Ultra-premium credit cards often have great perks like lounge access, elite status accelerators, free nights, companion tickets, etc. The problem is that the annual fees, which can be as high as $895, can be overwhelming. All of these pricey cards are worth getting for their initial welcome bonuses, but they can be very expensive to keep… especially if you have more than one. How can you decide which are worth keeping? We’ve created a spreadsheet that can help!

The premium card worksheet

To help identify which cards to keep or cancel, I created a Google Doc spreadsheet with tabs for each of the most popular premium (hundreds of dollars per year) rewards cards. I’ve also thrown in some $95-ish cards for comparison. On each tab, you can enter your estimated value for each perk and then return to the summary tab to see which cards are keepers.

–> Click here to open and copy the spreadsheet into your own Google account

The rest of this post goes into detail about how I recommend using this worksheet, but here are quick tips for those who don’t plan to read the rest (I get it: even though there’s some really good stuff below, you’ve got other things to do):

- Don’t double-count overlapping perks! For example, assign a value to the Global Entry credit only to the card that you’re most likely to keep.

- Value perks based on how much you’d be willing to pre-pay if it were available as a subscription. Don’t estimate based on how much you’re likely to save.

- If your total value of perks equals or exceeds a card’s annual fee, then its a keeper.

Background

To make up for big fees, issuers have been adding “sponsored perks” where you can get rebates from spend with specific vendors (Peleton, DoorDash, Dell, Lyft, Saks Fifth Avenue, etc.). On paper, it appears that you can recoup more money than the annual fee for these cards. And you can, if you would actually pay for these products and services anyway. The reality, though, is different. Take the Amex Platinum Saks credits, for example. Each year, January through the end of June and again July through the end of December, you can get up to $50 back from Saks and Saks.com purchases, for a total of up to $100 back. If you regularly spend $50 or more at Saks, both early in the year and late in the year, then the rebate can be considered nearly its face value. But if you find yourself scrambling twice per year to figure out what to buy, the rebate should be worth considerably less to you. In my case, I hardly value these Saks rebates at all. It’s nice to get a free pair of socks and other miscellaneous stuff twice a year, but not nearly face value nice.

When it comes time to pay the annual renewal fee on each of your premium cards, it makes sense to evaluate whether or not the card’s perks and rebates are at least as valuable as the card’s annual fee. If the answer is “no”, then I recommend calling to cancel the card. If the card issuer offers a great retention bonus, great — keep the card for another year. If not, go ahead and cancel or, better yet, product change to a fee-free card if possible (note that Amex Platinum cards do not have a product change path to a free card).

If you decide to cancel rather than downgrade, please review our checklist for canceling credit cards to avoid losing points and other rewards.

How to estimate value

When you pay a credit card’s annual fee, you are essentially pre-paying for a year of perks that this card offers. The best way to determine what these perks are worth to you is to decide for each one how much you’d be willing to pay if it were available independently as an annual subscription. Consider the Amex Gold card’s Uber credits, for example. The Gold Card offers $10 per month in Uber / Uber Eats credits. On the surface, that sounds like an easy $120 for those of us who use Uber or Uber Eats often. But you shouldn’t value it at the full $120. Imagine if Uber sold a benefit like this separately: What would you pay annually to Uber in order to get $10 per month in use-it-or-lose-it credits? You wouldn’t pay $120, would you? It wouldn’t make sense to pay $120 upfront for a total of up to $120 in savings spread out through the year. Instead, you might pay $60 (for example) for $120 in credits.

Other examples:

- Chase Sapphire Reserve $300 Travel Credits: This is a really easy credit to earn since all travel purchases count. But how much would you pay in advance to get $300 back? Keep in mind, too, that the Sapphire Reserve doesn’t give you points for that $300 in spend. I’d argue that you shouldn’t value this perk at more than $285, and it would be reasonable to value it less.

- Amex Platinum up to $600 Prepaid Hotel Credit: Consumer and Business Platinum cards offer up to $600 back per calendar year towards prepaid Fine Hotels + Resorts® or The Hotel Collection bookings ($300 from January to June and $300 from July to December; The Hotel Collection requires a minimum two-night stay). That’s great, but how much would you be willing to pre-pay for this rebate? Keep in mind that unless you habitually book through Fine Hotels + Resorts or The Hotel Collection, you might end up not using this perk at all.

- Marriott Bonvoy Brilliant 85K free night certificate: You might save $500, $700, $900, or more off a hotel night when you use this certificate, but there’s no way you should pay that much in advance. The only reason to pay in advance for a free night certificate (especially one that expires within a year) is if you expect to get way more value than you paid. For example, you might be willing to pre-pay $300 for the chance to save $500 or more.

