The Upside app (formerly known as GetUpside) began life as a way to save money when filling up with gas. It still has that feature, but they’ve since added the ability to earn cashback at select grocery stores and restaurants.

They’ve gone a step further as you can now buy gift cards for some restaurants in the app. There’s a couple of quirks that make this far less useful than it could’ve been, but the cashback you earn – as well as a couple of other stackable elements – make this worth checking out.

The Deal

- Earn cashback when buying gift cards for select restaurants in the Upside app.

- My referral link.

Key Terms

- Gift cards expire after four hours.

Quick Thoughts

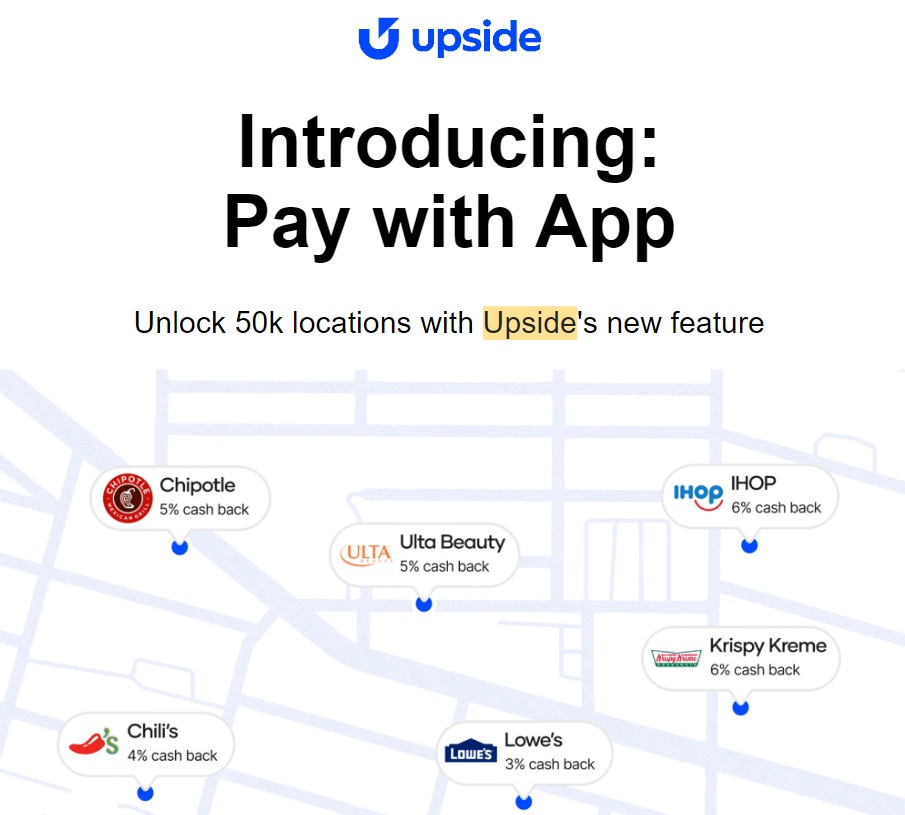

Let’s start off with a couple of negative aspects about Upside’s gift card offering before moving on to the positives. The first is that Upside – as things stand right now (I’m not sure if they’re building out its functionality) – has limited restaurants where you can use the Pay With App feature. It’s therefore not like an app like Fluz where you can buy gift cards for pretty much any brand. Having said that, the image above shows Lowe’s at 3% and Ulta Beauty at 5%. I’ve not seen either of those retailers in the app near me, so I’m hoping they’ll be adding more brands as time goes on.

The second negative feature is a particularly frustrating one. When buying a gift card, it’s valid for ~4 hours. After that time, Upside will cancel it if it remains unredeemed and will automatically issue you a refund. That therefore means this feature will, for the most part, only be good for using when you actually need to pay for a meal.

There is a workaround depending on the brand though. Some restaurants let you merge new gift cards to existing gift cards; Dunkin’ Donuts and Starbucks are two such examples, but there might be a handful of others out there. The first gift card I bought expired after four hours, but the second one I bought was for Dunkin’. I immediately added that card to the Dunkin’ app and merged it to an existing gift card I had on there and sure enough, the card didn’t get cancelled as it was already redeemed courtesy of that transfer.

