NOTICE: This post references card features that have changed, expired, or are not currently available

Note: Offers mentioned in this post were valid at the time of writing, but some have since expired. See our Best Offers page for the latest offers.

I’ve long been a big fan of SPG points. They’ve always been great for booking low to mid category Starwood hotels. And they’ve been terrific for transferring to airline miles. With most of their very large selection of transfer partners, 20,000 SPG points results in 25,000 miles. And now, with the Marriott SPG merger, SPG points can be freely transferred to Marriott at an awesome 1 to 3 ratio. This means that Marriott’s top tier hotels, which cost 45,000 Marriott points per night, cost only 15,000 SPG points per night. Plus, Marriott’s valuable travel packages are now within reach for many at only 90,000 SPG points (which equals 270,000 Marriott points). More here: Marriott SPG Complete Guide to Sweet Opportunities.

The obvious ways of earning SPG points (technically called Starpoints) are by staying at Starwood properties and by putting spend on Starwood credit cards. However, Starwood base members earn only 2 points per dollar for stays, and the credit cards earn only 1 point per dollar for spend (or 2 points per dollar at Starwood and Marriott properties). Those options are slow. Here are a number of ways to speed up your points earnings…

#1 Sign up for great credit card bonuses

At different times this year, Amex offered 35,000 point signup bonuses for their personal and business SPG cards. At the time of this writing, the offers are down to the usual 25,000 points (but some people see a 30K offer for the personal card when they view the offer in various browsers). If you’re interested in signing up for either or both of these cards and you don’t see the 30K offer, then I recommend waiting. I expect to see the 35K offers return, but I don’t know when.

Keep in mind that Amex has a standard clause in their credit card applications: “Welcome bonus offer not available to applicants who have or have had this product.” And, they do enforce this rule. There are, though, two exceptions: 1) The personal and business cards are separate products. So, even if you’ve had the personal card before, you can still earn the bonus on the business card as long as you haven’t had the business card before; and 2) Some targeted offers do not have terms restricting the bonus offer. If you receive a targeted offer, look carefully for words “Welcome bonus offer not available to applicants who have or have had this product.” If those or similar words are not there then you can get the bonus by signing up again.

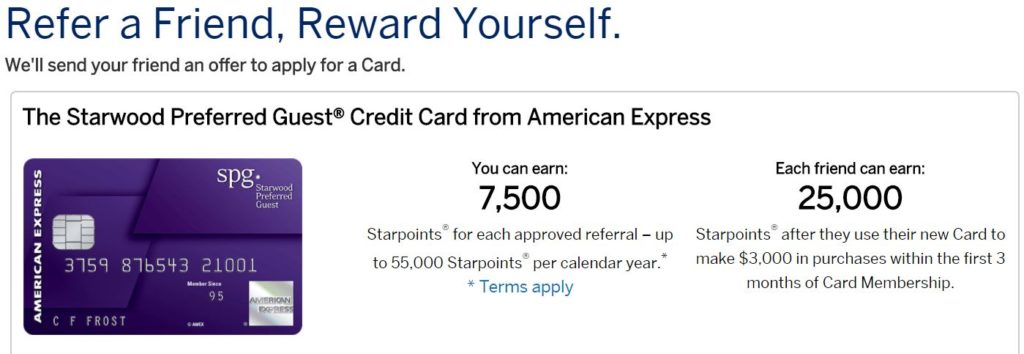

#2 Refer friends and family (earn up to 110,000 points per year)

If you’re currently an SPG cardholder, you can refer friends and earn 7,5000 SPG points for each approved referral. You are limited to earning 55,000 SPG points this way per calendar year, per card. If you have both the personal and business SPG cards, then you can earn up to 110,000 points per calendar year by referring 11 friends to each card.

The best way to refer friends is to go to Amex’s Refer a Friend site (found here). You can also log into your Amex account and look for the little Refer a Friend link at the bottom of the page.