Overlapping perks

One and done perks

There are many valuable perks that have no incremental value if you have the same perk from multiple cards. For example, getting Hilton Gold status from one credit card is great, but getting it from a second card has no incremental value. Here are some more examples where you might value a perk from one card, but having it on multiple cards doesn’t make it any more valuable:

- Free checked bags

- Elite status with a specific hotel, airline, or car rental service

- Lounge access to a specific type of lounge

Diminishing return perks

Some perks have diminishing value with each extra card that offers the perk. For example, each of the Amex Platinum consumer cards (the regular consumer Platinum card, as well as those from Schwab and Morgan Stanley) offers $300 per year in Digital Entertainment Credits: Up to $25 per month back for select digital entertainment services. In my case, I subscribed to Youtube TV (which costs much more than $25 per month) anyway, and so I value this perk on my generic Platinum card at nearly face value. But I also have the Schwab Platinum card, which I have used to subscribe to Peacock Premium for $16.99 per month. I wouldn’t pay for Peacock Premium without the rebate, though, so here I value the perk at only about $25 total.

How to value overlapping perks

The trick to doing this right is to first figure out which of your cards are the most likely “keepers” and assign perk values to those cards first. Then go to your next most likely to keep cards, and only assign incremental value (if any) to perks that overlap with your keeper cards. And repeat with the next most likely to keep cards, and so on.

If you have a bunch of premium cards, this is not easy! For example, many premium cards offer Priority Pass memberships. If you have more than one, then it’s a good idea to figure out which card is the most likely “keeper”, but keep in mind that the value of Priority Pass varies by card. Many versions of Priority Pass no longer include free meals at Priority Pass restaurants. And details vary about how many guests you can bring in and what it would cost (if anything) to add authorized users with their own Priority Pass membership. One of the best options is with the Chase Ritz card, which offers Priority Pass with unlimited guests, and free authorized users, each of which can get their own Priority Pass with unlimited guests. But the Ritz card isn’t easy to get (you have to start with a Chase Marriott consumer card and upgrade), and its perks aren’t ideal for everyone. Still, if you have the card and highly value its key benefits like the $300 incidental travel rebate and 85K free night certificate, it makes sense for this to be your first-in-line keeper card. Estimate the value of Priority Pass on that card, but not on any others (unless the other card’s Priority Pass is better because it includes restaurants).

Sapphire Reserve & Sapphire Reserve for Business

I used to show my entire spreadsheet here, but my situation has become too complicated to explain in a single post. Many of the cards I have are keepers just because writing and talking about credit cards is my career. So, instead of using the spreadsheet for all of my premium cards, I filled it out just for the Sapphire Reserve and the Sapphire Reserve for Business. You’ll find my valuations below…

Important background: I have (and plan to keep) the Ritz-Carlton card, which offers a better version of Priority Pass than the Sapphire Reserve offers. The Ritz version offers the same access to Sapphire lounges, but at regular Priority Pass lounges, the Sapphire Reserve’s version allows 2 guests, whereas the Ritz version is unlimited. Additionally, Ritz card authorized users are free, and each gets their own Priority Pass.

