Over the weekend, I had the opportunity to speak at Frequent Traveler University Seattle. I enjoyed speaking about credit card benefits beyond the signup bonuses, tools I use for finding deals, and earning miles for a car purchase (more coming on this next week!). During one of my presentations, an attendee asked me a great question: What’s the best Chase card that’s not subject to the Chase 5/24 rule? I didn’t have an answer as quickly as you might imagine — because I think the answer isn’t really very simple.

5/24 semanticsThere is sometimes confusion about the difference between expressions like “subject to 5/24″ and “count towards 5/24“, so let’s get the semantics out of the way: Chase has a 5/24 rule. This unwritten rule means you will not be approved for certain Chase credit cards if you have 5 or more new accounts that have been added on your personal credit report within the past 24 months. Most (but not all) Chase cards are subject to the 5/24 rule. If we say a card is subject to the 5/24 rule, that means the rule is enforced in making approval decisions. In short, if a card is subject to the 5/24 rule, you won’t get approved if you’ve opened 5 or more new accounts. However, all major credit card accounts that appear on your personal credit report count towards your 5/24 total. Some business cards also appear on your personal credit report (e.g. Capital One business cards) and will therefore count towards your 5/24 total. Chase business cards (as well as business cards from several other banks) do not appear on your personal credit report and do not count towards 5/24 (though most are subject to the rule). See “Chase business cards don’t add to your 5/24 count” for more on Chase business cards. |

Which Chase cards aren’t subject to 5/24?

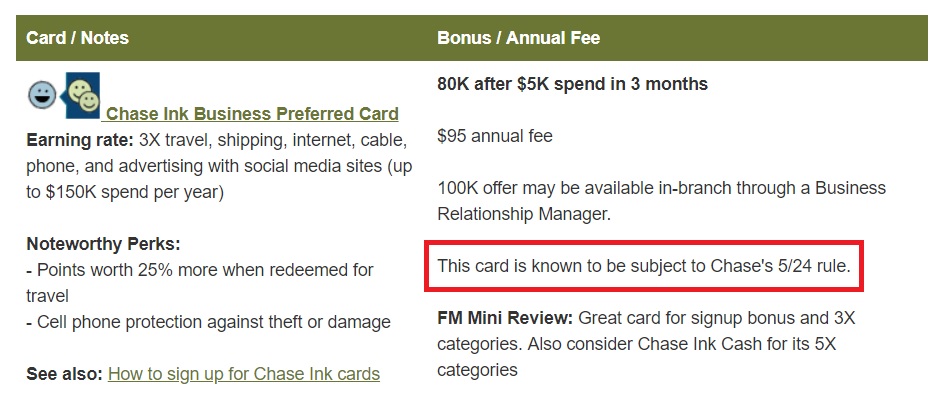

If you haven’t memorized which cards are/aren’t subject to 5/24, no problem — head to our Best Offers page. Under the section dedicated to Chase, each card blurb clearly states whether or not a card is subject to the 5/24 rule. For example, the Chase Ink Business Preferred card is subject to 5/24:

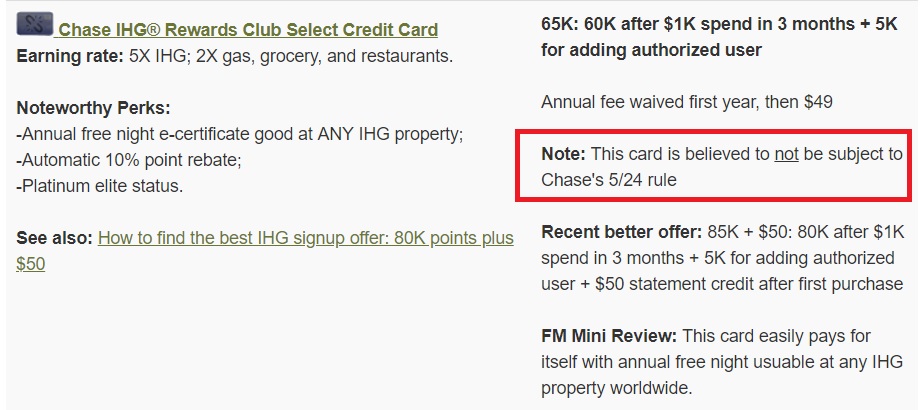

On the other hand, the Chase IHG Rewards Club Select credit card is believed to not be subject to the 5/24 rule.