#3 Refer friends and family members who have had the card before

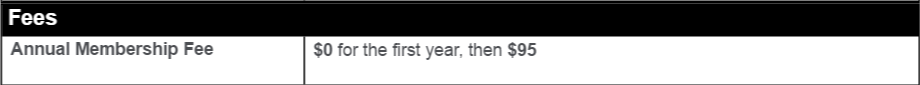

One problem with earning SPG points by referring friends (besides potentially losing friends due to being too pushy) is that you’re likely to run out of friends who have never had the card before. Luckily, the cards have benefits that can be worthwhile even if a person has had the card before. And, the first year is free:

A prior cardholder may want to sign up for the SPG business card in order to get free Sheraton lounge access for an upcoming stay. Lounge access alone can be quite valuable. Another reason a person may want to get these cards again is to reach elite status faster. Each card gives the cardholder 2 stays and 5 nights towards SPG elite status. If you have both cards, you get a total of 4 stays and 10 nights towards status. Signing up for a couple of cards is easier and cheaper than doing end of year mattress runs.

#4 Call for retention offers

When your annual fee comes due, it makes sense to call Amex to say that you’d like to cancel the card (make sure to say this to a person, not a computer because the computer might just go ahead and close the account). In many cases, they’ll offer you points to keep the card. Don’t automatically accept the first offer. Keep asking if there are any other retention offers. Sometimes you’ll learn about better retention offers this way.

#5 Get elite status to increase your stay earnings

Obviously you can earn SPG points through paid stays at Starwood properties (except when booked through an online travel agency like Orbitz or Expedia). However, you can earn more points through stays as an elite member. Here are the earning rates:

- General Member: 2 points per dollar

- Gold or Platinum Member: 3 points per dollar

- Platinum Member with 75 elite nights: 4 points per dollar

There are a few easy ways to get SPG Gold status:

- Sign up for an Amex Platinum card. Amex Platinum cards have many terrific benefits, one of which is free Starwood Gold status.

- Spend $30,000 in a calendar year on your SPG card.

- Sign up for the Ritz Carlton card to get Marriott Gold status. Link your Marriott and SPG accounts to get SPG Gold.

And, as I mentioned above, being a cardmember can help get status if you’re short a few nights or stays. Each card gives you 2 stays and 5 nights towards elite status. If you have both cards (personal and business), you get a total of 4 stays and 10 nights. Alternatively, the Marriott personal and business credit cards can help by giving you 15 nights each towards Marriott elite status (you need 50 elite nights for Marriott Gold). Once you get Marriott Gold status, you’ll automatically have SPG Gold status as long as your Marriott and SPG accounts are linked.

#6 Earn with Starwood partners

Starwood lists a number of partners with which you can earn Starpoints (found here).

Examples:

- Delta

- Emirates

- Uber (through December 17th)

- Audience Rewards (Broadway Tickets)

#7 Earn Marriott points and convert 3 to 1

Before considering elite bonuses and promotions, paid stays at many Marriott hotels actually earn more SPG points than stays at SPG properties. Most Marriott properties offer 10 Marriott points per dollar. That translates to 3.33 SPG points per dollar. Compared to Starwood’s 2 points per dollar, that’s awesome.

But when you stay at a Marriott property, you’re better off paying with your SPG card since it earns 2X SPG points per dollar, which equals 6X Marriott points per dollar. Marriott credit cards, meanwhile, offer 5 Marriott points per dollar at Marriott and Starwood properties (1.67 SPG points per dollar).

Another option for racking up Marriott points is to sign up for the Chase credit cards which usually offer 80K signup bonuses. 80K Marriott points equals 26,667 SPG points. Not bad at all. Currently the personal card has a 120K offer of sorts (found here). Unfortunately, the personal card falls under Chase’s 5/24 rule so you won’t get approved unless you have opened fewer than 5 cards with any bank in the past 2 years. The business card (found here), though, is known not to be subject to 5/24.