Sapphire Reserve

| Card Offer and Details |

|---|

ⓘ $1544 1st Yr Value Estimate$300 travel credit valued at $285, $300 StubHub credit ($150 Jan-Jun and again Jul-Dec) valued at $75, $500 Chase The Edit credit (2x per calendar year) valued at $125, $300 Chase Dining credit for dining at Sapphire Reserve Tables restaurants ($150 Jan-Jun and again Jul-Dec) valued at $75 Click to learn about first year value estimates 125K Points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 125K after $6K spend in the first 3 months. $795 Annual Fee FM Mini Review: Good all-around card for frequent traveler. Best when paired with no annual fee Chase Freedom Flex, Freedom Unlimited & Chase Ink Cash cards. Click here for our complete card review Earning rate: 8X Chase Travel℠ ✦ 4X flights and hotels booked direct ✦ 3X Dining ✦ 5X Lyft (through September 2027) Base: 1X (1.5%) Flights: 4X (6%) Portal Flights: 8X (12%) Hotels: 4X (6%) Portal Hotels: 8X (12%) Dine: 3X (4.5%) Card Info: Visa Infinite issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: After spending $75,000 each calendar year, get the following benefits: IHG One Rewards Diamond Elite Status ✦ Southwest Airlines A-List Status ✦ $500 Southwest Airlines credit when booked through Chase Travel ✦ $250 credit to The Shops at Chase Noteworthy perks: $300 Annual Travel Credit ✦ Transfer points to airline & hotel partners ✦ Up to $500 The Edit credit annually ($250 twice per calendar year) ✦ Up to $300 Dining credit through Sapphire Reserve Exclusive Tables ($150 January to June and again July to December) ✦ Complimentary AppleTV+ and Apple Music through 6/22/27 ✦ Up to $300 in StubHub credits ($150 January to June and again July to December) ✦ Points worth up to 2 cents each towards qualified bookings through Chase Travel ✦ Primary auto rental coverage ✦ Priority Pass Select lounge access ✦ Access Sapphire Lounges for yourself and 2 guests for free ✦ Access select Air Canada Maple Leaf lounges when flying Star Alliance ✦ Up to $120 Global Entry or TSA PreCheck® or NEXUS Application Fee Statement Credit ✦ IHG One Rewards Platinum status through 12/31/27 ✦ Free DoorDash DashPass through 2027 ✦ Two promos of $10 off each month on non-restaurant orders from DoorDash ✦ $5 off restaurant order each month from DoorDash ✦ $10 monthly Lyft credit See also: Chase Ultimate Rewards Complete Guide |

Here are my personal valuations for the Sapphire Reserve card. With one exception (Priority Pass), I only show perks that I gave a value to. All perks not shown were assigned $0 value. Please, please, please understand that your personal valuations should be different than mine. Additionally, there’s a good chance that you value some of the perks that I didn’t include at all below…

| Sapphire Reserve Benefit | My Value | My Notes |

|---|---|---|

| $300 in annual travel credits | $285 | I use this card for flight and hotel charges, so the rebate is automatic every year. |

| Priority Pass Select & Sapphire Lounge access for you plus 2 guests | $0 | I have a better version of Priority Pass thanks to my Ritz-Carlton card. |

| Best in class travel protections | $100 | I highly value this for the peace of mind it offers when paying for travel with this card. I appreciate that when I pay for airfare and hotels, I earn 4x, and get great travel protections. If I were into booking cruises or other types of travel that don’t earn 4x, I’d be less enthusiastic about this. |

| Free subscription to Apple TV+ and Apple Music | $110 | I already pay $10 per month for Apple TV+. This also gives me the opportunity to try out Apple Music to see if I like it as much as Spotify (and could therefore save money by cancelling Spotify) |

| The Edit hotel rebate, $250 twice per year | $100 | It will be interesting to see in practice how often I book 2+ night stays through The Edit. If it’s common, I’ll end up valuing this much more than $100 per year. |

| Sapphire Reserve Exclusive Tables rebate, $150 per 6 months | $100 | The list of eligible restaurants is very small, so I don’t know how often I’ll use this benefit. My guess right now is that I’ll use it at least once per year. |

| Stubhub rebate, $150 per 6 months | $50 | I don’t buy from Stubhub often, but I’d be willing to pay $50 in advance for this semi-annual rebate. |

| Lyft rideshare benefits. $10 ride credit per month plus earn 5X points on Lyft rides through September 2027 | $25 | I’m guessing that I’ll use the $10 Lyft discount at least 3 or 4 times per year, and often more. |

| DoorDash thru 12/31/27: Free DashPass for 12 months after activation. Two $10 discounts per month on non-restaurant orders and one $5 discount per month on restaurant orders. | $25 | Just guessing that I’ll get enough value from this to be worth “paying” $25 per year |

| My Total: | $795 |

This was a weird coincidence! My valuation came to $795, which is the exact new annual fee for this card. Since my estimates were based on what I’d be willing to pay in advance for these features, rather than the amount of value I expect to receive, this means that I should keep the Sapphire Reserve even when my annual fee increases to $795. Of course, by then my valuations of some of these things are likely to change, so I’ll do this exercise again at that time.