In other words, if you have opened 5 or more new accounts in the past 24 months, you’re not likely to be approved for the Chase Ink Business preferred, but you have a shot at the Chase IHG card.

Following that example and looking at our Best Offers page, we can see that the following cards are believed to not be subject to 5/24 (click the name of each card to go to a dedicated Frequent Miler page with more information and a link to the current offer):

- Chase British Airways Visa Signature

- Chase Hyatt

- Chase Marriott Rewards Premier Business

- Chase IHG Rewards Club Select

- Chase Ritz-Carlton Rewards Visa Infinite

- Chase AARP

- Chase Disney

Best Signup bonus offer

Part of the reason the question was hard to answer is because it depends on what we mean by the “best” card. Does that mean the best signup offer? The best for everyday spend? The best for ongoing benefits (i.e. the best “keeper” card), etc?

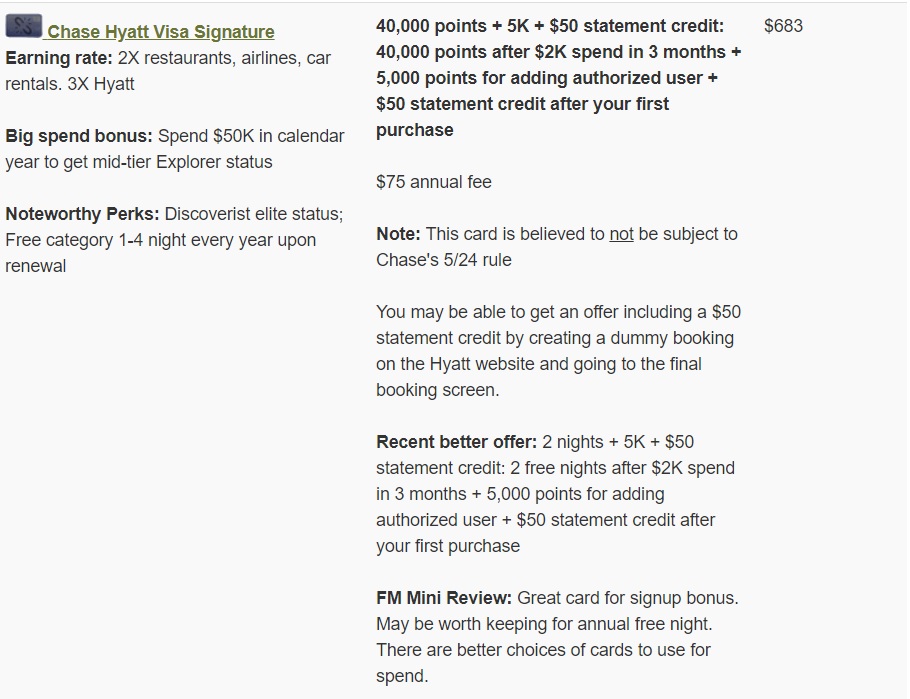

In terms of best signup bonus, that’s an easy answer: the Chase Hyatt Visa Signature. How can I declare that confidently? From our Top 10+ Credit Card offers page. Before I worked for Frequent Miler, I hadn’t realized the methods used to display rankings on that page as objectively as possible. That list isn’t manually created, but rather automatically populated from a spreadsheet that takes into account:

-our Reasonable Redemption Values for the points

-the amount of spend required to get the signup bonus

-the opportunity cost of spending for that bonus versus using a 3% cash back option like the Alliant Visa Signature or Discover IT miles

-a fair valuation of subjective-value items like free night certificates

-first-year annual fee

For more on the methodology, see: Credit card signup bonus estimation details and Unbiased credit card rankings: a work in progress. While both posts contain some outdated tidbits (e.g. the opportunity cost is now factored based on using a 3% card and some signup bonuses have changed since the examples given in those posts), the overall method/philosophy holds true today.

