

No, these changes were announced months ago to begin on August 23rd and then in June they moved up the changes to happen early (as of June 2nd), so it’s been earning 3x grocery and dining for a couple of months now. This post has those details:

https://frequentmiler.com/citi-joins-the-party-5x-prestige-online-3x-groceries-on-premier-starts-now/

If you buy something at the grocery store right now, the extra 2x shows up as some sort of additional bonus. I assume that on August 23rd we’ll see it show in our online accounts that it’s earning 3x dining and grocery – I think they probably just had the technology set up to do that and then decided to start the changes early in response to everyone else bonusing grocery and dining because of the pandemic.

By the way, don’t cancel — if you cancel, your points will expire. You want to product change to the Rewards+ or TY Preferred (both no annual fee) in order to keep the points alive if you’re not going to clean them out before closing. Also, canceling will reset your 24-month clock (locking you out of earning a new welcome bonus on the Premier or Prestige for 2 years), whereas product changing to the Rewards+ or TY Preferred would not reset the clock.

Thank you for the clarification and additional insight about why the website was not showing the update. I have not been paying close enough attention to my Premier card it seems. I did not think about that 24-month clock lockout either. I only dabble in the points and miles game because I don’t get to travel that often, but I appreciate all that you and the team do here at Frequent Miler! Many thanks!

I did this same analysis for myself back in January and came to the same conclusion. Basically the only thing I would really want them for is Turkish, but (1) I feel like Turkish has got to raise those award prices at some point soon, and (2) I’m SF-based, so while TK would still be my cheapest way to Hawaii, I have pretty good next-best options: using Avios on AS, or just cash tix on WN for ~$250 roundtrip during spring/fall.

One play I’ve been considering is downgrading my Citi AA card to a Double Cash and starting to use that for unbonused spend so that I work up a balance to have ready to use when I finally do get the Prestige/Premier for a year down the line.

Yeah, that’s a good plan. AA->Double Cash is the ticket.

Bay area based as well. No travel to Asia? EVA air business class 75k one way, and if you do round trip you can do a free stopover in Taipei. That’s my preferred TYP usage.

In fairness, for travel to Asia, I’d rather have Membership Rewards for transfers to ANA. 90K *round trip* on Star Alliance (including EVA — save 60K miles on a round trip if they have partner availability) in business class. As low as 75K RT to Japan in business. You can do a stopover on a round trip. EVA does release more availability to its own members though from what I hear, so that’s an advantage to using EVA.

Other good options for business class to Asia that beat 75K on EVA include Alaska miles to fly Cathay Pacific (50K one-way) or JAL (60K one-way) with a free stopover (or first class for 70K) or using AA miles to fly either of those airlines in business for less than 75K one way.

That’s not to say that EVA is a terrible redemption, it’s just not necessarily the one that would convince me to want TY points despite how highly-regarded EVA is.

Oh I would definitely go ANA too, but prepandemic availability on ANA was scarce. EVA availability was usually very good. EVA has always been my backup plan to SE Asia if I couldn’t find anything else. EVA J is also in my view in the top 2 products transpacific. I try to keep 75k in my EVA account at all times. It’s good to have options. Get that 24 month clock started!

I’m talking about using ANA to fly EVA. Again, that’s only going to work when EVA has availability that’s open to partners — but when they do, you’re talking 90 or 95K ANA miles to fly EVA business class round trip (less than 50K each way depending on where in Asia you’re going).

But you’re right that it’s good to have options and to get the clock started!

To be honest, I’ve never really looked too closely into EVA’s program since I’ve never had a way to transfer miles to them. I guess the problem would be that since I’m starting from 0, it would take me awhile to build up a balance big enough for that roundtrip with a stopover. And in the meantime I would be too tempted to spend them on 7.5k one-ways to Hawaii. 🙂

I see Turkish is a valuable TYP partner, especially for my case. I can fly Business class from ORD -DAC for 54K TYP. Where I will need 99 UR (UA) or 75 MR (Aeroplan) or 70 AA or 82.5 AS. I am heavily focusing on TYP. Am I missing better options for that route?

Honestly, I’m not sure where each program classifies Bangladesh (Asia? Indian subcontinent? This can affect pricing). I think Turkish is likely your best bet. Perhaps ANA would offer a good value as well for Star Alliance flights.

Keep in mind you have to pay fuel surcharges with Turkish miles. So it’s a trade off between paying fuel surcharges and less miles vs 70 to 85k miles and no surcharges.

My favorite for travel to that part of the world is still using AADVANTAGE miles for QSuites.

Turkish collects fuel surcharges on some, but not all partners — though your most likely Star Alliance partner on that route is going to be Turkish itself, in which case it’s true that you’ll be paying surcharges.

I love your really well-thought arguments. It’s pretty tough for the Premier+DC combo right now when Chase freedom has 5% on grocery for a year and 20k bonus, and Amex Gold just came out with a higher bonus. At the same time, Citi’s transfer partners are not really over appealing compared to Amex and Chase. I so wish that Citi would somehow add AA as a partner, like common this has been going on long enough.

