We’ve seen incredible offers on American Express cards over the past four years, but one of the hottest for those eligible has been a big targeted American Express Business Platinum card offer. We’ve recently seen many more people — including existing Business Platinum cardholders — get targeted for an offer providing the chance to earn 250,000 Membership Rewards points with a new Business Platinum card after meeting minimum spending requirements. In this post, I’ll explain where I found this offer (that I successfully opened with no pop-up despite being an existing cardholder) and other options you may consider for finding it yourself.

Incredible targeted Business Platinum and Business Gold offers

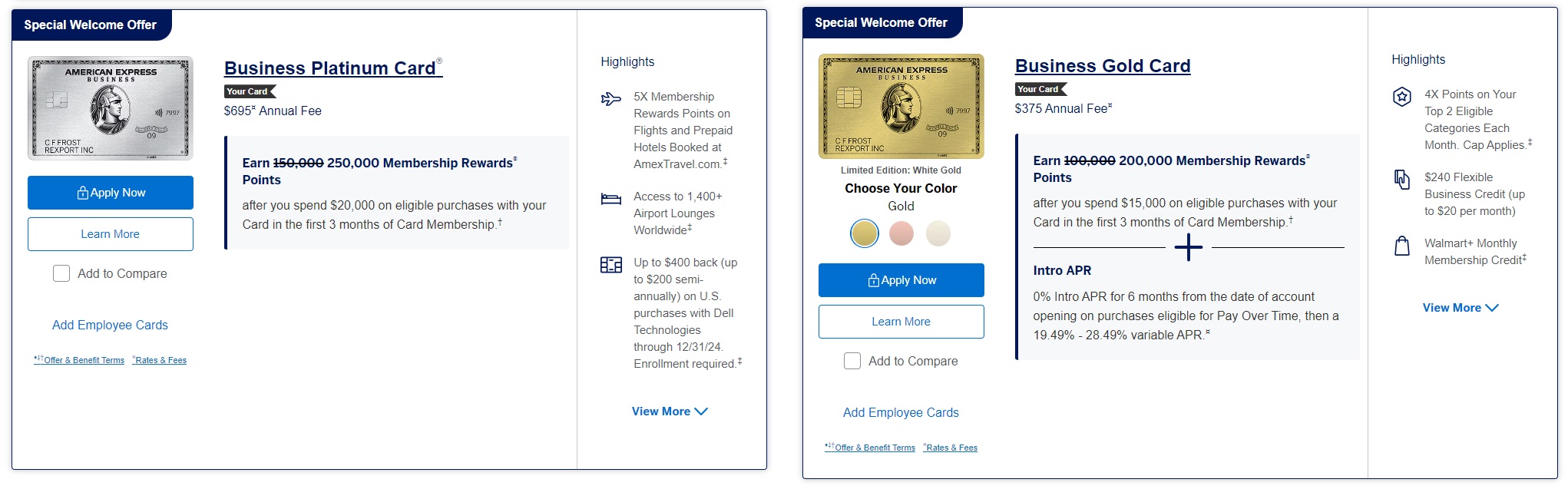

For several months now, there have been targeted offers sometimes arriving via email or the Amex Offers section of one’s Amex account to earn as many as 200,000 Membership Rewards points after $15,000 in purchases in 3 months with a new Business Gold card or as many as 250,000 Membership Rewards points after $20,000 in purchases in 3 months with a new Business Platinum card.

If you have the expenses to meet the spend, either offer is an incredible haul of points. Yes, both cards have high annual fees, but if you value the points at just $0.01 per point, then you’re looking at offers worth $2,000 or $2,500 — an excellent return on $15K or $20K spend even after accounting for the cost of the annual fee (and better still if you value benefits and “coupons” on either of those cards). In reality, I find the offers far more exciting yet since I know that, for example, one welcome offer here could get my entire family of 4 to Europe in business class (maybe even round trip). See our Amex Membership Rewards sweet spots post for more ideas about how to use the points to incredible value.