Sapphire Reserve for Business

| Card Offer and Details |

|---|

ⓘ $1595 1st Yr Value Estimate$300 travel credit valued at $285, $500 Chase The Edit credit (2x per calendar year) valued at $125, $100 GiftCards.com credit ($50 Jan-Jun and again Jul-Dec for cards purchased from https://reservebusiness.giftcards.com/) valued at $50 Click to learn about first year value estimates 150K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 150K points after $20K spend in first 3 months.$795 Annual Fee Recent better offer: 200K points after $30K spend in first 6 months. (Expired 1/22/26) FM Mini Review: Could be very appealing for a business that books a lot of travel, as it earns 8x through Chase Travel℠ or 4x when booking direct through airline and hotels. It has decent perks, best-in-class travel protections, and earns valuable Chase Ultimate Rewards points. Best when paired with no annual fee Chase Freedom Flex, Freedom Unlimited & Chase Ink Cash cards Earning rate: 8X Chase Travel℠ ✦ 4X flights and hotels booked direct ✦ 3X social media and search engine advertising ✦ 5X Lyft (through September 2027) Card Info: Visa Infinite issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: After spending $120,000 each calendar year, get the following benefits: IHG One Rewards Diamond Elite Status ✦ Southwest Airlines A-List Status ✦ $500 Southwest Airlines credit when booked through Chase Travel ✦ $500 credit to The Shops at Chase Noteworthy perks: $300 Annual Travel Credit ✦ Up to $500 The Edit credit ($250 twice per calendar year) ✦ Up to $400 ZipRecruiter credit ($200 January to June and again July to December) ✦ $200 Google Workspace credit ✦ $100 Giftcards.com ($50 January to June and again July to December for purchases at giftcards.com/reservebusiness) ✦ Points worth 2 cents each towards qualified bookings through Chase Travel(SM) ✦ Transfer points to airline & hotel partners ✦ Primary auto rental coverage ✦ Priority Pass Select lounge access ✦ Access Sapphire Lounges for yourself and 2 guests for free ✦ Access select Air Canada Maple Leaf lounges when flying Star Alliance ✦ Up to $120 Global Entry or TSA PreCheck® or NEXUS Application Fee Statement Credit ✦ IHG One Rewards Platinum status through 12/31/27 ✦ Free DoorDash DashPass through 2027 ✦ Two promos of $10 off each month on non-restaurant orders from DoorDash ✦ $5 off restaurant order each month from DoorDash ✦ $10 monthly Lyft credit See also: Chase Ultimate Rewards Complete Guide |

I was curious whether the Sapphire Reserve for Business might be a better option for me than the Sapphire Reserve. So, I filled out the tab for this card as if I didn’t also have the Sapphire Reserve. Here are the results…

| Sapphire Reserve for Business Benefit | My Value | My Notes |

|---|---|---|

| $300 in annual travel credits | $285 | I use this card for flight and hotel charges, so the rebate is automatic every year. |

| Priority Pass Select & Sapphire Lounge access for you plus 2 guests | $0 | I have a better version of Priority Pass thanks to my Ritz-Carlton card. |

| Best in class travel protections | $100 | I highly value this for the peace of mind it offers when paying for travel with this card. I like too that when paying for airfare and hotels I earn 4x. If I were into booking cruises or other types of travel that don’t earn 4x, I’d be less enthusiastic about this. |

| The Edit hotel rebate, $250 per 6 months | $100 | It will be interesting to see in practice how often I book 2+ night stays through The Edit. If it’s common, I’ll end up valuing this much more than $100 per year. |

| Google Workspace rebate, $200 per year | $190 | I spend more than $200 each year on Google Workspace, so this is an easy win. |

| Gift card credit, $50 per 6 months for purchases at giftcards.com/reservebusiness | $50 | I’d pay $50 to get two $50 gift cards each year. |

| Lyft rideshare benefits. $10 ride credit per month plus earn 5X points on Lyft rides through September 2027 | $25 | I’m guessing that I’ll use the $10 Lyft discount at least 3 or 4 times per year, and often more. |

| DoorDash thru 12/31/27: Free DashPass for 12 months after activation. Two $10 discounts per month on non-restaurant orders and one $5 discount per month on restaurant orders. | $25 | Just guessing that I’ll get enough value from this to be worth “paying” $25 per year |

| My Total: | $775 |

This one ended up just barely shy of its $795 annual fee. So it’s clear that the consumer version of the card is a better fit for me.

