NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

Capital One has debuted a new welcome offer on the Capital One Venture Rewards Credit Card. The number of bonus Capital One “miles” is an eye-popping 100,000 — though realistically that’s only about 75,000 airline miles (or as few as 50,000 for some partners) and it requires a steep $20,000 in purchases in the first year.

The Offer & Key Card Details

| Card Offer and Details |

|---|

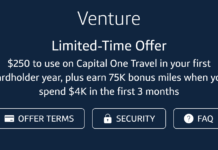

ⓘ $1205 1st Yr Value Estimate$250 travel credit valued at $220 Click to learn about first year value estimates 75K Miles + $250 Capital One Travel credit 75k miles after $4k spend within first 3 months + $250 to use on Capital One Travel in your first cardholder year$95 Annual Fee Alternate Offer: Alternate offer for 75k miles + $300 travel credit available for some via referral pre-approval Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 75k miles after $4k spend within first 3 months + a one-time $250 Capital One Travel credit to use in your first cardholder year FM Mini Review: This card earns 2 miles per dollar, which are worth exactly 1 cent each toward travel. This makes the return on spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One big advantage over cash back: Capital One allows transfering their miles to airline miles & hotel points. Click here for our complete card review Earning rate: 2X miles everywhere ✦ 5X miles on hotels, vacations rentals and rental cars booked via Capital One Travel ✦ 5X miles on Capital One Entertainment Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Receive up to $120 application fee credit for Global Entry or TSA PreCheck® ✦ Redeem miles for travel at value of 1 cent per mile ✦ Transfer Miles to airline miles & hotel points |

Quick Thoughts

I’m a rare fan of the Venture card, but in my case it is because of a niche situation. Capital One allows you to combine Capital One “miles” with any other cardholder who has a card that earns Capital One Miles. I happen to have an old Capital One Venture One card that allows a special redemption of 64,250 Capital One “miles” for a $900 Marriott gift card (or $900 toward Fairmont or Raffles). That makes Capital One “miles” more appealing to me than to others.

Greg has previously noted that if you only want to have one credit card, the Venture card is actually a good choice. It provides reasonable value and the ability to transfer to partners without requiring a second credit card.

However, there are better options on the market if you’re willing to carry at least two cards. See these posts for more ideas (though note that both posts could use a bit of an update on card specifics, so you may find even better combinations given current temporary offers):

If you truly want a single credit card, you may be better off giving up transfer partners and sticking with a no-fee 2% cash back card than paying for the Venture card long-term (or those who have enough cash or investments may consider Bank of America).

The steep spending requirement here feels like a large investment to make when it could alternatively be split over multiple bonuses that would add up to more miles. On the other hand, for someone looking to open one card and put all purchases on that single card, this offer is hard to beat at this price point. After spending $20,000 on the card in year one, you’ll end up with a total of 140,000 Capital One “miles” — good for $1400 in reimbursed travel purchases or either 70,000 or 105,000 airline miles depending on the transfer partner you choose (and assuming no transfer bonus).

Of course, that opportunity excites me less at this moment in time than it might otherwise given the unprecedented opportunity on the Amex Platinum card (see: Sign up now for the Platinum 100K + 10X offer (here’s why)). Most people would come out far ahead with that Platinum card offer even after accounting for the annual fee — see that post for more on that.

Overall, it’s always nice to see an increased offer, but the high spend here makes it lukewarm in my opinion.

For those who don’t know, Capital One frequently denies applicants who have great credit and pay their balance in full every month. If you apply, and get asked if you ever carry a balance, best to say YES.

Have you ever heard of an upgrade offer from VentureOne to Venture?

No bonus, but you may be able to product change online. https://frequentmiler.com/capital-one-product-change-dilemma/

I got this card a few years ago for a different reason- I was having trouble finding a card that earned more than one airline mile per dollar on non bonused spend without a foreign transaction fee when traveling out of the country, especially in the sub-$100 annual fee category. This one works (unlike Freedom Unlimited and Citi Double Cash which both have foreign transaction fees). Haven’t checked for awhile if there are others but if there are, I’d be very interested in hearing about them!

Thanks DSK, I had not made that useful connection with this card, I’ll definitely be traveling with it once countries open up.

I think PenFed’s Pathfinder Visa (up to 3.4% return on any travel purchase (redeemed as gift cards or for booking in their travel portal, plus some annual lounge and airline fee credits) and their Power Cash Visa (2% cash back with no FTF) are great choices.

[Points earned with the Pathfinder are only worth about 85/100ths of a cent. 4 points = 3.4% return.]

Some other options besides what anonymous said are the Amex biz platinum (purchases >$5k), the navy federal flagship, and the spark miles for business. Not to mention, there are a number of airline cards that earn 1.5x-ish everywhere with no FTF (Virgin, Air France, Hawaiian biz, United Club Biz, Delta Biz Plat, etc)

Thanks Anonymous and Aloha808. Looked at PenFed and I think that is cash-back only. Also I really don’t qualify for a business card so that knocks out a lot.

You’ve still got the Air France and Virgin cards. There’s also citi Premier and Amex premium cards with no FTF. Wait till they have transfer bonuses (like Citi with Avianca, etc) and there’s a 1.3x everywhere.