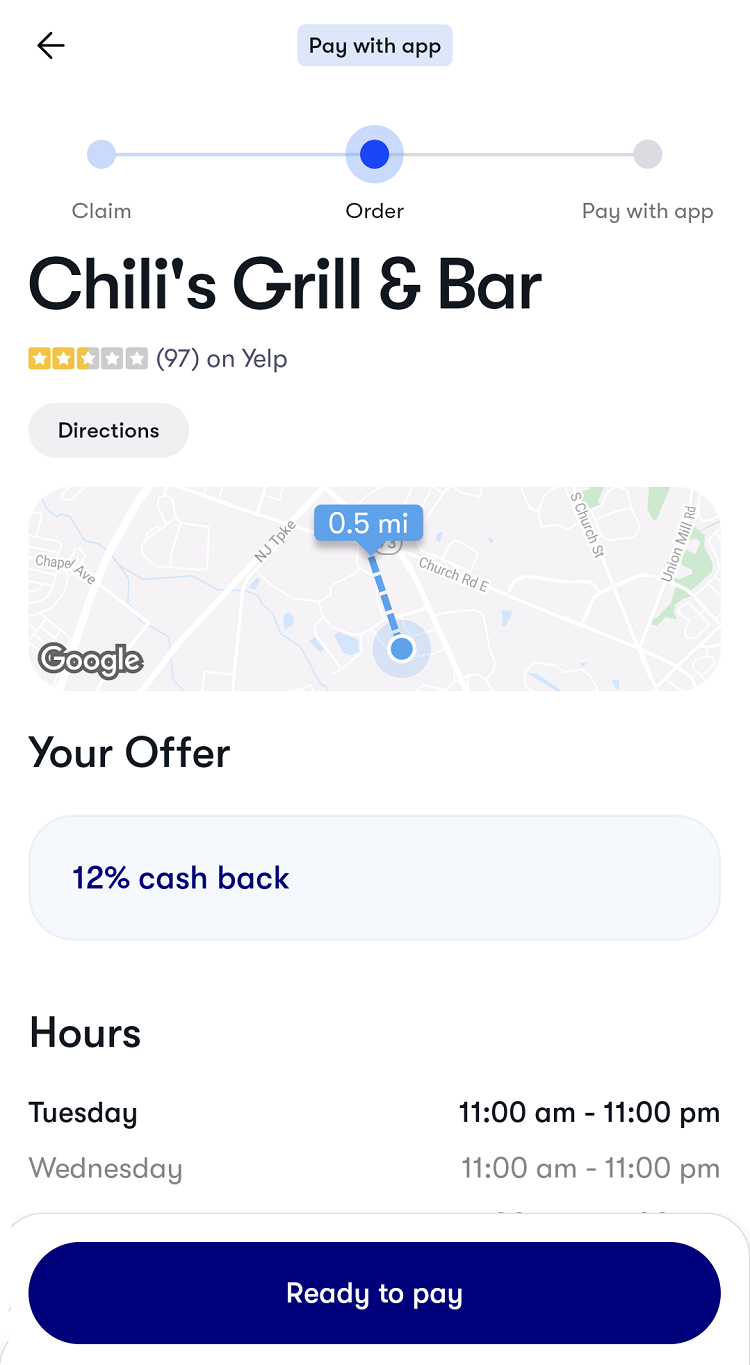

There are some positive features with Upside’s Pay With App feature though. One is that they offer cashback when buying the gift cards, sometimes at a very generous rate. The Dunkin’ purchase I made only gave 2% cashback, but Starbucks was at 10%, Chili’s at 12%, Chipotle at 10%, etc. It’s sometimes possible to get higher discounts on these gift cards via grocery store deals and other sources like that, but those are good cashback rates for instant gift cards you can buy in the moment.

Another positive is that you can buy gift cards for precise amounts rather than fixed denominations. If your Chili’s meal comes to $63.17, you can buy a gift card for that amount.

The next two features are ones I’ve tested out in recent days and I’m pleased to say they both worked. Seeing as Upside started out as a gas app, I thought that perhaps it would code as a gas station purchase or some other kind of travel-related merchant category coding (MCC). That wasn’t the case, but that doesn’t mean it’s bad news. Instead, it appears to work more like United’s MileagePlus X app. That’s another app that sells instant gift cards and which is known for passing on merchant coding. Upside appears to do the same; both the Starbucks and Dunkin’ gift cards I bought in the app coded as ‘Food & Drink’. That means it’d be worth paying with a card that offers bonus points in that category. Both cards I paid with were Chase cards, so I don’t know if it’ll work with Amex cards or cards issued by other banks.

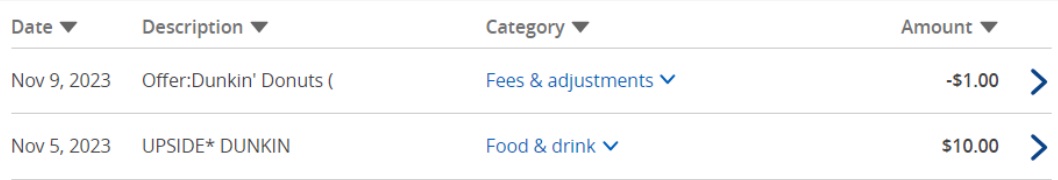

The final positive feature to highlight is a particularly fun one. The reason I chose the specific payment card I did for the Dunkin’ gift card purchase is because it had a Dunkin’ Chase Offer loaded to it which was giving 10% back. Despite the payment being processed by Upside, the name of the gift card brand also appears in the transaction description; in this example, it was ‘UPSIDE* DUNKIN’.

Chase Offers – and offers run on the same backend for other banks like Bank of America, US Bank and Wells Fargo – don’t seem to be as sophisticated as Amex Offers which require payment directly with the retailer. Instead, they seem to simply search transaction descriptions for the name of the retailer. As a result, I’ve seen data points in the past of statement credits from Chase Offers being triggered by non-direct purchases but which still include the name of that company. Sure enough, paying for a Dunkin’ gift card in the Upside app with a credit card with a Dunkin’ Chase Offer loaded to it meant that I earned the 10% cashback from the Chase Offer.

There’s no guarantee that this will always work, but the ability to earn cashback on the purchase, cashback from a Chase Offer while also getting merchant coding passed through makes for a nice little stack in situations where the stars align. It’s just a shame that the gift cards expire after four hours unless you’re able to merge them and that there’s a limited selection of participating restaurants.

I said that the Chase Offers element was the final positive stack, but there’s another potential benefit too. Upside sometimes offers bonus gas savings when using the app x number of times in a month. For example, right now they’re offering my account 10c off per gallon if I make four purchases with Upside this month. That Dunkin’ gift card purchase counted as an eligible purchase, so this could be a helpful way to hit those targets if you’ll end up short at the end of the month and want to complete one of these bonuses.

Very cool, I’ll check out Upside more often. My local gas stations seems to go on and off Upside every few weeks.

Thanks for this write up Stephen!