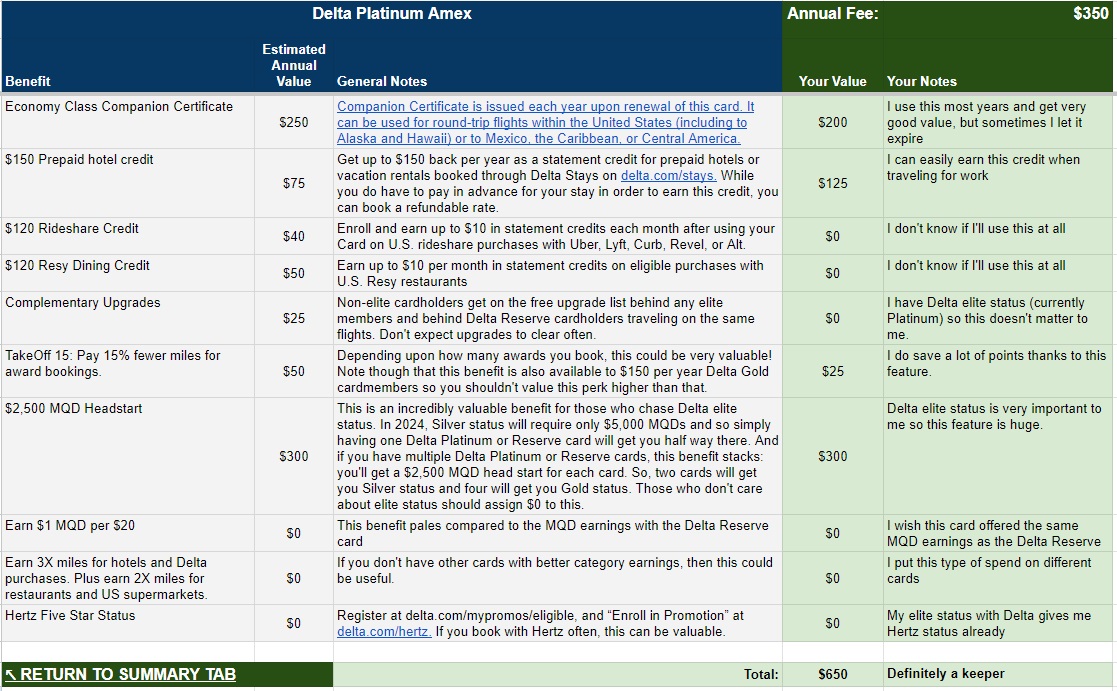

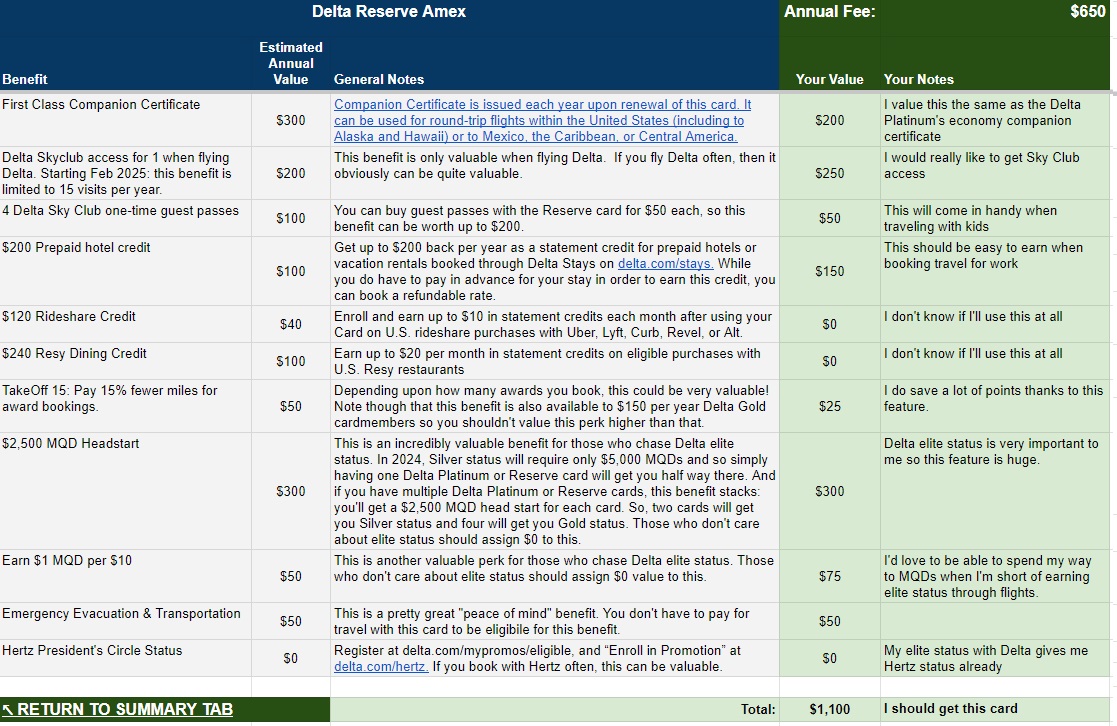

A friend’s example (From Feb 2024)

In this example, I created a spreadsheet for a friend. She has the Delta SkyMiles Platinum card. She also currently has Delta Platinum Medallion Elite status and values that highly. She is thinking about upgrading her Delta Platinum card to a Reserve card in order to get Delta Sky Club® access and to get a better way of earning Medallion Qualifying Dollars towards elite status through credit card spend. She has a job where she is reimbursed for travel that she pays for herself and so she believes that it would be very easy for her to use the Delta Stays hotel credits available through Delta cards.