Tim has written about the big targeted Amex Business Platinum and Business Gold offers a number of times, including with a link that works for some folks. See the post New link for the Amex Business Platinum 250K welcome offer (targeted). It might be worth trying that if you don’t see the offer in the same place that I did (covered below). Note that some people have also seen a 300K offer, though I haven’t noticed many reports of that offer.

In my case, I had tried the link in Tim’s post back in July and it didn’t work for me (after logging in, it said that the offer was no longer available). However, I ended up finding the offer elsewhere recently, and anecdotal reports from readers combined with experience on our Frequent Miler team indicate that the 200K and 250K offers seem to be more broadly targeted as of late via the following method.

Where I found these offers (even as an existing cardholder)

While we’ve seen some people receive emails and others who have had success with a targeted link, I found targeted Business Gold and Business Platinum offers in a different place.

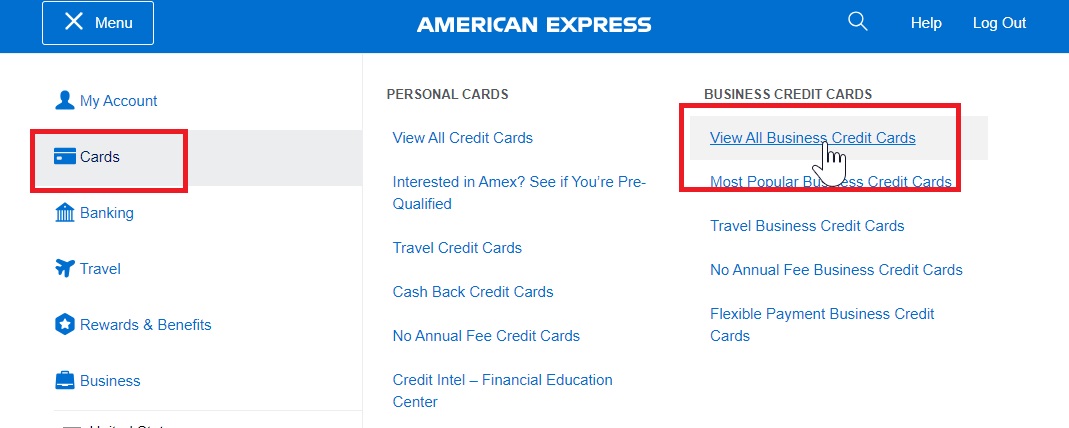

I had some big expenses coming up, so I was poking around in my Amex account to check for offers. While logged into my Amex account, I went to the “Menu”, “Cards” and then “View All Business Credit Cards”.

That brought me to a page full of offers that began with the Business Platinum and Business Gold offers you see above to earn 250,000 or 200,000 points after qualifying purchases, respectively. It was hard to ignore the opportunity for such a big haul with a single card.

I’ll also add that other members of the Frequent Miler team have also found these same offers in the same place, though success in applying has been mixed. At least one member of the team applied the same way I did, but they got a pop-up saying that they weren’t eligible for the welcome offer (spoiler alert: I didn’t). Your mileage may vary, but I found it interesting that all of us had the 200K and 250K offers in our accounts (and so did other members of a few of our households).

An aside: applying for business cards

In order to apply for a business credit card, you must have a business. That said, it’s common for people to have businesses without realizing it. For example, if you sell items at a yard sale or on eBay, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship and you can apply for a business credit card using your own name as the business name, and your Social Security Number as your business Tax ID (also known as EIN).

Deciding which offer was right for me

After some analysis between the two offers, I ultimately decided to go for the Business Platinum card.

The numbers seemed to support that decision in my case. The Business Platinum card would cost me an additional $320 in annual fee (the Business Platinum’s $695 annual fee as compared to the Business Gold card’s $375 annual fee) and an additional $5K in spend since the minimum spending requirement for the Business Platinum offer is $20K versus a minimum spending requirement of $15K on the Business Gold card.