Isn’t Qatar a unique transfer partner for TYP?

You’re totally right. I skipped over the partners from the section of our Citi transfer partner page on the not-so-useful partners. There’s also Malaysia Enrich and Thai Royal Orchid Plus. I’ve added those.

On the flip side, if you just want to keep things simple and accumulate points at an increased rate without paying much in annual fees, it’s hard to beat 3x on dining, grocery, travel, and gas, and then 2x everywhere else, plus 10% back in points redemptions with the Premier/Double Cash/Rewards+ for $95. I think I’d recommend that combo for a lot of people who want to keep things relatively simple.

I thought you lost the points within like 30 or 60 days if you downgrade the premier (and don’t have the prestige). Is that wrong? Is there a way to save them and downgrade?

If you downgrade to another ThankYou card (but not to the Double Cash), points remain alive. See this post: https://frequentmiler.com/cancelling-your-prestige-or-premier-card-heres-how-to-keep-your-thankyou-points-alive/

Only if you product change out of the ThankYou family. If you product change to a Rewards+ or ThankYou Preferred, you keep your points alive (just not transferable to most partners). See:

https://frequentmiler.com/cancelling-your-prestige-or-premier-card-heres-how-to-keep-your-thankyou-points-alive/#:~:text=An%20easy%20way%20to%20keep,card%20is%20the%20best%20option.

Oops! Replied at the same time.

That’s really useful info, thanks! I was planning on keeping P2’s premier open this coming year for grocery/restaurant spend as the gold has always been a bit of a turnoff due to the awkward monthly credits, etc. That said, I’ve been reconsidering now that there are 60k+ SUBs for the gold, plus really high referrals with that card in many cases too. I’ve been mostly focused on URs for the past year and not MRs, but now might be a good time to take advantage.

I read this post with great interest all the way to the very end, where I found the final nugget, which re-affirmed my decision. Early this year, I made my first sojourn into TYPs with the Premier, mostly to have the ability to try to use Turkish to Hawaii, with the plan of downgrading to the rewards plus card at the end of the year. I was long confused about keeping the points alive, their use (even with your guide about emailing Turkish), and I am hesitant about signing up for an annual fee card without an immediate use and an end game. However, yours and Greg’s observation (pre-pandemic, I believe) that 60k TPs signup was the highest Premier signup bonus would go finally pushed me over the edge. (Shortly after I signed up, there were reports of a 65k SUB in bank, which shows you how timing really matters, as that might have delayed my sojourn.) Near the end of the post you note in parentheses “and they certainly still may look strong for someone unwilling to fork out $250 per year for the Gold.” Ding, ding, ding, that is me! Now I don’t need to sign up for your card consultation! 🙂

I too got the Premier early this year (January) for use to Hawaii (as well as for Disney tickets). It is now August and haven’t used any points and based on current COVID situation, it doesn’t appear I will be using any this year. In about 5-months, will product change to Reward+ (after this and in a little over 12-months, apply for another TYP bonus card).

Rob-did you convert toRewards+ successfully and keep your TYP and same credit card #? It is annual fee time for me. TIA!

Hello Kim,

No, I still have the Premier card; keeping it for 2-years as it doesn’t reset the 24 month clock.

In regards to product change to Rewards+, as I understand it, this should keep TYP from expiring as Rewards+ is a TYP product.

Thanks for responding!

I’m also not a Gold fan because, for me personally, I hate jumping through all the Amex hoops in order to get the airline and dining credits that offset the $250 fee.

I agree with you, Kim. I don’t like the argument Nick’s making that the Citi Premier card is a bad idea. I think the right argument is that holding BOTH the Citi Premier and the Amex Gold may be a bad idea since you’re duplicating the supermarket and restaurant bonus. Like you, I’m not crazy about the $250 annual fee on the Amex gold and am much more comfortable with the $95 on the Citi Premier. So holding the Premier becomes an argument for me not to get the Amex Gold since I’ve already got 3x bonus on supermarkets and restaurants (and travel) with the Premier. I’ve also had success getting Citi to give me a retention bonus on the Premier.

Despite a terrible experience with Turkish in terms of trying to get miles back from a canceled award, I really do like that sweet spot and have used it to go to Hawaii for a ridiculous rate. The only Amex point card I have right now is the old Business Gold Rewards, and I’m about to cancel that and get out of the Amex point business altogether for now. I like Amex points a lot but their cards are expensive!

Brian-have you considered AMEX Biz Blue Plus, instead of exiting MRs? No fee and no other card is required to access travel partners, unlike Chase and Citi. I don’t think Nick’s point is that Premier is bad, maybe just duplicative for some people. Cheers!