#8 Buy points when SPG offers a 35% discount

Every now and then, Starwood offers a 35% discount on purchased points. Points usually cost 3.5 cents each to buy, but with a 35% discount the price goes down to 2.275 cents per point. Factoring in the 25% bonus for converting points to miles, that’s like buying miles for 1.8 cents each (or less if you use the points to buy a Marriott Travel Package). That said, I don’t usually recommend purchasing points unless you have a specific high value redemption in mind.

Starwood has the 35% discount deal going on right now until December 29th (Click here to buy SPG points). I’ve had so much good luck with SPG points lately (thanks to the 1 to 3 transfer ratio to Marriott) that I’m considering prospectively buying more points, despite my own advice to the contrary.

#9 Transfer from Membership Rewards when Amex offers a 50% transfer bonus

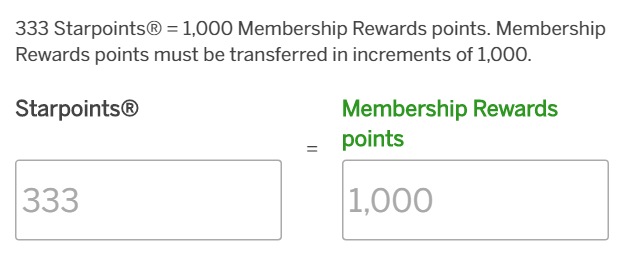

As found in our Amex Transfer Partners page, Membership Rewards points transfer to Starwood at a rate of 3 to 1. 1000 Amex Membership Rewards points transfer to 333 SPG points:

In most cases, that’s a terrible deal. Most people would be far better off transferring Membership Rewards to airline partners at a 1 to 1 ratio. That said, Amex sometimes offers a 50% transfer bonus to SPG. When they do that, the transfer ratio improves to 2 to 1. That is 1000 Amex Membership Rewards points transfer to 500 SPG points. That’s still not a great deal, but it can be useful if you have specific needs that cannot be met with Membership Rewards points (such as point transfers to JAL or to Alaska Airlines, or you need to top off your Marriott points account).

#10 Transfer from Diners Club

If you’re one of the few people with a still active Diners Club card, you should be able to transfer Diners Club points to Starpoints. The transfer ratio is: 1250 Diners Club points transfer to 750 Starpoints (1.67 to 1). If you factor in SPG’s 25% bonus on transferring to miles, the conversion ratio improves to 1.33 to 1. Not great, but not horrible either. Before you make any such transfer, though, keep in mind that Diners Club has several decent 1 to 1 transfer partners such as Aeroplan, Alaska Airlines, and Korean Air.

[…] also: Top 10 shortcuts to earning SPG points; Amassing Membership Rewards; Amassing Ultimate […]

[…] Top 10 shortcuts to earning SPG points […]

Chase Reserve vs SPG Starwood Bus American Express.

How does one determine the value for daily use, in regards to points earned?

Chase Sapphire Reserve earns 3X for travel & dining, 1X elsewhere.

SPG earns 1X everywhere (or 2X at SPG and Marriott properties)

I value SPG points higher than Chase Ultimate Rewards but not by a factor of 3. So, when eating out or paying for travel I’d use my Sapphire Reserve. For other stuff, SPG

Hi Greg. I posted earlier because there was a question as to whether buying SPG points using the SPG cc earned 2x. I can confirm that I earned 2x on my Dec 13 purchase using my SPG biz cc – my statement just cut. Just wanted to clear the confusion, even as I’m aware that the 35% bonus for buying is over.

Great! Thank you for sharing that confirmation!

