NOTICE: This post references card features that have changed, expired, or are not currently available

Last month, I enjoyed a 5-night paid stay in a Vacasa vacation rental. While we’ve written a lot about using Wyndham Rewards points to book Vacasa vacation rentals, in this case it didn’t make sense to use points. Rather, my dilemma became how to book a paid Vacasa rental: via Airbnb, through Marriott Homes & Villas, or through Vacasa. While I was very tempted to book my Vacasa stay through Marriott, booking direct through Vacasa ultimately won out.

Vacation rental cross-listings: you’d better shop around

My wife and I wanted to take a vacation with friends who have kids the same ages as ours. The primary purpose of the trip was to relax and spend time with good people, so a vacation rental fit the bill.

Out of habit, we started our search with Airbnb. Since our group was 4 adults and 4 young kids, Vacasa didn’t even come to mind initially since the Wyndham/Vacasa sweet spot relies on booking places with one or maybe two bedrooms and for this trip we were looking for 4 or more bedrooms. That would have made a Vacasa rental 60K points her night (or 54K points per night for those with the Wyndham Business Earner card) which just wasn’t a value in the areas we were considering.

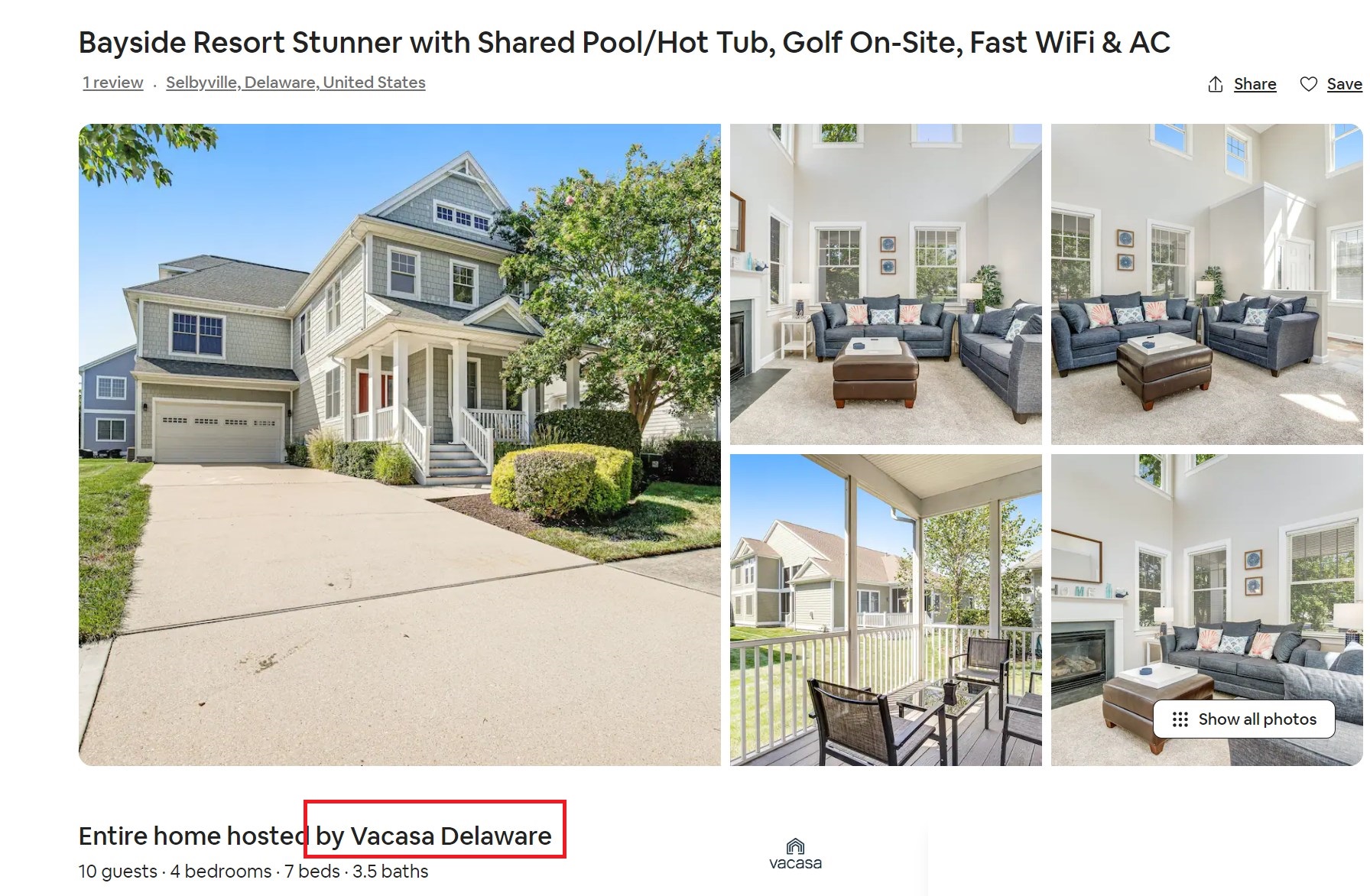

However, when a specific Airbnb listing caught our eye at around $1850 total for our intended 5 nights in a 4-bedroom house, I noticed that the Airbnb listing said “by Vacasa” in the tittle.