Committing that extra $5K in spend on the Business Platinum card has some opportunity cost. If I would have otherwise earned 2.625% back on that $5K spend (more on how I would do that here), and if I value Membership Rewards points at our Reasonable Redemption value of 1.55c each, that means that my “cost” to spend on the Business Platinum card, after accounting for the 1.55c at which we value 1 Membership Rewards point (the typical return on spend on the Business Platinum card) is just over 1%. One percent of that $5K spend is $50. By spending an extra $5K to meet the welcome bonus on the Business Platinum card, I’d be earning $50 less than my best alternative. Add that to the $320 extra that I’ll pay in annual fee and we’ll call the Business Platinum card offer $370 more “expensive” to me than the Business Gold card offer.

In exchange for that $370 in annual fee and opportunity cost, I’ll get:

- 50,000 additional points (since the 250K welcome offer on the Business Platinum is 50K more points than the 200K offer on the Business Gold card)

- At least $200 in Dell credits (note that this benefit is expected to end on 12/31/24, but there’s been no word about a replacement)

- At least $400 in airline incidental credits in the first year ($200 now and a fresh $200 in January 2025)

- Up to $120 in wireless service credits (for some reason, I tend to be better about remembering to use these than most other monthly credits!)

I’ll miss out on the $20 monthly office supply credit on the Business Gold card though. I value that about the same as the wireless service credit since I very often forget to even use the office supply credit but rarely forget to use the wireless credit (and I’m obviously paying the bill at full price whether I use this card or not). To me, the additional 50K points alone were worth the cost difference, so I’m looking at the Dell and airline fee credits as the gravy that made the Business Platinum offer a bit more attractive yet.

Keep in mind though that if I did the entire $15K spend requirement for the Business Gold card in a 4x category, I’d end up with an additional 45K points for that spend over what I’ll likely get with the same quantity of spend on my Business Platinum card. If you don’t want to buy anything from Dell or bother with airline fee credits, I could see someone making the decision to go with the Business Gold card. I don’t think there is a right or wrong answer here. Both offers are excellent for those with the capacity to meet the spend.

Getting a Business Platinum card even though I already had one

I imagine that at least a few readers have gotten to this point wondering how I was eligible for a Business Platinum card. You likely assume that I already had a Business Platinum card (you’re right) and you may be familiar with Amex “Lifetime language”.

Amex application terms typically state that you may not be eligible to receive a welcome offer if you have or have had the card for which you’re applying. The operative word in the terms is may. So-called “lifetime language”, at least in many cases (and obviously in this one) does not typically say that you are not eligible to earn a welcome bonus but rather that you may not be eligible. That leaves open the possibility that you may be eligible.

While there was a time when “lifetime language” was applied fairly evenly across the board, the “may not” distinction is one that has been proven in recent years to leave room for earning a welcome bonus on a card that you have or have had before. During the pandemic, we frequently saw people get targeted to “expand” their Membership with an additional Business Platinum card and many received the welcome offer again despite having had or even having an existing Business Platinum card at the time of application.