For this exercise, I filled out the spreadsheet on my friend’s behalf as if I were her and imagined her valuations for each card perk…

Delta SkyMiles Platinum Card

| Card Offer and Details |

|---|

ⓘ $758 1st Yr Value Estimate$150 Delta Stays credit valued at $75 Click to learn about first year value estimates Up to 100K miles ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Limited Time Offer: Earn 80,000 Bonus Miles after you spend $4,000 in purchases with your new Card, and an additional 20,000 bonus miles after you make an additional $2,000 in purchases on the Card, both within your first 6 months.Terms apply. Rates & Fees (Offer Expires 4/1/2026)$350 Annual Fee Alternate Offer: Dummy booking offer of 70K + $400 credit. See this for more details. FM Mini Review: Good choice for frequent Delta flyers who can make use of annual companion certificate Earning rate: 3X Delta ✦ 3X purchases made directly with hotels ✦ 2X eligible restaurants ✦ 2X US Supermarkets ✦ 1X everywhere else Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $20 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Receive $2,500 Medallion(R) Qualification Dollars each Medallion Qualification Year ✦ US, Caribbean, or Central American economy companion certificate (subject to taxes & fees) each year upon card renewal ✦ Earn up to $150 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $10 per month in statement credits for US purchases with select rideshare service providers [enrollment required] ✦ Up to $10 per month in statement credits on eligible purchases with U.S. Resy restaurants [enrollment required] ✦ Priority boarding ✦ First checked bag free on Delta flights ✦ Up to 12 months of statement credits for Uber One membership (must enroll by 6/25/26) ✦Complimentary upgrades: get added to the complimentary upgrade list after Delta elite members and Reserve cardmembers ✦ Cell phone protection ✦ Terms and Limitations Apply. |

Primarily because my friend highly values Delta Elite status and this card offers a $2,500 MQD Headstart, it’s a clear winner. That said, she may do even better with the Delta Reserve card, so I filled that out on her behalf as well.

Delta Reserve Card

| Card Offer and Details |

|---|

ⓘ $712 1st Yr Value Estimate$200 Delta Stays credit valued at $100 Click to learn about first year value estimates Up to 125K miles ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Limited Time Offer: Earn 100,000 Bonus Miles after you spend $6,000 in purchases with your new Card, and an additional 25,000 bonus miles after you make an additional $3,000 in purchases on the Card, both within your first 6 months.. Terms apply. Rates & Fees (Offer Expires 4/1/2026)$650 Annual Fee Recent better offer: 125,000 bonus miles after you spend $6,000 in eligible purchases on your new card in your first 6 months of card membership. (Expired 10/29/25) FM Mini Review: Excellent choice for frequent Delta flyers who can make use of Delta Sky Club® access and companion certificate. Also a good choice for big spenders seeking Delta elite status. Earning rate: 3X Delta ✦ 1X everywhere else Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $10 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Receive $2,500 Medallion(R) Qualification Dollars each Medallion Qualification Year ✦ Companion Certificate on a Delta First, Delta Comfort, or Delta Main round-trip flight to select destinations each year after renewal of your Card. (subject to taxes & fees) ✦ Delta Sky Club® access when flying an eligible Delta flight: 15 visits per year to be used from February 1 until January 31 of the next calendar year (after 15 visits have been used, additional visits can be purchased for $50 each) or to earn an unlimited number of visits, spend $75K or more on eligible purchases each calendar year. ✦ 4 Delta SkyClub one-time guest passes ✦ Centurion Lounge access when flying Delta same day (flight must be booked with your Reserve card) ✦ Earn up to $200 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $20 per month in statement credits on eligible purchases with U.S. Resy restaurants [enrollment required] ✦ Up to $10 per month in statement credits for US purchases with select rideshare service providers [enrollment required] ✦ Complimentary upgrades: get added to the complimentary upgrade list after Delta elite members ✦ One statement credit every 4 years for up to $120 Global Entry application fee or one statement credit every 4.5 years for up to $85 TSA Precheck application fee ✦ Priority boarding ✦ First checked bag free on Delta flights ✦ Up to 12 months of statement credits for Uber One membership (must enroll by 6/25/26) ✦ Hertz President's Circle Status [Enrollment required] ✦ Terms and limitations apply. |

The Delta Reserve card has even more upside in this example than the Delta Platinum card. My friend would get Sky Club access and the ability to earn a reasonable number of MQDs through spend. She should apply for a Reserve card (that’s better than upgrading because she’d be able to earn a welcome bonus) and then either keep or cancel her Delta Platinum card. An advantage to keeping it is that the MQD Headstarts are additive, so she could get even more of a boost towards elite status. If she thinks that she can make good use of two companion tickets each year, then this would be a good strategy.