Sure enough, I found many of the vacation rentals in the area where we were looking were listed on both Airbnb and Vacasa. Furthermore, I found many of the same rentals listed via Marriott Homes & Villas. In each case, the price and stacking opportunities differed. Here were my booking options:

- Book via Airbnb for ~$1850 all-in, I and could have earned 3 British Airways Avios per dollar through the British Airways link, though I think that would only be on the total before taxes and fees (it still should have been around 5,000 Avios).

- Book via Marriott Homes & Villas for ~$1800. At the time, I had an Amex Offer good for $200 back on a Marriott Homes & Villas booking of $1,000+, so the net cost would be around ~$1600 before rewards. The advantage here is that I would earn Marriott points and elite credits. Members earn 5 points per dollar (on the rate before taxes and cleaning fees). As a Titanium Elite member, I’d have earned a 75% bonus for a total of 8.75 points per dollar. Along with 6 Marriott points per dollar earned on a Marriott credit card (assuming you have the offer on one of the Marriott cards), I expected that I would earn about 22,000 total Marriott points. Furthermore, I think I could have clicked through a shopping portal to earn another 4% back at the time (I no longer see Marriott Homes & Villas listed on many shopping portals), which would have been good for about $66 back on the rate before fees.

- Book with Vacasa for $1386. I’d use the Chase Sapphire Reserve and earn a little over 4,000 Ultimate Rewards points (worth about $60 based on our Reasonable Redemption Value) for a net cost around $1325.

- Book via Vrbo for about $3,000. No thanks.

As you can see above, the Marriott Homes & Villas offered some attractive stackage. After accounting for the Amex Offer and the shopping portal cash, the Marriott booking would have cost me about an additional $200 over the price if booked directly through Vacasa (depending on how you value the various rewards). In return, I’d have earned Marriott points on the booking price before fees. Essentially, overpaying for my rental by a bit would have given me about 22,000 Marriott points and 5 nights of elite credit.

Based on our Reasonable Redemption Value, that’s not a bad deal. Greg’s most valuation of Marriott points was 0.75c per point, meaning that 22,000 points are worth about $165.

By the numbers, one might expect me to have booked via Marriott Homes & Villas given that I’d be paying an additional ~$2000 up front and getting points worth $165 (or more) and also five elite nights with Marriott. That brought the net cost of booking through Marriott to around $1370:

$1800 rental price

-$200 Amex Offer

-$66 shopping portal

-$165 in Marriott points (22K points at a value of 0.75c per point)

$1369 net cost

I wouldn’t fault someone for deciding to go with Marriott Homes & Villas in that situation, but I ultimately decided to book via Vacasa for $1386 (minus ~$60 in Ultimate Rewards points earned).

While the net cost of the Marriott property would have been similar to my all-in cost booking via Vacasa, that calculation ties up $165 in the form of Marriott points. While I don’t doubt that I could get even more value out of the points eventually, I’m not necessarily a buyer of Marriott points at 0.75c per point. In this case, if I value the Marriott points at their Reasonable Redemption Value, I am essentially “buying” Marriott points at that price — that $165 could be cash in my pocket or it could be Marriott points in my Bonvoy account.

On the one hand, I don’t have a lot of reasonable opportunities to generate more Marriott points. On the other hand, I’m just not in a hurry to buy them at 0.75c per point.

Unaccounted for in the calculations above is the value of elite nights. I would have also earned 5 nights of Marriott elite credit for my 5-night Vacasa stay if I booked it through Marriott Homes & Villas. That could certainly have value if it means you will meet an elite status threshold that you otherwise wouldn’t have met.

In my case, I don’t yet have firm Marriott elite status plans for 2022/2023. I currently have Marriott Titanium status, which has been extended since I earned it in 2019. I definitely won’t requalify for Titanium and I am unsure where I’ll end up in my journey toward Platinum status. I may end up very much regretting the fact that I missed out on 5 nights of elite credit with this vacation rental booking.

On the other hand, if I make it to the 50 nights required for Platinum status without the Vacasa stay, or if I’ll ultimately fall short even with the 5 elite nights from this booking, then elite night credits from this stay will have been nearly worthless. Essentially, I have a hard time assigning any value here unless it is clear that these nights will make a difference in whether or not I reach “free breakfast status” (Platinum at 50 nights). Sure, the nights count toward lifetime status, but I am not particularly focused on lifetime status at the moment. If you know that the nights will make a difference in earning elite status, the elite earnings here could certainly make a difference.

A big part of the reason I booked via Vacasa: Travel protections

However, the calculations above were only part of the reason that I ultimately booked directly through Vacasa. While the chance to use the $200 Amex Offer was attractive, I find travel protections more important in 2022. Booking via Marriott Homes & Villas would have meant triggering a $200 Amex Offer, but we would rather have used a Chase card, in which case booking via Vacasa was a better deal.

