NOTICE: This post references card features that have changed, expired, or are not currently available

This week brings a feast of delicious transfer bonus opportunities aplenty. Which are the best and should you transfer speculatively? Why is this happening — does Amex want us to get our points off their books? We discuss the answers to those questions, why Greg’s son is going after Hilton Diamond without the Aspire card, and more on this week’s Frequent Miler on the Air.

Watch or listen below or read on for more this week about how best to book luxurious suites, the best ways to manage your points, the easy path to hotel point millionaire status, which blockbuster credit card offers are still out there ripe for the picking and more.

Frequent Miler on the Air

- 00:27 Giant Mailbag: Is the Hilton Surpass the better choice for Hilton Diamond status in 2021?

- 3:10 Mattress Running the Numbers: If you’re spending for a Hilton free night certificate in 2021, should you finish off the spend for Diamond status?

- 10:14 What crazy thing…did Citi do this week?

- 13:55 Main Event: A deluge of transfer bonuses

- 43:01 Post Roast: Is the Capital One transfer bonus to Air France a poor deal?

- 48:17 Question of the Week: What are you excited about in September?

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe (if we get enough people to subscribe, we might be able to earn some income from this someday. So far, the podcast is just a labor of love).

Our podcast is available on all popular podcast platforms, including:

Apple |

Spotify |

You can also listen from your browser:

This week at Frequent Miler

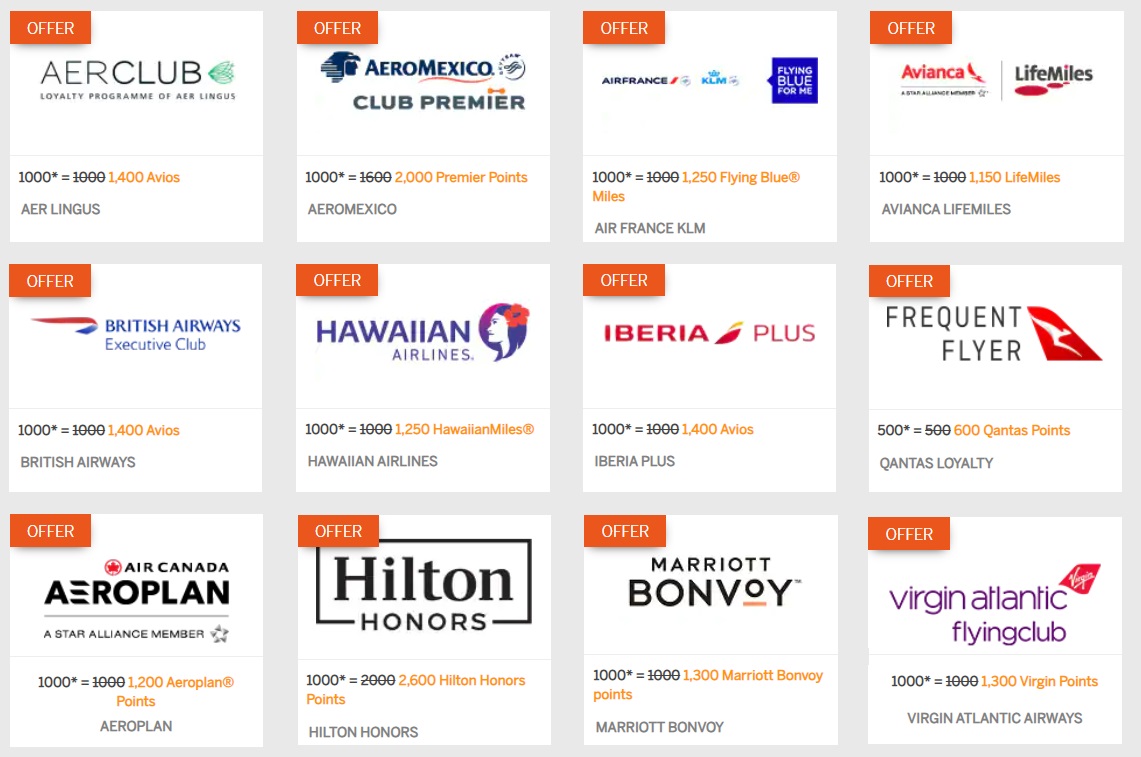

Wow! 12 Membership Rewards Transfer Bonuses (Aeroplan, Avios, Virgin Atlantic & More)

As I said this week on Frequent Miler on the Air, we sometimes see 2 or 3 concurrent transfer bonuses, but we have never seen anything like the current twelve different transfer bonuses being offered by Membership Rewards alone. In this post, Stephen provides the scoop on which programs are included and at what ratios. Also see this post about a separate stacking bonus on Avianca’s side that increases the effective rate on that bonus up to 1.32%. If you’re looking to book award travel, great opportunities now abound.

Greg’s Top Picks for September: Blockbuster Offers Continue

Since the beginning of the pandemic, Greg and I have predicted strengthening credit card offers, at least in the near-term. I don’t think that either of us would have predicted just how long the “near-term” would carry on. I can not imagine that things like 125K + 15x and a card that offers more than 100K transferable points without a credit pull will last forever, but for now the hits keep on coming.