Hi

I am using my cobalt from amex and for december they give 10 points per dollar up to 2k of purchase then transfer to spg 2 for 1 that is 5 spg points or 15 marriott

http://amex.ca/share/bernahDUhH?CPID=100200331 for canadian to apply

Hi

I am using my cobalt from amex and for december they give 10 points per dollar up to 2k of purchase then transfer to spg 2 for 1 that is 5 spg points or 15 marriott

That’s great. I didn’t realize that Canadians had such a good MR card!

Isn’t uber an opportunity partner with SPG pts too?

Only until Dec 17th.

I’ve always found starpoints so difficult to earn, which has driven me away from the brand. SPG hotels tend to be the pricier options, and yet you earn much fewer starpoints per dollar. Granted, you need about 20k to redeem at their higher end properties rather than Marriott’s 40k – a 50% difference – but you only earn 2 points/dollar at spg and 10 points/dollar at Marriott, which is a difference of…80%. Plus, their annual fee card doesn’t even give you a free night in return for the same fee that you’d pay on one of the Chase Sapphire cards. I got the SPG amex for the sign-up bonus, but got rid of it as soon as the annual fee came up. It’s a shame, because there are definitely some starwood resorts I’d love to stay at.

Feel free to disagree with me, but I don’t think getting rid of the SPG card makes sense. Here’s why:

If you’re talking total earn at the hotel using the CC:

–SPG members earn 4x on stays (2x from hotel, 2x from CC)

–Marriott members earn 15x* on stays (10x from hotel, 5x from CC) *except at Residence Inn & Townplace, where they’ll earn 10x total.

Those numbers are much closer than they appear since 4x SPG = 12x Marriott.

In terms of how much value you can get out of the points, that really varies depending on where you want to stay. At the bottom end, a Cat 1 SPG property can be as low as 2,000 points per night — which you’d earn from $500 spend at an SPG hotel with the SPG credit card. Alternatively, a Marriott Cat 1 point saver would be 6K points, which you’d earn from $400 spend at Marriott hotels with the Marriott credit card. By that point of comparison, the chains aren’t all that far off.

At the top end, a Cat 9 Marriott is 45K….though I’d say that the top end of SPG is really more comparable to the top end of Ritz-Carlton — which is 70K. That 70K requires $4,666 in hotel spend at 15x. That same amount of spend at SPG hotels would only get you 18,667 points — which is enough for Cat 5, not quite enough for Cat 6, but only just more than half the 30K-35K of a Cat 7 SPG property. By that point of comparison, Marriott surely seems like a “better” deal.

But where I think the game-changer comes is in this: The SPG card is earning the equivalent of 3x Marriott points everywhere, every day, without a cap. So whether you like SPG properties or Marriott properties, it makes more sense to put your everyday spend on an SPG card than on a Marriott card. Sure, an Ink Plus/Cash can earn 5x at places where it has the category bonus on up to $50K per year and those points can go to Marriott 1:1 (and I certainly believe in doing some of that!). But for everything that can’t be paid using the 5x category bonus, the SPG card comes out to be a better everyday spender.

It also makes more sense to put your Marriott hotel spend on an SPG card than a Marriott card since you’ll earn a total of 16x Marriott points instead of a total of 15x.

I wouldn’t get rid of the Marriott card either — I keep that card for the free night certificate. I’ll easily get more than $85 in value out of the hotel certificate. Even if I only get a night that would have cost me $120 on that, it’s still a $35 win year after year….and most years I’ll get more value out of it. But that’s the only reason to hold the card — you can earn more Marriott points per dollar on a Freedom Unlimited than you can with the Marriott card, so it wouldn’t make sense to put regular spend on the Marriott card. The only kind of spend I’d put on it would be Marriott hotel spend — and only if I didn’t also have an SPG card.

To me, the beauty of the SPG points is in the flexibility. I can use them to stay at an SPG property if I want. I can transfer SPG: Marriott at 1:3 to stay at a Marriott property. I can use them for airline miles at 20K:25K. I can use them towards a Marriott Travel Package and get huge value out of them.