On our Top 10+ Credit Card offers page, we can initially see the 10 best offers — and none of the non-5/24 Chase cards are in the list. However, we can use the drop-down menu at the top of the list to view more than 10 cards or the “next” button at the bottom of the list to continue to the next page of offers. The 14th card in the list (at the time of writing) is the first of the Chase cards noted above:

As you can see, the first year value of this card is estimated at approximately $683. Here’s how that is calculated:

45,000 points x 1.74c = $783 + $50 statement credit – $25.20 (opportunity cost of $2K spend at a return of 1x (1.74cpp) vs $2K spend on a 3% cash back card) – $75 annual fee = $682.80

Compared to the signup bonuses of the other Chase cards that are not subject to the 5/24 rule, the Hyatt card is the winner.

Best for everyday spend

None of the non-5/24 Chase cards above appear on our Best Rewards for Everyday Spend page. That’s because none of these cards are terribly compelling for day-to-day purchases. Each of them earns 1x (or 1% for the AARP card) back on most purchases (and in the case of some of the hotel cards, 1x is even worse than 1%). Even when considering bonus categories, return is poor on many of these cards. For example, both the Chase Marriott Rewards Premier Business credit card and the Chase Ritz-Carlton Visa Infinite cards earn 2x at restaurants. However, with our Reasonable Redemption Values for their points pegged at less than 1 cent each, a 2x bonus category is still worth less than 2% cash back.

The Hyatt card is a notable exception since Hyatt points are more valuable than other points on the list. At a value of 1.74 cents per point, Hyatt’s 2x on restaurants, airlines, and car rentals might be decent.

On the other hand, the AARP card offers 3% back at restaurants and gas stations and carries no annual fee — possibly a better deal than the Hyatt card for restaurant spend depending on how much you spend and how much you value the Hyatt points.

Best ongoing value

This is where things start to get murky. When we consider ongoing value year after year, the variables become a bit more difficult to balance.

For example, how do we compare the ongoing value of a free annual Hyatt Category 1-4 night vs a free annual Marriott Category 1-5 night? How do we go about comparing those to the annual free night at any IHG property? How do spending habits play into the equation?

As you can see in this post, our unbiased valuation of “2-free-night” signup offers has been $500. If I halve that value for a single free night certificate, the value becomes $250. But is $250 a fair valuation of the Hyatt 1-4 certificate or the Marriott 1-5 certificate?

I didn’t feel like that valuation works out as fairly for a category-restricted free night as it has for less restricted free night bonuses. In this case, I decided to go back to Greg’s old calculation method:

Maximum number of points that would be required for the same free nights X .75 fudge factor X

Fair Trading PriceReasonable Redemption Value

As you can read about in the unbiased valuation post above, the .75 fudge factor takes into account the fact that you might not always redeem for the top category. So here was the math on free night benefits:

Hyatt Category 1-4: 15,000 points X .75 X 1.74c = $195.75

Marriott Category 1-5: 25,000 points X .75 X .72c = $135.00

IHG any hotel: 70,000 points X .75 X .57c = $299.25

Once we take away the cost of the annual fee, the ongoing value of each card (not counting the value of spend on that card) is:

Chase Hyatt credit card: $120.75

Marriott Rewards Premier Business: $36.00

IHG Rewards Club Select: $250.25

Based on the value of the free night perk alone, the IHG Rewards Club Select card comes out on top with an ongoing value of $250.25 per year (and that’s not placing any value on the Platinum Elite status granted by the card….though, in fairness, there isn’t much value to be had from that status).

However, what about spending on the card?

As noted above, it wouldn’t really make sense to put everyday spend on any of these cards. However, there are two subsets of people who might consider the value of specific types of spend:

If you spend a lot on restaurants

If you spend a lot at restaurants, the two cards to consider would be the Chase Hyatt credit card and the Chase AARP credit card. If we take the Hyatt points at the Reasonable Redemption Value of 1.74c each, that’s a return of about 3.48% on restaurant spend. Ignoring the fact that points aren’t as valuable as cash, that’s only marginally better than the 3% return at restaurants on the AARP card. If we consider the $75 annual fee on the Chase Hyatt card, you would have to spend more than $15,625 per year at restaurants to come out ahead with that card versus the AARP card (though when we consider the value of the annual free night, the Hyatt card is a clear winner).