Kim, funny you mention that because when I called Amex a couple of days ago to ask about a retention bonus on the BGR, the CSR suggested I get the BBP and cancel the BGR for the reasons you mention. I may do it. I only have 10K Amex points right now so protecting them is not foremost on my mind. But I do like the idea of getting 2x Amex points for non-bonused spend vs the 2% cashback I’m getting right now (with the Amex Blue Business Cash). Really, my only holdup is spending an application “slot” on a card with no (useful to me) sign up bonus. I know it doesn’t affect 5/24 (which I’m about to slide under on October 1), but it still feels like if I’m gonna apply for a card, I should get a sign up bonus! I’m a single person household so my non-bonused spend is not that much, especially when you subtract out spend to hit SUBs. Do I really want to apply for a card that has no sign-up bonus just so I can get maybe 15K amex points a year instead of the $150 cash back I’m getting now for non bonused spend? The quick hit of a card with a SUB worth $400 or $500 feels better to me lol.

Brian-are you able to. product change instead of sign up for a new card? Or is the BGR a charge card instead of a credit card? There has been a signup bonus in the past, 10k MR? Or maybe apply thru someone’s referral link and they will apply through yours another time? It is harder without a P2, but not impossible. Good luck!

I don’t think (but am not positive) that it’s possible to product change to the BBP from either the BGR or the BBC (both of which are worthless to me if I have the BBP). I think some people were even getting 20K offers fairly recently for the BBP. I’d love to hold out for at least some sort of bonus when I sign up.

Thanks!

Also not a fan of the Amex Gold, however I DO like my Amex Everyday Preferred. It’s my “go to” card for groceries getting me a consistent 4.5X which edges out the Gold’s 4X so long as I make 30 transactions/month – which is easy to do. $95 AF and no hoops to jump through for airline credits. This card never really gets much more than a casual mention here and there. Not sure why.

Two reasons it doesn’t get much more than a casual mention:

1) The low cap on 4.5x earnings. The average US household spends more than $6K per year on groceries, and I’d venture to guess that those interested in rewards credit cards probably skew that up without considering any manufactured spending or strategy spending like buying a gift card at the grocery store before you go to the home improvement store, etc. It’s much more restrictive than $25K per year. Before the Gold, this card got more attention. Once the Gold debuted, it lost its luster due to the low cap and #2.

2) Personally, I find doing 1 Southwest flight purchase to trigger the airline incidental credit a much much much easier hoop to jump through than making sure I do 30 transactions every single month in order to get 4.5x. I think that’s likely true for many people.

I naturally end up using the $10/mo credit that’s good for GrubHub, Cheesecake Factory, etc 5 or 6 times. Between that and what I find to be an easy airline incidental $100, I don’t find the Gold significantly more expensive than the EDP and I find it much easier and more rewarding (given the higher cap on grocery and the addition of 4x US restaurants, uncapped).

All that said, a single person may stay within the grocery cap pretty easily and then it comes down to making sure you do thirty transactions. I’m not saying it can’t work for you, but I don’t find it as compelling a value proposition.

Admittedly, I’m a bit of an amateur when it comes to the points/miles game. Our household spends less than the 6K cap on groceries and we don’t MS – though I like your idea of strategy spending and may incorporate some of that going forward.

The 30 transactions per month is really easy for me personally. I just stop at the gas station on my way to and from work each day. I need to buy fuel anyway, so I just add a little each stop, and I hit my 30 transactions a little over halfway into the month.

Thanks for sharing your perspective as it helps me to understand where others may find better value with the Gold.

Great description of relative value of a card/points currency. Nothing in the world exists in a vacuum – everything has to be compared with everything else to get a relative sense of value.

One decision I grappled with for a long time was, should I liquidate my Amex points through the Schwab route? I accumulated 1.3 million points through the years, and finally decided to pull the trigger back in May.

Tough and heart wrenching to see all my points go “poof” but I think it’s the right choice from a “relative value” perspective. Here’s why:

1. Pre-pandemic travel isn’t coming back soon, and since to me Amex points are uniquely positioned for international premium class travel, it’s the points currency that’s going to fall in value the most. In this situation I’d gladly accept a 1.25 cpm “exchange rate” now (which can grow in the stock market) over a potential aspirational redemption that likely won’t materialize soon.

2. Amex MR is relatively easy to earn. Though I’ve exhausted most SUBs, I can still earn a respectable amount through retention offers, referral bonuses and Amex offers, given a 3-5 year time horizon.

3. My stash of 3 million airline miles across various programs decreases the incremental value of holding on to Amex MR. We should always strive to use “single-use” mileage currencies before “multi-use” transferrable point currencies.

4. When travel returns, I expect the flights to be oversupplied, depressing prices and decreasing the cpm value of redemptions. I may be wrong, but just looking at the domestic US market alone I am seeing many sub-$100 cross country one-ways and CLE-EWR $27 RT. While some may balk at paying cash for flights, the gains from the investments using the Amex MR/CS route would likely pay for more than I could ever travel over the next year or two.

The thing that tipped the scales in favor of redeeming my MR the CS route was the introduction of the limited time Platinum credits from May-Dec. That’s $320 in value. Add a 60k MR SUB ($750), 2x $200 airline incidental credits (2020, 2021), $200 Uber credit, 3x $50 Saks credit (1H20, 2H20, 1H21) and a $500 bonus for transferring $100k in cash/securities to the new CS Brokerage, that’s $2320 in value for $550.

I dumped a million MR into Schwab. My wife has about 300K currently which will be enough for any potential use in the next 18 months for us.