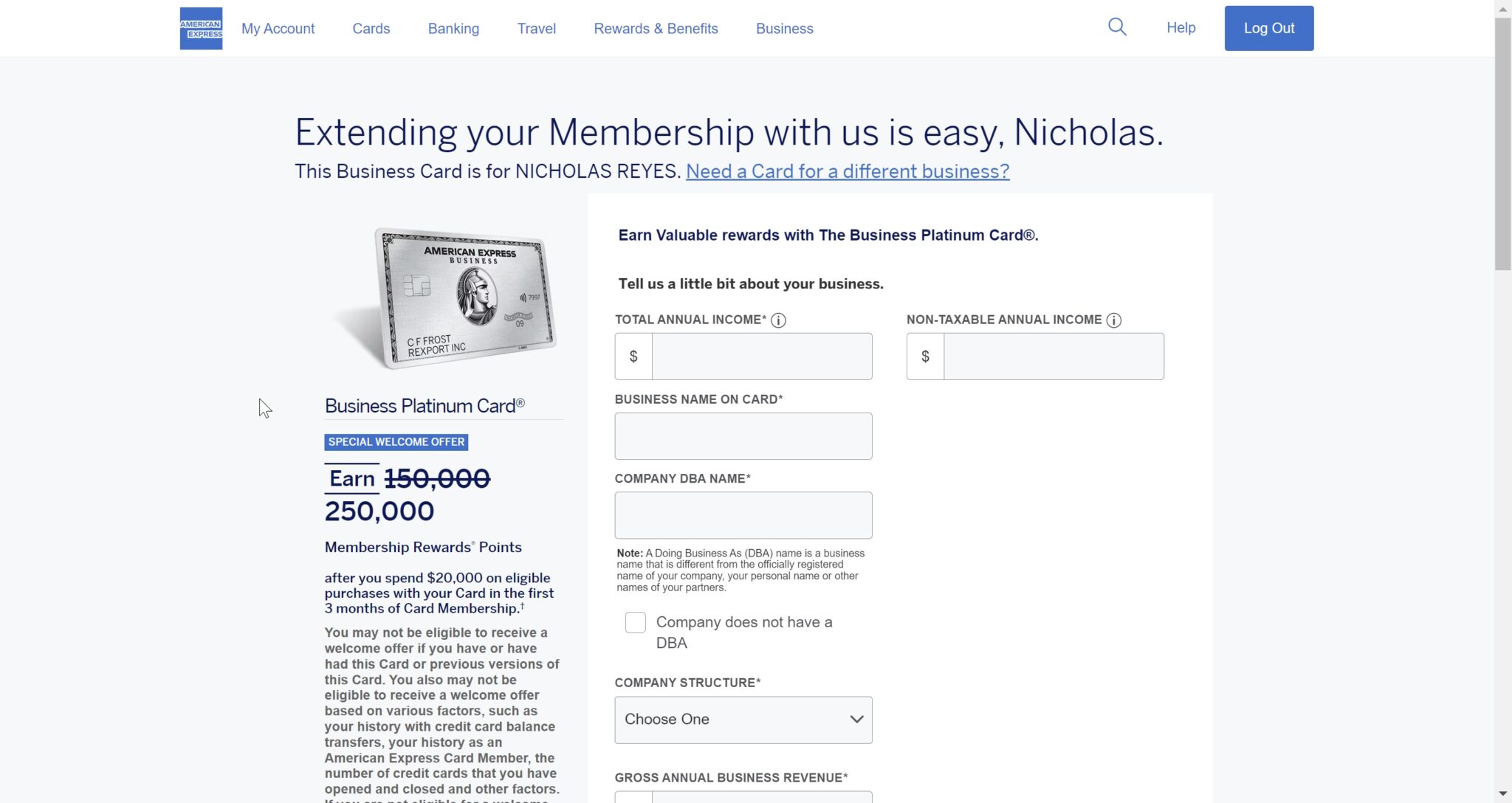

Knowing that much, I clicked on the “Apply now” button next to the Business Platinum offer and it brought me to the application page saying that “Extending your Membership with us is easy, Nicholas”.

Amex pre-filled most of my information. After entering a bit of personal info, I was prompted to “Accept this Offer” at the bottom. I was happy to accept their offer to earn a quarter of a million points.

In recent years, Amex has also become well known for its “pop-up”. If Amex has determined that you are not eligible for a welcome offer, you will typically get a pop-up box during the application process saying that you are not eligible for the welcome offer either because you have had the card before / currently have it or because of your “history” with offers. Note that I did not receive any pop-up even though I already had two open Business Platinum cards. I didn’t do anything beyond clicking the “Accept this Offer” button and waiting.