If we’re talking which place does it make more sense to lay your head at night in terms of earning from hotel stay, you’re absolutely right that you’ll earn more points either way staying at Marriott. And these days, with the ability to transfer back and forth, you can have your cake and eat it too — stay at Marriott, use your SPG card, earn your choice of 16x Marriott (10x from the loyalty program and 6x from the SPG card by earning 2 Starpoints) — or convert those to more than 5x SPG. Suddently your $4,666 in Marriott hotel spend at 16x has earned 74,656 Marriott points or just shy of 25K SPG points – enough (just about) for all but the top-tier Cat 7. That’s the best of both worlds in my opinion.

I’d rather keep the SPG Biz card than the personal since it also comes with SPG Club Lounge access. If I’m going to pay the same fee, I might as well get the Sheraton lounge access benefit.

And after all of that long-windedness, I’d say that SPG points are so highly valuable because they are difficult to earn….but they are less difficult to earn when you’re a regular FM reader and keeping up with our “Increase credit card spend (and get most of it back)” guides :-).

Of course, if you’re not spending big, I can see where it might not make sense to pay the fee on the SPG card. If you’re mostly just spending on paid hotel stays, and only a few times a year, it wouldn’t make much sense to keep and pay for the SPG card. It’s not a cheap card to hold, and unlike competitor hotel chain cards like IHG, Hyatt, and Marriott, it doesn’t come with an annual free night. That said, IHG and Marriott certainly have to bundle a free night with the cards since neither card is particularly useful for regular spend. The Hyatt card probably falls in the same boat.

I should note: the other reason to keep the Marriott card may be for help towards Elite status — if you’d otherwise be on the cusp of Gold or Platinum and the 15 elite credits per year and/or 1 for every $3K spend will put you over a tier, it might make sense to keep it and spend some on it.

Thanks for these thought-out replies! I admit I actually got rid of the SPG card a couple years ago – before the SPG/Marriott merger was announced. Now that you can basically earn 3 Marriott points/dollar on everyday spend with the SPG card, the math looks a bit different, and I have actually considered getting the card again. Of course, I wouldn’t qualify for the bonus the second time around, and I don’t stay at SPG properties nearly enough for the night/stay credits to matter to me at all. Plus, I’m holding off on sending out too many cc applications at the moment because I don’t want too many pulls on my credit report at the moment for a variety of reasons. But with the new SPG/Marriott partnership and Marriott’s air travel packages, I can absolutely see the value of having an SPG card – in fact, I think it earns Marriott points at a better rate than most flexible currencies cards? (To clarify, though, paying with an SPG card at a Marriott property would still net you 2 SPG point/6 Marriott points per dollar, correct? Another bit of small print I seem to have overlooked)

Wow, okay, so in writing this comment I have…kind of convinced myself of the value of the SPG card. Congrats.

Admittedly, I have less yearly spend than the average FM reader, which changes the math a bit for me. As a grad student, my travel is more about making trips I wouldn’t otherwise be able to make than about truly aspirational redemptions. If my yearly spend were closer to $80k, of course the $95 fee would pay for itself much more easily. I’ve also usually been of the opinion that if I’m going to pay ~$100 as a cc annual fee to earn points, I’d want a card with more flexibility in terms of hotel, not just airline transfer partners- hence one of the other flexible points currencies like MR points. I may have to rethink that, though, given the earning rate of 3 MR points/$ – most of my aspirational properties that I hope to one day stay at Marriott resorts in places like Thailand and the Carribbean

I’ve absolutely considered the MR card, though, just haven’t pulled the trigger on it. The sign up bonus and yearly night are tempting – I don’t have any Cat 1-5 redemptions in mind but with how quickly my plans change, I’m sure I’d find a use for it. (though the elite night credits would be less valuable – apparently qualifying for gold requires 50 nights and not 25 like I thought, which made me think I was having early onset dementia when I found out – I could have sworn it was 25!)