Credit Cards

Are the Hilton cards the most underrated hotel credit cards?

A reader reached out to say that they think we have collectively been undervaluing the Hilton credit cards. After contemplating parts of their argument, I can agree that the Hilton cards are widely underappreciated given the massive 7-figure sum of points that can be accumulated by a couple in two-player mode. If Hilton fits your travel needs, their cards can be hard to ignore — though when you’re not spending toward a free night certificate or welcome bonus, you can probably do better.

How to use your Citi ThankYou point fortune

I’ve seen a lot of questions come up in recent months from people who have only dabbled in Chase or Amex points (or some combination of the two) who have wondered whether or not it is worth expanding to include Citi in the mix. With sweet spots of their own and some great opportunities that they share with other transferable currencies, it can certainly be worth diversifying, particularly in light of the current increased offer on the Premier. See this post for more on how you can put your Citi fortune to good use.

Loyalty programs

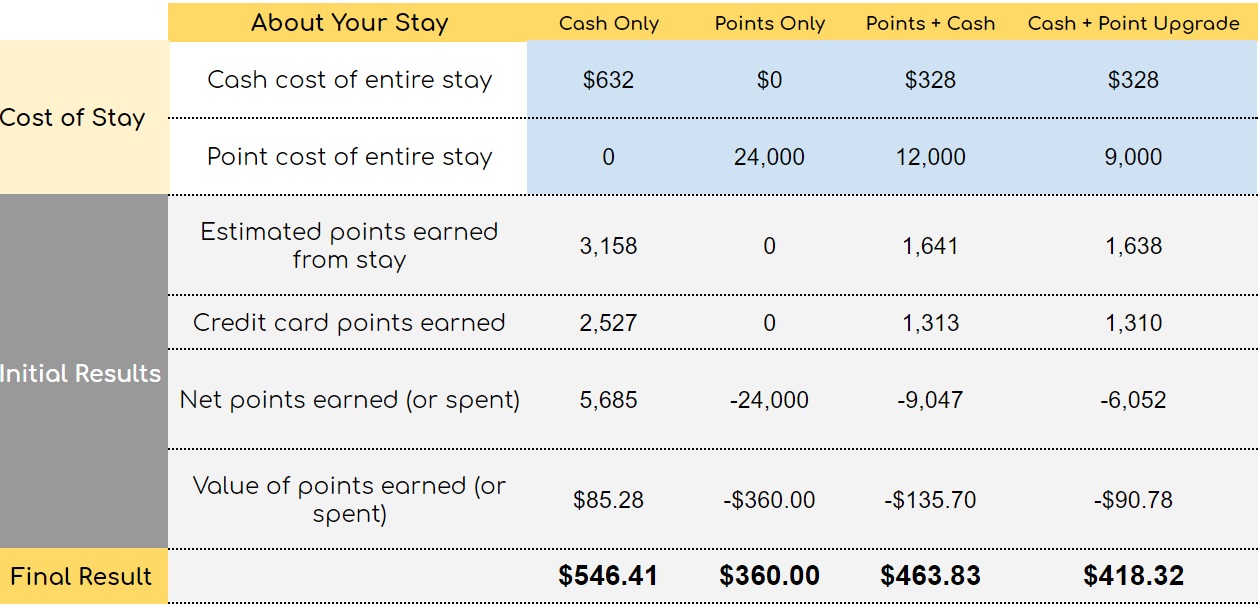

How best to book Hyatt luxury suites

Hyatt offers a number of different ways to book premium suites. Contrary to what you might expect, there is not one best way to book premium suites because it will very much depend on cash rates (and not just the cash rate of the suite, but also the cash rate of a standard room). In some cases, the “right” answer will be obvious, but Greg shows a great example in this post where it may have been less obvious from the start. With his spreadsheet, you can simplify the process when hunting down your own luxury suites.