The next page said that my application was “pending review” and it gave me a phone number to call customer care to provide additional information. However, that wasn’t necessary — it wasn’t very long before I received an email noting that I was indeed approved for a Business Platinum card and thanking me for expanding my relationship with American Express.

The process was painless.

I noted above that I already have a couple of Business Platinum cards. That is thanks to previous similar offers to expand my membership and I did indeed earn the welcome offer on each of them, so I’m confident that I’ll earn the offer as expected here when I accepted it.

Don’t forget to enroll in benefits

As an aside, I wanted to include a reminder to enroll in benefits of your new card. Several of the associated “coupons” that come on Amex cards require enrollment before using them.

As soon as I set up my online account, I made sure to enroll in the Business Platinum Dell and wireless services benefits and to select an airline for the airline incidental credit (see what works). I did that for several reasons.

First, past experience has taught me that the airline fee credit can take until the next calendar day to become active. I once made the mistake of choosing United and making a qualifying charge on the same calendar day that I selected United as my chosen airline. I did not receive the fee credit for that charge and I’ve seen the same from others. I wanted to make sure to choose my airline right away.

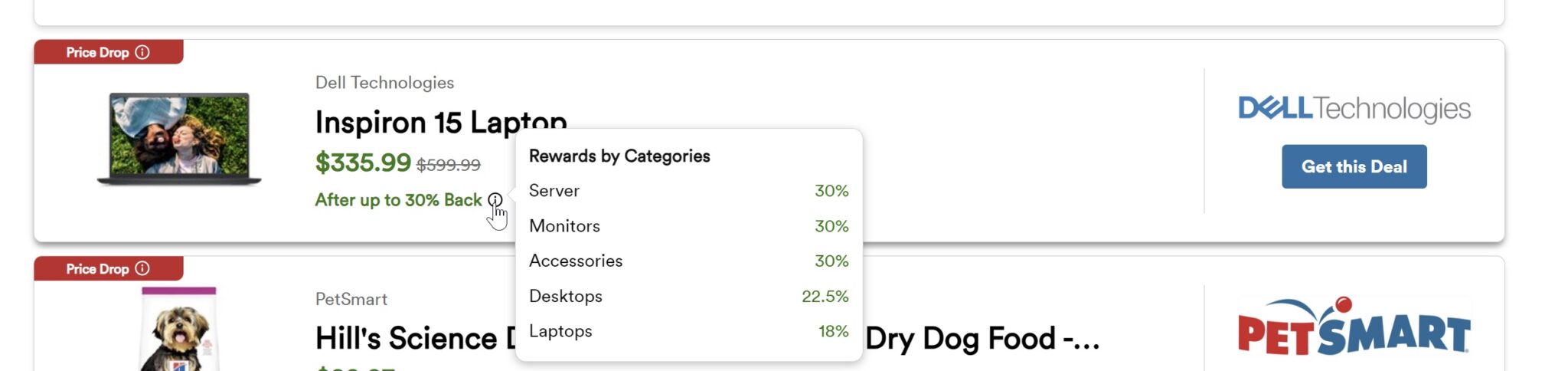

Second, I wanted to be prepared to use my Dell credit if and when opportunity struck with the right deal. Yesterday, I noticed that I’d been targeted for 30% back on most categories at Dell via Capital One Shopping.

I noted above that I already had a couple other Business Platinum cards. Since Dell allows you to split tender over 3 cards in a single order, I decided to use all $600 in a single order. I additionally had an Amex Offer for 10% back at Dell (up to $1,000 back) that I activated on my new Business Platinum card.