An even better strategy for my friend would be to consider obtaining Delta business cards. They have the same annual fees and perks as their consumer counterparts, but come with even more hotel credits. To keep things simple for this exercise, though, I made the assumption that she is not comfortable applying for business cards.

The UA business card earns 5000 anniversary miles if you also hold the Gateway or other personal card. I think it’s missing from your table. Since Pay Yourself Back usually allows 1.5c/m that’s a floor value of $75 off the annual fee.

Dosn’t your Ritz have the same travel protections as CSR? The CSR is 5/24 while the CSR biz is not. Worth $20 to me.

On my Strata Elite i get $500 of easy AA/BB and hotels (booking.com) twice in first card year. After that those $500 calendar year credits offset all but $95 of the card fee.

I don’t know what is wrong with me, but I can not find your “keep/don’t keep” calculations for the AMEX PLATINUM card. Is there one?

I’m going with the Chase Sapphire Reserve as my premium card because it fits better if I only want one. The 4x on flights and hotels lets me book whatever brand I want, and the $300 travel credit is easy to use. Paired with Freedom Flex/Unlimited, I can pool points into CSR for transfers or 2¢ value through the travel portal, which adds real flexibility.

I looked at the Amex Platinum, but outside of flights its multipliers are weak, and I don’t want to rely on chasing credits to justify the fee. For me, CSR + no-AF cards is simpler, earns faster, and gives long-term value.

But don’t you have to chase credits with the CSR too? With $795 annual fee and $300 travel credit worth maybe $285 you still have to make up the $510 value somewhere. I realize the credits on the CSR probably work for you and that’s great, but it seems like you are still going to have to chase some credits to make the CSR worthwhile. The Venture X seems like the only transferable points premium card that doesn’t require chasing credits to justify the annual fee.

Your right but I see the CSR differently. The $300 travel credit is basically cash, so I treat the effective fee as ~$495. For that, I get 4x flights/hotels, 3x dining, and I can pool points from Freedom Flex/Unlimited. Those UR points can either transfer to partners or be cashed out at 1¢ each if I want simplicity.

I’ve had Amex before (PUJ), and the problem there is if I want good multipliers I’d need Platinum ($895) + Gold ($325) just to cover the same ground. That’s $1,200+ in AFs and a lot of credits to track. CSR lets me keep one premium card + no-AF backups, which is a cleaner setup for me.

Cap1 Duo is nice too, but I’m not eligible. For now, CSR gives me the balance of perks, earning, and flexibility without stacking AFs.

What are you running?

Well I have too many cards right now and need to downsize. I will keep Venture X and have to decide between CSR and Amex Platinum, and Amex will win because the coupons are a better fit for me and I fly Delta a lot. But honestly combos like Citi Premier + Double Cash are looking better and better. I use the Citi Premier a lot overseas, and between those two cards the bonus categories are hard to beat.

I’ve looked at the Citi setup looks strong too. AA as a transfer partner adds real value, and earning with Custom Cash + Premier is solid. I just never went with Citi after hearing too many bad service stories. Chase and Amex have been smoother for me, so I’ve stayed there.

SkyClubs are great with the Platinum, but I caught myself booking Delta even when it wasn’t the cheapest or best schedule just to use the perk. That’s why I lean back toward Chase I like being able to book whatever flight or hotel works best.

Do you mostly fly domestic or international? If you’re looking at more international trips, AA via Citi could be a strong switch depending on your airport.

I fly out of ATL!

Under Venture X you value authorized users at $100 for lounge access, but that’s gone starting in Feb 2026.

Fixed, thanks!

If you redeem enough Atmos miles, especially for shorthaul AA flights, Summit pays for itself pretty easily, never mind any overlapping benefits.

Thanks very much for the update. I only compared AmexPlat to CSR so far – noting that CSR has a line for valuing transfers to partners while Amex does not, which you ascribe a $50 value to (I presume for Hyatt mostly). Would of course be interesting to see your personal valuations for the Plat like you show for the CSR.