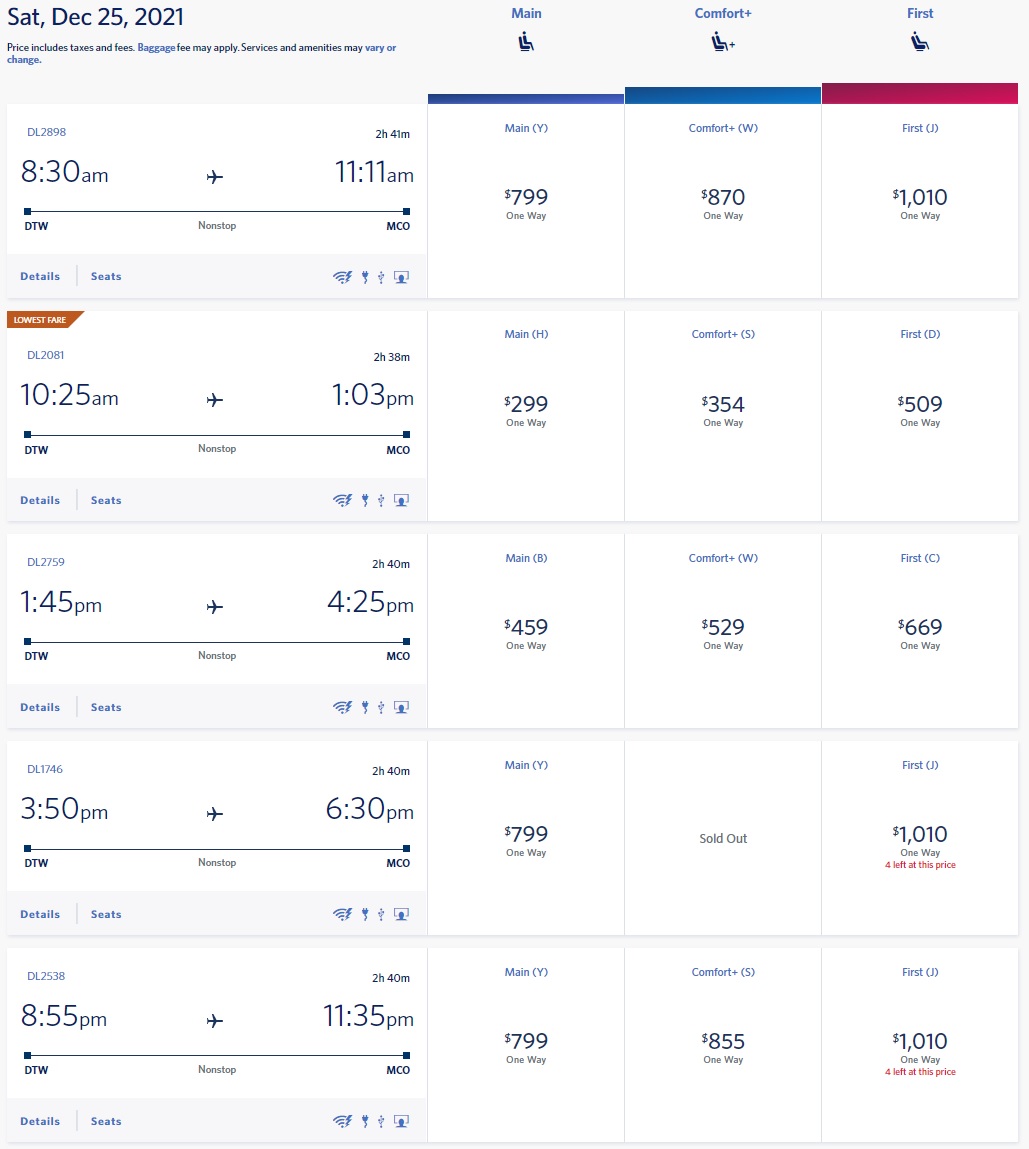

Leveraging Delta’s Same Day Flight Changes (It’s good to be Gold)

Since I have not been one to chase airline elite status, the idea of same-day flight changes just hasn’t been something on my radar until the past couple of years. However, between some pandemic-related changes and some easy elite status I’ve been able to snag, I see how highly valuable it can be to be able to book the cheap flight and change to the “good” flight on the day of departure. While I’ve been looking at it through the lens of my United Silver status, I look forward to seeing just how good it is to be Gold with Delta soon.

How to cancel your Radisson international award and get your points back

If you made Radisson reservations using your points before the programs split, you’ll want to see this post well in advance of your booking’s cancellation deadline (assuming there is some chance that you’ll need to cancel and you would like to get your points back with a minimal number of hours on the phone). Radisson has a process. It isn’t simple, but it isn’t terribly hard. Just get this started at least a few days ahead of your cancellation deadline.

That’s it for this week at Frequent Miler. Also be sure to keep your eye out for this week’s last chance deals.

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

Great episode as always. It really explains a lot about the background workings of how Amex differs from say Visa combined with Chase or another bank if listen closely in terms of rewards points. I think early in the discussion was the key fact that AMEX buys lots of whatever fiat currency (points, miles, aveo etc) from whatever primary travel partner they intend to barter there own currency (MR) with. What it means is the travel partner likely views the barter as a more controllable gift card (which is really a way for a company to sell issue a low interest bond, as in function thats similar to how it acts, except there is the chance the person will forget about it). The travel company (TC) made fiat currency (points, miles, aveo’s) is really probably viewed at the company as a type of derivative, specifically an option. Like an option they can expire often, like an option they may sometimes never be used, and better then an option the TC has a higher degree of control over there actual value (the market holds less sway then a real option). Therefore the TC issuing the fiat (points, miles, aveo’s) will always want to sell them, especially during a pandemic, as they are an alternative to bonds which if too high issuance can actually lower a companies credit rating. It is likely AMEX or in Chase/Visa case Chase, who approached the now somewhat financially distressed travel providers and said: hey if you sweeten the ratio we can buy more and you can get more money lent upfront in this exchange. It would benefit both parties.