But yes, my major issue with SPG back when I had the SPG card was, essentially, that you earn so many fewer points/dollar actually staying at their hotels. To get a night at SPG’s Cat 6 property you’d need to spend $15,000 at their hotels (assuming no cc spend/status), while a Marriott top Cat 8/9 requires closer to $4,000. That’s what made the biggest difference to me in my situation and with my annual spend. Well, that and SPG seems to have very few lower end hotels for when you need to spend a cheap night somewhere.

(Sorry for the extremely lengthy comment, but thank you for taking the time to reply to me! Really glad I started reading – I’ve already picked up so much great advice).

FYI: The transfer ratio on Diners Club is now 1075 Club Rewards points to 1000 miles for any US based airline program such as Alaska, Delta and Southwest due to the excise tax.

But when you stay at a Marriott property, you’re better off paying with your SPG card since it earns 2X SPG points per dollar, which equals 6X Marriott points per dollar.

==

Do you mean SPG property?

No, he means Marriott. At least, that’s what he meant in the context of which card to use at a Marriott. You get 2x SPG points at both Marriott and SPG properties (so it obviously makes more sense to use the SPG card at an SPG property — but it ALSO makes more sense to use it at a Marriott property as you’re earning more Marriott points with the SPG card than you would with a Marriott card).

Thanks for clarifying for me. I understand it now.

A much faster and cheaper way to accumulate SPG points is to buy $500 Visa GCs with your Starwood Amex and then convert them to MO at WM. Rather than buying points from Starwood for 2.275 cents apiece, this approach allows you to accumulate SPG points for 1.0-1.2 cents apiece (or less, depending on where you buy the GCs). Or, if your real goal is to redeem points at Marriott, then this shortcut allows you to acquire those points for .33-.40 cents apiece.

That is called manufactured spending, where Greg is actually a pioneer and expert. So are quite a few readers of this blog. With that said, don’t undervalue your invested time, gas, and risk (if I may add the suspicious eyes of the store cashier). For 30K SPG, you can just buy them at $682 at a snap of a finger. If you want to buy them use GC-MO way and let’s trust your calculation, assuming you can buy 2K for each trip, you need 15 + 15 trips and spend net $300 “fees” to reach the same goal. It is doable but not everyone think it is worthy.

Hi, Greg. If/when you purchase SPG points, can you please confirm if you got 2x using SPG credit card? there seems to be some question recently as to whether or not it still gives 2x. Thanks in advance.

Thank you for the thorough analysis. I have the IHG card as of last summer and plan to get either SPG or Marriott, depending on bonus offers. Is there also a reason to wait to see results of the merger?

me and my wife have the spg and planning on using one of them after a year

so charging everything on my wife’s spg

when her time comes to pay the annual fee she will be transferring points to my account and cancelling her account .

is this a wise move ?

Yes, there’s no reason for both of you to have the SPG card if you keep your finances together. You could always add her as an authorized user to your account for no additional fee. There’s no particular hurry to transfer her SPG points to your account though. Closing the SPG card will not cause her to lose any SPG points. SPG points are held with the Starwood loyalty program, not with Amex.

For everyday use, is it better to use my Starwood Business Amex or Chase Reserve? Which card provide better overall points and flexibility of using the points for flights? Our hub airport is O’hare.

Also, which other Chase card would you recommend to build up additional points for flights overseas? We’re looking at travelling to Australia next year.

Thanks!

I’d use the Sapphire Reserve for travel and dining (to earn 3X points) and SPG for everything else since I value 1 SPG more than 1 Ultimate Rewards point.

The best Chase card for quickly earning points is the Ink Business Preferred 80K offer: https://frequentmiler.com/cibp/

Points from the Ink card can be moved to the Sapphire Reserve in order to buy airfare at 1.5 cents per point value through the Chase portal, or can be transferred to various airline and hotel programs.