Personally, I’d probably take the annual Hyatt free night and I value Hyatt points at 1.74c or better, so I’d give the edge to the Chase Hyatt Credit Card for restaurant spend.

If you spend a lot on domestic economy class airfare

If you spend a lot on domestic economy class airfare, the Chase Ritz-Carlton Visa might make a lot of sense for you. First of all, it comes with a hefty $450 annual fee — but you get $300 in airline incidental credits. That might come in handy for baggage or seat selection fees if you’re flying a lot of domestic economy class.

Furthermore, if you often fly with a partner, you might get enormous value out of the repeatable companion fare discount: this card offers $100 off round trip domestic economy class airfare when booking for 2 people through the Chase Ritz-Carlton Visa Discount Airfare website (See: Bet You Didn’t Know: A Repeatable Companion Airfare Discount with the CNB Crystal Visa Infinite — this also applies to the Ritz card). Since this benefit is unlimited, you could come out well ahead of the annual fee. And if you’re flying that much, you may also get good value out of the Priority Pass select membership that comes with the card (especially if you live near or transit an airport that has one or more of the newer restaurant options, where you can get $28 in free food and drinks).

It’s hard to put a dollars-and-cents valuation on these benefits, but suffice it to say that the Chase Ritz-Carlton Visa card will definitely come out on top for people who can utilize the Visa Infinite airfare benefit again and again.

But what about my subjective opinion?

At this point, it wouldn’t be unreasonable to come to the conclusion that the Chase Hyatt credit card is the best overall Chase card that is not subject to 5/24. After all, it has the best first-year value, the best return on everyday spend of the options above, decent ongoing value, and a nice return at restaurants. However, that card didn’t even come to mind when answering the question this past weekend. Why not?

First of all, I’d never use it for everyday spend. While I certainly can get better value than 1.74c per point for Hyatt points, I’m not sure I could beat it consistently enough to justify using the Hyatt card over better options in my wallet for everyday spend (like the Alliant 3% back card or the Blue Business Plus at 2x everywhere on up to $50K per calendar year).

Second, I much prefer a free night anywhere to a category-restricted free night certificate. Hotels change categories, and more often the better ones move up. Furthermore, Hyatt is pretty limited on footprint: while there are a few hundred hotels between Hyatt’s Category 1 and Category 4, there are more than 5,000 IHG hotels where the annual IHG free night certificate can be used.

Third, in my personal situation, it’s easy to get excited about the annual IHG night. I live about 3 hours away from Manhattan — close enough to make a day trip possible, but an overnight highly preferable. I rarely have trouble finding some IHG property in Manhattan where I can get a nice value on a last-minute weekend night in the city. Add to that the fact that Hyatt and Marriott have a combined 0 properties in Manhattan where I could use their annual free night certificates (and where it would otherwise cost me a lot of points or more money than I’d care to spend) and the annual IHG certificate looks pretty good to me. It looks even better if you’re playing in 2-player mode and can line up your annual free night anniversary dates.

In the end, my answer was that I’d probably say the IHG card, followed by the Ritz-Carlton card if you can make use of the airfare benefit. Did I wrongly ignore the Chase Hyatt credit card? It’s surely a decent offer, but I still don’t think I’d consider it ahead of the IHG card.

What do you think — which is the best Chase card that is not subject to 5/24?

Since IHG now has a category limit on their card, too, the Hyatt card wins hands down.

[…] another Chase credit card. If you truly feel like rolling the dice, don’t simply go for one of cards that do not follow 5/24 – that’s what I did and the axe still came down on me (and I am special, remember?). Instead, […]

Hi Nick.

It is a well done article. I know the subject about Chase 5/24, however I just wonder about “living with over 5/24”. I realized that there are so many good credit cards around and does not care much about Chase anymore except Southwest credit in order to earn companion pass. Right now I came up an ideas between me and my wife, she would clean up in order to keep below 5/24 and I will keep apply some cards with decent bonus or the credit cards not subject to 5/24, I also like to build up with Marriott points to earn travel package.