In our case, we were planning a trip for a group including 4 adults and 4 children under 5 years old, 3 of whom attend some sort of preschool or daycare program. Anyone who has ever had young kids know how susceptible they are to getting sick even in normal times. In the past, if one of the kids had a cold, the trip probably would have still gone ahead as planned. In the 2022 world, I knew that a positive COVID test for anyone in the group would totally derail our plans.

That uncertainty makes travel protections more valuable than ever. I wanted to use our Chase Sapphire Reserve card for peace of mind in case of a cancellation.

Chase Sapphire Reserve Trip Cancellation insurance covers up to $10,000 per person and up to $20,000 per trip (far more than the cost of this vacation rental). Coverage extends to the cardholder and immediate family members, but I wasn’t immediately sure how coverage worked if we had to cancel the trip if our friends or their kids got sick. The good news is that the Chase Sapphire Reserve’s guide to benefits is pretty clear. Under “What losses are covered?” it says (among many other scenarios) that coverage applies due to “Sickness experienced by You or Your Traveling Companion which prevents You or Your Traveling Companion from traveling on the Trip”. Quarantine imposed by a physician or competent governmental authority is also covered. I expect that if we had to cancel the trip because of a positive COVID test, we could have gotten reimbursed by Chase for the full cost of the vacation rental.

Unfortunately, if we booked via Marriott Homes & Villas to take advantage of the Amex Offer, we may not have had the same type of coverage. A few Amex cards, including both the Amex Platinum cards and the Marriott Bonvoy Brilliant card, include trip cancellation insurance (details here). However, whereas Chase states that all or a portion of your trip needs to be charged to your card to get coverage, the Amex benefit terms require the full amount of the covered trip to be charged to your card. In this case, we were all driving to the destination. In my mind, the vacation rental constituted the ‘full cost of the trip”, but I wasn’t sure whether a claims adjuster would have some alternate view about what other charges (if any) needed to be on the card. Furthermore, we don’t have the Bonvoy Brilliant card, so we would have needed to have used a Platinum card, which would have meant earning fewer Marriott points than shown in the calculations above. Using the Sapphire Reserve left no ambiguity about coverage. To me, that was worth forgoing the Marriott elite nights (though, again, I could see one making the opposite argument and perhaps Greg will in his post roast this week during Frequent Miler on the Air).

Bottom line

Greg has previously written about Marriott Homes & Villas a s a way to generate Marriott elite status. In that post, he noted that one has to shop around because prices can really vary. In this case, Marriott and Airbnb were more expensive than booking via Vacasa directly, but with the chance to trigger an Amex Offer and earn some Marriott points, the calculations were close. Ultimately, I saved a few bucks and missed out on the chance to earn some Marriott elite nights but picked up valuable trip cancellation protection. There are a lot of trade-offs to consider. I feel like I made the right decision, but since the trip went forward without anyone getting sick, I’m sure I’ll regret this when I end up 5 nights short of Marriott Platinum status at the end of the year.

Did you get the extra points in chase? I read that it codes vacasa as real estate and not travel so I was wondering if travel protection would work if it was not coded for travel? I’m about to book a trip in Florida in September and don’t want to get burned by a hurricane

I used to work for Vacasa. I would NEVER book a Vasasa place. The company cares only about numbers. The houses are uncared for, maintenance goes ignored. I guess I would say it’s worse to be an owner than a guest, but if you have an issue during your stay, at least in the area I was in (Colorado), your problem won’t be even answered (if it is at all) until well after you’ve left.

I need to look up travel protection for my Chase Sapphire Preferred

if i book an award ticket and use the CSR to cover fees, will the Trip Cancellation insurance still kick in for the full cash value of flights or only on taxes & fees paid out?

I agree that you made the right call. Having a Marriott offer for cashback or bonus points on a Marriott co-brand card might make make that option better, but otherwise, I’d definitely rather have the peace of mind that Chase travel coverage generally provides.

Nick – would it have been possible for you to ask Marriott to match the direct Vacasa price?

Hey Nick, did you earn any Vacasa or Wyndham Rewards points for your paid stay?

They said on the podcast last weekend that paid Vacasa stays do not earn Wyndham points. It’s a 1-way street. You can use Wyndham points to book Vacasa, but no earnings from Vacasa -> Wyndham.

Good to know. Such a shame that paid Vacasa stays don’t earn points in any program.

Interesting analysis, Nick. Really important to note (as you did) that there are always trade-offs and you need to make the best decision for your own needs.

Vacasa is getting a bad reputation for being unfriendly when guests incur issues at their rentals. We travel a lot with our large dog and many properties if they are dog friendly have a weight limit. I find that Vacasa is typically very vague on the size of the dog but the same property listed on Airbnb or VRBO has more details to limitations; not sure I would want to gamble and take our dog only to be denied despite what Vacasa has listed (or not listed) on their site. I have a friend who uses them for his STR beach condo and likes them from that the view point.

what other issues are you seeing / where reading about it?

We have a Vacasa stay in 1 month, so now I’m getting anxious.