I decided to buy an Insta360 X4, which is a 360° action camera (some of my favorite footage from our Party of Five trip was recorded with Greg’s Insta360). I find the camera a lot of fun to use, but I had a hard time justifying the price tag. However, the camera, its associated selfie stick, and a Nintendo Switch game that I’ll give to my kids at the holidays came to a grand total of $631 with tax. That was perfect: I put $200 each on two existing Business Platinum cards and the remaining $231 on the new Business Platinum card. I expect to get $200 back on each card plus $23.10 back on the new card (from the 10% Amex Offer). My net out-of-pocket after Dell credits should be about $8 and I expect to earn about $175 in Capital One Shopping cash back. That made it much easier to stomach the cost of the camera!

Keep in mind that you do need to enroll in the Dell benefit. Similarly, enrollment is required for the Business Gold card’s office supply store credit.

Bottom line

The Amex points parade marches on, with incredible targeted welcome offers out on the Business Platinum and Business Gold cards. While we’ve previously seen some people get targeted for these offers via email or online link, many people appear to be seeing these offers now within their online accounts. We’ve had reports in our Frequent Miler Insiders group as well as experience on the team finding this offer within our online accounts as shown above. While you obviously may not be eligible for the welcome offer as per Amex’s terms, don’t forget that you may be eligible to “expand your Membership” — even though you might have thought otherwise. Having burned through a lot of points on my family’s 28,000-mile summer vacation, an offer to earn 250,000 points with a single card was certainly a sight for sore eyes.

Data point. I was able to get the 250k offer to pop after many refreshes of an incognito window. However, I received the popup regarding ineligibility due to a current Amex Business Plat.

Is anyone still getting targeted for the 250k offer? I had it last week, but can’t seem to recreate it now!

Yes, I got it to pop today.

Played around on my MacBook using Chrome and Safari (incognito on both) then on my iPad using Safari (incognito). Finally got 250K on my iPad after 4-5 tries. Application approved for my solo LLC without pop-up, even though I just canceled a Business Platinum for the same business 10 days ago.

Yesterday 250k. 1st try today 150k, 2nd 200k, 3rd 250k – all incognito and 20k spend. Recently received and approved for business platinum on mailed targeted offer for LLC. Applied for this one for second business (sole proprietor) – no pop-up regarding bonus but did get one regarding a hard pull on business credit. Approved. No mention of offer on approval, asked about employee cards etc. Called AMEX and they said the offer is attached to the application but it is too soon to see it on their end. Hopefully it goes through with bonus and I didn’t put myself in a bad spot with AMEX…

yesterday 250K, today 150K. same 20K spend.

oh well.

Neither me nor P2 were eligible even though 250k offer showed up in both of our accts. It acted like we were but gave us the popup saying we weren’t eigible. We’ve both had biz plat and biz gold in the last 2 years

Are you applying using a business which already has a Business Platinum card associated with it or using a company that does not?

One that already has one (sole proprietorship in this case).

I just logged into the Amex app, Special Offers and was presented with Business Platinum 250k miles, $15k. Very tempting.

Android App? How do you get to the offers via that?

I searched around, but could not find it.

I got the same offer — came here to check if anyone else got the 250K points offer for just $15K spend. Mine came as a pop-up when I logged into my account on a desktop. I wasn’t seeking it out.

Not meant to be for me or P2: “because you have or have had the Business Platinum Card or previous versions of this Card, you are not eligible to receive the welcome offer.” At least P2 and I maxed out those delta offers last month that Tim posted!

Thanks a lot jerk! You just cost me $20k! And on top of that I’m gonna have to figure out what to do with 250k MRs…You’re the worst.

I guess I’ll figure this out while I’m on my 16 day “free” cruise through the Panama Canal….

Just promise me no more great tips, OK?

Thank you. I followed your lead and found the 250,000 mile offer. Approved!

pop up happen on plat and gold for me :/

another great post with a very useful tip. FM team is the GOAT!

P2 got pop up for both elevated Biz Plat and Gold offers. I was able to sneak the Biz Plat elevated offer through for Biz Plat #2, appreciate the heads up!

Approved for Gold #2. Ty Nick!