Now I have to decide if I should cancel the Hyatt card and reapply. I’ve had this card for 5+ years and use the annual free night at two different 15K/night properties. Next year I’d like to stay at the Bahamar in Bahamas.

[…] previously published “What’s the best Chase card that’s not subject to 5/24?” As much as I enjoyed his post, I thought this was the wrong question. After all, with […]

Are there any DP on whether a Staples business card will be held against me? I do love the ink recycling rewards. Thanks.

A few months ago I was at 5/24, but I remembered reading somewhere that business cards are not subject to the 5/24 rule, so I applied for the Ink Business Cash card. I did not receive immediate approval, but I was approved about three weeks later. From my reading and experience, I don’t think there is a unanimous opinion that business cards are all subject to 5/24.

Chase business cards (and business cards from Amex, Citi, and BOA at least) don’t add to your 5/24 count — that’s the piece that was the topic of debate for some time (some people thought that Chase business cards did add to the count; we eventually figured out that they don’t). However, the Ink Business Preferred is subject to 5/24. The only known way around that has been to apply through a Business Relationship Manager in-branch.

Did you apply online? Are you sure you were at 5/24? (are you counting a business card in there that wasn’t actually part of your 5/24 count?).

[…] Good reminder of What’s the best Chase card that is not subject to 5/24. […]

Under normal spending circumstances, I believe the Hyatt card is the best Chase card that’s not subject to 5/24, in the first year. Followed as a close 2nd by the Marriott card.

nick or anyone, about the the biz CIP, will chase give bonus if i did earn bonus from the personal CSP about a yr ago? think reading somewhere about chase rule for the preferred products that may have to wait 24 mos, but not sure if the biz is separate from the personal. TIA

You’ve got a couple of small mix-ups there:

1) Yes. you’re eligible for the signup bonus on the Chase Ink Business Preferred (CIP = Chase Ink Plus, which is no longer available for new applicants) as long as you haven’t received a signup bonus on the Chase Ink Business Preferred in the past 24 months.

2) Chase now counts the *Sapphire* products as one — if you’ve received a signup bonus on the Sapphire Preferred a year ago, you won’t be eligible for a signup bonus on the Sapphire Reserve until 24 months from when you received the signup bonus on the Sapphire Preferred. Also, if you currently have a Sapphire card open (any of the three: Sapphire, Sapphire Preferred, or Sapphire Reserve), you will not be eligible to open a new Sapphire product until you close or product change your existing Sapphire. This has nothing at all to do with the Ink cards or the word “preferred”.

Hope that helps!

clear as crystal, thx a lot, NIck yeah, i got mixed up with the wording & a few recent changes

Nice analysis of the free night benefit. I think the decision to signup for these cards also depends on what cards you already have in your wallet. I’m dumping my Marriott card: I just can’t find any cat 1-5 properties I want to stay at and I’d rather put my hotel spend on my ink preferred. I am keeping my IHG for the reasons you mentioned. I’m not bothering to sign up for the Hyatt card. While the signup bonus is nice, the category limitation takes the value out of the annual free night. And while,the 2x dining is also nice, i’ve got the Ink Cash at 2x already, and 3x for all hotels with the Ink preferred.

Agreed. Part of the reason the everyday spend analysis doesn’t make much sense with any of these cards is that if you’re over 5/24, you presumably have Ultimate Rewards cards for everyday spend that earn at least as much if not more in a flexible currency.

As far as dumping your Marriott card: it might be worth reconsidering that. As Amex and Chase are both going to be issuing Marriott cards moving forward, I’m holding on to all of my Marriott/SPG cards to see what gets converted how and with what benefits. Further, at some point likely in the coming year, the loyalty programs are slated to be merged – which may well increase the number of desirable properties at which you can use your annual certificate depending on how SPG properties get folded in. Food for thought, anyway.

Great post Nick! I like the analytics as well as the subjective. I agree with IHG being the top choice. Hyatt was 2nd for me though I hadn’t really considered the Ritz card as the 450 scared me off. I already carry AMEX Plat and Prestige. I may have to look at it again but was considering the Marriott Biz. My only interest in Marriott was to convert to SPG points for a planned redemption this summer.