I think it’s very telling that for the CSR you’re barely making back the fee. That’s pretty much in line with my own valuation of the CSR. With the Plat the value is just massive, I’m basically doubling the annual fee in value, using conservative valuations.

I believe these cards (a) are good for the travel insurance they offer (and excellent post on that BTW) and (b) are cards designed primarily to get you access to lounges. They can be useful for earning points on flights and hotels, but there are plenty of other fish in that sea.

Bottom line: If you travel and value access to the branded lounges, PP with 2 guests and travel insurance, these are excellent cards to consider. They charge you an annual flat fee for that ($795 CSR; $895 Plat). They then offer credits against the fee (Amex better than CSR), and maybe you can make the fee back (or do better!) with some elbow grease. But if you don’t value the lounge access / travel insurance in the first place, there are many better no and low fee cards to hold and earn points with, and you don’t ever have to think about how to redeem coupons.

And if you live in NY/DC/Denver/Dallas/Las Vegas you may want to consider largely bypassing the coupon book in exchange for the C1VX for $395, or use the one $300 coupon and it’s $95 (sure you could value the $300 coupon at $200, but you also get 10k bonus miles each year, which you could easily value at $150 – net net you’re getting your value here if you use the coupon). Pair it with a Savor for a great points earning combo as well. Plus you get primary auto coverage as a NY resident (you don’t get this with Chase anymore). It is, in many ways, what the CSR was when it came out – an excellent KISS (keep it simple stupid) card. Yes the lounge access rules are changing, but they are in line with Centurion access, albeit no guests with the PP. But the AU fee is only $125, and P2 could just get a VX of their own if you’ll use both $300 credits. So lounge access and good travel insurance for 2 people for $790 – $600 credit – 20k anniversary miles = more than $790 potentially… pretty great deal!

Of course, if you are willing to live with the hassle of a coupon book, could do similar (but more!) math with the Platinum, and you could potentially barely scrape by with the CSR as well. YMMV.

CSR has a line for valuing xfers bc you need a sapphire card to make points from no-fee cards (freedoms or ink cash) transferable. With Amex there are no-fee cards that still allow xfers to airlines. In this way amex is different than citi and chase so there is no value added (or more accurately, no penalty for having only their no-fee cards).

I see. I suppose that has a value, although you can get a $95 preferred and achieve the same thing if the goal is points transfers, and the preferred may “pay for itself” with the $50 credit and 10% points bonus on spend. So I guess that has some value, but I’m not sure it’s $50 necessarily, but I understand the point now. Thank you!

exactly. So if you have a CSP you should value it at zero. If you don’t have a CSP or Ink Preferred then how much do you value the ability to xfer points? $100 should be the maximum since you could get it for 100 w one of the other cards. You might value it as $95 or you might value it as $10 or 0. You assign the value based on what you would be willing to pay for that, which is the whole point of the spreadsheet.

The issue I have is my experience of Chase’s ‘customer service’ on the CSR. Credits do not apply properly, the offshore agents in particular mis-state things, their ‘risk’ team seem irrational when it comes to foreign spend. The travel portal is expensive (and those agents equally inept). It is a hassle, and not ‘premium at all.

It’s probably time to re-value adding AUs to the Venture X and VX biz 🙁

Done. Thanks!

That’s a really interesting way to evaluate credits. For example, I have the Amex Gold with the $10/month in Uber credits. I was valuing those at 100% of face value, since I knew that my daughter would automatically use them while Uber’ing around at UCLA, which she was doing anyways. But when I buy Uber cash, I get it at around 20-25% discounted from Costco, so perhaps the real value is more like $90 instead of $120.

Yes, $90 is a good valuation for that situation

Greg, you mentioned the best in class for travel protections feature of the Chase Sapphire Reserve cc (and that’s why you are keeping it) but doesn’t the Ritz give you the very same travel protections and you’re keeping that, as well?

Yes, that’s true, but I hate earning only 2x or 3x Marriott points per dollar when booking travel. I value the combination of getting 4x Ultimate Rewards for flights & hotels plus great travel protections

I understand!

Can we also get Atmos Summit card added to this sheet?

Ditto request. And the Atmos Ascent while you are at it. lol

I cancelled my Chase Sapphire Reserve and am going with the ATMOS SUMMIT as the Visa Infinite benefits and protections (such as primary car rental insurance) are about the same.

Would be nice if the spreadsheet were updated.

[…] Get The Premium Card Worksheet here […]

Can you add chase’s aeroplan card as well?