If your main interest in the Marriott card is to convert points to SPG, the Ritz card won’t do much for you. The sign up bonus is two free nights, not points. If you often travel as a pair in domestic economy class, it might work out well with the VISA infinite discount, but it wouldn’t necessarily fit your plans if you’re looking for SPG points.

You forgot the Amazon card. Probably one of the most underrated cards. Not a very good sign up but no AF, no FX And at least 5% back on Amazon if not more when they run specials. And who doesn’t live off of Amazon? (And now Whole Foods!)

Great point! I did forget the Amazon card. Not only does it get 5% on Amazon and 5% at Whole Foods if you’re an Amazon Prime member, there’s a new targeted promotion out for 5% back at restaurants. While there’s not much of a signup bonus, be ongoing rewards could really add up.

Thank you for your always thoughtful and thorough analysis.

Quick question: The CNB Visa Infinite and The Ritz Carlton (Another Visa Infinite Card) have the repeatable $100 airline companion domestic fare benefit.

Chase Sapphire Reserve Visa has the $300/yr travel credit. It is also an Infinite Card. Does the CSR also have the $100 domestic economy fare credit when booking through Chase? Just wondering…

How is parenthood? 😉

NO, although it’s still a Visa Infinite card, CSR does not have the $100 airfare credit unfortunately

Thank you!

As Juno said, the CSR does not have this benefit. To my knowledge the CNB Crystal Visa and the Ritz-Carlton Visa are the only two in the United States that do.

Parenthood is amazing. Best thing I’ve ever done. Beats flying first class and staying in a fancy hotel any day of the week.

Thanks for both replies 🙂

Little surprised that the British Airways card didn’t get some more love. I’d have to MS to get the max 100k Avios bonus (when it’s around), but some of those OneWorld business and first class seats (on some looooong hauls), pop up on the radar.

I almost included British Airways in the last paragraph to ask if people thought I unfairly left it out. There’s certainly some value to be had there with good redemptions. The thing is, the best redemptions with British Airways miles are for short-haul direct flights outside of the United States at 4500 miles each way. It’s easy enough to generate small numbers like that using Ultimate Rewards cards that you presumably have if you’re over 5/24. Of course, that’s not to say that there aren’t some other sweet spots where the distance is right. Would you take it over the other Chase cards that are not subject to 5/24?

Nice analysis, Nick. I’m very happy with the 105k bonus I got on the IHG card last fall. Platinum benefits have already scored me several suites. Most recently on a 3 night stay at the newly built Vientiane Crown Plaza. I hope to use my free night and excess balance at one of the French Polynesian properties next winter.

That said, I’d also like to see the BA card get more love. The 75,000 Avios are easy to come by. Yes, I’ve gotten massive value booking expensive LATAM and JL 4,500 point flights. But if you live on the west coast, the best redemptions are still 12,500 to Hawaii. I have family in HNL and the ability to book a direct, last minute flight on AS, from 3 bay area airports is priceless. Not to mention I can cancel and refund these bookings for as little as $5.60.

BA also has some very inexensive PE flights to Europe. I picked up SJC-LHR-FCO in PE for $869 RT, then used 30,000 Avios + $280 to upgrade to business on the 787-9. Avios upgrades aren’t the best use of your points but can represent good value in certain circumstances.

Aren’t Avios also good for redemptions of Air Lingus and for transfer to Iberia? Also for upgrades if a cheap BA World Traveler+/Club World ticket is available?

I have saved a ton couple times buying family tix to India with BA and the 10% discounts

Doesn’t using BA entail heavy fees if you transit via London?

Thanks for responding.

I have yet to use Avios for these best redemptions. Our OneWorld travel has mostly been funded with introductory bonuses on AAdvantage and BA cards, and it’s likely that I irrationally overestimate just how much those BA cards contributed to those flights. Maybe I conflate fond memories of the travel with the means that made it possible.

And now that the Hyatt Visa’s introductory bonus does not include the 2 free nights anywhere after the 2k spend, I would agree with you and put the IHG card at the top of this list, especially with the 80k + 50 (or better, as Jay got below) offer.